Anti-Bribery and Corruption: FCPA Prosecution Trends in the U.S.

The 2020 Year in Review report from the DOJ's Fraud Section reflects a remarkable record of individual prosecutions in 2020

Each year the Criminal Division of the U.S. Department of Justice (DOJ) – specifically the Fraud Section -- releases its “year in review” report. The 2020 Year in Review report released on February 24 reflects a remarkable record of FCPA prosecutions in 2020 (albeit slightly down from 2019) notwithstanding the ongoing COVID-19 pandemic. While the report encompasses the results of activities across its three litigation units of the Fraud Section (FCPA Unit, MIMF Unit and HCF Unit), the focus of this post is the 2020 activities of the Fraud Section’s FCPA Unit in 2020.

About the Fraud Section

The Fraud Section plays a unique and essential role in the Department of Justice’s fight against sophisticated economic crime. (Page 3 of the DOJ report - Fraud Section provides more details on the Fraud Section’s responsibilities.)

The Fraud Section is comprised of three litigation units, including the Foreign Corrupt Practices Act (FCPA) Unit, the Market Integrity and Major Frauds Unit (MIMF), and the Health Care Fraud Unit (HCF).

Interesting FCPA Statistics1

The Foreign Corrupt Practices Act (FCPA) Unit has primary jurisdiction to investigate and prosecute violations of the FCPA working in parallel with the U.S. Securities and Exchange Commission (SEC). The FCPA was enacted in 1977 and generally prohibits the payment of bribes to foreign officials to assist in obtaining or retaining business (“corrupt” motive).

The FCPA Unit has brought criminal enforcement actions against individuals and companies and focused enforcement efforts on both the supply side and demand side of the corrupt transaction.

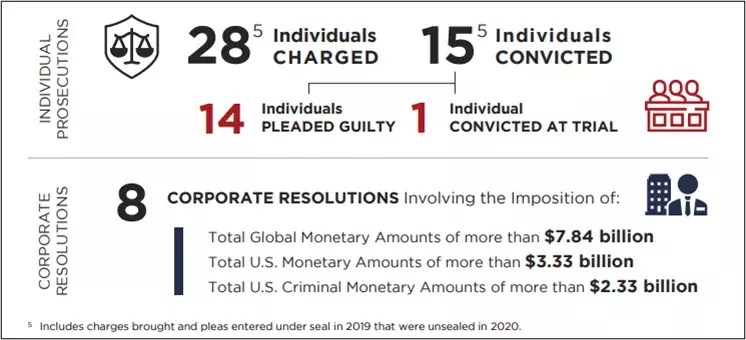

In 20201, the Fraud Section’s FCPA Unit brought charges against 28 individuals and secured 15 convictions against individuals in 2020, compared with 34 individuals charged and 30 convicted in 2019. This slight decrease is not surprising given that the courts and grand juries in the U.S. were shut down for much of 2020 due to COVID-19 restrictions.

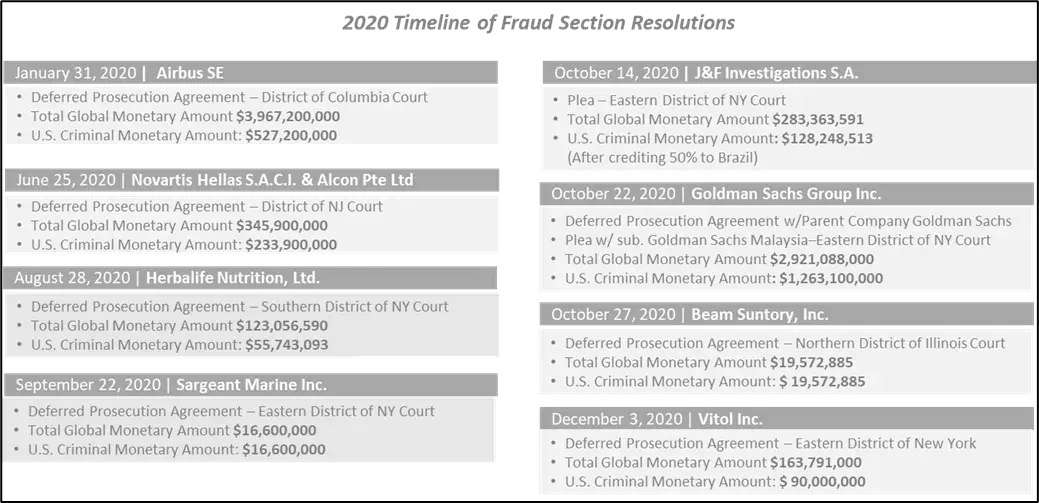

Interestingly enough, despite the start of the COVID-19 pandemic in 2020, the FCPA corporate resolutions saw a slight increase, with eight corporate resolutions in 2020 involving over $2.3 billion in U.S. criminal monetary penalties, as compared to seven corporate resolutions in 2019, involving more than $1.6 billion in financial penalties. Significant corporate resolutions included companies Airbus, Goldman Sachs, and Sargeant Marine (see highlights on pages 11 & 12 of the report).

A timeline depiction of the Fraud Section’s Corporate Resolutions in 2020 is provided below (also page 7 of the report):

According to the report, the FCPA Unit also issued two declinations2 with disgorgement pursuant to the DOJ’s FCPA Corporate Enforcement Policy (CEP) which resulted in approximately $37.7 million in disgorgement, interest, and penalties.

FCPA Corporate Enforcement Policy Declination |

World Acceptance Corporation In August 2020, the Fraud Section issued a declination letter to World Acceptance Corporation (“World Acceptance”) a South Carolina-based company, relating to bribery by its subsidiary in Mexico. The company voluntarily self-disclosed the conduct, fully and proactively cooperated with the investigation, full remediated and disgorged the ill-gotten gains from the scheme. The SEC also resolved its parallel civil investigation, pursuant to which World Acceptance was required to pay a civil penalty, disgorgement and prejudgment interest totaling approx. $21.7 million. The Fraud Section credited the disgorgement paid to the SEC. |

In Closing

FCPA enforcement actions continue to be a high priority area for the SEC and the Department of Justice, not to mention under the Biden Administration (the SEC is expected to be aggressive in bringing enforcement actions against alleged corporate wrongdoers). It is not surprising to see the strong results represented in the “2020 Year in Review” report. While the pandemic has forced rapid changes to the global marketplace, including unique supply chain challenges, the impact of COVID-19 on the Fraud Section’s FCPA corporate cases will not be seen until at least 1-2 years from now.

To learn more about how FICO helps organizations fight financial crime visit our website and/or connect with me on LinkedIn. Stay tuned for other interesting topics and follow this Fraud and Financial Crime blog.

This post is intended to be a high-level reference guide for informational purposes. It does not contain an exhaustive list of requirements under the BSA or any other laws and is not for the purpose of providing legal advice. You should contact an attorney to obtain advice with respect to questions on applicable legal requirements, including the DOJ Guidance, the United States Sentencing Guidelines or on regulatory expectations for an adequate BSA/AML compliance program or Anti-Bribery and Corruption/FCPA compliance program.

1 The summary statistics exclude sealed cases. With respect to all charged individual cases referenced in the 2020 report, individual defendants are presumed innocent until proven guilty beyond a reasonable doubt in a court of law. Includes charges brought and pleas entered under seal in 2019 that were unsealed in 2020. http://www.justice.gov/criminal-fraud/foreign-corrupt-practices-act

2 DOJ’s decision to bring or decline to bring an enforcement action under the FCPA is made pursuant to the Principles of Federal Prosecution. To be eligible for the benefits of the CEP, including a declination, the company is required to pay all disgorgement, forfeiture, and/or restitution resulting from the misconduct at issue. For more information, kindly refer to “A Resource Guide to the U.S. Foreign Corrupt Practices Act. Second Edition” (last updated in 2020).

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.