The 6 "E"s of Enterprise Fraud Management

Navigate the complexities of enterprise fraud management with seamless orchestration, real-time detection, and scalable prevention and intervention strategies.

In today's rapidly evolving digital landscape, the threat of fraud is more pervasive than ever. Because of the digital transformation we’ve undergone in the last few years, as well as the access to and applicability of data, criminals are adopting new technologies and evolving their fraud strategies, impacting customers and banks alike.

Years ago, we all assumed that credit cards were the only mechanism that had to have real-time fraud protection. But now every event, every action, every interaction that a customer has with their bank needs to be validated – from the instant of login, to transactions using credit or debit cards, to moving money from account to account, to updating beneficiaries or adding a new payee. Banks need to ensure that customers are protected from fraud, which means that every action a customer takes must be evaluated and assessed for fraud in real time.

The speed at which we need to be able to process all of these signals and identify which treatment we should apply has just grown exponentially. Banks need to evaluate real-time signals to understand things like whether the customer a victim of a scam, whether the customer is actually a fraudster and has no intent to repay, or whether somebody compromised the customer's credentials and is trying to take over their account.

To stay ahead of criminals and deliver the experiences that customers expect, banks need adaptable, scalable solutions designed for the future. They need the ability to bring in the right data at the right time for the right decision, and they need the ability to let business users compose and deploy value-added strategies to meet the ever-changing fraud landscape.

Understanding the Causes and Effects of Fraud

Causality carries forward into the world of fraud. Causal agents like global economic struggles, increased digital adoption, and the availability of advanced technologies like GenAI and Gen4 bots lead to corresponding effects, including increases in first-party fraud, account takeovers, synthetic fraudsters, and various other fraud-related issues.

The changes in the way people interact with and move money, as well as make payments for goods and services, are fueling growth in the complexity of the fraud ecosystem and the need for comprehensive solutions.

For example, the rise of real-time payments has led to a sea-change in the way fraudsters target victims, creating a relatively new vector for losses that surpass the most historically high channels for loss (i.e., credit cards). Because the victims of authorized push payment fraud (aka scams) are legitimate account holders, traditional things like scores for unauthorized transactions are insufficient for detection and prevention. Banks need different tools and techniques, all readily available and configurable, to win the arms race against the fraudsters.

Fraud by the Numbers

At FICO World 25, I shared some eye-opening statistics about fraud. For instance, 13% of Americans committed first-party fraud over the holidays in 2024, and 73% of global survey respondents received a call, text, or email they believed was part of a scam. Additionally, there was a 73% growth in the number of money mule accounts held by individuals over 40, and a single multinational firm lost over $25 million to a deepfake scam in 2024. These numbers highlight the widespread nature of fraud and the significant financial impact it can have on organizations.

Top Fraud Prevention Challenges

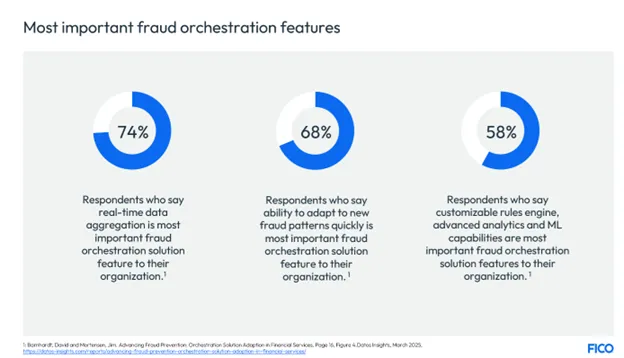

The presentation also addressed the top fraud prevention challenges faced by financial institutions. These include siloed data across different systems (95%), limited visibility across different channels (63%), inadequate orchestration of fraud controls/tools (58%), and lack of real-time fraud detection capabilities (58%). Addressing these challenges requires a holistic approach that integrates data, systems, and processes.

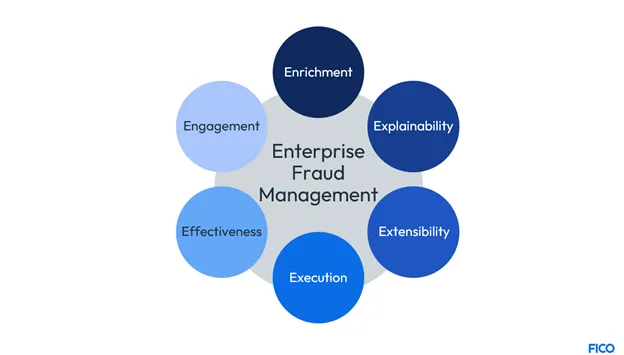

The 6 "E"s of Enterprise Fraud Management

To combat fraud effectively, my FICO World 25 presentation introduced the concept of the 6 "E"s of enterprise fraud management. Each of these factors plays a crucial role in building a robust fraud prevention strategy.

- Enrichment: Data enrichment transforms raw, siloed events into rich, contextualized features that are always running. This continuous transformation ensures that fraud detection systems have the most relevant and up-to-date information. And with the right technology, you can have flexible input formats, and seamlessly bring any internal or external data into a fraud decision exactly when and where it’s needed.

- Explainability: The risks of “black box” fraud decisions have very real regulatory and compliance impacts. A lack of visibility into why a specific decision happened can result in fines and oversight, not to mention that opacity will prevent financial institutions from identifying and improving false positives/negatives. Banks I’ve worked with understand the importance of transparency in fraud decision-making, and demand technology that gives end-to-end traceability and observability across all fraud-related use cases.

- Extensibility: Designing strategies with extensibility in mind allows for the integration of decision-making with non-fraud decisions and the flexibility to connect different metaphors. This adaptability is crucial for evolving fraud tactics, and is increasingly table stakes for banks as they look to improve legacy fraud detection and prevention systems. It’s no longer enough for legacy systems to sit in silos – modern fraud prevention requires systems that are connected and informed from every decision and data asset along the entire value chain.

- Execution: Effective execution involves flexible and composable architecture to adapt to any organization’s unique risk and fraud tolerances; the ability to connect to systems and data sources quickly with pre-configured APIs; and support for throughput that can quickly and easily handle the highest transactional volume with minimal latency.

- Effectiveness: Even the best strategies, rules, and models are only as good as their ability to quickly confirm fraud. This speed at which fraud can be confirmed is a critical measure of effectiveness, and leading companies will need technology that leverages AI assistants for efficient case management and resolution. This can help ensure that the right cases are worked in the right order, at the right speed, by the right analyst, with the right treatment.

- Engagement: Customer engagement is key to fighting fraud. I simply cannot overstate the importance of involving customers in the fraud prevention process and using communication as a strategic way to lower risks. With real-time, omni-channel engagement technology, banks and other financial institutions can communicate with customers in their preferred channels, reducing time to resolution and improving customer experience while setting up yet another layer of protection against fraud.

While each of these factors is important on its own, the true power lies in combining all of them together. When banks consistently apply all six principles through a next-generation fraud detection and prevention system, they’re future-proofing their fraud defenses and establishing a means to protect customers from the known frauds of today – and the unknown frauds of tomorrow.

The future of fraud prevention does not live in siloed systems, where disconnected decisions and outcomes remain sequestered away. The future lies with companies that adopt comprehensive, connected, API-enabled technology that deliver the 6 Es of Enterprise Fraud.

I’m thrilled to continue my work with leading banks around the world as we push boundaries and explore the most effective solutions to uncovering and stopping fraud – and I look forward to sharing more of these ground-breaking innovations in the near future.

How FICO Delivers Enterprise Fraud Management Solutions

- Read more about FICO’s enterprise fraud innovations

- Check out my presentation from FICO World 2025

- Learn more about global impact of scams from FICO’s recent research project

- Explore the power of real-time, omni-channel communications for fraud

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.