How Vitality Fuels Customer Engagement & Loyalty

Vitality, a major healthcare insurer in the UK, shows how harnessing technology to personalize healthcare experiences can drive sustainable growth

In today's competitive healthcare landscape, customer engagement and retention are more important than ever. Vitality, a leading health and life insurance provider based in the UK, is leveraging innovative healthcare technology to personalize customer experiences, automate claims processing, and drive sustainable growth.

At FICO® World 2024, Annabel Simmons, head of Healthcare Programmes at Vitality, shared insights on how Vitality is transforming healthcare services for millions of customers. She discussed how a personalized, digital-first approach is fueling customer engagement and loyalty while optimizing operations.

Personalizing Healthcare Journeys with Technology

Vitality understands that no two members are the same. As Simmons highlighted, some customers prefer a "belt and braces" approach to healthcare — no-nonsense, straightforward, and self-managed — while others require more guidance and an empathetic touch. The key to success is offering personalized healthcare journeys that cater to these individual preferences.

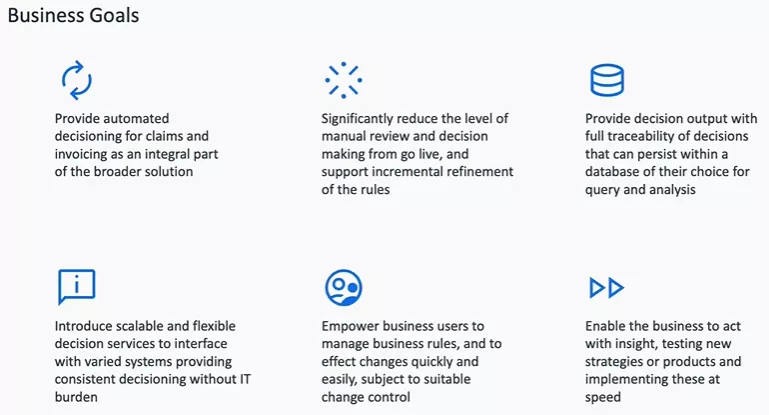

Vitality is adopting a cloud-based microservices architecture that integrates seamlessly across platforms, from life insurance to reward schemes. By pulling data from multiple sources and using advanced decision-making tools like FICO Platform, Vitality can deliver personalized experiences for customers. Whether they’re accessing healthcare services online or interacting with agents, customers benefit from tailored journeys that match their needs, leading to improved customer satisfaction and loyalty.

Driving Efficiency and Automation in Claims Processing

Another critical area of focus for Vitality is improving the efficiency of claims processing. Traditional systems were impacting the company’s ability to scale and manage increasing volumes of complex claims,. Simmons noted that automating claims assessment through the FICO Platform has significantly reduced the need for manual intervention by agents. This shift has not only lowered operational costs but also minimized risks associated with manual assessments, such as human error.

By leveraging the FICO® Business Outcome Simulator (BOS), Vitality can now predict the outcomes of rule changes in real time, allowing the company to make data-driven decisions. Simmons emphasized how vital this tool has been in generating accurate insights for their boardroom discussions, helping them optimize decision-making around both claims processing and invoicing.

“Now, when we have those go-no-go conversations, I can confidently present the data on how these changes will impact our business,” Simmons explained. This new level of precision is helping Vitality save costs, reduce claims leakage, and further improve the overall efficiency of its healthcare claims management system.

Expanding Digital Services to Meet Customer Expectations

Vitality is not stopping at automating claims. The company is committed to building an end-to-end digital healthcare experience that allows customers to access services seamlessly. For instance, their online claims journey initially saw lower-than-expected success rates compared to their telephony-based services. However, after integrating more comprehensive data and utilizing automated testing systems, Vitality was able to drastically improve the process.

After refining their approach using FICO Platform, they improved the system’s ability to handle the complexity of online claims. This resulted in a more seamless experience, allowing customers to submit claims easily and with fewer follow-ups, thus improving both satisfaction and customer retention.

The Future: Bespoke, Data-Driven Customer Experiences

Looking forward, Vitality aims to leverage the full potential of FICO Platform to create even more bespoke healthcare journeys for its customers. The company plans to further digitize and customize interactions by offering relevant, data-driven questions to its agents and online systems, reducing the noise of irrelevant information. This will allow agents to focus on what matters most — offering empathy and support to customers who need it, while delivering efficient service to those who prefer a hands-off approach.

Vitality’s ability to integrate external data sources, such as drug regulatory bodies, will also provide deeper insights into claims, allowing for more accurate assessments and cost controls. As Simmons mentioned, this will improve profitability and help keep premiums stable, benefiting both the company and its customers.

A Strategy for Sustainable Growth

Vitality's approach is a clear example of how digital transformation can revolutionize healthcare, enhancing both customer engagement and retention. By focusing on personalization, automation, and operational efficiency, the company is building a future-proof system that meets the diverse needs of its customers while driving sustainable growth.

The transition from legacy systems to FICO Platform has opened up new opportunities for Vitality to continue innovating. As Simmons explained, upgrading their system wasn’t just about moving to the cloud — it was about unlocking the potential for growth by allowing their teams to focus on what they do best: providing excellent healthcare services and improving patient outcomes.

For companies still on the fence about making a similar transition, Simmons advises looking closely at the potential business benefits. “We realized we were limiting our possibilities by staying with our old system,” she said. "Our upgrade is paying for itself and will continue to drive value for years to come."

How FICO Can Fuel Customer Engagement & Increase Retention

- Explore the power of FICO® Platform

- Read: See Customers Clearer with Hyper-Personalization at Scale

- Read: Critical Steps to Improving Hyper-Personalization at Scale

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.