Communicating with Your Customers to Beat Fraud

With real-time, omni-channel communications, banks can improve fraud management and customer experience with personalized outreach

Real-time, two-way communication, delivered in the channel of each customer’s choice, creates personalized engagement that improves experiences across the customer lifecycle. From originations, loyalty, collections and fraud to improving operational efficiency for any type of claims or case management, omni-channel engagement is a fundamental capability that creates happy customers and benefits banks across their portfolios and throughout key customer lifecycle events.

Today, we’ll examine how this right time/right channel/right message approach applies in the context of enterprise fraud management.

Prevent Fraud Losses

Everyone wants to avoid fraud losses. Yet consumers and banks continue to face increases in fraud across multiple portfolios and channels. Common frauds range from application fraud to third-party types (e.g., stolen identity credentials and card-not-present fraud) to impersonation scams and authorized push-payment (APP) fraud, also known as scams.

Banks can provide the best level of fraud intervention and protection – and remain compliant with regulatory requirements – with real-time communications delivered in the channels that their customers prefer. This real-time engagement is proven to help break through the spells of fraudsters as they perpetrate increasingly complex scams relating to real-time payments, for example.

Right Channel, Right Time

A message delivered at the right time, through the right channel – the one the customer prefers, like a message in a banking app, an SMS or WhatsApp message to a mobile phone, or a voice call – can be a powerful step in preventing a customer from sending a real-time payment to a scammer or giving card, payment, or login information to an unauthorized person.

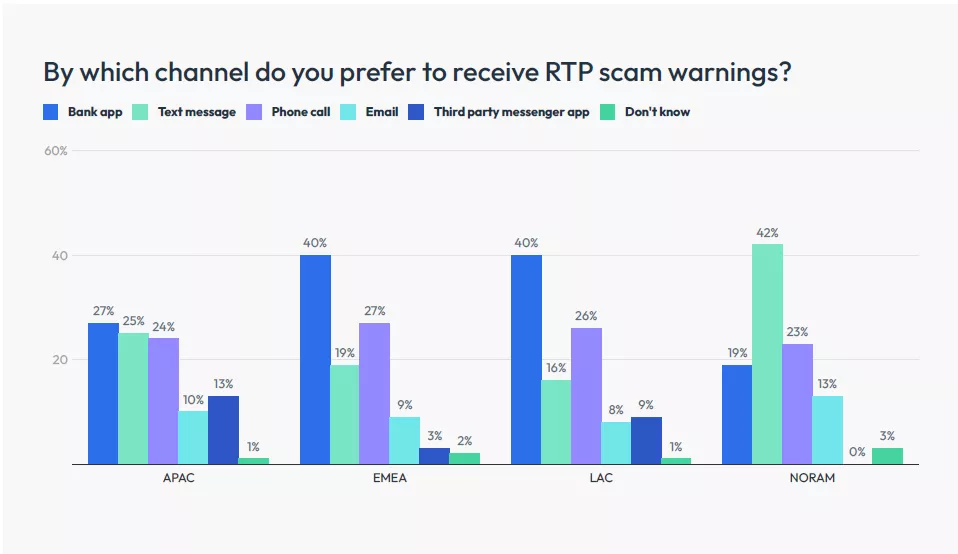

Consumers’ communications channel preferences tend to vary by region and have changed over time. The FICO 2024 Global Scams Impact Survey shows that where text messaging was once predominant in many markets, one-third of consumers worldwide now prefer to receive real-time fraud notifications within their banking apps, while another quarter prefer to receive them via voice call. A further 23% continue to use text messaging, though this preference varies significantly across markets.

Engagement, Not Just Outreach

Customer communications must be two-way, which makes a real-time feedback channel for customers a key component. Real-time feedback is critical to drive processes like payment authorization and fraud management. Banks can immediately engage customers about the legitimacy of a transaction, as with payments, or to verify facts about their account to detect and stop impersonation frauds.

By communicating and getting feedback in real time, banks can act rapidly either to facilitate a legitimate customer’s experience with a product, or prevent a fraud loss from occurring. This includes making updates to claims or cases, and giving customers a way to resolve things on their own without requiring additional attention from live agents.

Automating Fraud Management

Two-way communication feeds automation across key aspects of fraud detection, prevention and management. Banks can combine fast, personalized, contextual alerts with self-service options to address different fraud types and claims management scenarios. For example, as a customer initiates a payment, banks can send additional messages to warn of known frauds and to offer alternatives like delaying the payment or speaking to a fraud prevention specialist.

Key examples of how banks can use real-time, omni-channel engagement and automation to prevent fraud and improve customer experiences include:

- Separate fraudulent and legitimate transactions by communicating with customers in real time, and automating self-service to verify or deny pending and recent charges or payments.

- Confirm or deny pre- and post-book transactions by obtaining ID verification and payment authorization.

- Perform step-up authentication for large transfers based on customer or bank-defined thresholds.

- Add sensible friction to real-time payment processes, like warnings or other checkpoints, and intervene if fraud is detected or identity checks fail.

- Provide warnings about specific fraud typologies and automate communication-related fraud workflows to free agents from repetitive low-value tasks.

- Analyze customer feedback and responses to improve fraud strategy, tactics, and operations.

With automated two-way, real-time communications, fraud management teams can deliver better results faster while reducing operating costs and improving efficiency.

Resolve Fraud Faster, for Less

With automated, real-time communications, banks can lower expenses and improve efficiency by reducing what’s asked of contact center agents. Fewer agents are required to work, escalate and resolve cases because many cases can be automated end-to-end, like flagging mistaken charges from a trusted vendor on a customer’s credit card.

Automation and customer feedback can also help eliminate false positive scenarios. Real-time customer verification, in preferred channels, helps streamline legitimate transactions while adding sensible friction into suspected fraud transactions. When customers can verify or deny transactions themselves in real-time, it’s a win-win for everyone.

Automated fraud management capabilities combined with real-time, omni-channel communications make it easier for banks to meet their regulatory requirements, and help protect against the reputational damage that poor fraud management can cause. Our research finds that more than one in ten consumers worldwide (12%) would change banks entirely if dissatisfied with how their current bank handled a fraud case. Most consumers, 59%, will complain directly to their bank.

Improve Customer Experience with Fraud Management Done Right

Banks can deliver world-class customer experiences and address fraud effectively by engaging customers with personalized, contextual, and automated communications. Fraud-specific insights, such as SIM swap detection data and Scam Signal details, help identify fraudulent transactions, account takeover attempts, and other frauds. By adding additional telco intelligence to customer and payment data during high-risk events, you can deliver better decisioning capabilities and ultimately better outcomes for your customers.

Messages can be built into conversation "flows" that respond in real-time to the actions customers take. These can be delivered in any channel the customer chooses. They provide an immediate response mechanism to enable a highly responsive customer experience that excels in fraud prevention.

And these fundamental capabilities do not apply to fraud alone. Real-time, omni-channel communications coupled with automation improves processes ranging from product promotions and originations to payments and collections.

How FICO Helps Deliver Omni-Channel Engagement to Prevent Fraud

- Explore how FICO helps fight fraud, regardless of channel or portfolio.

- See how Customer Communications Services for Fraud engages customers in real time to disrupt a variety of fraud typologies.

- Learn how real-time customer communication can be a competitive differentiator across the entire customer lifecycle.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.