How to Strengthen your Organization’s Money Mule Strategy

Money mules are causing significant problems across the globe. Organizations must take proactive steps to identify and disrupt them.

Money mule fraud is a complex and wide-reaching problem which continues to cause major concern around the globe. A recent global collaboration between Interpol, Europol & Eurojust, alongside law enforcement agencies and several private companies, uncovered more than 10,000 money mules, with losses of around 10m EUR, all between June and October 2023.

This monetary value only scratches the surface of the potential money mule figures, as the NCA estimates around £10 billion of illegal money is laundered every year in the UK alone. According to a 2023 report by the European Union Agency for Cybersecurity (ENISA), around 20% of reported financial crimes involve money mules. A recent Sumsub identity fraud report rightly calls out money mules as a top 5 fraud trend for 2023. We have seen this trend continue throughout 2024, with more and more clients expressing concern around tackling money mules.

Financial institutions, law enforcement and regulators are fighting a constant battle to detect, monitor and disrupt money mule networks. Many of these networks cross geographical borders, multiple banks and varied payment types, and comprise a mixture of willing participants and unwitting victims.

Digital onboarding and the rise of synthetic identity accounts have also complicated the risk for the banks. While organizations are improving customer experience via digital transformations such as fully digital onboarding, real-time payment channels and contact-free account management, fraudsters too are adapting to digital enhancements and strengthening their own approach to layering proceeds of crime. Increasing complexity and sophistication can be seen on both sides.

The threat of money mules within an organization has far-reaching consequences. Funds stolen via fraud and scams and routed through mules impacts victims and, in many countries, financial institutions on which the burden lies to protect and refund customers. Money mule activity also often underlies more serious crime, such as human trafficking, terrorist financing or proliferation of dangerous goods.

Having insufficient controls to detect the laundering of the proceeds of crime can result in hefty fines, jail time and serious reputational damage for an organization. Financial institutions across the globe are acknowledging the significant risk that money mule networks pose to them and understand that now is the time to take proactive steps towards fighting money mules in real time.

What Is a Money Mule?

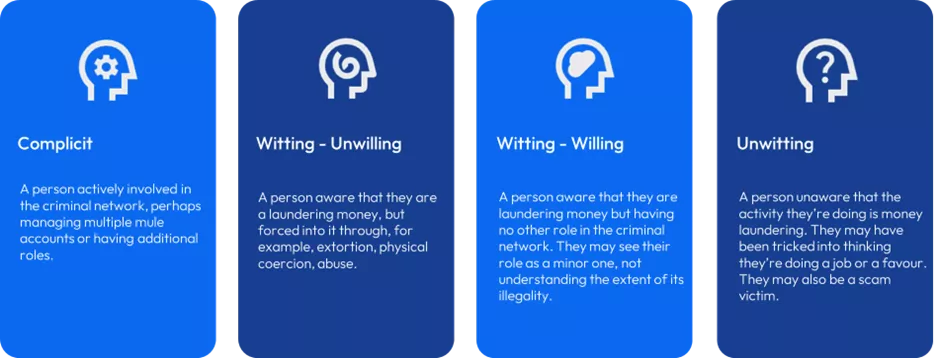

According to the FBI, a money mule is someone who transfers or moves illegally acquired money on behalf of another person. People who set up and facilitate money mules are called mule herders and often operate as part of criminal networks. The main reason for criminals to use mules is to get “dirty” money from its starting point to a state of appearing “clean”, by obfuscating its origins and sending it through many different accounts across different countries and banks to make it impossible to trace back to its criminal origin.

Why Do People Get Lured into Being a Money Mule?

Many individuals actively get involved in money muling because they see it as an opportunity to make passive income with little effort. These people may already have financial difficulties or existing poor credit (a “nothing to lose” approach). Some criminal networks even have dedicated money mule teams, whose work involves setting up synthetic accounts to move money.

Muling is also carried out by scam networks, who trick their victims in a variety of ways into sending money to a fraudster via mules. These networks rely on a significant number of people based across different regions, who are willing to receive physical as well as digital funds and move them around to get them to their destination. In recent years, these networks are also growing in sophistication and appeal to individuals who see it as an easy inroad to making money.

There are also different types of people that mule herders look to lure in as victims or unwitting accomplices. Young people are regularly targeted, who may have less financial experience and therefore don’t pick up on the true nature of the activity. Students are particularly sought after as they can get large overdraft facilities, and are drawn in with the promise of flexible, easy income to support their studies.

Fraudsters also often target individuals (irrespective of age) who have good credit and good standing with their banks, as their accounts are often approved for higher limits and overdrafts and may not arouse as much suspicion during Know Your Customer and ongoing due diligence checks. These individuals are often lured in via a scam, such as romance or investment.

Fraudsters also often target individuals (irrespective of age) who have good credit and good standing with their banks, as their accounts are often approved for higher limits and overdrafts and may not arouse as much suspicion during Know Your Customer and ongoing due diligence checks. These individuals are often lured in via a scam, such as romance or investment.

Adverts on various social media sites are another channel that mule herders use, capitalizing on current trends and alluring claims of working from home, passive income and quick gains. The process for “onboarding” a mule recruit can be highly organised with the prospective mule being coached through the process of setting up the account and moving money without arousing suspicion.

Organizations should consider the types of vulnerability that can lead unwitting individuals to fall prey to mule herders. Many mules are being scammed as part of the criminal enterprise, and can be being scammed for a long time as a fraudster builds up trust and exploits their good credit and good nature to gain significant sums of money from them.

Identifying Money Mules

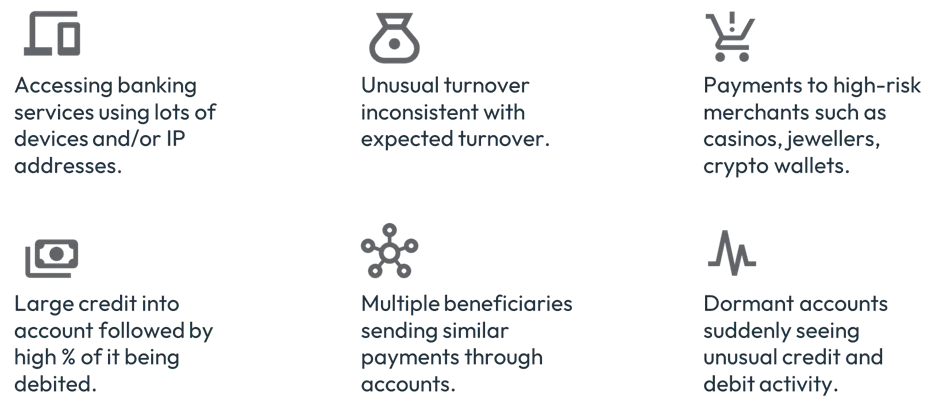

Finding and disrupting money mule networks in an organization can be difficult. Key risk indicators are often more complex than traditional 3rd party fraud indicators because the activity is most often in the hands of the account holder themselves, though sometimes an account may be controlled by a criminal over a long period of time. Risk flags such as a change in device, sudden high value payment, or high volume over a short period of time are not normal behaviours for mules.

The above indicators are often seen in the case of mule accounts, but what is key to aware of is that money mules are often actively engaged in trying to bypass detection by behaving as ‘genuinely’ as possible. The sophistication levels of organised groups are increasing too, as coaching tools and “talk tracks” are often used to train mules into avoiding detection and giving the “right” answers if questioned by their bank.

Enhance your Strategies to Detect Money Mules

Enhance your money mule strategies by making better decisions in real time about suspicious payments and account changes. Profiling at the level of the beneficiary allows you to track and take action against suspicious payees. In the case of mules, multiple accounts will often funnel illicit funds to common beneficiaries. By aggregating data at the level of the beneficiary account, you can see where the money is going and understand the risk associated with the end-point of a transactions, as well as from the payer.

In the case of unwitting money mules, targeted, personalized disruption is key to mitigating the risk of money mules without leaving consumers uneducated and unsupported. By using hyper-personalized customer communications, organizations can customise their communications strategy in a way that works for their customers, whether that’s using insights of suspected risk categories, targeted customer segments, or even adding sensible friction in complex mule cases.

It is crucial that once an entity in a network is detected, the organization can then conduct thorough analysis to reveal the networks that mules build. FICO®’s Identity Resolution Engine solution will allow your organization to analyze complex networks and connect together entities such as devices, IP addresses, beneficiaries, emails, addresses and whatever data points you choose to feed into it. It visualizes the mule’s network so you can take action against risky entities and build strategies to feed that intelligence back into fraud detection rules.

What Are Regulators Doing about Money Mules?

Money mules are not a short-term trend; their impact is growing globally each year. Law enforcement and regulators are increasing their focus on how organizations mitigate the risk of financial crime through digital channels.

Regulators are increasingly keen to push banks into accepting responsibility for facilitating the movement of illegal funds. In the UK, for example, the Payment Services Regulator has told payment companies that in order to tackle authorized push payment (APP) fraud, both sending and receiving bank need to assume financial liability, and there are indications that this sort of directive will spread to other countries as well.

The EU, for example, has outlined its 3rd Payment Services Directive (PSD3), in which it instructs schemes, wallet provides, and payment gateways to assume liability if they fail to apply Strong Customer Authentication. This will go some way towards organizations stepping up their prevention strategies to stop mules sending money out of traditional banks to wallets, which are harder to track.

These changes in Europe are being noted by regulators across the globe and are paving the way for other regions to implement additional measures (my colleague Szymon Morytko wrote about innovations in scam prevention across LAC and APAC). Money mules are a similarly concerning area, with many clients reaching out to us in recent months to understand how they can strengthen their detection and prevention.

Add to all this the increasing focus on organizations recognizing and supporting vulnerabilities in their consumers, and we can see that engaging with customers at the right time, through the right channel, is key to ensure that unwitting victims are treated fairly.

How FICO Helps Future-Proof Money Mule Management Strategies

A 360-customer view is key to understanding and disrupting money mules, from pre-book through to account management. Risk indicators can be seen throughout the lifecycle of the customer, so being able to see the end-to-end journey is key for detection.

Financial institutions must stay ahead of fraudsters by leveraging advanced technology that is highly adaptable and configurable, as well as leveraging the full customer journey. With the right insights applied at the right time, you can identify and stop money mules without impacting legitimate customers.

- Explore how FICO helps fight fraud, regardless of channel or portfolio.

- Get information about our Identity Resolution Engine.

- See how Customer Communications Services for Fraud engages customers in real time to disrupt mule networks.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.