Digital Transformation and the Future of Insurance

Two surveys of insurance industry executives show the challenges in insurers' digital transformation initiatives - here's how a platform approach closes the gaps

There’s isn’t an industry in the world that hasn’t been impacted by digital disruption and digital transformation: from banking and insurance to snow plowing and dog-walking, the ways customers are finding, comparing, and selecting products and services is constantly changing.

And so has the notion of “customer loyalty”: switching from one company to a competitor has never been easier. Today, every customer is now one dissatisfied transaction away from defecting, taking a lifetime of potential revenue with them.

In SWOT terms, this is a double-edged sword, posing both a “threat” and an “opportunity” for insurance companies. The number of insurance consumers who are “at-risk” has risen to its highest level since the metric started being tracked 20 years ago by J.D. Power. Consumer complaints about insurance companies are at an all-time high, with customers frequently citing impersonal, disconnected service experiences as a reason they defect.

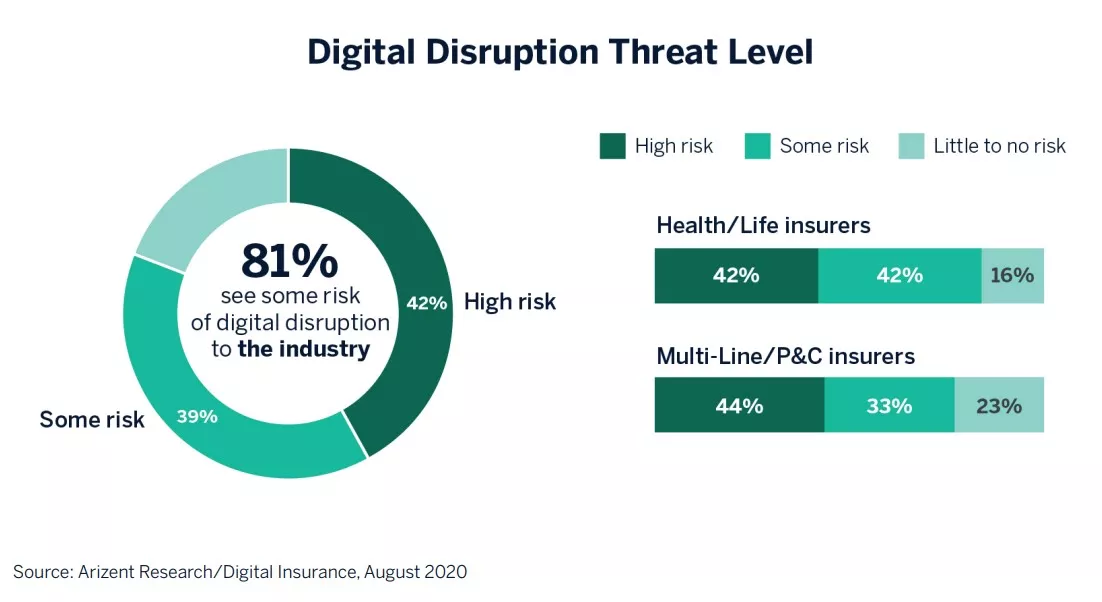

To help understand this industry churn, Digital Insurance – a leading publication serving the insurance automation and decisioning industry – conducted a survey of insurance industry executives, asking them to share their companies’ concerns about digital disruption and their progress towards digital transformation. The results of the survey were both illuminating and sobering. For example,

- 81% of insurers believe that digital disruption poses a threat to the industry

- In every category measured in the survey, Health and Life insurers were significantly more confident in their digital transformation progress than Multi-line and P&C insurers

- In terms of data democratization, 65% of Health and Life insurers reported that they have empowered business users, versus just 35% for Multi-line and P&C insurers

The Digital Insurance survey revealed that the real challenge insurers and other industries face is building an omnidirectional, all-encompassing view of their customers, the prerequisite to increasing customer satisfaction, retention, and share-of-wallet. In most cases, the data they need exists and is already somewhere in-house; the problem is that it is sitting in disassociated siloed applications scattered across the org chart. For example, the homeowners’ insurance department might have a policy in the name of Chris Smith at their home address; the auto insurance group has a policyholder named C.J. Smith at the same address; the business group has a business address where the owner is named Christopher J. Smith, etc.

If a company could combine all of its customer records and make their data interoperable across these and other lines, it could gain powerful insights in each customer’s behaviors and future needs… and build automated, hyper-personalized strategies for increasing lifetime share-of-wallet for each. That is the key takeaway of the recorded webinar, which can be viewed at:

https://www.fico.com/en/latest-thinking/webinar/present-and-future-insurance

Similarly, the Digital Insurance special report provides an excellent narrative for how this customer centricity can be achieved. It includes practical advice from industry insiders on achieving digital transformation goals, including expert commentary from two companies highly regarded for their digital transformation success, Mercury Insurance and Reinsurance Group of America (RGA).

The Platform Solution for Insurance Digital Transformation

To dig deeper into the issues around digital transformation for insurers, FICO partnered with Forrester Research on a 2023 study. Some of the highlights:

- 59% of insurers agree making the right business decisions faster to remain competitive will be critical this year

- 76% say that ecosystem complexity makes it difficult to centralize their organizations’ decisioning efforts

- 82% agree their business would greatly benefit from a centralized platform to support decisioning

To achieve customer centricity, most are looking to software “platforms” – centralized software foundations through which all software applications interoperate – to synergize all of their data around policyholders, to engage them individually in a highly personalized way.

Digital decisioning platforms help insurers improve their customer experiences in these ways by centralizing the data they have in disparate systems, combining and sharing the customer data, and creating a 360-degree view of their policyholders. They will be able to leverage data analytics to understand customers, gather actionable insights, improve customer engagement and design hyper-personalized offers to reward policyholders. Insurers then can more accurately target up-selling and cross-selling efforts and create messages that are more often welcomed by consumers, because they are perceived as custom-fit to their needs.

Insurers already have substantial IT investments in dedicated departmental applications for policy administration, pensions administration, billing, underwriting, agent/broker management and others. Digital decisioning platforms can both enhance and extend the lifetime of these existing applications and legacy systems by unifying them enterprise-wide. Information in each is shared and interoperable across the organization and customizable for all users' needs.

A digital decisioning platform brings together a variety of data points from disparate systems that the policyholder has interacted with in the past, and make it all available to inform the next interaction at the policyholder's point of need. Such a system:

- Provides a 360-degree view of the policyholder. The platform allows you to access disparate data stores, from internal or external data sources, and gather that data, in real time, at the time that a decision needs to be made.

- Executes business logic and strategies. You gains the ability to execute logic and run analytic models at the decision point, when it is needed.

- Acts as a knowledgeable intermediary. The decisioning platform takes the available data and makes assessments based on preassigned logic or analytic models. These provide the carrier with the ability to personalize communications with the policyholder and improve upselling and cross-selling opportunities with custom policy features and optimally tailored pricing.

- Improves personalization. The decisioning platform takes the available data and makes assessments based on preassigned logic or analytic models. These provide the carrier with the ability to personalize communications with the policyholder and improve upselling and cross-selling opportunities with custom policy features and optimally tailored pricing. With the help of the decisioning platform, the policyholder experience after a claim can be individually tailored for a superior experience.

Getting Started with Digital Decisioning Platforms

Investments in digital decisioning platforms are on the rise. Insurance professionals are devoting more of their budgets to technology as business leaders consume more technology in their own lives and become more effective at interacting with technology. A growing portion of insurers — one in five — planned to use digital decisioning platforms in 2022, according to Forrester's "Prepare for What's Ahead" presentation.

How can CIOs and insurance executives prioritize their tech budgets when it comes to digital decisioning platforms? There are many right answers to that. A digital decisioning platform is componentized, so insurers can choose to implement as much or as little as they need at each step.

An easy approach for insurers: Identify one or two decisions in the process to automate. FICO Platform enables you to manage digital decisions, enhance decision logic with predictive analytics, machine learning and an optimization engine. Business users can use the platform tools to directly author, monitor and optimize decision logic.

Start with one or two decisions. Consider the example of a carrier's claims process, which includes a set of rules around the size of a claim. Whenever a policyholder files a claim, a human adjuster must spend time examining it to determine the proper size category. Say standard-sized claims in amounts of $300 or less are handled through the regular process, while large claims, comprising roughly the top 10% of claims, are set aside for special manual processing. The digital decisioning platform can automate the question, "Is it a standard or large amount?" Through this utilization, you can identify claims in the amount of $300 or greater, increasing the efficiency and speed of the claims process by removing the human adjuster from the equation in approximately 90% of those decisions around claim size.

After this initial utilization is smoothly implemented, you can proceed to a second step. This could be considering those previously identified standard-sized claims. Out of this set of claims, the platform can be set up to discern those claims that require manual intervention for one reason or another. These can be flagged for adjusters to address. They may make up 10% of the set. The remaining 90%, having been determined to fall within the insurer's standards, don't require further manual processing. Based on these automated findings, the insurer is then able to quickly issue checks to the policyholders for the bulk of the claims.

By utilizing the platform for these two simple decisions, the claims process gains significant efficiency. Instead of human adjusters manually examining 100% of the claims, utilizing the decisioning platform means they are able to focus their attention only on the 10% of large claims and 10% of normal claims that require special handling.

How Mercury Insurance Uses a Platform to Improve Underwriting

Executives at Mercury Insurance, an award-winning independent agency writer of auto and home insurance, had a business goal of accelerating their underwriting decisions on policies submitted by the company's network of independent agents. Mercury initially experimented with internally developed decision engines, but due to their large volume of rules, decided to seek a technology partner to help make the most of their resources. The insurer chose to integrate FICO Platform into the policy processing software it was using to manage workflow, in order to start automating its underwriting process made up of hundreds of constantly evolving business rules.

“We benefit because the person who’s deciding what the rule should be is the person deciding how the rule actually executes in the system,” said Kevin Bailey, Director of Underwriting Research and Innovation, Mercury. “When you run into an exceptional situation, the author can adapt the rules to manage it very quickly.”

Read the Mercury Insurance case study

How FICO Can Help You Improve Insurance Results with a Platform Approach

For years, FICO has been a leading provider of decisioning solutions for the insurance industry, helping carriers around the world make smarter, faster, more profitable customer decisions. With FICO Platform, we can do more than ever to help you make better decisions a core part of your digital transformation.

- Discover FICO insurance solutions

- Explore FICO Platform

- Read educational material on digital transformation and digital disruption

Note: This is an update of a post from 2021.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.