Unlocking Profit Potential in India's Credit Card Boom

Boosting revenue and effectively navigating risk using FICO Platform

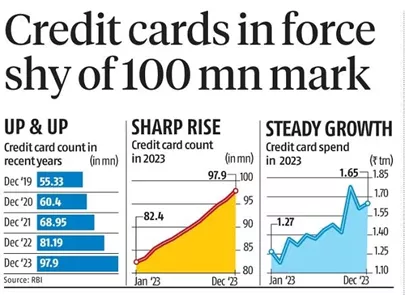

India is fast approaching the significant milestone of 100 million credit cards, according to the Reserve Bank of India (RBI). In 2023 alone, Indian customers acquired an extra 16.71 million credit cards, a substantial jump from the 12.24 million added the previous year. This growth trend has been steadily gaining momentum for over five years, driven by the concerted endeavors of banks and the evolving consumer spending patterns. This surge underscores a remarkable 77% increase in the overall number of credit cards in circulation in 2019, highlighting the burgeoning credit card growth in India.

Spending in India has also seen significant growth, with credit card transactions among Indians reaching USD$19.9 billion in December 2023 with e-commerce payments contributing significantly to this increase, rising to USD$12.78 billion from USD$12.3 billion in November. So how can banks seize the momentum and boost their revenue while balancing risk during this consumer credit boom in the credit card market?

Unlocking the Power of Real-Time Authorization for Profitability and Customer Satisfaction

In the dynamic landscape of Indian banking, a game-changing regulation from the Reserve Bank of India mandates customer opt-in for automatic credit line overlimit authorization. This shift isn't just about compliance; it's a catalyst for transforming the banking industry towards a customer-centric experience.

The real-time credit card authorizations capability wields a transformative impact on customer experience in India, as the modern Indian customer demands swift and frictionless financial interactions. Consumers in India, now accustomed to on-the-go transactions, benefit from the assurance of instant approvals, eliminating the frustration of delays or uncertainties. The real-time authorization feature caters to the need for security, assuring the India customer base that their transactions are promptly validated, fostering trust in the credit card system.

In the dynamic world of credit card transactions, real-time authorization equips banks with the ability to maintain an acute awareness of their customers' current risk profiles, right up to the minute delving into the heart of each incoming transaction, distinguishing between high-risk and low risk spending and activities across purchase types and merchant categories enabling agile and profitable credit decisioning.

The fine line between regulatory compliance, customer experience and responsible lending opens up a world of possibilities for banks in India. By granting a select credit worthy percentage of customers the ability to temporarily go over their credit limit intentionally, banks can unlock a treasure trove of revenue and interest. Moreover, they can foster an environment where declines are minimized to the critical high-risk categories, creating a positive customer experience for credit card holders and maintaining valuable customer goodwill.

Key FICO® Platform Capabilities Delivering Real-time Decisioning for Industry Leaders in India:

A. Real-Time decisioning

Business Benefit: Customer experience: Helps bank stay front of wallet.

When customers in India seek an over-the-credit-limit facility, the FICO Platform swiftly evaluates their request, ensuring the bank’s stay "front of wallet." This responsiveness makes credit cards the preferred choice for daily spending, elevating customer experience and loyalty.

B. Consent Management

Business Benefit: Regulatory Compliance

At the point of request, the FICO Platform can determine whether the transaction can be authorized; facilitating the ability to trigger explicit customer consent requests at that point. This provides the bank the opportunity to drive higher customer consent as opposed to the typical marketing program driven consent and therefore has the potential to deliver a significant targeted uplift. Further, tracking electronic consent, along with detailed reports, ensures transparency and accountability, making compliance seamless.

C. Transaction type, merchant category codes and limit assignment:

Business Benefit: Targeted authorization

FICO Platform empowers Indian businesses to refine authorization by considering transaction types and merchant category codes. By categorizing spending into risk bands, businesses make more precise decisions, leveraging percentage expansions for low to medium credit limits and fixed amount increases for higher credit limits. The FICO Platform also facilitates the ability for banks to differentiate between preferred cobranded cards thereby further enhancing partner programs.

D. Current and rounded view of existing strategies:

Business Benefit: Aligned decision-making and facilitating policy adherence.

In the realm of Indian credit card businesses, maintaining a cohesive decision-making approach is paramount. This entails integrating various portfolio actions like over limit authorizations and permanent line increase assessments to optimize the credit card journey for customers. Let's delve into the journey of a customer who hasn't consented to credit card overlimit expenses. Initially, an overlimit transaction is approved, followed by facilitating soliciting the customer's consent for overlimit approval. Upon consent, the FICO Platform conducts a credit risk assessment for a permanent line increase. Subsequently, it facilitates for another request to be made to the customer for a permanent credit limit increase, including consent and any necessary documents. Timing these actions strategically ensures they enhance rather than disrupt the transaction, delivering excellent service. Moreover, these actions are selectively applied to eligible customers based on credit risk strategies, leveraging the overlimit transaction as a trigger to identify the next best action and executing it opportunistically.

Finally, and importantly, how FICO Platform unlocks the valuable business benefits:

1. Customer Experience: FICO Platform enhances customer satisfaction and strengthens brand loyalty by prioritizing seamless temporary transactions over credit limits, potential permanent line increases, and instant approvals. Real-time credit card authorizations elevate the banking experience by prioritizing customer needs and providing unparalleled convenience. This approach fosters lasting relationships and promotes advocacy for the bank.

2. Fee Income: FICO Platform empowers banks to optimize fee structures by leveraging real-time monitoring and risk-based decision-making. Through analyzing customer behavior and transaction patterns, banks ensure competitive fee adjustments that attract and retain customers while balancing fee income and satisfaction.

3. Interchange Income: Indian banks can maximize interchange income by making targeted authorization decisions based on transaction types and merchant category codes. Grouping merchant category codes into risk bands and approving more spending in low-risk categories enhances revenue through interchange fees, ultimately boosting interchange income.

4. Interest Income: FICO Platform drives increased interest income potential by facilitating enhanced risk assessment and incremental transaction approval rates. This results in more outstanding balances, thereby maximizing interest income.

5. Improved and Reduced Bad Debt: Businesses benefit from real-time credit monitoring and risk-based decision-making capabilities provided by the FICO Platform. This enables them to closely monitor spending above limits and detect early signs of financial stress. Proactive decisions mitigate the risk of bad debt, preserving the bottom line.

In India's rapidly growing credit card market, where over 100 million cards are now in circulation, notable shifts in consumer behavior and banking practices have emerged. Banks are now tasked with striking a delicate balance between boosting revenue and effectively managing risks.

FICO Platform stands as a pragmatic solution, offering real-time authorization capabilities that ensure seamless transactions and provide valuable insights for informed decision-making. By aligning with regulatory standards, enhancing customer experience, and promoting responsible lending practices, banks can explore new revenue opportunities while mitigating risks.

As the credit card market continues to expand, leveraging advanced technologies like FICO becomes increasingly essential. By embracing innovation, banks can enhance their performance in customer service and financial management, thereby influencing the future direction of India's banking landscape.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.