UK Cards Report - Holiday Spend and More Missed Payments

Omicron didn't dampen Christmas spending, as balances increased - but so did missed payments and other signs of trouble on UK cards

Our analysis of trends for UK cards in December 2021 showed that spend and credit card balances increased, as you would expect for the Christmas period. But with the percentage of payments to balance levelling out and a drop in the numbers of accounts paying the full balance, the data suggests rising living costs could be starting to take effect.

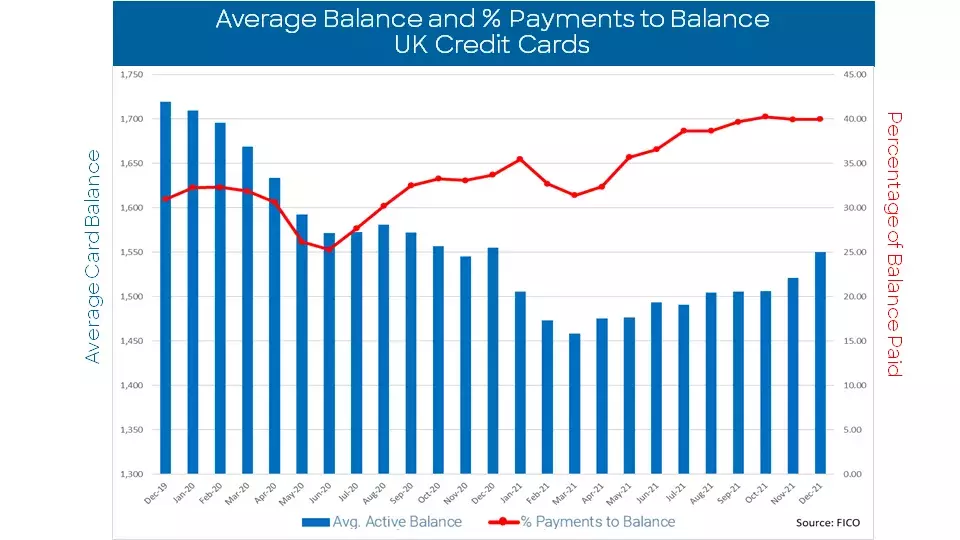

Balances continue to increase and percentage of payments to balance stable

The average active balance continued its strong upward trend at £1,550 in December, although it will take several more months of continuous growth to reach the £1,719 average seen in December 2019.

The percentage of payments to balance was sharply increasing between March and October, suggesting consumer confidence in managing their finances. After dropping in November, the average percentage of payments to balance stabilised in December at 40%. This pattern is typical of the Christmas period, when balances increase while funds are used elsewhere, but lockdown savings could also be a factor. The question is how long these will last.

The percentage of accounts paying the full balance has started to drop across all accounts. It will be interesting to see how payment rates continue with living costs rising and with inflation at its highest rate for 30 years.

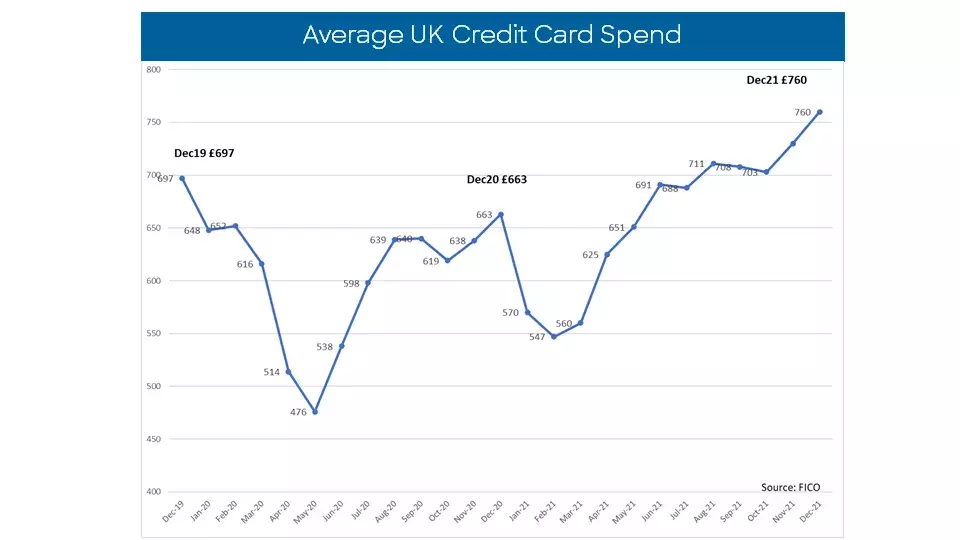

UK Card spend remains higher than pre-pandemic levels

Average spend on credit cards continued to increase, averaging £760 in December, which is 14 percent higher year on year and probably more significant, £63 more than in pre-pandemic December 2019. The continued rise in spend and balances, especially with the easing of COVID restrictions, reflects a more confident consumer base. However, the picture of missed payments suggests lenders need to be vigilant.

Rise in consumers missing payments

Missed payments usually peak just after Christmas and start to level out and decrease by spring. However, the percentage of accounts missing one payment increased by 17% between November and December 2021, with a 3.65% increase year on year. A similar trend was seen for the percentage of balances with one missed payment.

Accounts missing two payments also increased between November and December, a trend that was also seen in 2020 and which peaked in January 21. However, compared to last year there has been a 15% drop in the percentage of accounts missing two payments and a 23% decrease in the percentage of balances with two missed payments.

With the end of furlough support this year, combined with flat incomes and higher inflation, issuers will be following payment behaviour closely over the coming months.

Seasonal drop in cash sales as a percentage of total sales

Cash usage slowed in December and only marginally increased month on month. Although 22% higher than in December 2020, there is still a long way to go before it reaches pre-pandemic levels.

Looking ahead

Even with the rise of the Omicron variant, FICO data shows that Christmas spending increased in December 2021. But with higher inflation, and a potential gradual increase in interest rates, this may be too much for some consumers to pay. Over the next few months, lenders will need to continue to monitor and offer appropriate payment options for customers showing signs of financial stress.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

How FICO Can Help You Manage Card Performance

- Learn about our FICO TRIAD Customer Manager

- Explore the work our FICO Advisors team does

- Discover our solutions for credit line optimization

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.