Australians & New Zealanders Want Online Car Loans

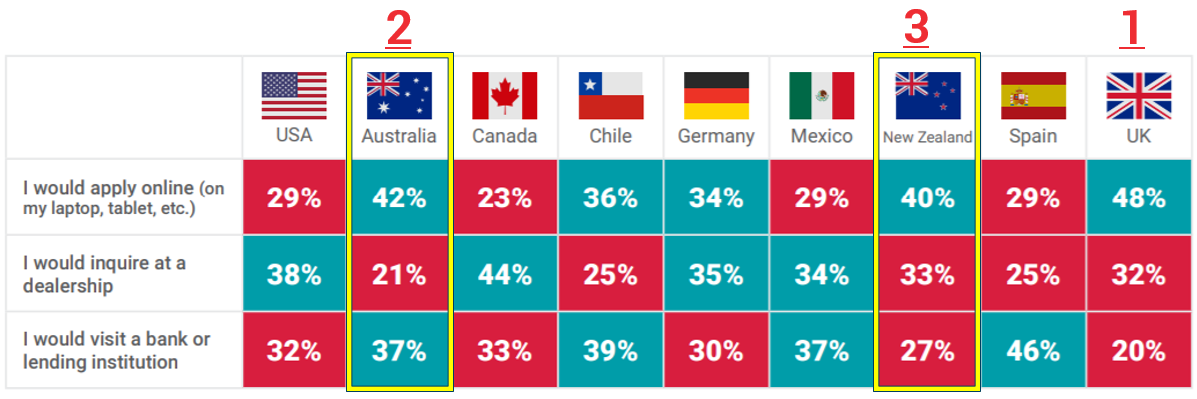

42 percent of consumers in Australia and 40 percent of consumers in New Zealand indicated they would like to apply for their next automotive loan online These were the surprising…

42 percent of consumers in Australia and 40 percent of consumers in New Zealand indicated they would like to apply for their next automotive loan online

These were the surprising results of our first global survey on consumers’ automotive finance experience. The study found that there was a growing inclination for vehicle shoppers in the antipodes to apply for auto loans online. Australia and New Zealand had the second and third highest figures among the nine countries surveyed. Only the UK had more respondents who indicated a preference for online at 48 percent.

These results indicate a significant shift in channel preference for loans with the majority of consumers in Australia (45 percent) and New Zealand (62 percent) having applied for their most recent auto loans at dealerships.

“Unlike the US, where seven in ten respondents would rather apply for their next loan at a dealership or through a visit to the bank or lending institution, Australian consumers are more open to the idea of digital financing,” said Paul Swyny, automotive lead in Australia for FICO. “Convenience, speed and ability to comparison shop across lenders were the top reasons given by consumers. Unlike other markets, auto dealerships and banks were not seen as having a pricing, security or convenience advantage in the Australian market.”

Consumers are very open to instant, pre-qualified offers to improve expediency. Only 15 percent of New Zealand consumers would not accept such an offer and may prefer instead to work through a traditional, full loan application process and credit check.

“Predictive scoring analytics can help to ensure creditworthiness accuracy and reduce the manual underwriting that still takes place to complete a loan today. Optimisation of deal structures can ensure an appealing offer is made to the consumer while ensuring profitability for the lender. Instant and accurate lending decisions will deliver a positive customer experience and grow the loan books of lenders,” added Vaile Mexted, country manager for New Zealand at FICO.

A total of 2,200 adult consumers across nine countries including the US, Canada, Mexico, Chile, Australia, New Zealand, Germany, Spain, and the UK were surveyed. Respondents were between the ages of 18-64 who acquired a loan on a new/used vehicle within the last 3 years.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.