How to Win Banking Primacy with Composability + Hyper-Personalization

Becoming the principal bank for your customers demands hyper-personalized decisions and a customer-centric approach, powered by composability

One of the key issues for financial institutions in many parts of the world is principality or primacy. In banking, principality or primacy means selecting an institution to serve as your primary bank—the one you turn to for a mortgage, a credit card, buying a car, opening a deposit account, or making investments. When choosing a primary financial institution, you ask whether they understand you, where you are on your journey, and whether they offer the services and support you expect.

The digital age has changed the way banks approach this dramatically. Traditionally, banking relationships were built through in-person, brick-and-mortar interactions. Not anymore.

Smart transfers and unified apps now allow users to manage their finances across multiple banks from a single platform. New offers and services are delivered via apps. Consumers now interact with multiple financial services institutions and may hold products — such as mortgages, deposit accounts, credit cards, and auto loans — with different banks. The digital experience and customer service have become central, and people prioritize convenience and personalized engagement over proximity.

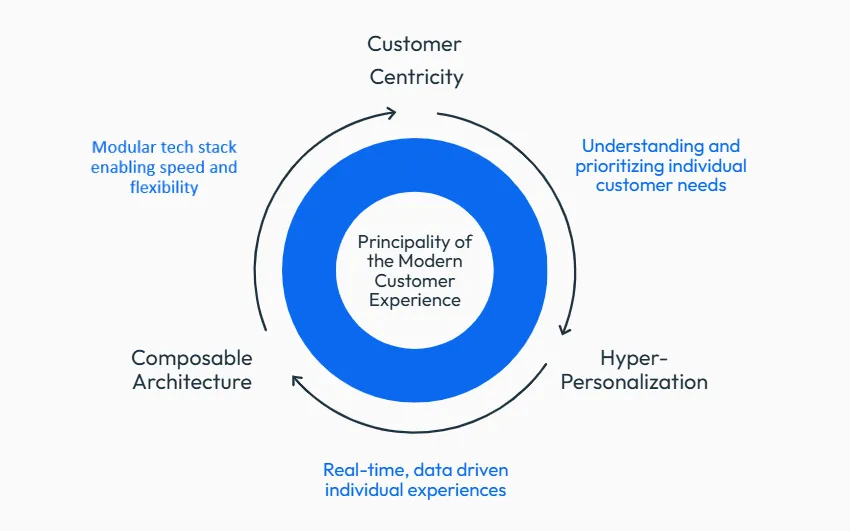

The keys today to achieving long-term primacy involve customer-centricity, hyper-personalization and composability.

How Do You Build and Hold onto Primacy/Principality?

Given the ease with which consumers can open new accounts and manage accounts across several institutions, it is harder than ever for banks to stay as the primary bank. The key is reciprocity: if you want to be the most important bank to your customer, make the customer feel they are the most important to you. Customer centricity is the key to principality, and it enables hyper-personalization, which to consumers is a visible sign that the bank understands them and meets their needs.

Data tells us that 72% of customers are influenced by personalization when choosing a bank. Personalization is not about sending generic offers to segmented groups, but creating one-to-one interactions that analyze individual preferences, behaviors, and data to present relevant offers.

Furthermore, 73% of global consumers now engage with multiple institutions, making choice and digital engagement key drivers in banking. Banks with the highest advocacy scores experience revenue growth 1.7 times faster than others, underscoring the importance of customer experience. The primary reason people choose their main bank is the quality of digital and customer experience.

One of the strategies for building principality is to give greater control to the consumer, and banks in many countries are offering “super apps” in order to win that principality. By enabling consumers to perform multiple activities in one app, these apps provide a greater customer 360-degree view, allowing the primary bank to understand interactions with the customer across multiple lines of business and products.

Personalization, a digital strategy, good customer experience, and offering many choices puts you in an advantageous position to win the race versus your competitors to be the primary institution or bank.

Hyper-personalization is enabled through a composable architecture to drive customer centricity. These three elements are crucial for any institution's strategic objectives: having a customer-centric objective, driving a hyper-personalization strategy enabled by a composable architecture, and achieving flexibility to reach customer centricity. These are the three things you must focus on as a bank or institution to become the primary bank for your consumers.

Hyper-Personalization of Customer Experiences and Offers

As defined by Forrester, hyper-personalization is the experience created by leveraging consumer data, context, history, and preferences to guide interactions and services. It goes beyond segmentation, using advanced analytics and optimal customer engagement techniques to create unique, one-to-one interactions.

To succeed in hyper-personalization, you need to create, maintain and activate a singular view of your customers. This involves:

- Generating insights on the individual by applying analytics and machine learning to the data.

- Analyzing data creates certain insights, which must be turned into actions that can be implemented to drive optimal outcomes.

- Monitoring, controlling, and improving actions. All of the data you gather will feed back into your strategies, models, and analytics, enabling you to understand customer behavior and iterate on those strategies to improve over time. The maturation of strategy and analytics is essential for achieving a sophisticated, customer-focused approach.

Having the right level of engagement differentiates you from other institutions that still use a siloed approach, sending targeted offers for specific accounts or products. Understanding customer data and context allows you to create differentiation, and when you create engagement and differentiate, you bring loyalty.

Composability and Hyper-Personalization

Composability is the technology enabler for hyper-personalization. A composable business is one that can architect solutions in real time, adapt quickly, and remain resilient. Four key principles define composability:

- Modularity: Each capability — whether data processing, analytics, strategy automation, or decisioning — should function as an independent module to accomplish specific tasks.

- Autonomy: Each capability must be independent; if one fails, others remain unaffected, ensuring resilience.

- Interoperability: All capabilities should work together seamlessly, like Lego blocks, creating end-to-end solutions.

- Discoverability: Technology should allow for deployment and easy reuse across different use cases.

Connecting these capabilities allows you to improve hyper-personalization and customer understanding, whether a customer interacts with you pre-book, post-book, or at any point in their journey. This composable approach enables you to process data efficiently, deepen customer relationships, originate customers faster, and provide excellent customer experiences.

For an example, take Maria and Joe. Maria and Joe have the same income and debt, and seem similar at a glance. But upon closer inspection, Joe is a frequent traveler and foodie who shops a lot, while Maria likes gambling, rarely goes to the grocery, and takes out a lot of cash, which could indicate suspicious behavior.

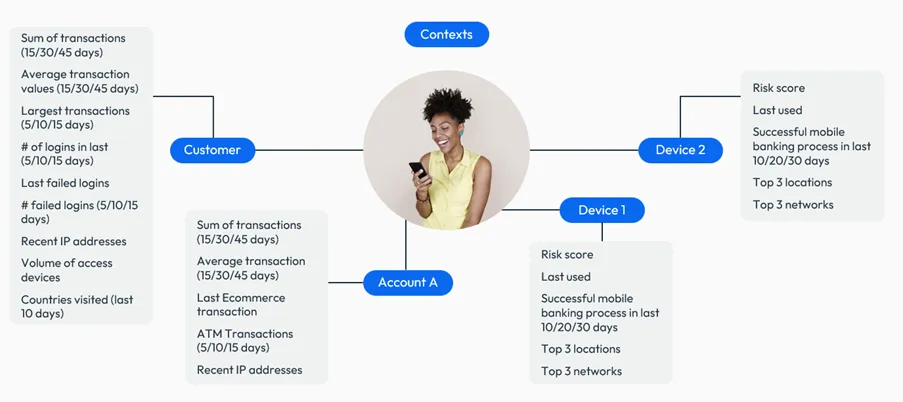

Now that we've looked at the data, how do we turn it into insights? Customer profiling is a very important process. Profiling involves logical grouping of features, calculations, time series aggregations, and interactions with your institution. You can derive data from their devices, accounts, and IP addresses to build up profiles over time, predict behavior, and bring more context into every decision.

Transforming insights into actions for a customer-centric approach enables better personalized pricing, recommendations for next best actions, cross-selling and upselling, and improved customer protection. It enables you to drive the right enterprise decisions through a customer 360 approach.

In summary, composability empowers hyper-personalization, which is vital for achieving customer-centricity. With a composable architecture, banks increase their ability to understand customers and hyper-personalize decisions, which helps them win the race for principality.

How FICO Platform Supports Composability and Hyper-Personalization

FICO Platform can take data from any source — internal or external — apply insights, do features and profiling, use transactional analytics and optimization, and drive actions through intelligent decisioning, business composability, and communication, all while simulating and providing feedback loops.

When you put FICO Platform at the center of your ecosystem and connect it with everything your bank is doing, it becomes the connective tissue of all your operations. Processing all data through the same platform lets you understand data across origination, customer management, collections, and the customer lifecycle and products, layering in the right analytics, using a composable architecture, and connecting with customers through the right channel at the right time.

Learn More

- Explore FICO Platform

- Watch the FICO World presentation, Ready, Set, Innovate: Super Apps, Open Finance, and the Race to Win the Customer Experience Game

- See customers discuss their use of FICO Platform

- Read Tech Trends: Decision Intelligence, Business Composability, and Context-Aware Computing

- Discover What Is Intelligent Feature Management? Why Is It Essential?

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.