Bank Primacy: Survey Reveals Secrets to Customer Loyalty

FICO's global survey finds that 90% of customers have a primary bank provider, but over a third would switch to get a better offer or customer experience

The relationships between consumers and their financial institutions have certainly become more complex. The advent of new, digital offerings and the ease with which accounts can be opened is vastly expanding the range of financial organizations we all have access to.

As the competition grows, banks aim to be their customers’ primary provider by serving as their main resource for banking services (such as deposits, payments, and loans). Bank primacy (sometimes referred to as principality), which goes hand-in-hand with customer loyalty and retention, is vital for success because it increases resilience and drives higher revenue.

What Does Primacy in Banking Mean?

Banks invest in acquiring new customers at a certain cost per acquisition, but many of these accounts can end up under-utilized or even dormant. To build stronger and more profitable customer relationships, becoming a primary provider is key.

According to FICO’s recent Bank Customer Experience Survey, which polled more than 19,000 consumers in 19 different countries across North, Central, and South America; Europe; and the Asia-Pacific region, 90% of consumers globally consider one financial institution to be their primary provider.

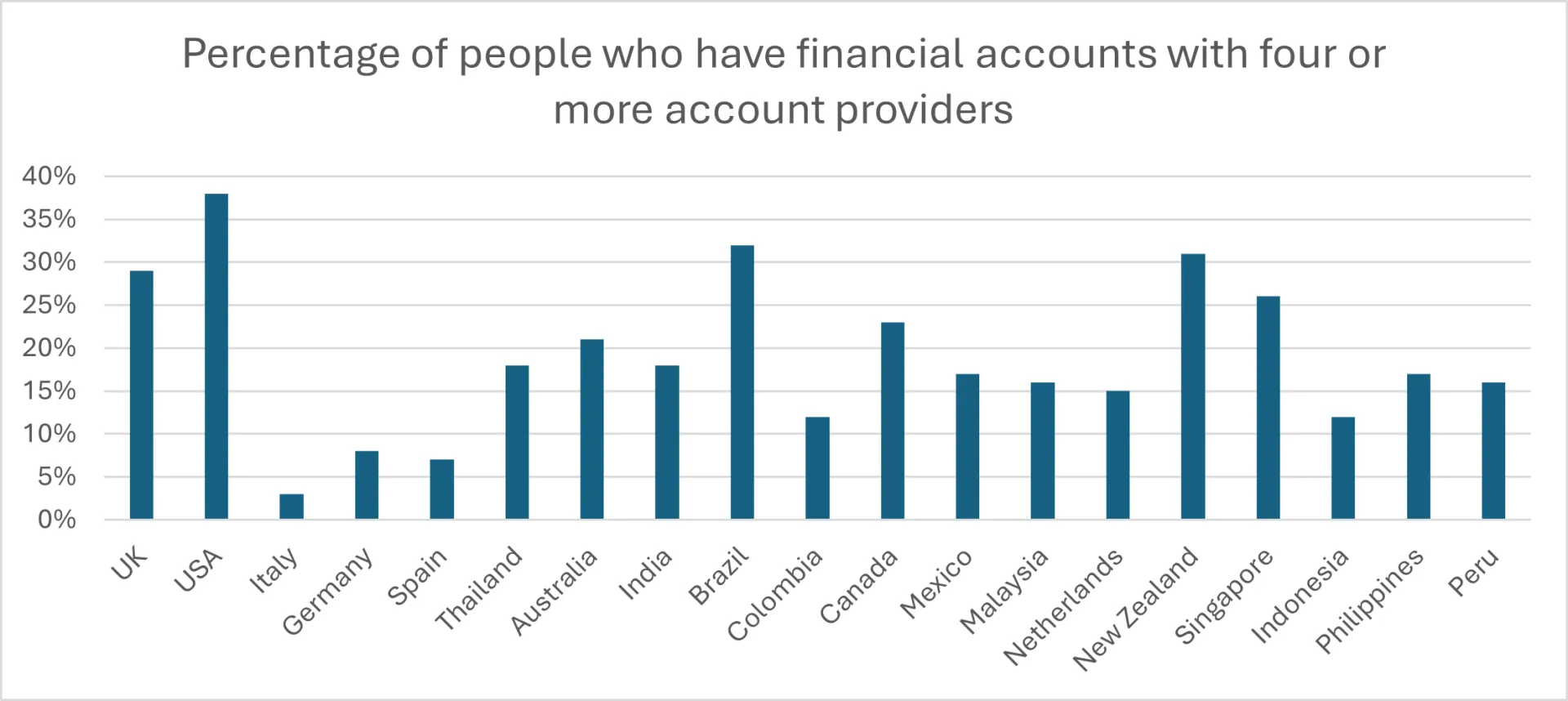

Our survey found that 74% of people have more than one provider for their financial accounts and 19% have more than 4 providers. Italy is the only country surveyed where less than half of respondents (46%) have only one provider for their financial services. However, even in those countries where over 30% have more than four providers, at least three quarters of people confirmed that they have a primary provider.

Maintaining a steady portfolio of primary customers is vital for success in retail banking. Let’s explore some strategies for banks to become or remain the preferred choice for financial services among their clients.

A Wide Range of Factors Determine Bank Primacy

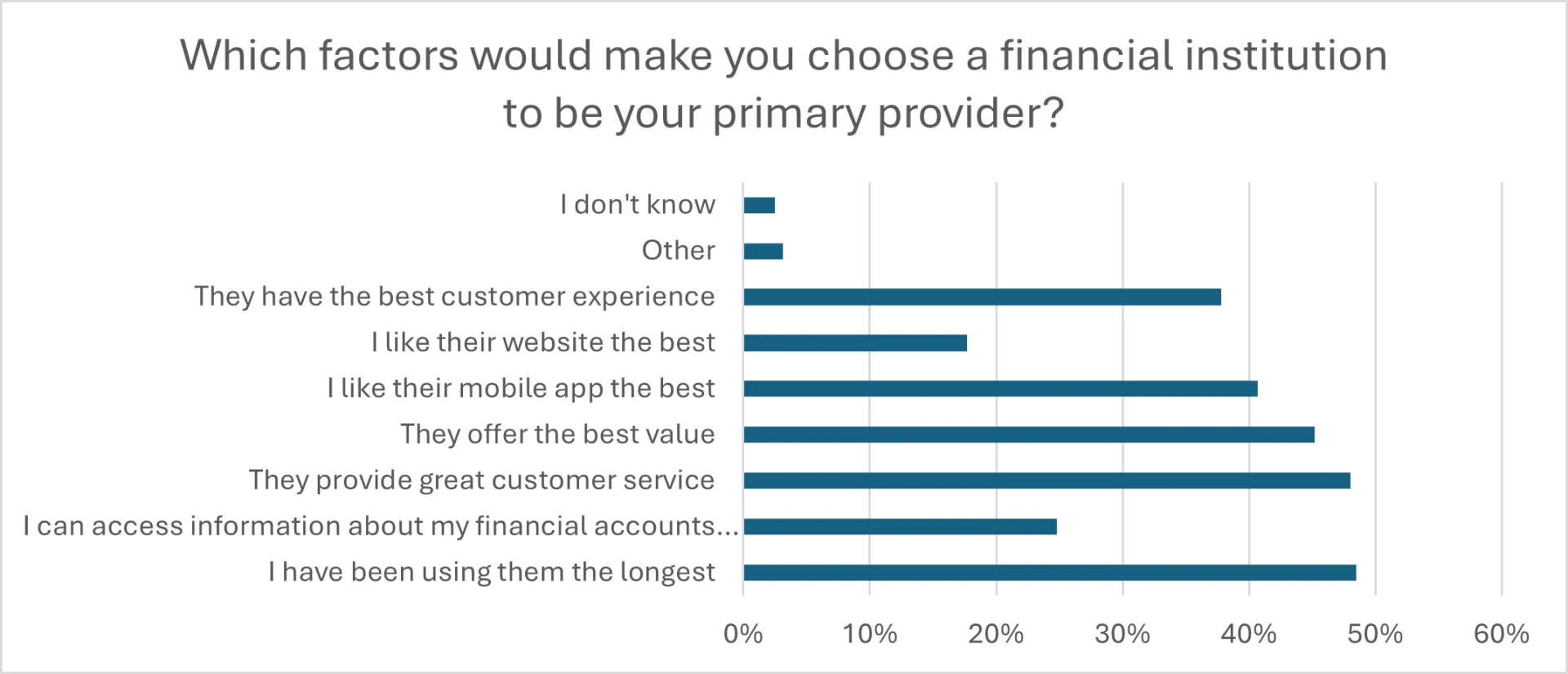

Our data revealed that nearly 50% of customers consider their primary provider to be the bank they’ve been with for the longest amount of time. This is particularly true in Australia and New Zealand, where over 61% of participants indicated the length of their bank’s relationship as a deciding factor for primary status. Fewer customers in Italy (36%), Germany (34%), and Spain (34%) say that their primary bank is the one they’ve used the longest – consumers in these countries are also less likely to have accounts with multiple providers.

Other leading factors that affect bank primacy include value for money and the quality of customer service, customer experience, and mobile app technology. 48% of consumers globally say that “great customer service” is a main reason they consider a financial institution to be their primary provider. Meanwhile, 45% of those surveyed said that offering the “best value” is a top deciding factor when it comes to choosing a primary bank.

The quality of the mobile app is a major consideration for consumers In fast-growing economies such as Thailand (52%), India (52%), Mexico (51%) and Brazil (50%). This seems to reflect the importance of mobile phone technology in delivering financial services to those populations.

Customers also expect their primary bank to provide a range of products and services. The most important to customers are saving accounts (64%), credit cards (55%), loans (43%), and the ability to send payments in real time (43%). Meanwhile, investment services (39%), mortgages (28%), and foreign exchange (25%) ranked a bit lower.

What Makes People Leave Their Bank Provider?

While attracting people early in their financial journey is a key part of growing long-term relationships, customers can’t be taken for granted and many will leave if feel unappreciated.

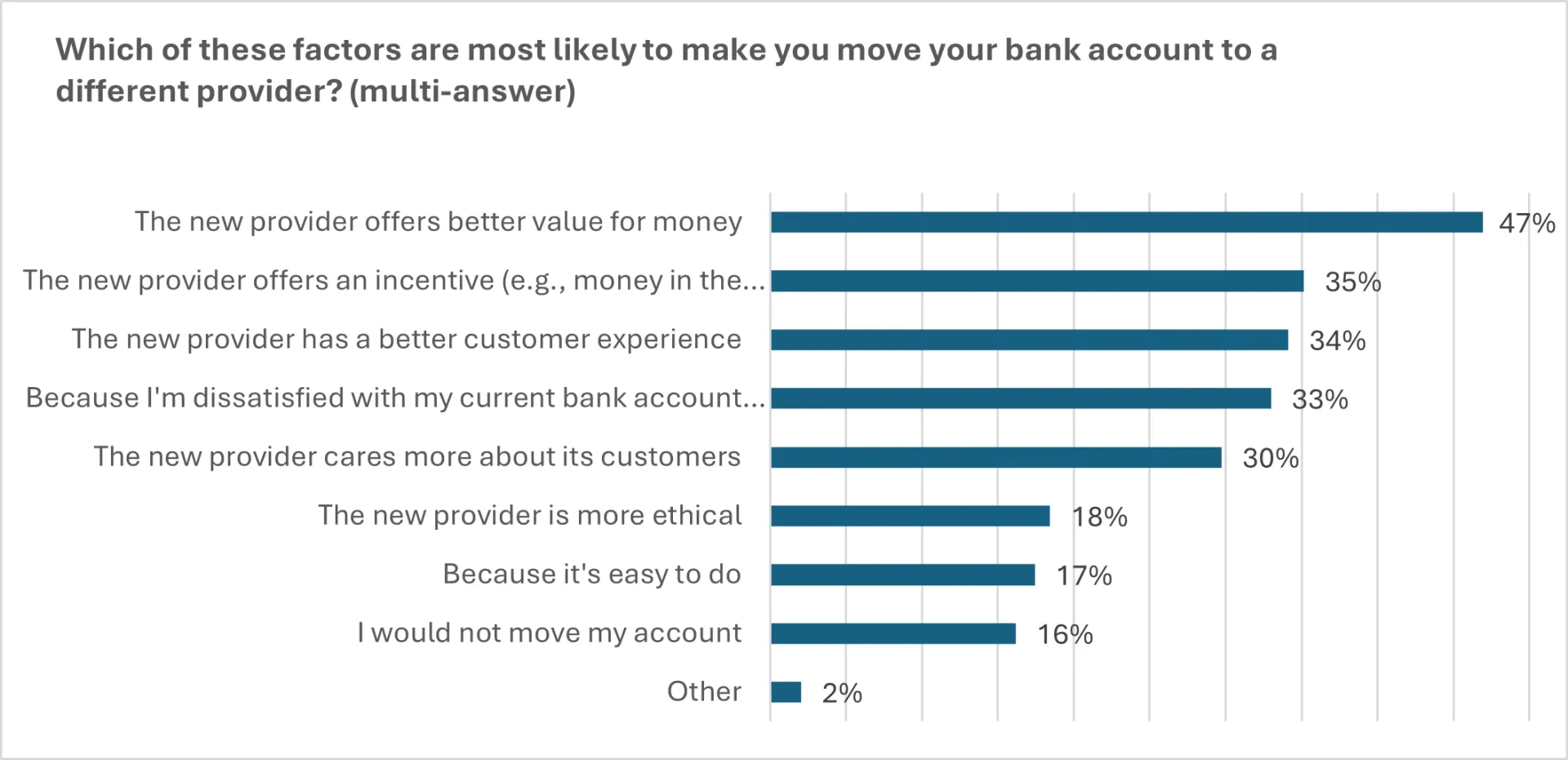

FICO’s survey reveals that 43% of people have switched their main bank provider at least once. On the other hand, a loyal 16% say they would never change their bank. 47% of consumers say they would move their main bank account to a different provider if it offers “better value for money.”

The challenge for financial institutions is that a significant number of consumers say they would switch primary providers for a wide range of reasons. For example, over a third of people would change their primary bank if the new provider offers an incentive (35%), better customer experience (34%), or they are dissatisfied with their current provider (33%). Furthermore, 17% say they would switch primary providers simply if it’s easy to do.

How Banks Can Achieve and Maintain Primacy Status

To earn and keep primary provider status, banks must understand the key drivers of primacy and strategize around them. Here are several ways financial institutions can address customer priorities and serve as their primary bank provider:

Provide and communicate value

Banks gather a lot of information about customers and it’s important to demonstrate how that data is being used to provide value. Make sure your customers feel understood and appreciated by tailoring experiences to their needs and preferences. Educate them and let them know you’re there to help them with their financial journey. Focus on customer-centric, omni-channel strategies that enable you to engage each customer when and where it matters.

Offer smart incentives

Everyone loves a great deal – or even better, getting something for free. 35% of consumers say they would switch their primary bank if a new provider offers an incentive, such as a cash bonus for opening an account. It’s vital for financial institutions to have clear insights into what incentives appeal to customers as well as what’s being offered by competitors. However, don’t spend all your efforts on winning new customers and remember that your existing customers want to be rewarded for their loyalty.

Deliver great customer experience and service

FICO’s survey found that 63% of people believe customer experience is as important as a bank’s products and services, and 28% believe customer experience is more important. Furthermore, 34% of consumers say they would switch banks for a better customer experience. Demonstrate that you value their relationship by delivering personalized experiences that cater to their preferences and anticipate their needs. Leverage real-time data and advanced analytics to drive tailored experiences and communications to the right customer at the right time through the right channel.

How FICO Can Help You Improve the Customer Experience and Loyalty

- Explore FICO solutions for customer management

- Read How to Unlock the Power of Hyper-Personalization in Banking

- Review the e-books on our customer survey:

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.