What Is Intelligent Feature Management? Why Is It Essential?

Intelligent feature management is a disciplined approach to identifying, creating, managing, and utilizing enriched data assets

Introduction: The Data-Driven Imperative

In a world where digital interactions shape every aspect of business and daily life, the ability to harness data intelligently is more critical than ever. Organizations are under constant pressure to deliver highly personalized, timely, and relevant experiences to their customers. No longer is personalization a luxury or competitive edge — it has become the baseline expectation.

But as the volume, velocity, and variety of data explode, so too does the complexity of managing it. How can companies turn this flood of information into actionable insights that actually drive business outcomes? The answer lies in robust, flexible, and intelligent feature management. In this blog post, we’ll explore why feature management is more essential than ever, how it works in practice, and the innovations FICO is pioneering to make it easier, more scalable, and more impactful.

Why Intelligent Feature Management Is Essential in Today’s Business Environment

Imagine your typical day. You check the weather, scan your calendar, glance at your emails, track your kids’ whereabouts, and handle a flurry of notifications—all within moments on your smartphone. Each interaction is backed by data and, more importantly, by applications that are constantly making decisions to serve your immediate needs.

But ask yourself: does your banking app, insurance portal, or retail platform respond with the same contextual awareness and agility? If not, you’re not alone. Most businesses are still struggling to capture, interpret, and leverage data across thousands—or millions—of touchpoints in real time. The stakes are high: fail to deliver, and your customers will readily turn to competitors.

The root challenge isn’t just about collecting data from multiple sources. Raw data is just the beginning. The true differentiator is the ability to transform this data into intelligent features—discrete, meaningful, and actionable data points that power real-time decision-making.

Key Drivers for Intelligent Feature Management

- Scale and Complexity: With millions of transactions happening every second, organizations must manage data at unprecedented scale and complexity.

- Personalization at Speed: Customers expect interactions tailored to their context, history, and preferences—instantly.

- Consistency and Governance: Data must be used consistently across all channels and applications, with rigorous governance for privacy and compliance.

- Reusability and Flexibility: Features need to be independent and reusable across use cases, enabling faster innovation and lower development costs.

- Transparency and Auditability: Businesses need to know exactly how decisions are made—critical for trust, compliance, and continuous improvement.

How Intelligent Feature Management Works: Principles and Practice

In the context of decision management based on advanced analytics, features are enriched data attributes that fuel analytics, decision automation, and personalization engines. Data feature management is a disciplined approach to identifying, creating, managing, and utilizing features. This is a critical part of transforming raw data into high-value business outcomes.

The impact of robust feature management is best illustrated through practical examples:

- Fraud Detection: Aggregation features count and analyze “card-not-present” transactions at high-risk merchants, flagging suspicious behavior in real time.

- Credit Utilization: Complex expression features calculate ratios and indicators, helping lenders make smarter risk decisions for each customer or product.

- Onboarding and Application Fraud: Aggregations track application velocities, device fingerprints, and co-applicant relationships, detecting anomalies before onboarding is complete.

- Customer Behavior Analytics: Aggregates spending patterns across locations, channels, and merchants to inform marketing, loyalty, and retention strategies.

- Operational Monitoring: KPIs and stored values measure everything from case creation rates to false positives and offer take-up rates, supporting agile business management.

Guiding Principles of Data Feature Management

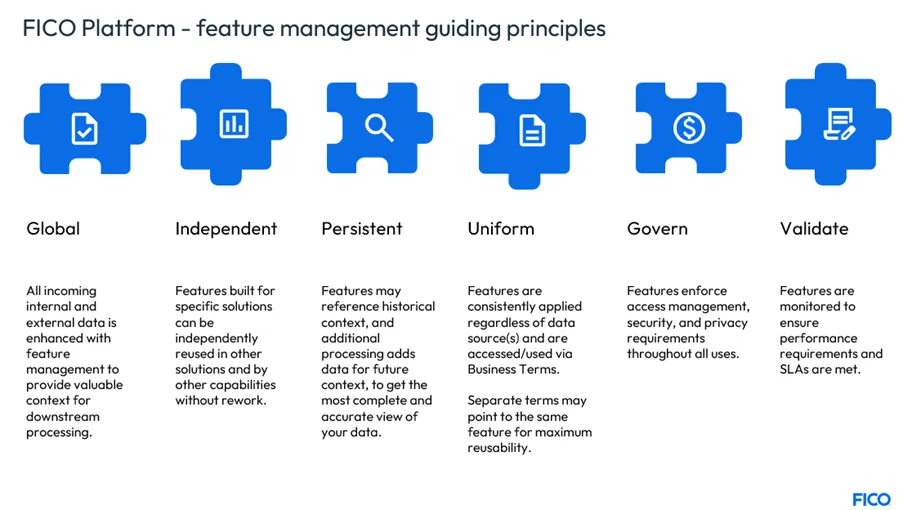

In building the feature management capabilities of FICO® Platform, we have distilled our approach into several key principles, ensuring that its feature management platform is ready to meet the demands of today and tomorrow:

- Globality: Feature management is applied globally, so there’s no loose or untyped data floating in the system. All data must pass through the feature management layer.

- Independence: Data features are completely decoupled from specific solutions, tools, or use cases. This separation drives reusability and lowers system complexity.

- Persistence: All interactions and data points are remembered by default, enabling longitudinal, time-based profiles for deeper insights.

- Uniformity: Features are referenced and used in a consistent way across all tools and solutions, ensuring reliability and ease of integration.

- Governance: Robust governance, privacy, and metadata management ensure data control, visibility, and compliance at every step.

- Self-Awareness & Self-Healing: Features are designed to maintain consistency over time, automatically checking timestamps and validity to ensure data integrity.

Feature Types: Building Blocks of Intelligent Data

FICO’s platform defines several distinct types of features, each serving a specific purpose but all designed for interoperability and scalability:

- Aggregation Features: Summarize data across millions of transactions to detect trends, historical contexts, and behavioral patterns. For example, aggregating all payments from a sender to a recipient over time, or counting transactions at high-risk merchants within seconds.

- Expression Features: Allow for both basic and advanced calculations or transformations (such as calculating credit utilization or extracting a customer’s age from their birthdate) at a single point in time.

- Stored Values: Capture and store any business attribute or data value from any feed, making it instantly reusable across all use cases. This is ideal for relatively static data like account open dates or customer addresses.

- Decision Store: Persist all inbound and generated data, creating a complete snapshot of every decision, including context, features, and outcomes.

- KPIs: Define and measure business metrics (like fraud detection rates, approval rates, or spend across products) in real time, with monitoring and alerts.

- Reference Lists: House key reference data—such as hotlists, negative files, whitelists, or do-not-contact lists—directly in the platform, making it easy to update or augment as needed.

Innovations from FICO: Making Feature Management Simpler, Smarter, and More Scalable

FICO Platform doesn’t just provide intelligent feature management—it redefines it through automation, ease of use, and real-time intelligence. Let’s dive into the standout innovations making it all possible.

Intuitive User Interfaces and No-Code Tools

Traditional feature engineering and management often required specialist coding skills and deep technical knowledge. FICO removes these barriers with powerful, graphical interfaces. Configuring a new aggregation or expression feature is a matter of a few clicks, not hours of scripting. The graphical expression builder allows users to select business terms, choose operators, and assemble formulas visually.

For those who prefer code, a new, simpler, and more readable syntax is available across the platform, ensuring consistency at every touchpoint.

Real-Time, API-First, Agentic Readiness

The platform is designed to be API-first and “agentic-ready”: both humans and algorithms (or agents) can create, modify, and dispose of features. Every aspect, from transaction flows to decision assets, can be authored, orchestrated, and scaled programmatically or by analysts, supporting seamless integration with enterprise and AI systems.

Automated Feedback Loops and Data Persistence

With automated feedback loops, FICO’s feature management captures every action taken, creating a continuous cycle of learning and adaptation. The decision store holds snapshots of every decision made—enabling robust auditing, explainability, and the maturation of features over time.

Advanced Data Validation and Transformation

Before data even becomes features, FICO’s validation and transformation layers ensure data quality and consistency. Custom validation rules, applied as data enters the platform, check patterns, formats, and required attributes—flagging issues before they can do harm. The transformation tools make it easy to map, enrich, and manipulate data on-the-fly, with minimal technical friction.

Governance, Privacy, and Sensitivity by Design

As data privacy and jurisdictional requirements become ever more stringent, FICO embeds rigorous governance controls by default. Businesses retain control over where data is stored (jurisdiction, cloud environment, etc.), how much is stored, and how visibility is managed or restricted. Sensitive data can be masked, encrypted, tokenized, or excluded according to robust business rules, ensuring compliance and customer trust.

Contextual Awareness and Interconnected Features

Features aren’t isolated—they’re inherently interconnected. Changes in one feature can immediately impact others, and this peer awareness supports more sophisticated and context-aware decisions. For instance, a change to a high-risk merchant reference list automatically updates all features and logic referencing it, propagating risk rules instantaneously.

Seamless Scalability and Real-Time Performance

Whether you’re ingesting data for a single use case or streaming millions of events across portfolios, FICO’s platform delivers consistent low-latency performance. Aggregations, calculations, and KPIs are recalculated and contextualized every time a new transaction arrives, making it possible to identify and act on trends in seconds—not days or weeks.

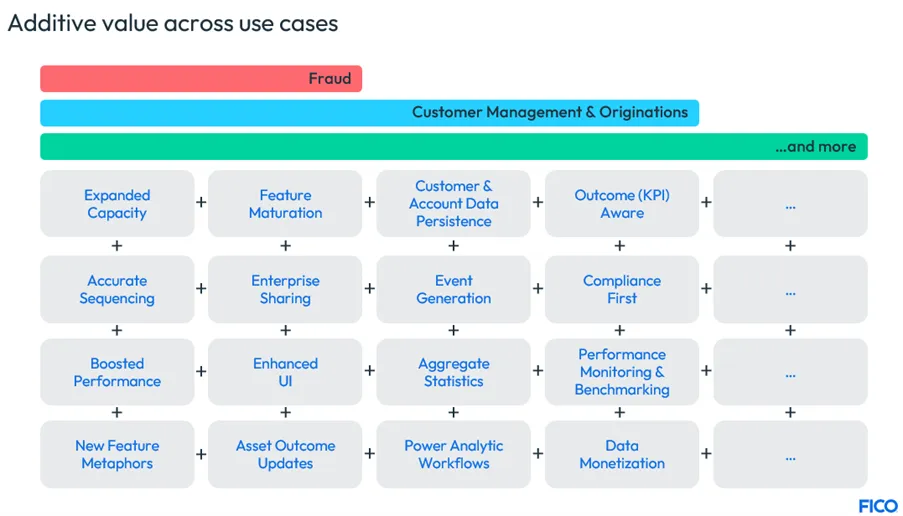

End-to-End Use Case Composability

The modular nature of FICO’s intelligent feature management allows organizations to implement one or multiple use cases simultaneously, with parallel flows enriching the entire feature layer. Every incremental transaction, customer action, or business decision adds to the shared pool of intelligence—creating a virtuous cycle of improvement across the enterprise.

Conclusion: The Future Is Feature-First

The shift to intelligent, scalable, and governed feature management isn’t just a technical upgrade—it’s a business imperative. As customer expectations rise and data ecosystems grow more complex, only those organizations that master the art of feature management will be able to deliver the real-time, personalized, and meaningful experiences that define success.

FICO’s innovations in intuitive interfaces, real-time feedback loops, automated governance, and API-driven extensibility are setting a new standard for the industry. By making feature management accessible, powerful, and context-aware, FICO enables organizations to turn data into competitive advantage—one feature at a time.

Whether you’re wrestling with fraud, striving for operational excellence, or aiming to delight customers at every touchpoint, building on a foundation of robust feature management is the path forward. The future belongs to those who can turn intelligent data into intelligent action—swiftly, securely, and at scale.

How FICO Helps You Maximize the Use of Data and Analytics

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.