How Digital Twins & Simulation Improve Credit Line Management

Business outcome simulation enables business users to simulate changes to strategy and quickly make informed decisions to help reduce risk and enhance profitability

Digital twins and simulation capabilities enable business users to quickly and accurately predict the impact and implications of change without the need for recoding sophisticated models and complex business logic in non-production, analytic environments and tools. This can drive significant competitive advantage through enabling businesses to be more agile and responsive to a changing competitive landscape and macro-economic environment, and acts as an accelerator for innovation helping businesses to drive sustainable growth, to better manage risk, and to improve profitability. This kind of capability has enormous benefits to credit line management.

Imagine being able to seamlessly perform real-world simulations in a risk-free learning environment, performing side-by-side comparisons across a wide range of scenarios, enabling business stakeholders to better understand business impacts and trade-offs, leading to more informed decision making.

Why rely on guesswork, risk using data or business logic that does not fully reflect real-life, or utilise significant time and effort to run scenarios? Business simulations fully integrated to your decisioning capabilities can quickly offer the commercial guardrails to driving faster smarter and more confident credit strategies.

Managing Credit Challenges

Right now, consumers, households, sole-traders and small businesses alike are wrestling with the combined impact of inflation, cost of credit and a squeeze on income. For lenders it means careful credit strategy management is among the most critical areas of expertise within their back office as they strive to strike a balance between growth, profit, risk, and exposure whilst enhancing customer experience and supporting customers who are experiencing financial stress and hardship.

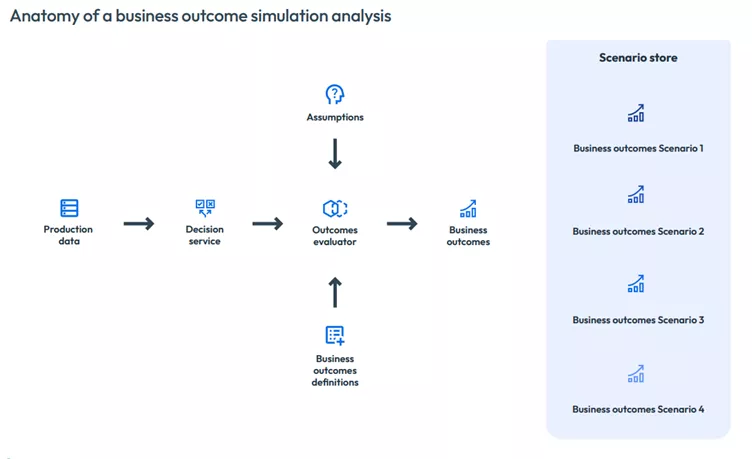

The challenge is to deliver successful credit strategies, win and retain a competitive advantage. As a result, simulation is now front-of-mind for many, given it offers tools for teams to experiment, test and learn, without the risk of negatively impacting business results or the customer experience. FICO Business Outcome Simulator, one of the FICO Platform capabilities, acts as an accelerator by supercharging the speed of analysis from weeks to minutes, by fostering greater collaboration across business stakeholders, and by reducing the risk of basing business decisions on simulations that are not reflective of real-world outcomes.

Business Simulation: Five Key Features

Putting sophisticated simulation capabilities in the hands of business users enables them to more quickly, efficiently and accurately assess the potential impact of changes to strategy, and therefore to make informed decisions on how to better manage risk, to enable growth and enhance profitability.

Five key features:

- Scenario-Based Modelling: Enables credit risk and other business experts to create a wide range of scenarios to evaluate the real-world impact of different credit strategies. This includes changes in lending criteria, models, pricing and terms, and actions taken such as offers issued, changes to credit lines, collections actions, etc.

- Data-Driven Insights: By leveraging historical data and modelling the impact of strategies applied, the outcomes evaluator generates realistic projections across a wide range of key metrics enabling detailed understanding of impacts on impairment and losses, revenues, operational costs, capital, economic profit, etc.

- Quick Decision-Making: Business experts can rapidly assess the potential outcomes of new strategies without the need for extensive testing in the real market, saving both time and resources and increasing the likelihood that change delivers the desired outcomes.

- Collaboration Across Different Stakeholders: Different stakeholders have different KPIs that they are interested in and responsible for. For example, a credit risk manager is interested in risk weighted exposures, an LOB leader is interested in portfolio size, revenues and profitability, an operations manager is interested in the number of agents required to deliver a strategy, etc. With digital twin and simulation every stakeholder can evaluate the impact of the strategy on their KPIs and can better understand the trade-offs between different courses of action allowing more effective collaboration and more informed decision making.

- Risk Mitigation: By modelling the impact of external change, such as a downturn in the macro-economic environment or a change to competitor pricing, financial institutions can proactively adjust their credit strategies to mitigate vulnerabilities in portfolio and balance revenues, cost of risk and operational costs whilst complying with regulatory requirements.

Why Knowledge is Power When It Comes to Business Outcome Simulation

FICO has been a pioneer in credit risk analytics since 1956 and continues to develop, improve and refine the effectiveness of its Business Outcome Simulator as an advanced tool for financial institutions, as an integrated and complementary component to decisioning solutions on FICO Platform. Using FICO Platform, you can rapidly model and simulate the potential business outcomes of various realistic business scenarios. To put this in context, let us consider an originations use case.

Simulating an Originations Strategy’s Impact

Acquisitions and originations processes and decisions are crucial in terms of attracting and onboarding the right profile of customers on the right products and terms, whilst ensuring regulatory compliance, and detecting and preventing financial crime. Processes and decisions in this space can have a material impact on an organisations ability to hit growth targets, maintain portfolio quality within risk appetite thresholds, and to achieve desired returns.

Staying ahead of the competition through the ability to rapidly understand the impact and implications of change, make informed decisions, and seamlessly deploy change is critically important. Using Business Outcome Simulator on FICO Platform:

Marketing personas can assess the delta effectiveness of granular personalized acquisition strategies versus segment-level offers through detailed response and take-up analysis.

Credit risk teams can zero in on areas of concern regarding exposure, probability of default and loss given default; can explore and control the aggregate effect of adverse selection; and can balance losses against revenues and growth.

Product and pricing teams can assess the impact of various pricing scenarios on take-up and profitability. By comparing different pricing structures, and incorporating a view of the competitive environment, lenders can quickly make well-informed decisions that maximise revenues without driving away potential borrowers.

Operations can predict resourcing requirements and operational costs arising as a function of changes in decision processes and strategies, and prepare for any disruptions ahead of time.

Portfolio analysts can understand the multi-faceted impact of change, avoid or mitigate surprises, and focus on robust, sustainable business growth.

Beyond onboarding and originations, simulation capabilities on FICO Platform provide significant value across a wide range of use cases, including:

- Marketing offers / Next Best Action decisioning

- Customer profiling and ongoing customer management

- Exposure and credit line management

- Proactive financial support and pre-delinquency strategies and treatments

- Collections and recoveries

- Enterprise fraud

- Back-testing decision strategies

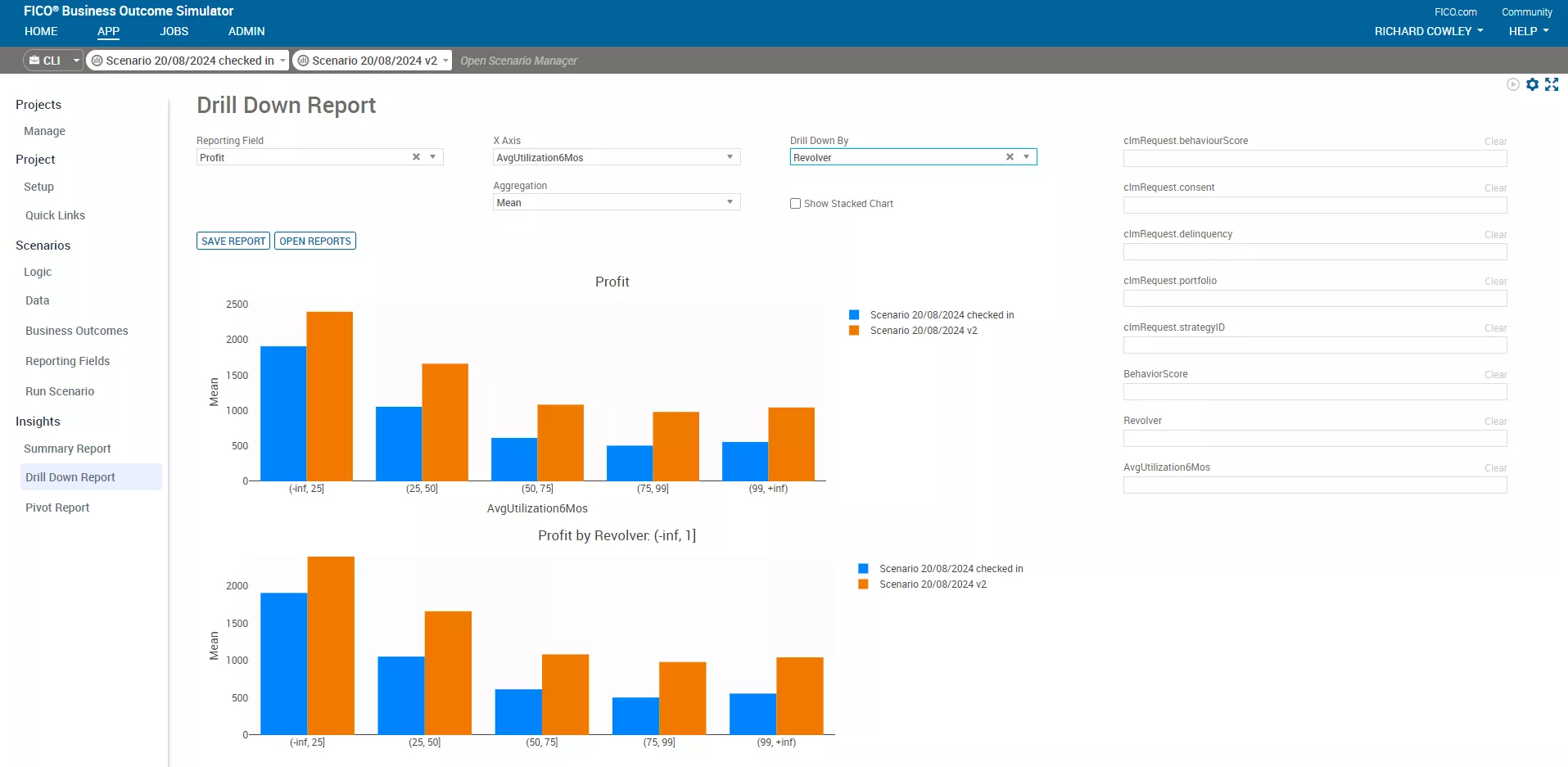

FICO Business Outcome Simulator allow users to quickly create forward-looking simulations to compare multiple versions of decision assets, such as new models or alternative credit policy rules or affordability criteria, utilising varying business assumptions across a range of market outlook expectations. Results can be compared using flexible reporting and visualisation capabilities to get an in-depth understanding of the direct and indirect consequences. Impact analysis can be performed relative to an isolated step in a decision process, or across the full end to end decision process and strategy. Key business metrics can be assessed to understand and drill down into the impacts and drivers of changes in performance.

It all helps prepare organisations to identify and exploit opportunities for improvement in outcomes from automated decision processes, and lay the groundwork for being forewarned and forearmed against a broader set of eventualities. That includes everything from understanding impacts on portfolio-level risk and adjusted returns on capital from macro-economic change, to the impacts of hardening risk appetites for loan originations, or analysis of call centre capacity on changed collections policies. Each simulation scenario – or version of the future – can be named, saved, reused, or re-evaluated against emerging trends and information.

By providing a platform for scenario-based modelling, data-driven insights, and quick decision-making, FICO Business Outcome Simulator empowers financial institutions to navigate credit strategy challenges with confidence. It means credit risk experts can simulate different portfolio mix strategies, develop effective pricing strategies, ensure regulatory compliance, prepare for economic downturns, and proactively manage risk. Ultimately, it enables lenders to strike the elusive balance between profitability and risk, setting the stage for sustainable growth in the competitive financial landscape.

How FICO Platform Helps You Make Credit Strategies More Successful

- Explore FICO Platform

- Watch the webinar on Moving at the Speed of Business by Leveraging Decision Testing and Business Outcome Simulation

- Learn more about FICO Business Outcome Simulator

- Watch FICO Chief Product & Technology Officer Bill Waid discuss Applied Intelligence and FICO Platform

- Download our paper featuring Agile Credit Card Limit Management

- Explore our credit line management solutions

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.