5 Trends in Collections - Omni-Channel Communications, AI and More

Explore the 5 areas revolutionizing debt collection, including the importance of omni-channel communications

The collections industry is undergoing a significant transformation, driven by advancements in technology and evolving consumer expectations. As we navigate this dynamic landscape, it's crucial to stay ahead of the curve and embrace the new frontiers that are shaping the future of collections.

Here are five key areas that are revolutionizing the industry:

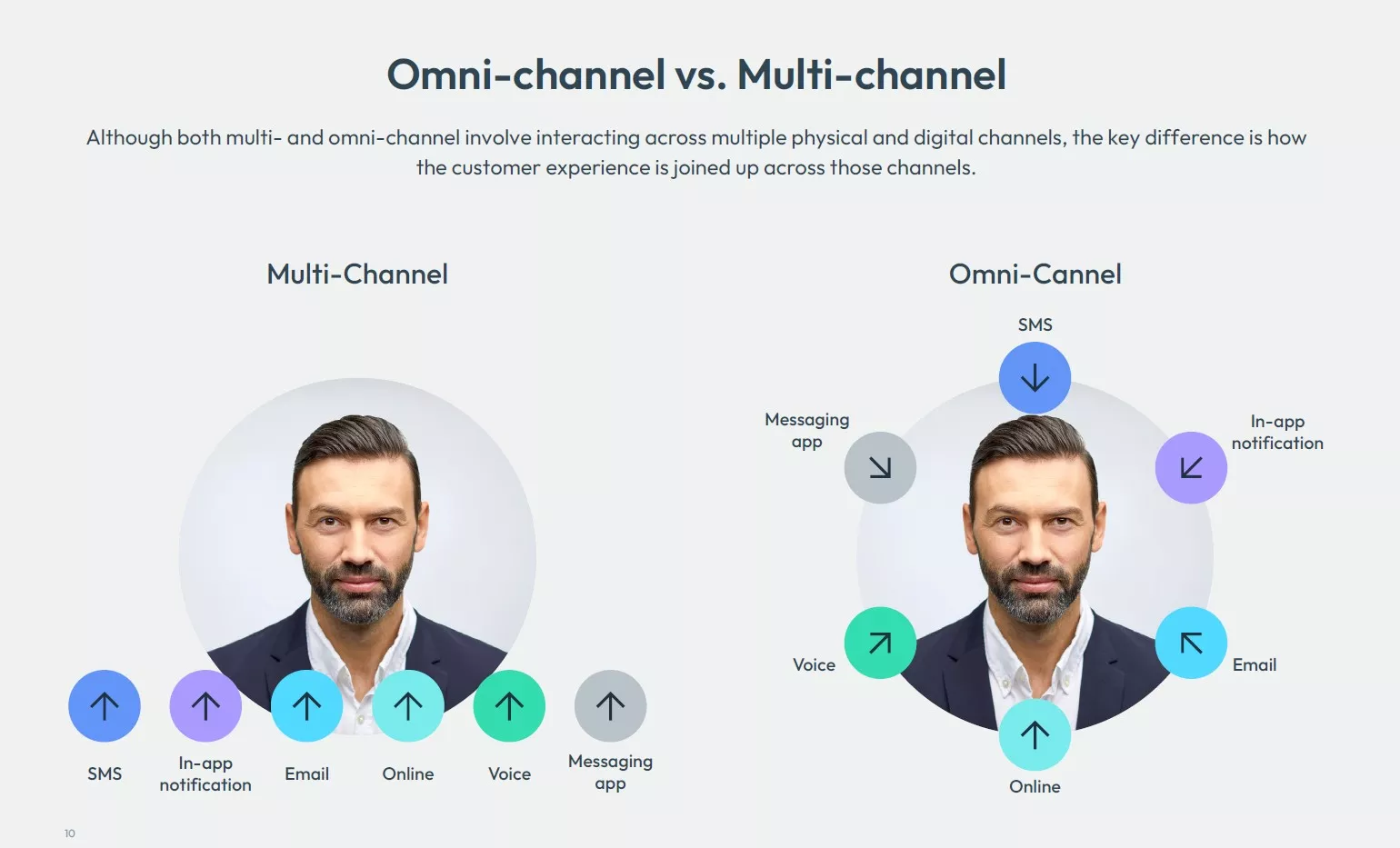

1. Omni-Channel Communications

In today's digital age, reaching out to customers through multiple channels is no longer a luxury but a necessity. An omni-channel approach enhances penetration by utilizing a variety of communication channels, resulting in a “nudge factor” that encourages customers to pay at a higher rate than traditional methods. By integrating phone, email, SMS, and social media, collections agencies can create a seamless and engaging customer experience.

2. Customer-Centric Strategies

The shift towards customer-centricity is redefining how collections are managed. There is an increased emphasis on providing financial support and understanding the life-time value of the customer relationship. By combining technology with customer insights, financial institutions can tailor their approaches to meet and exceed customer expectations. This involves understanding customer behavior, preferences, and pain points, and using this information to create personalized and empathetic collection strategies.

3. Advanced Analytics and AI

The integration of advanced analytics and artificial intelligence (AI) is transforming the collections process. Predictive analytics can identify high-risk accounts and prioritize them for collection efforts. Chatbots enabled with conversational AI can handle routine inquiries and provide instant support and routes to making payments. These technologies not only improve efficiency but also enhance the overall customer experience by providing timely and relevant interactions.

4. Regulatory Compliance

Navigating the complex landscape of regulatory compliance is a critical aspect of modern collections. With regulations constantly evolving, it's essential for financial institutions to stay informed and ensure their practices are compliant. Leveraging technology to automate compliance checks and maintain accurate records can help mitigate risks and avoid costly penalties.

5. Digital Payment Solutions

The rise of digital payment solutions is revolutionizing how customers settle their debts. Offering a variety of payment options, including online portals, mobile apps, and digital wallets, makes it easier for customers to pay on time. By providing convenient and secure payment methods, agencies can improve collection rates and enhance customer satisfaction.

By embracing these new frontiers, the collections industry can not only improve its efficiency and effectiveness but also build stronger relationships with customers.

How FICO Can Help You Improve Debt Collection

FICO provides financial organizations with the tools they need to leverage omni-channel engagement to reach customers through multiple communication channels. By integrating phone, email, SMS, and social media a seamless and engaging customer experience is created.

Conversational AI capabilities can parse the information that customers provide and map them to highly relevant but pre-defined responses and actions. This enhances automation while minimizing customer frustration when virtual agents struggle to understand their needs. Additionally, in a highly regulated environment it ensures the information provided back to customers is relevant and controlled by your organization.

This approach improves collections performance by ensuring that customers can interact with the process in the way that is most convenient for them, leading to an improved experience of financial support and increased collections success.

Learn More

- Read our new Hot Topic Q&A New Frontiers in the Collections Industry – Unlocking the Potential of Omni-Channel Communications

- Find out how FICO empowers organizations to engage with customers requiring financial support

- Discover collections strategies that recover more while enhancing customer experience

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10 T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10 T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.