Report Shows Many Banks Fail at Hyper-Personalization - at a Price

Customer defections are one result of poor personalization — but new Forrester report also shares how some banks are winning

In an era where the technology exists to pre-empt such problems, unsatisfactory customer experiences in banking are causing customer defections to reach record highs.

- According to the 2023 Accenture “Banking Consumer Study” only 23% of consumers rated their main bank highly for the competency of its personalized financial advice. And less than a third (30%) of respondents rated their main bank's customer experiences as excellent… while nearly twice as many (59%) recently acquired a financial services product from a provider other than their primary bank.

- In a similar study, Standard & Poor recently asked consumers why they switched from one bank to another. The two top responses were “Better mobile app banking experience” (39%) and “Better customer service” (38%), a reflection of their personalization capabilities.

- In the UK, the Payments Association found that the number of banking customers who switched banks in Q4 of last year spiked 69% over the prior year, the sharpest increase in customer defections in a decade. Among the respondents, 73% cited “non-financial, customer service-related issues” being the main reason for switching, again, an indicator that banks are not making the most of their customer data and are offering non-compelling, impersonalized user experiences.

The experts at Forrester Research have also noticed these concerning trends, and earlier this year conducted an in-depth study (sponsored by FICO) of hundreds of bank executives to understand what financial services companies can do – and are doing – to deliver hyper-personalized customer experiences to reduce the problem of consumer defections.

The Forrester report took a deeper, beyond-the-symptoms dive into the problems being experienced by financial institutions with lackluster customer experiences. It summarized its findings in two reports: 1) a 13-page eBook entitled “Unlocking Hyper-Personalization at Hyper-Scale” and 2) an easy-to-read infographic entitled Hyper-personalization At Hyper-scale: A Must For Banks.”

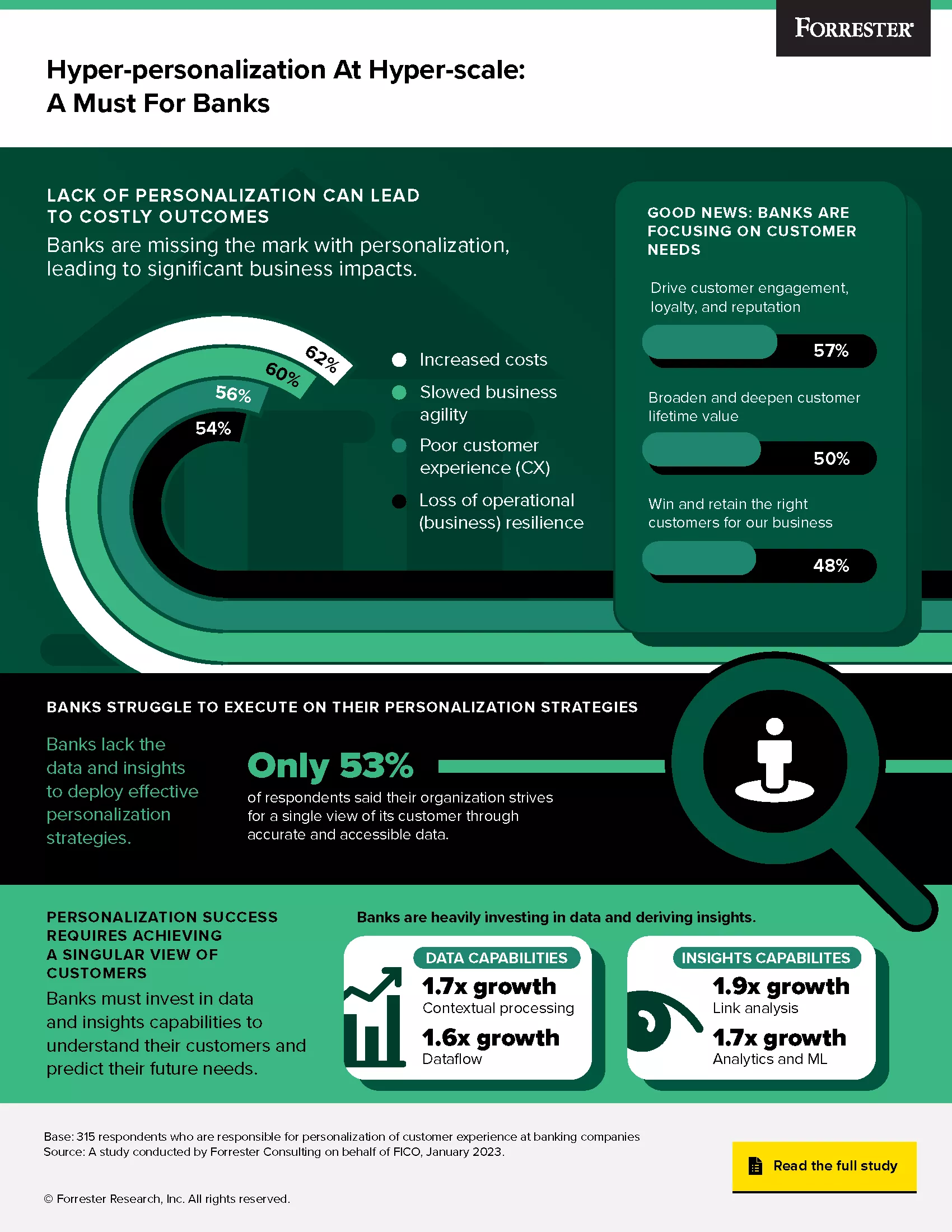

This infographic draws a clear and concerning picture: beyond the problem of customer defections, more than half (56%) of these banks told Forrester that not only were their customer experiences (CX) below consumers’ expectations, they were also struggling with:

- Increased costs (62%)

- Slowed business agility (60%)

- Loss of operational/business resilience (54%)

Though most are endeavoring to improve customer engagement (57%), optimize customer lifetime value (50%), and maximize customer retention (48%), they lack the customer data and insights necessary to deploy effective personalization strategies. In fact, only 53% of respondents said their organization can realistically achieve a singular, unified view of its customers through accurate and accessible data.

But they are not resting on their laurels. Virtually all of the banks surveyed said that are heavily investing in improved data and insights capabilities to understand their customers, achieve a singular view of each, predict their future needs, and provide contextually personalized experiences.

- In data capabilities, they are increasing their investment 1.7x in contextual processing and 1.6x in data flow.

- In insights capabilities, they are increasing their investment 1.9x in link analysis and 1.6x in analytics and machine learning.

In the modern competitive climate, these types of investments are critical in delivering the types of personalized customer experiences needed to increase customer satisfaction, retention, and lifetime value. Why should this be banks’ primary focus? Harvard Business Review found long ago that new customer acquisition costs are five-to-six times more expensive than investments in customer retention. Bain & Company went even further, noting that increasing customer retention by just 5% could, depending on the industry, increase profits by at least 25% by improving your cross-selling and up-selling efforts.

Furthermore, the current economic climate makes it imperative for banks to help their customers through a difficult period.

They say charity begins at home. So does profitability. If you are a bank seeking to keep customers loyal, satisfied, and in the fold for years to come, investments in compelling user experiences to show you care and build trust, offer the most promising returns under your control.

FICO Platform Empowers Your Digital Transformation

- Explore innovation with FICO Platform

- See customers discuss their use of FICO Platform

- Read my article from The Journal of Digital Banking, “How Financial Services Leaders Are Using Enterprise Intelligence to Optimize Efficiency Ratios”

- Watch FICO Platform in action with the story of your everyday consumer, Digital Jane.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.