Do After-Hours Contact Strategies Work?

Many businesses assume customers won’t respond to communications outside normal business hours. Some even wait until the next day to contact customers when suspicious,…

Many businesses assume customers won’t respond to communications outside normal business hours. Some even wait until the next day to contact customers when suspicious, potentially fraudulent activity occurs. Two recent FICO banking case studies call this approach into question, suggesting instead that after-hours engagement strategies are worthy of consideration. Emma Mills shares these findings on the FICO Labs Blog—here's an excerpt:

***

At FICO, we’re data junkies, constantly working with clients to fine-tune their engagement approach to squeeze every last drop of efficiency, while deepening the customer relationship. We recently worked closely with two banking clients to test off-hour contact strategies and found some very interesting results.

After-Hours Interactive SMS

Our first client, a large European credit card issuer, implemented a two-way SMS strategy. In this case, after the initial suspicious activity, a SMS was sent to the customer with an explanation of the situation, the process, and the need for them to respond. Then a subsequent SMS was sent with transaction information, to which the consumer was asked to confirm if the activity was genuine or fraudulent.

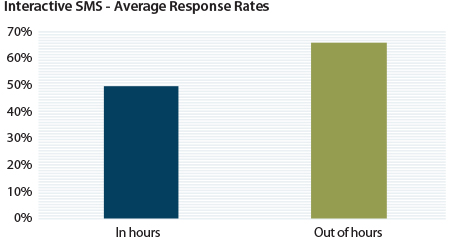

Contrary to conventional wisdom, response rates after hours (8pm to 8am) were significantly higher at 66% than business hour rates (8am to 8pm) at 50%. Interactive SMS for simple transaction verification was clearly effective and acceptable to these consumers.

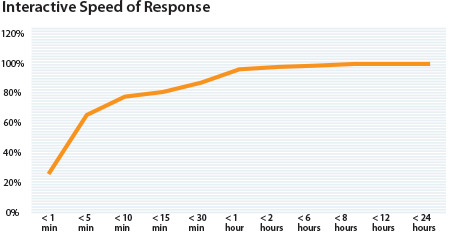

Additionally, we saw that the speed at which consumers responded to after-hours SMS alerts is very good. Of those consumers that responded, over 80% did so within 15 minutes of the initial contact.

SMS Invite for Inbound Calls

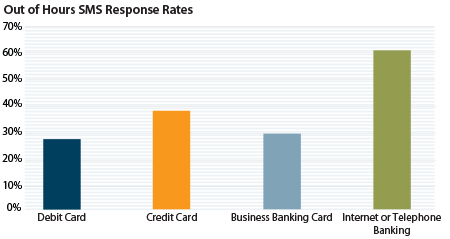

Our second client – also a substantial European card issuer – pursued an SMS-to-call strategy. Here again, conventional wisdom suggests that you shouldn’t contact customers and invite them to call outside of normal business hours. The client sent customers SMS messages immediately following suspicious activity on their cards or accounts after business hours. Customers were instructed to call and confirm if the activity was genuine, or speak to an agent if it was suspicious.

For card transactions, about 30% of consumers responded when contacted between 8pm and 8am, while 60% responded for Internet or Telephone Banking transactions. The response rates for Internet or Telephone Banking transactions are significantly higher because the sums tend to be larger and are often transfers to friends or relatives—vs. card activity where the value is often smaller, and people have other payment options (other cards or cash).

Consumer Empowerment = Better Customer Experience

Across both strategies, we see consumers embracing after hours contact...Engaging customers quickly increases customer satisfaction because it allows the consumer to resolve the situation on the same day, rather than having to wait for in-hours contact. From the company’s point of view, it allows a situation to resolve much sooner than a business-hour strategy would. Additionally, the typical “morning rush” of call volumes declines when much of the activity can be resolved after hours, helping to reduce consumer wait times at peak hours.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.