Practical Applications of Transaction Analytics in Banking

Explore how transaction analytics can improve credit scoring, deepens customer relationships and reduce collection costs.

As we learned in the previous blog transaction analytics is a powerful tool reshaping the banking industry. We delved into the concept of transaction analytics, its significance, and how it offers a 360-degree view of customer behavior and preferences. Today, we're going to dive deeper into the practical applications of transaction analytics in banking and how it can revolutionize decision-making across the lending lifecycle.

Originations - Saying “YES” to more customers with a better and more suitable offer.

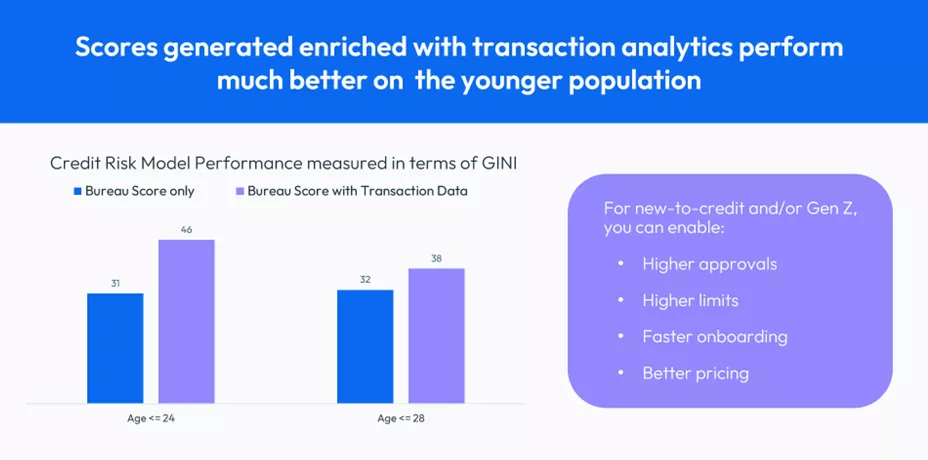

Based on our extensive experience in delivering numerous transaction analytics projects, we've observed that credit scoring frameworks driven by transaction data provide a substantial uplift in GINI scores, ranging from 8% to 18%, depending on the population segment.

GINI coefficient measures the accuracy of a credit risk assessment model in screening high-risk customers and low-risk customers. A higher GINI indicates a more effective credit risk model, with banks being able to tailor treatments and decisions based on the customer’s risk level.

Transaction analytics also provides the ability to score customers who are new to credit enabling better offers for the customers and faster onboarding.

A more accurate credit scoring model results in increased approval rates without an associated increase in risk. This means banks can approve more customer loans. The advantage extends to scoreability as well.

Many customers who are absent from credit bureau records or have minimal representation can now receive a credit score, enabling credit underwriting. Furthermore, credit scores derived from transaction data outperform those based solely on bureau data, particularly for young customers.

Moreover, bank accounts with no verified evidence of income but complete expense records can still be used to predict outcomes and generate a robust credit score.

This is because a customer's spending behavior is closely tied to their income, and any changes in income are reflected in their expenses. This is particularly relevant when employers cannot directly deposit income into their employees' accounts, and employees deposit their earnings themselves to enable digital spending through online banking or smartphone payments.

Enabling deeper customer relationships and driving customer loyalty

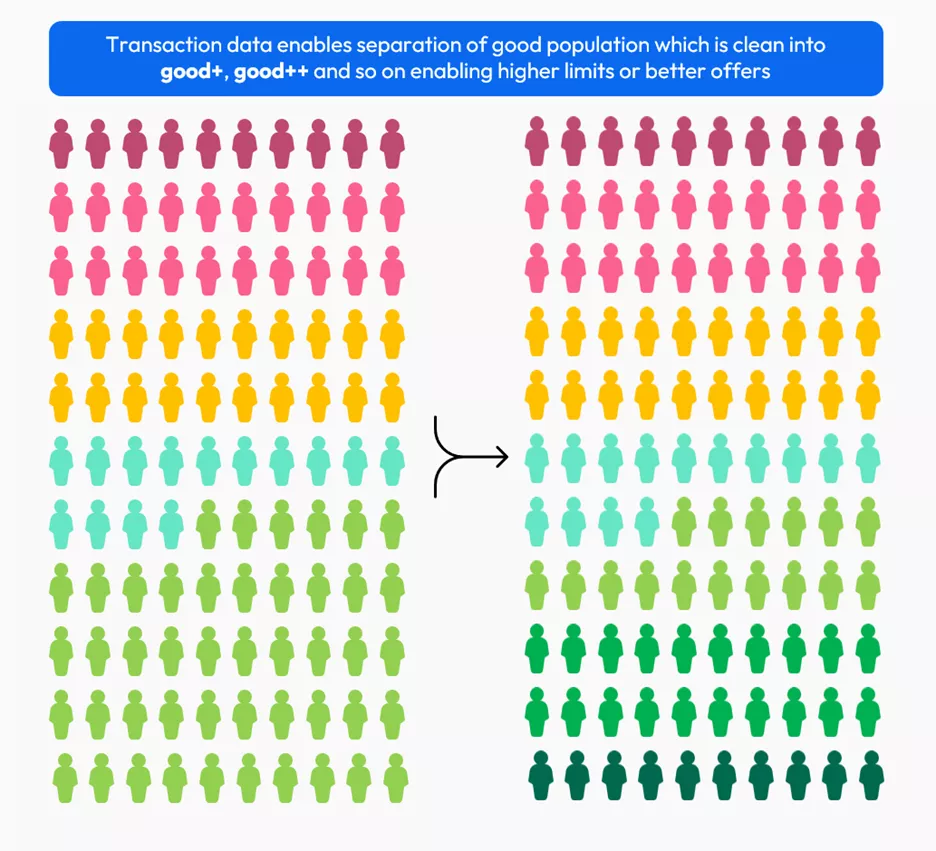

Transaction data offers profound insights into customer behavior, enabling better customer differentiation and the provision of highly personalized offers that foster stronger customer relationships. For instance, transaction data, when integrated into cross-selling strategies, can offer analysis to differentiate customer types.

Distinguishing between good customers, who make up the majority, and tailoring differentiated offers using traditional data elements can be challenging. However, transaction data makes this differentiation possible, resulting in improved customer experiences, reduced churn, and increased loyalty. In our experience, we've identified a distinct segment comprising 8% to 13% of the good population, which was previously challenging to identify. This has enabled the implementation of more personalized offers and enhanced customer journeys for this specific group.

Protecting customer vulnerabilities and reducing the cost of collections

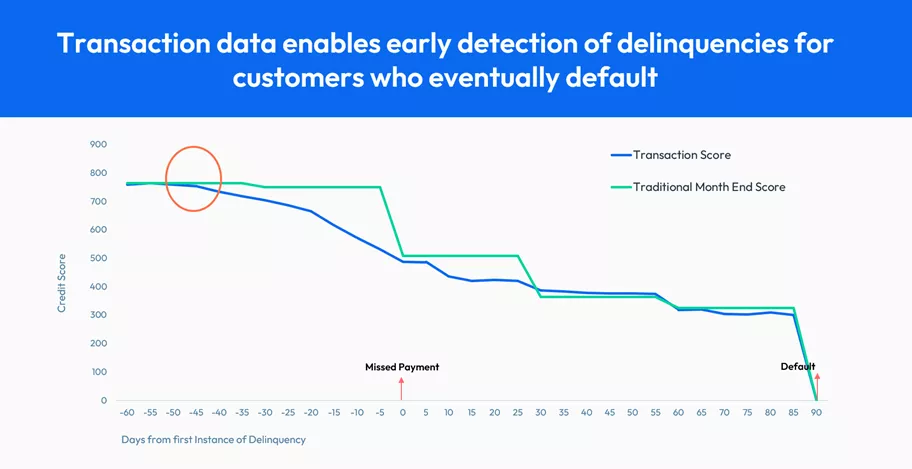

Transaction data's real-time nature empowers banks to proactively monitor customers, allowing for intervention in case of any issues with a customer's profile.

In multiple scenarios, we've observed that transaction data-driven customer scores can detect profile issues at least 40 days before customers become delinquent. This provides banks with opportunities to intervene and assist customers much earlier, enhancing the customer experience and leading to a higher Net Promoter Score (NPS) for the bank.

Transaction data also optimizes collections operations by offering better customer segmentation, resulting in more tailored and efficient collection treatments.

As we've discussed, AI-powered transaction analytics is a potent tool in the banking industry's mission to serve underbanked and unbanked market segments. By facilitating more informed credit decisions, enabling faster customer onboarding, delivering hyper-personalization of services, pricing with confidence, and assigning optimal loan amounts, transaction analytics has the potential to transform the banking landscape.

Through effective transaction analytics strategies, the era of one-size-fits-all banking solutions is rapidly giving way to hyper-personalized services driven by a profound understanding of each customer's individual spending habits, income patterns, and financial goals. This granular understanding empowers banks to offer tailored financial solutions and timely applications, ultimately leading to improved customer outcomes across the lifecycle.

How FICO Can Help You Harness the Power of Transaction Analytics:

FICO's transaction analytics is powered by FICO Platform integrating our proprietary model, where we use patented feature generation technology and a multi-model approach. It follows the same blueprint design as most of FICO's industry-level scoring projects.

Transaction analytics powered by FICO Platform are flexible and modular – meaning they can be lifted, customized, reused for new use cases or applications with minimum rework.

With this state-of-the-art framework, financial institutions are empowered with a centralized decisioning platform to generate actionable insights from transaction data that seamlessly analyze and integrate the insights into lending decisions across the customer lifecycle.

Ready to take the next step? Contact us to discuss more.

Also,

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.