Are Student Loan Holders at Risk as Deferments Expire?

Factors driving credit score decreases observed among student loan holders involved behaviors such as delinquency on credit products including bankcards, auto loans, and mortgages

As many federal student loan holders exit accommodations made during the pandemic period to suspend student loan payments, they are now faced with managing these payments and maintaining their credit standing. Here we present results of our research into FICO® Score dynamics for holders of student loan debt between 2021 and 2022, to give an indication of key factors that seem to accompany large decreases in the FICO Scores of this population.

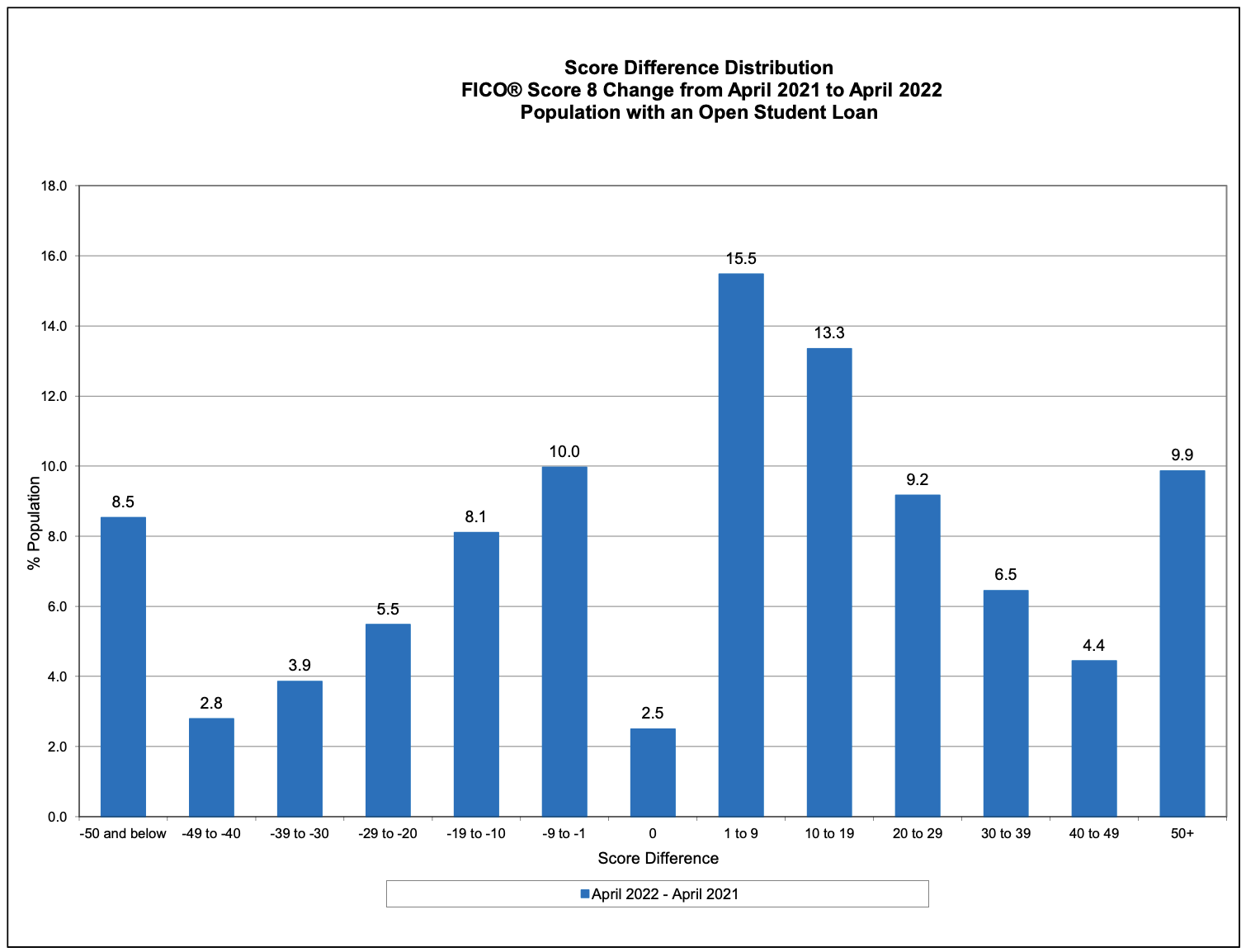

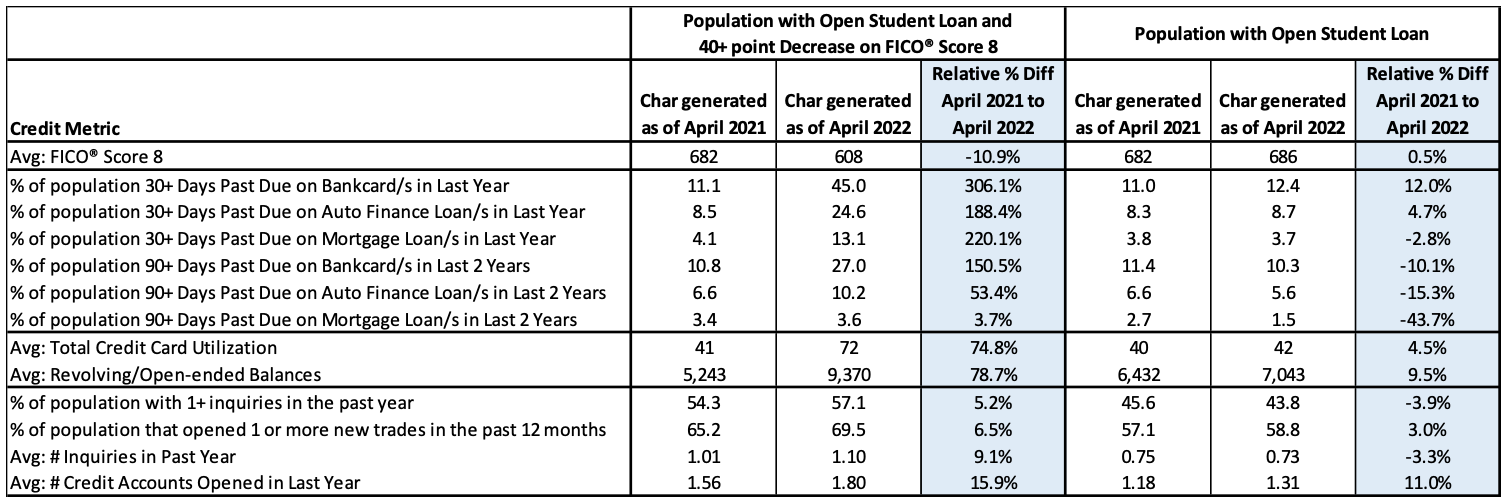

Our analysis looked at depersonalized consumer credit reports from a nationally representative credit bureau sample of consumers who had one or more open student loans as of April 2021 and we observed their credit score change as of April 2022. This population had an average FICO® Score 8 of 682 as of April 2021, and an average FICO Score 8 of 686 one year later. Out of the overall population of student loan holders as of April 2021, 49.4% had a credit score change within +/- 19 points. Notably, even with most in this population having their student loan payments suspended over this 12-month period, 11.3% experienced credit score decreases of 40+ points (“credit score decreasers”).

Focusing on this population of student loan holders with large year-over-year credit score decreases, we compared factors from their credit report that had a bearing on their FICO® Score calculation vs. the same factors on the population of student loan holders as a whole. Significant contributors to the large credit score decreases were typical factors considered by the FICO Score from their credit history.

Recent delinquency:

Of the open student loan population, 11% had a 30 day past due delinquency or worse on a bankcard in the prior year as of April 2021. For that overall population, the percentage increased to 12.4% at April 2022. But of those with large credit score decreases, 45% had a 30 day past due delinquency or worse on a bankcard in the prior year as of April 2022.

Similarly on auto loans, the baseline was 8-9% of the student loan population having a 30 day past due delinquency or worse on an auto loan in the prior year at both points in time, but nearly 25% of the large credit score decrease population as of April 2022 had some auto loan delinquency in the prior year.

4% had recent delinquency on a mortgage among the student loan population as a whole at both points in time, but 13% of the large credit score decreasers had recent delinquency on a mortgage in their credit history as of April 2022.

Factors measuring payment history and evidence of late payments account for 35% of the FICO® Score calculation.

Revolving balances and utilization:

The large credit score decreasers also increased their revolving utilization (revolving balances as a percent of revolving credit limits) from an average of 41% to 72% over the period, while the student loan population as a whole had stable average utilization values, from 40% at 2021 to 42% at 2022.

The average of revolving/open-ended balances for credit score decreasers went up by nearly 80%, vs. going up by 10% among the total student loan population.

Calculations involving revolving balances, credit card utilization, loan balances and other measures of outstanding debt from the credit report contribute to 30% of the power of the FICO® Score.

Pursuit of new credit:

Another, less heavily weighted category of information within the FICO® Score calculation is “pursuit of new credit”, which makes up roughly 10% of the overall credit score calculation. This area too was observed to be a contributing factor in this study. Among the credit score decreaser population, those who had one or more inquiries in the past year increased by 5%, while for the student loan population as a whole, there were fewer who had a recent inquiry during that period. The large credit score decrease population also had a larger percentage increase in new account openings compared with the baseline student loan population. It’s also worth noting that the credit score decreasers already had a higher number of inquiries and new account openings on their credit report even as of April 2021.

Considering the student loans themselves were largely in deferment, it’s not surprising that the factors driving the credit score decreases involved behaviors that didn’t relate to the student loans on the credit report: delinquency on other credit products including bankcards, auto loans, and mortgages; significant increases in revolving balances and utilization; and seeking and opening new credit at an elevated pace.

2023 promises to be an important year for those who carry student loan debt. Unanswered questions abound: Will the debt relief program for federal student loans be permitted by the courts to move forward? When will the federal student loan repayment pause, soon to enter its third year, expire? For lenders and loan servicers, it would behoove you to carefully monitor those who hold student loan debt within your portfolio to ensure that they are responsibly managing their credit with you in light of potential re-setting occurring with their student loan obligations. The FICO® Score continues to be a valuable asset in your toolkit for lenders to manage their borrower accounts.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.