The Future of Risk Management: Acquire and Engage Customers

How to improve customer acquisition, experience, and lifetime value with a personalized, 360-degree customer view

Welcome to my four-part blog series on the future of risk management. With more than 30 years as a banker and (a somewhat ridiculous) 130+ financial apps across my devices, I’ll be sharing risk management insights on the hidden challenges and opportunities across the credit lifecycle. At FICO, we frame the 360-degree customer view with the customer very intentionally at the center.

The attract and engage lifecycle phase is exactly what it sounds like—cut through the competitive noise and attract the right customers, with the right offer, in the right channel, and at the right time. Sounds easy, right? It’s not.

- How many emails, texts, calls, and mailers do you get in a day?

- How many do you read, let alone consider, and actually engage with?

- How often does the bank you’ve been with for years with one product send you discordant (or even contradictory) product offers depending on the channel? (Ahem, thank you for making me feel like a faceless number.)

Challenge #1: Winning (and keeping) customers is increasingly difficult—and expensive

With growing competition and constrained marketing budgets, it’s harder than ever to attract profitable new customers and stand out from the crowd. As a lifelong banker, I’ve seen the cost to acquire new customers range from $500 up to $1,500 for premium cards. Costs are driven by ads, campaigns, credit bureau costs, and from losing customers in the process (known as low conversion rates, which I’ll address in #2 below). If you win and convert customers, how do you keep them with aggressive competition that isn’t pulling any punches?

Personalized customer experience can mean a lot of things. And personalization at scale—well, that can be a tall order and a hollow promise. Think customer experience has become a buzzword that’s losing momentum and investment with all of the competing challenges? Think again. CEX still reigns supreme according to our 2024 US Bank Customer Experience Survey. The in-depth study looked at the needs and preferences of banking customers across the United States, asking them what offerings they care about most, what makes them loyal to one bank above all others, and why good customer experience is as or more important to them than services and products.

We were stunned to see that 88% of customers consider customer experience of equal importance to product offerings when choosing their bank. Banks that offer high-quality customer experience across all touchpoints and channels better compete with fintechs, drive growth, and secure loyalty.

Opportunities

To win on customer experience for acquisition, organizations need to break down siloes across product lines and untangle discordant messages. To attract and engage the best customers, they must be seen with a holistic, human, 360-degree view with customer experiences that build trust and loyalty to your bank.

To find (and win) profitable new customers, we’ve seen our clients achieve incredible results with advanced analytics to generate the right actions to present across every touchpoint. They’ve delivered stand-out campaigns and real-time, meaningful customer experiences that deepen loyalty and brand engagement that continuously builds and updates always-on customer features and profiles with each interaction. They’ve been able to outshine and outperform the competition with personalization at-scale, responsibly growing portfolios and enhancing customer uptake and engagement.

This begins with attracting and engaging the right customers through marketing, and it continues to build a full, rich view of your customers through risk, fraud, and IT operations.

Challenge #2: Good prospective customers won’t go through bad processes

I say this one regularly: Good prospective customers won’t go through bad processes…but fraudsters and higher-risk customers might…hello adverse selection.

Want to aggravate your best prospects and damage your conversion rates? Inundate your prospective customers with generic, untimely offers through disconnected channels that feel like they’re coming from different banks. That hurts the customer experience, trust, engagement, uptake, retention, and your brand…and it’s expensive and inefficient.

Further, once you do get them to respond to the offer, you need to have a smooth, low-friction, intuitive process to get them from look-to-book, which is the product of four different ratios. For a new credit customer, we have:

- Attraction ratio—campaign to app or site

(# of people that go to site or app) / (# of people in campaign) - Application ratio

(#of people that apply) / (# of people that go to site or app) - Approval ratio

(# of people approved) / (# of people that apply) - Funded ratio

(# of people funded) / (# of people approved)

Weak customer experience means fewer people will complete the application, lowering #2. This may attract more of the wrong customers (higher risk / fraudsters), lowering #3. And, creating too much friction in the post-approval process lowers #4. I’ve seen the look-to-book rate as low as 1% for online loans. Think about how that drives the costs mentioned above. If I drive 100 potential customers to my site, and only 1 gets funded, then I potentially have 100 credit bureau pulls (at say between $1 and $3 each), running $100 to $300 for just the credit bureau pulls. That doesn’t include the campaign costs. Ouch.

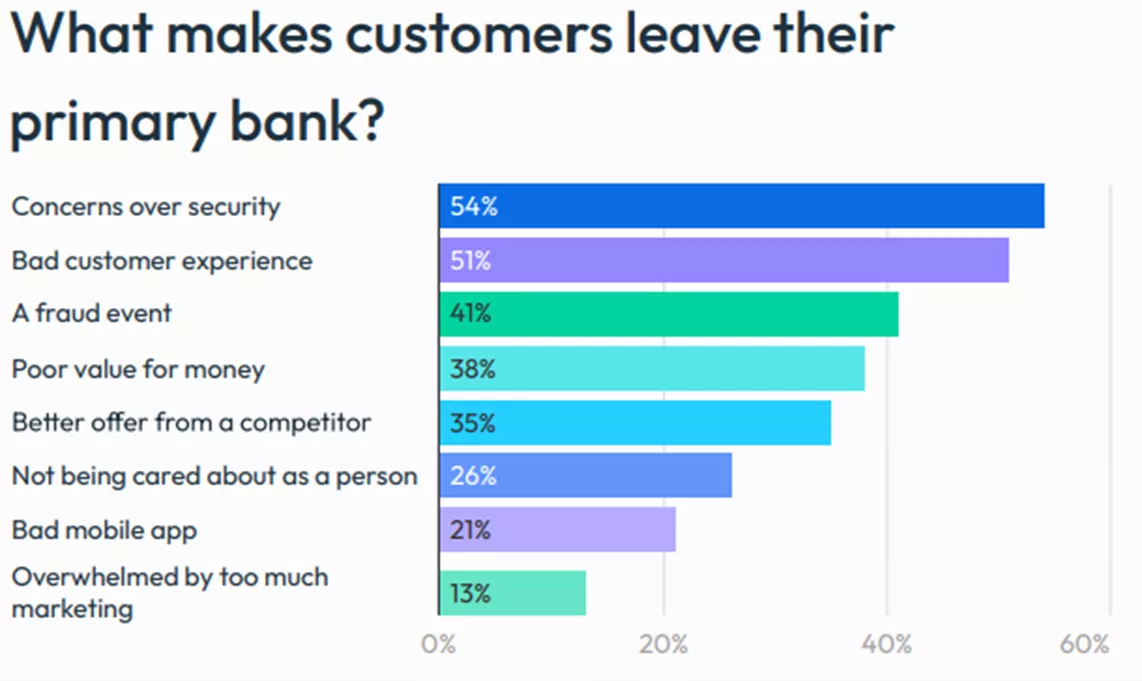

Our latest research sheds light on why customers leave their primary bank, and security, customer experience, and fraud are at the top of the “I’m out of here” list:

Opportunities

Organizations need to deliver fast, smart, cost-effective, and risk-aware offers to attract, win, and retain the right customers. That means attracting and engaging with risk-aware, responsible applications, while deterring fraudulent or higher risk ones.

Forward-looking organizations should review all of their digital experiences and ensure that they delight customers. This is a bold ask, but many institutions are in catch-up mode and have cobbled together processes that resemble the digital version of form filling. These processes are ripe for change – your conversion rates are suffering, and you may inadvertently cause adverse selection. Again, good prospects won’t go through bad processes (but bad ones probably will).

So, I say go to the mattresses! Well, actually, go to the numbers. For conversion rates, identify each ratio and dig into where the application is falling off. Understand where a customer is stopping:

- Am I stopping potential fraudsters? If so, good.

- Does my process feel secure?

- Am I attracting the right customer (risk profile)?

- Is what I’m asking for clear and intuitive?

- Have I explained why I need the information?

- Am I asking for data I don’t need right now?

- Am I approving early as I can? It’s easier to get customers to complete the process if they know they are approved.

- Is my pricing competitive? Am I attracting prospects with a low price, and then not delivering?

- Do I have automated follow up when a customer drops or stops midway through a process?

- Do I have adequate testing, and am I measuring those results and making changes quickly?

Ask and answer all of these questions and revisit them. The application and onboarding process should constantly be improved.

Challenge #3: Disparate systems make agility nearly impossible. How can I build streamlined, efficient workflows to personalize at scale?

I hear this one a lot. Front-end and back-end systems don’t communicate, and many firms are unsure of where to start on the journey. If you have generic, universal marketing campaigns, how do you start to build centralized, personalized campaigns across the organization?

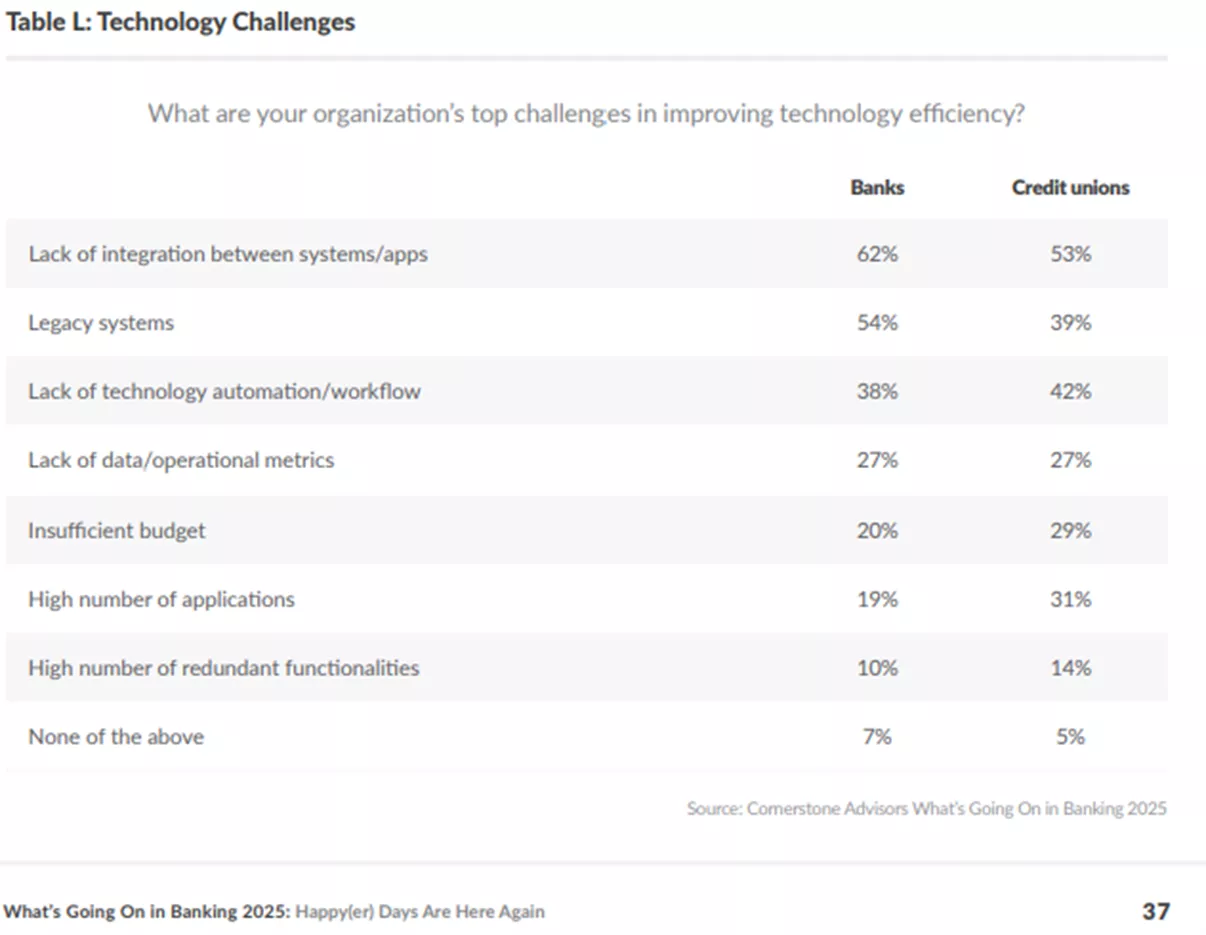

System integration and streamlined automated workflows are top priorities for bank executives. Cornerstone Advisors ranked these top challenges for improving technology efficiency in their “What’s Going on in Banking 2025 Report”.

To increase profitability, captivate prospects, cultivate new relationships, and drive future customer retention, banks must tailor acquisition strategies to the needs of each prospective customer with winning offers. How? Unless you are a brand-new start up (if you are, reach out as I have thoughts and experience there), you already have a wealth of information on campaigns and results that need to be mined. Start with a deep analytical review of what has worked and what hasn’t, and then start asking the questions:

- What data don’t I have? Can I get it? Is data out on some system I don’t have access to?

- What response models do I have? Are they old?

- If you’re driving volumes through social media (LinkedIn, Instagram, Facebook, etc.), have I optimized those campaigns? Am I working with the experts on those platforms? They have good folks to help – it’s their business model.

- Like above, am I attracting the right customer? It’s better to attract one good customer versus five bad customers that don’t fit your risk profile.

- There’s more but…

Now, it’s time to start breaking things: simulate, test, monitor, change, test, and monitor. The keys to modern risk management are more data, understanding channel preference, and getting meaningful, specifically designed offers to the individual you are communicating with. This is the difference between segments and a personalization approach.

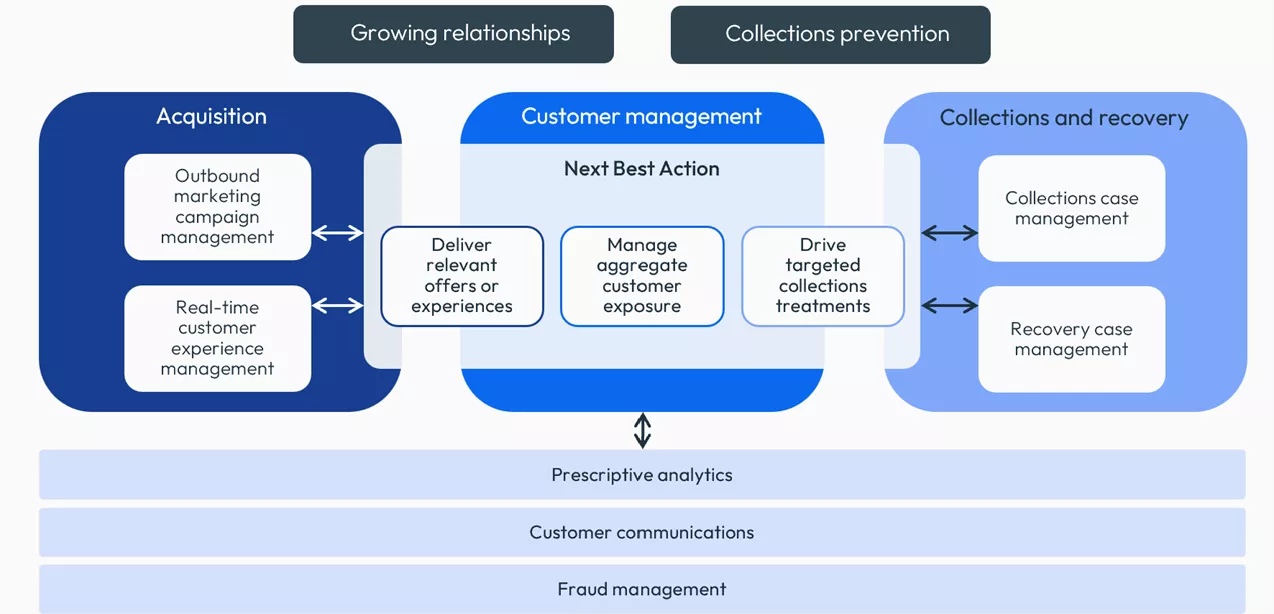

I like to envision an analytics communication brain that orchestrates the communication strategy—the right personalized and compelling offer, at the right time, in the right channel, to the right customers.

From there, you can quickly deploy changes to acquisition campaigns through a safe, scalable, flexible cloud environment. With AI, machine learning, and advanced analytics, you can continue to optimize your marketing offer strategies to drive portfolio performance and customer experience.

Opportunities

Today’s customer journey isn’t what it used to be—sequential and orderly. The lack of synergy creates missed customer opportunities and spotty risk management. Enduring, risk-aware customer relationships require real-time, near-perfect personalization strategies and timing…in the right channel. When banks align with customers’ interests and put prospective customers at the heart of every decision, it’s win-win for all.

We’ve seen leading organizations use decisioning platforms to power these decisions across all stages and lines of business, delivering optimal control over the customer journey from customer acquisition, through customer management, all the way into collections prevention.

Acquiring and growing relationships result in:

- Improved customer engagement and satisfaction, reduced attrition, and improved Net Promotor Scores.

- Increased automation of marketing, credit line, pricing, and collections interactions driving reduced operational costs.

- More precision, relevance, and consistency in decision-making.

- Better understanding of customers and the ability to act on insights in real-time.

To dive deeper into modern risk management for attracting and engaging customers, visit: https://www.fico.com/en/customer-lifecycle/attract-and-engage

To see the results from our Global 2024 Bank Customer Experience Surveys, visit:

- US: https://www.fico.com/en/latest-thinking/ebook/2024-bank-customer-experience-survey-us

- UK: https://www.fico.com/en/latest-thinking/ebook/2024-bank-customer-experience-survey-uk

- Canada: https://www.fico.com/en/latest-thinking/ebook/2024-bank-customer-experience-survey-canada

- Mexico: https://www.fico.com/en/latest-thinking/ebook/2024-bank-customer-experience-survey-mexico

In my next blog in the series, I’ll dive into my favorite lifecycle stage: onboarding and originations.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.