US Risk Managers Bullish On Housing Recovery

I’m always curious to see what insight our quarterly survey of US bank risk professionals will yield. Here’s a finding that jumped out at me from this quarter’s survey: respondents…

I’m always curious to see what insight our quarterly survey of US bank risk professionals will yield. Here’s a finding that jumped out at me from this quarter’s survey: respondents think the housing recovery is for real.

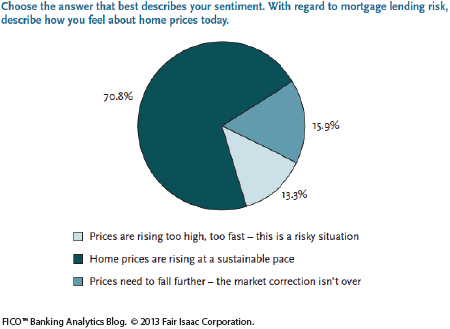

By now, we’ve all seen media reports of rising home prices in many areas. In our survey, 71% of respondents feel these prices are “rising at a sustainable pace” within the context of mortgage lending risk.

In addition, 39% of respondents expect mortgage delinquencies to decrease over the next six months. Another 45% expect delinquencies to remain flat and only 16% expect an increase. These are the most optimistic figures we’ve seen in the three years we’ve been conducting the survey.

We also found that a majority (59%) expect the supply of credit for residential mortgages to meet demand over the next six months, and a slightly larger majority (60%) expect the supply of credit for mortgage refinancing to meet demand. You can see the full survey report here.

Mortgage lenders have been understandably guarded over the past five years. The uptick in their sentiment is welcome news. I wouldn’t be surprised to see lenders cautiously expanding mortgage and home equity lending in the months ahead.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.