Using AI to Improve Debt Collection Strategies

The path to hyper-personalization in collection strategies involves combining AI-driven decisioning and conversational AI

AI in Debt Collection Is a Game Changer

The pandemic changed many things, particularly in the realm of payments. During that period, people did not spend as much, some received supplemental income, and as a result, repayment rates reached unprecedented levels. One client even referred to this phenomenon as the “Great American Payoff,” with high risk segments paying off debts at unprecedented rates.

As the pandemic subsided and things began returning to normal, we observed the effects of inflation and other economic pressures. Many professionals report increased pressure in loss mitigation and higher losses. At FICO® World 25, Richard Pohlmann and I reviewed current economic conditions and explored how AI can help debt collectors work more efficiently, and support borrowers to remain current on their accounts with timely messaging and easy self-service payments.

How the Pandemic Changed Payments and Debt Collection

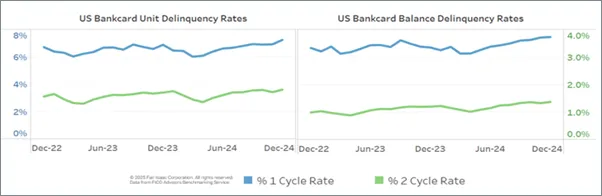

Let us first discuss recent economic trends. Notably, balances have recently been a bit lower, but the number of accounts missing a payment has increased. Average monthly credit card balances are slightly down, possibly due to reduced usage and less underwriting activity.

More concerning is the considerable increase in customers only making minimum payments. Data from 2023 to 2024, covering 130 million U.S. consumers—particularly those with credit cards—shows that 18% are now paying only the minimum. Previously, about half of this population paid either their balance in full or more than a monthly payment, but now the trend is toward the minimum, which may indicate growing financial strain.

Additionally, two key indicators in loss prevention show troubling trends. The number of people missing one payment has increased by 5.3%, and, perhaps more critically, the percentage of those missing two payments has risen by 6.3%. From my experience in loss prevention, when the number missing two or more payments rises, it signals increased stress and the need to review underwriting and customer outreach strategies. This trend prompts a reassessment of underwriting practices, client outreach, and strategies for assisting clients in maintaining current account statuses.

Turning to customer experience, a recent FICO survey found that 88% of respondents consider their experience with a financial institution just as important as the products themselves. However, only 28% feel they are actually having a good experience. Many attribute this gap to disconnected or non-timely communication, creating a disjointed feeling when interacting with financial institutions. Customers cite clear, timely communication and easy self-service options as top priorities.

Omni-Channel Communications in Debt Collection Strategies

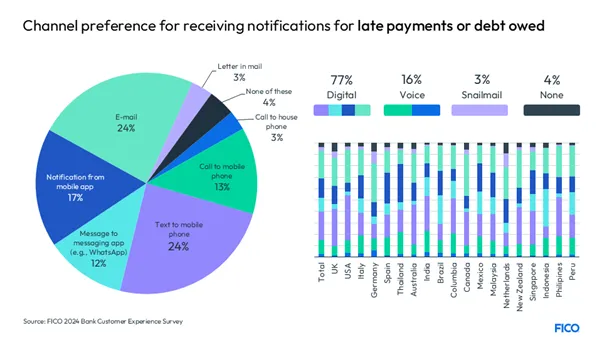

When it comes to communication channels, traditional methods such as phone calls are becoming less effective, with current right-party contact rates rarely exceeding 8–10%. Most customers now prefer to be contacted by text message or push notification for debt or payment reminders, as these methods are more immediate and visible. Email, while still relevant in an omnichannel strategy, is less effective when used alone due to inbox overload however, when coupled with SMS, Voice and push notifications it can be part of an intelligent communication strategy to enhance consumer trust and self-service action.

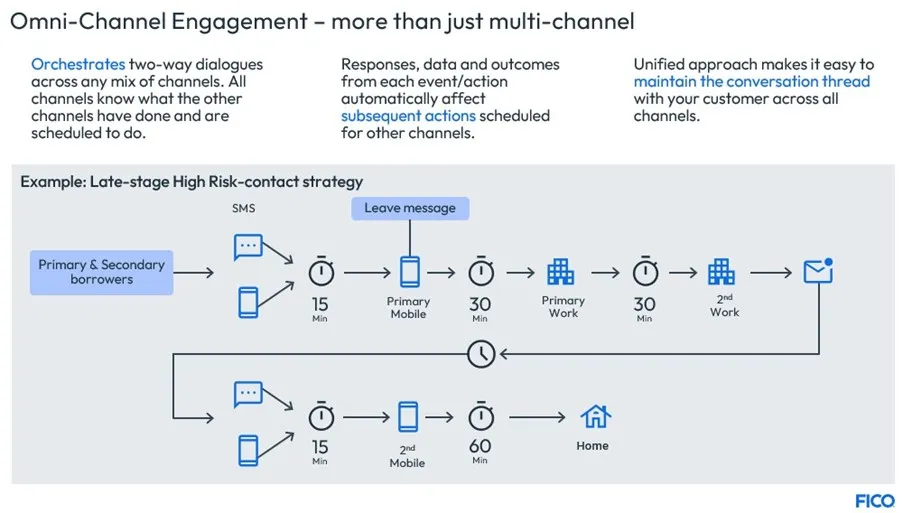

A true omnichannel approach—using multiple, integrated communication channels—is now the best way to ensure that customers are notified of issues and given opportunities to resolve them. Rather than using siloed channels (e.g., dialers, texts, emails, push notifications operating independently), integrating these channels and sequencing them within the same day significantly increases the chances of reaching the customer and prompts quicker responses.

Intelligent, data-driven communications also help identify customer preferences. If a customer responds to a text or IVR call, that information is used to shape future outreach. Sometimes, simply asking for a customer’s preferred channel is the most straightforward way to capture this data. The goal is to reach the right customer at the right time, with the right message, using interoperable channels and personalized messaging strategies.

Using AI to Improve Debt Collection Strategies

AI technology provides several ways to improve on debt collection communication strategies and results.

AI in Debt Collection Use Cases

- Segmentation of Accounts: AI can analyze vast amounts of customer data—including communication history and payment behavior—to group similar accounts and personalize outreach.

- Optimization: AI can help reach business goals such as increasing response rates or collecting more payments by finding the best channel and time to contact each customer.

- Communications: Natural language processing (NLP) powers conversational AI and large language models, enabling advanced self-service experiences where customers can interact naturally with virtual agents.

- Engagement: AI customizes messages from approved templates or generates personalized communications on the fly—enables hyper-personalized engagement across all touchpoints.

Let’s drill into the communication example.

Optimizing Outcomes by Using AI in Debt Collection Strategies

AI offers new ways to engage with customers in the debt collection process. It provides better options for treating customers with respect and empowers them through self-service tools to resolve debt situations independently.

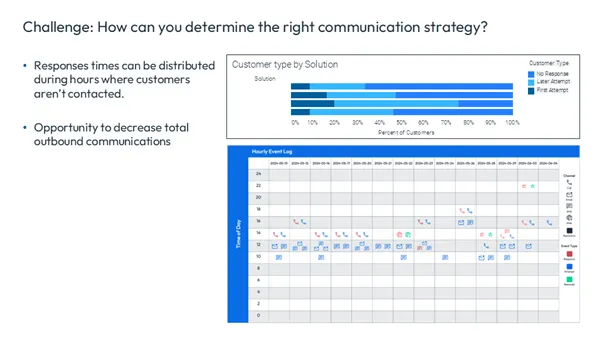

To illustrate the impact, consider a scenario where a financial institution uses AI to analyze its customer data. It might be discovered that one customer prefers voice calls in the afternoon and is more likely to respond at midday. By leveraging this insight, the institution can schedule communications at optimal times and through preferred channels, increasing the odds of a timely response.

The benefits of this approach are twofold

· Moving customers from the “late responder” cohort to the “early responder” group saves costs and avoids over-communication, resulting in a better customer experience.

· Increasing overall response rates leads to higher self-service and improved outcomes for both customers and the institution. In some cases, this approach can even help identify customers at risk of delinquency before they miss a payment, enabling proactive outreach and support.

AI-driven intelligent communication strategies can be built to optimize various outcomes. Models can use payment and cost data to maximize payments collected while limiting dollars spent. It can also look at communication data to optimize responses, enabling more customers to self-service.

Conversational AI, specifically, is revolutionizing collection communication strategies by enabling out-of-the-box chatbots that financial institutions can rapidly deploy and customize. These chatbots can handle payment arrangements, hardship scenarios, and other common interactions—automating what once required a live agent.

The path to hyper-personalization in collection strategies involves combining AI-driven decisioning (best time and channel), conversational AI (for handling responses and self-service), and dynamic content generation. This trio of technologies enables personalized and seamless engagement throughout the delinquency lifecycle.

The Time for AI in Debt Collection Strategies Is Now

While AI is a popular buzzword, its true value lies in driving measurable business outcomes: increasing containment rates (the percentage of customers who resolve issues without needing an agent), boosting response and resolution rates, and creating positive customer experiences. Containment rates are a crucial metric—indicating how many customers can resolve their situation independently, freeing up agents to focus on more complex cases.

The key takeaways are :

- Focus on business metrics such as resolution rate, containment rate, and response rate when evaluating AI solutions.

- Personalize outreach by tailoring communication timing, tone and channels while measuring the impact on key performance indicators (KPIs).

- Modernize collection communication strategies by expanding digital and self-service options, using tools like conversational AI.

Modern tools empower customers to resolve debts independently while enabling institutions to optimize collections strategies and resource allocation. With the right approach, conversational AI can deliver positive outcomes for both customers and businesses.

How FICO Can Help You Improve Debt Collection Strategies

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.