5 Steps to Strengthen Credit Risk Strategy for Lenders: A How to Guide for Institutions of All Sizes

How using FICO’s Innovation Lab can help future-proof for evolving economic conditions and credit risk decisions

The past few years, I’ve spent a considerable amount of time focusing on the credit risk needs of regional and community banks, and credit unions. And, in that time, I’ve observed some lenders who have a rigorous and robust approach to their credit risk management strategy, and those on the opposite end of the spectrum, whose approach is little more than “set it and forget it.” Perhaps the variance is based on lender size, team expertise, access to data and benchmarking limitations, or simply the time and capacity to manage data-driven credit portfolio strategies with some wondering: “isn’t good enough ok?”

Historically, credit portfolio management (CPM) was an attempt to understand the institution’s aggregate credit risk, improve returns on those risks, and manage concentrations of risk, which sometimes leads to trading loans in the secondary market. Today, that’s still very much the attempt of CPM, along with a slew of other considerations, including the need to align portfolio goals to those of other departments within the organization, including finance, risk data management, and let’s not forget business origination and growth goals. With the evolving demands faced by portfolio risk managers, coupled with climbing credit card delinquency rates, as reported in FICO’s latest US Bankcards Industry Benchmarking reports, “good enough” is no longer “enough” no matter the institution's size, expertise, or capacity.

Understanding and leveraging the latest credit insights, along with reviewing and revising credit portfolio strategies, including credit line management, collections, and reissue to positively impact your portfolio, are more important now than ever. It might be easier than once thought when FICO® Scores, along with other attributes, are consistently leveraged within a lender's customer and portfolio management strategies. Remember, a FICO Score, is designed to provide a precise assessment of a consumer’s current credit risk on all credit product lines, including mortgage, home equity loans or lines of credit obligations, auto loans, credit cards, and personal loans; and FICO’s latest score, the FICO® Score 10 suite, provides lenders with unparalleled predictive power to make more precise lending decisions.

For institutions with less than $10B in assets, you may be thinking, “we can’t afford the time and resources required to monitor and revise our credit portfolio strategies consistently.” FICO expert, Tommy Lee, Senior Director, Analytics and Scores, recently researched FICO® Scores of credit union borrowers, and found that the national average for credit union borrowers in the US has decreased, though slightly, over the last two years and suggests that increased spending, and the effects of high interest rates, and increased prices, among other things, “may be negatively impacting some credit union members credit risk – especially those struggling to manage their financial health.”

How to get started when you’re a smaller institution:

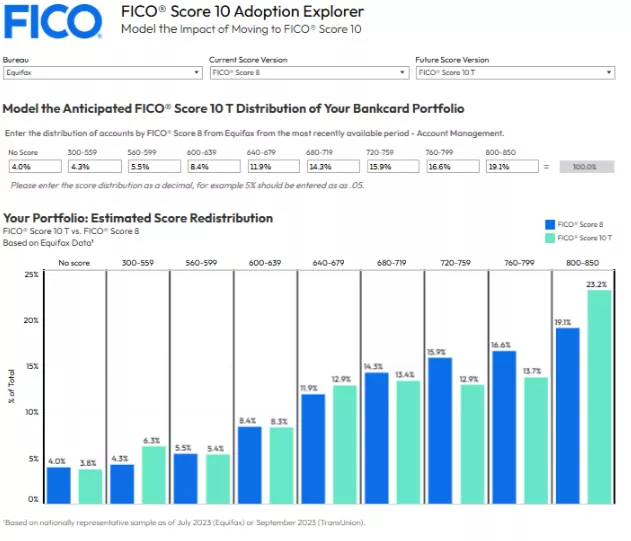

Visit the FICO® Score Innovation Lab to explore our suite of complimentary tools where financial institutions and credit risk managers are empowered to explore our latest score offerings, FICO® Score portfolio benchmarking tools, financial inclusion opportunity modeling, and our latest, the Adoption Migration Tool which helps lenders examine the impacts of migrating from one FICO® Score to another and includes options for assessing score distributions along with simulating business impacts.

Learn more about FICO’s most recent score suite, the FICO® Score 10 suite. This suite of credit scores includes FICO® Score 10 and FICO® Score 10T, which provides more consumer behavior insights by integrating trended data. Defaults are costly, and binary events can have rippling effects throughout differing departments within an organization. If your organization is considering a model review and update, be sure to explore both FICO’s suite of traditional scores, like FICO Score 10, along with alternative data scores to potentially get a better sense of your borrowers' credit profile and lend deeper.

Review your originations and customer management strategies; if they were set up more than two years ago, based on current trends, it’s likely a good time to make some changes and start by performing a risk assessment test on your portfolios to ensure alignment with your business goals and objectives along with your risk appetite and strategy. General best practice: Portfolio reviews should occur at least on a quarterly basis. Economic and political changes, signals in vintage analysis, and protean conditions in your local economy can have profound impacts on your portfolio risk and, ultimately, your profitability. Reviewing and analyzing these risks are the first steps in mitigating and managing the performance of your portfolios.

Explore FICO’s library of thought leadership on topics including US Bankcard industry trends, fraud, debt collection, and much more.

Connect with a FICO expert who can assist by answering questions, showcasing Innovation Lab tools, and connecting you to specialists who can help with portfolio assessments.

How FICO Can Help You

Learn about our FICO® Score Innovation Lab

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.