Auto risk on the decline

New auto risk is on the decline. Recent FICO research shows lower delinquency rates and better performance on new auto loans opened in May-June 2009 compared to those opened in May…

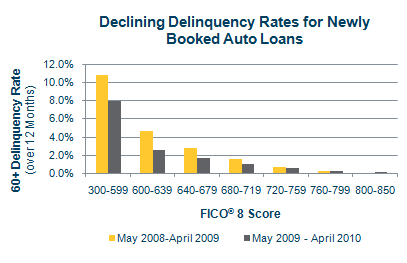

New auto risk is on the decline. Recent FICO research shows lower delinquency rates and better performance on new auto loans opened in May-June 2009 compared to those opened in May-June 2008. This trend holds true across the entire FICO® 8 Score range.

As an example, in the 12 months ending April 2010, about one of every 411 borrowers with a FICO® Score of 720 or higher became 60-days delinquent or more on a new auto loan opened in May-June 2009. In the prior year, one of every 288 borrowers in the same score range became 60-days delinquent or more on a new auto loan.

The improved performance on new car loans is the result of two underlying factors—a more cautious lending environment and low consumer confidence. Underwriting standards for car loans have become stricter over the past couple years, a trend also seen with other types of loans such as mortgages and credit cards. In addition, many consumers aren’t feeling too confident about the economy. This seems to have made them less likely to splurge on big-ticket purchases, unless they feel that they can handle the additional debt.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.