UK Card Payment Trends: Delinquencies Still Climbing

FICO UK Credit Report for August 2024 shows familiar card payment trends, but late payments are still higher than 2023

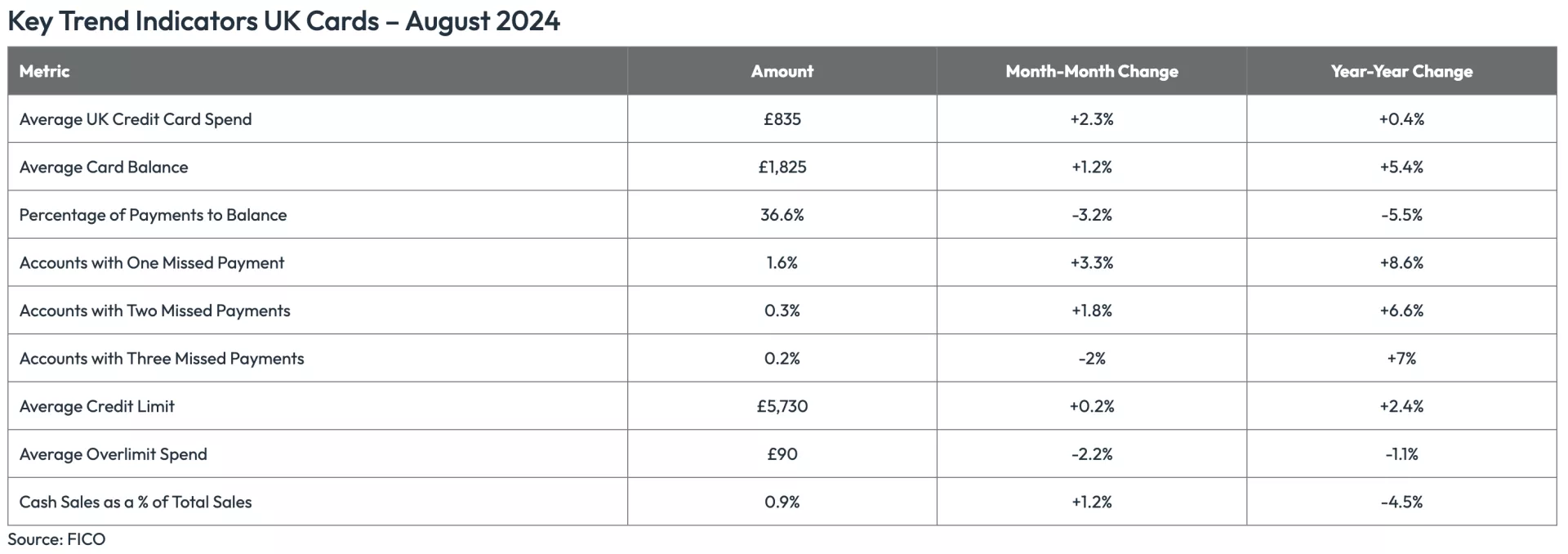

The problem for UK card issuers continues to be the rise in delinquencies. While our FICO UK Credit Card Market Report for August 2024 reveals that payment trends followed seasonal patterns, missed payments remain stubbornly higher in 2024 than the same period in 2023.

In July 2024 the percentage of customers missing payments across all three delinquency categories rose. In August, increases continued for customers missing one and two payments. However, there was a decrease of 2% for those missing three payments, albeit year-on-year there is a 7% increase.

With these payment trends in mind, banks and card issuers who want to demonstrate clear alignment with Consumer Duty may want to encourage cardholders to adopt direct debit for payments, and implement proactive customer communications where delinquencies occur.

Average balances for all categories of delinquency are also higher in 2024 than 2023. Year-on-year average balances have increased by 2.2% for one missed payment, 4.3% for two and 5.3% for those who have missed three payments. Perhaps exacerbating the issue, only 44% of customers pay their balance by direct debit; a percentage that has been declining for newer customers.

Lenders who promote payment by direct debit will help to reduce the number of late payers, and in turn reduce the balance outstanding.

UK Card Payment Trends for August 2024

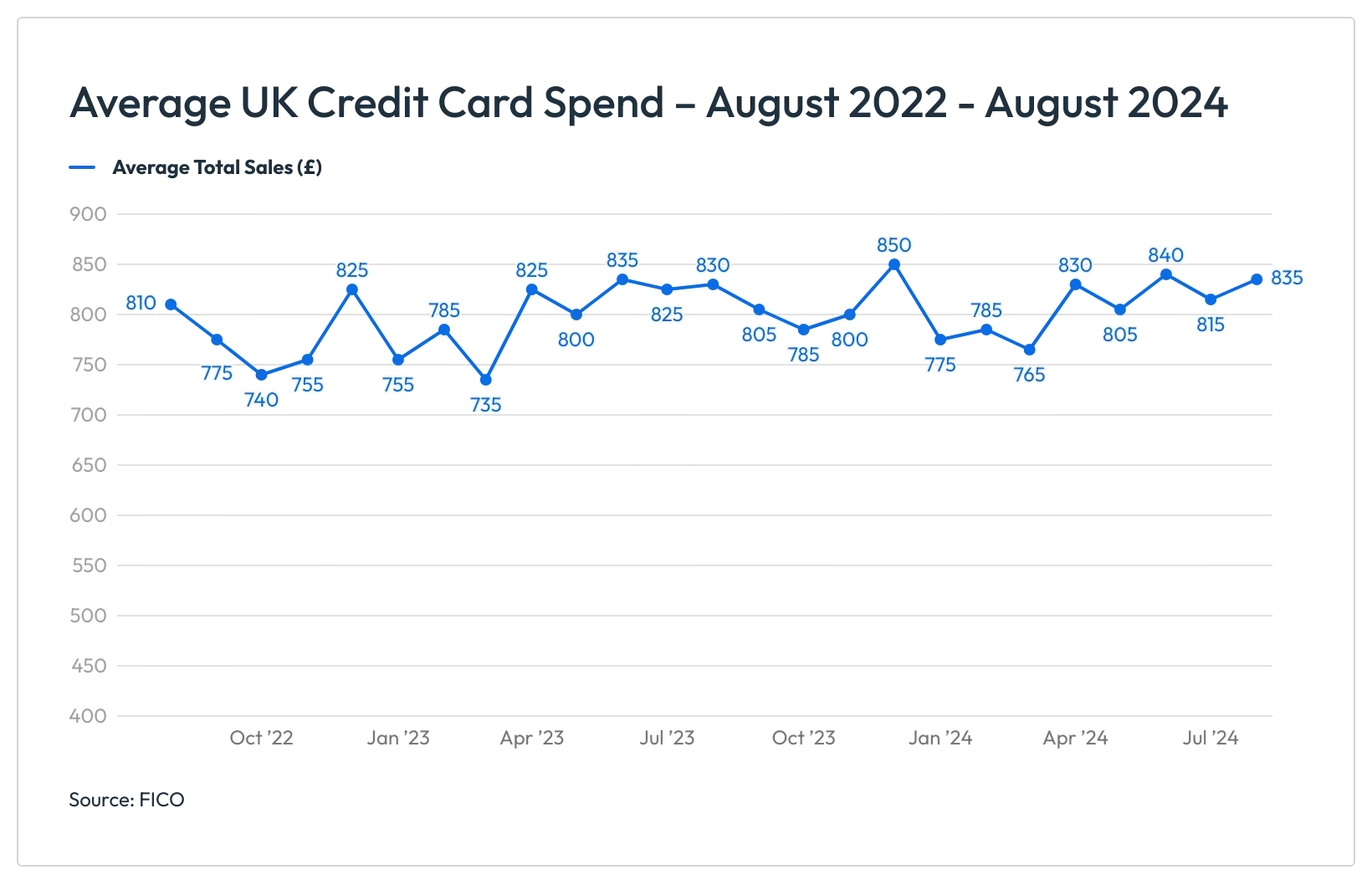

- Spending on credit cards increased to £835, 2.3% higher than July 2024

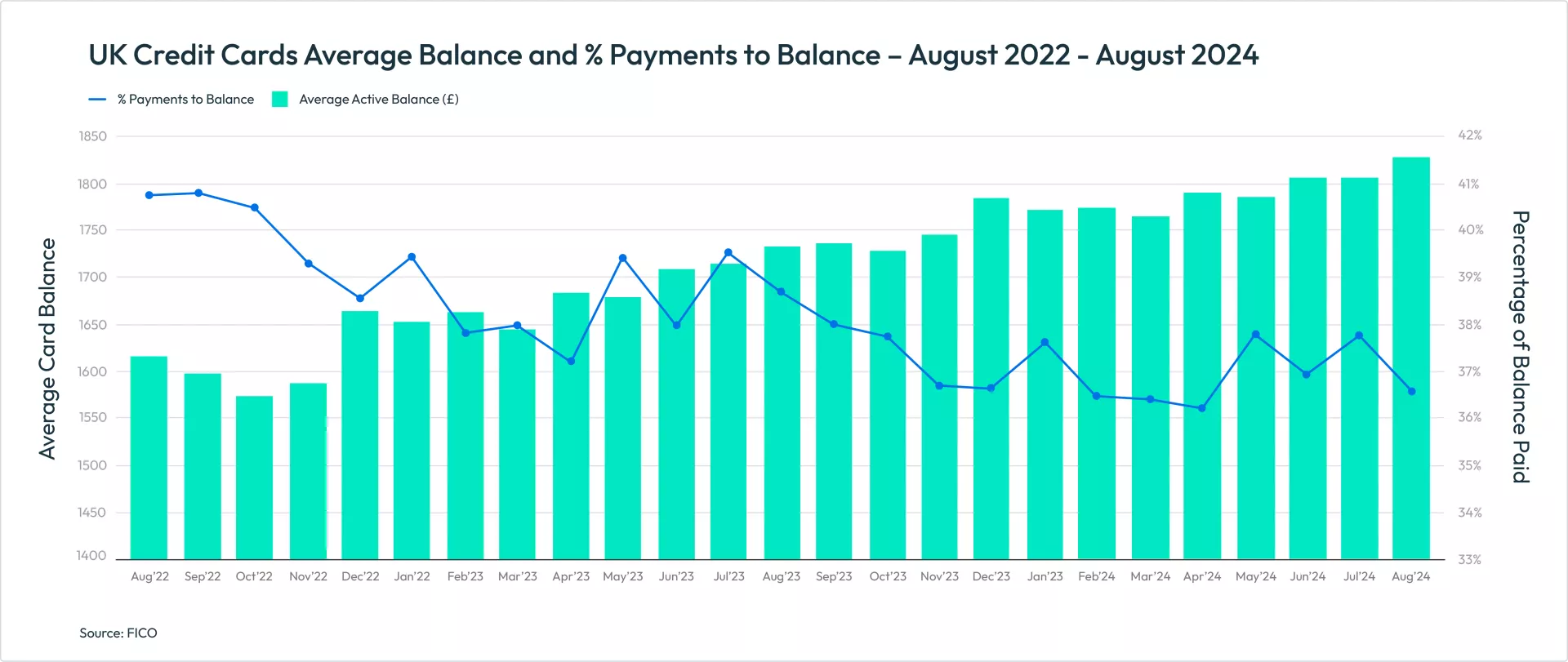

- The percentage of balance paid fell by 3.2% on the previous month and 5.5% on the previous year to 36.6%

- Higher spending and lower payments to balance led to average balances increasing by 1.2% month-on-month and 5.4% year-on year, to £1,825

- Month-on-month and year-on-year, more customers missed one and two payments, although the number of cardholders who missed three payments fell by 2% month-on-month

- Only 44% of customers currently pay by direct debit, with the number of newer customers using direct debit declining

- 1.3% more cardholders used credit cards to withdraw cash in August than July 2024, but this remained 4.2% lower than in August 2023

Rise in Card Spending and Cash Use

August generally sees an uptick in credit card spending and a drop in payments to balance, and August 2024 was no exception. Spending rose by 2.3% on the previous month, with payments to balance dropping by 3.2% in the same period. This has inevitably led to credit card balances rising by 1.2% month-on-month, a figure which has already been trending upwards for the past two years.

As previously reported, cash usage on cards typically increases between March and September. In August this percentage increased month-on-month by 1.3%, to 3.5%, and is likely to rise again in September. However, when compared to 2023, this is 4.2% lower. With cash usage on cards an important potential warning sign for financial stress, it remains important to monitor this continuing upward trajectory.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact us.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis

- Read more posts on UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.