How to Communicate with Customers about Possible Fraud

Real-time communications play a key role for banks to balance sensible friction in fraud management with customer preferences for ease and convenience

Communicating to the right customer, at the right time, on their preferred channel should be a primary focus for any fraud management organization. Real-time engagement, integrated with fraud detection systems, can mean the difference between stopping fraud (and saving your customer money) or letting someone become a victim.

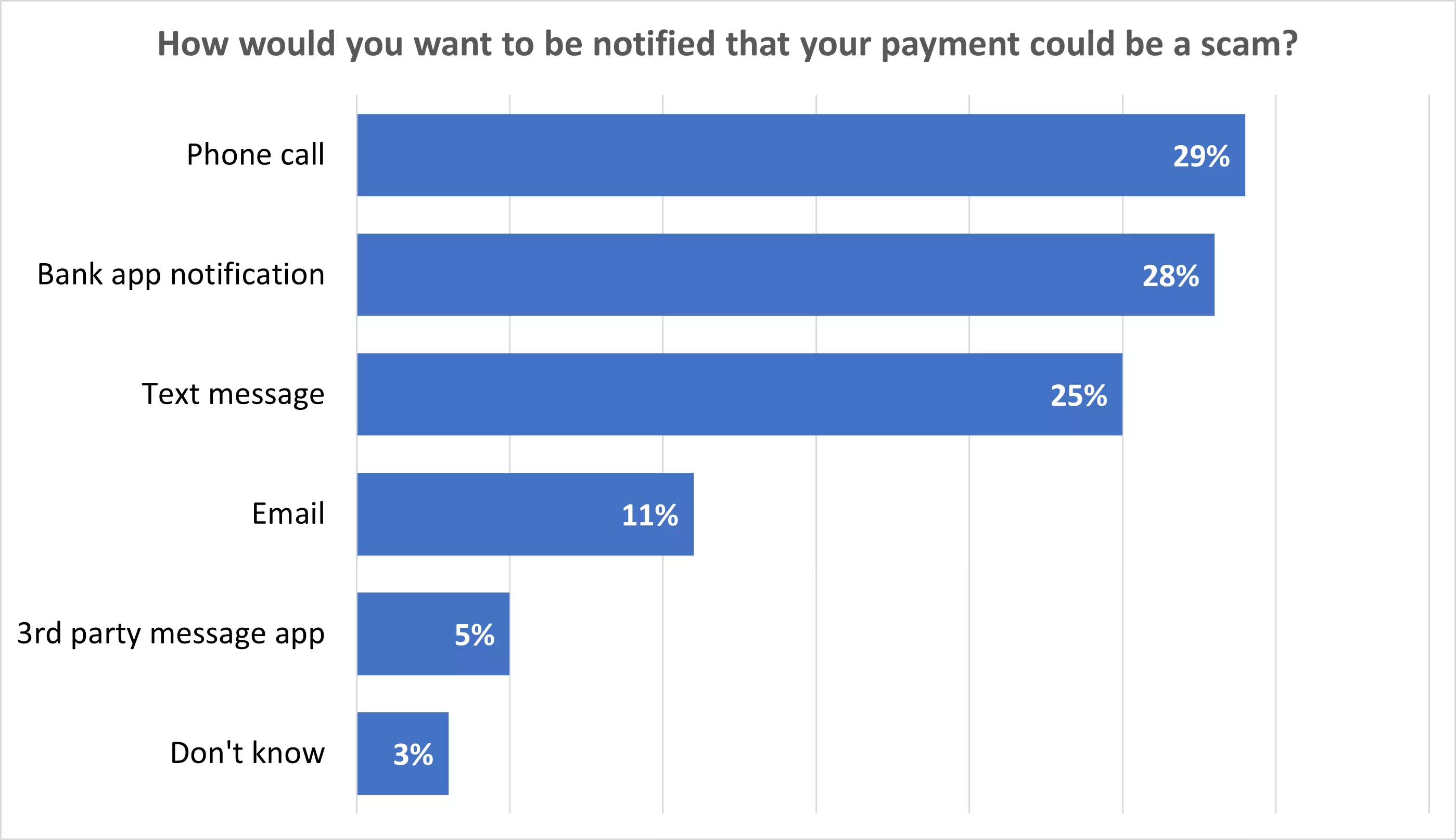

Consumers around the globe use many different ways to communicate, and their preferences for managing fraud and identity authentication are diverse. According to FICO’s global scams impact survey data (see chart), 28% of consumers worldwide prefer to keep these sensitive notifications in their banking app, 29% prefer a private phone call, and 25% want a text message. Banks need to get real-time, bi-directional communication just right to balance fraud prevention friction with easy, convenient customer experiences.

How to Engage Customers

Like banking, most industries quickly adopted SMS as an easy way to reach customers, even with security-related communications. When the two-factor authentication wave hit, SMS was one of the most common and cost-effective ways to connect, even though it isn’t encrypted. Today, however, much of the world has an SMS security problem; fraudsters are increasingly successful with scams ranging from smishing to SIM swaps because SMS was never designed for secure and sensitive information.

Push notification fraud alerts and in-app authorizations are preferred by many enterprises because they are more secure than SMS, but so far they’ve lacked the kind of interactive, two-way, or multi-party messaging that would make them true customer communications channels. In some markets, like Brazil and Indonesia, over-the-top (OTT) messaging apps, like WhatsApp, have seen impressive increases in adoption among banks and consumers for handling private communications since they allow live, secure, multi-party communication.

When to Engage Customers

The frequency and context of sending customer messages is vitally important for fraud prevention. Consumers already face an overwhelming load of digital communications every day. Adding to that, even if well-intentioned, can create decision fatigue and even result in customers ignoring the message.

In the past, standard practice was only to communicate within specific windows throughout the day. But newer approaches can optimize 3 to 5 contacts within a 15-to-20-minute window. Anecdotal reports indicate that consumers react to personalized warnings at different rates at different stages; response rates can jump from 16% to 50% between the first and second messages. That kind of engagement can make a huge difference when it comes to getting a customer to pay attention to a potential fraud threat.

Multichannel self-resolution is still the best end game for both banks and customers, but tailored communications, delivered with the right frequency in the customer’s preferred channel, is crucial to prevention when it comes to fraudulent transactions.

What to Say When Engaging Customers

Hyper-personalized, relevant communications are especially important when it comes to an unfolding fraud situation. Conversational messages, whether through online chat or through text/SMS, are now replacing live voice interactions, even though more than a quarter of consumers still like a private call to handle fraud or step-up authentication.

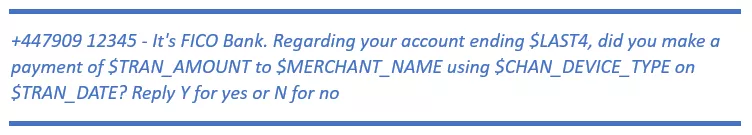

Conversational messages can allow communication to shift from being transaction-related and stiff, to more fluid and engaging. For example, if a bank’s machine learning analytics flagged a payment as potentially fraudulent, the bank might send a confirmation message that looks impersonal and technical like this:

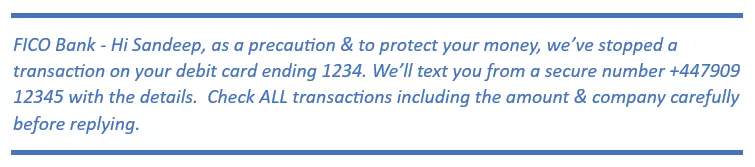

Shifting to a conversational style, however, allows a more positive and clear communication to the customer, like this:

In the latter example, the customer communication is positive, provides context for the reason behind the communication, offers next steps, and encourages the customers to take action to protect themselves further.

Shift Customers from Feeling to Thinking

When it comes to fraud management, it is increasingly important to help a customer move from “feeling” to “thinking.” Scams tend to prey on victims’ emotions. Asking consumers to stop and think a bit before sending a real-time payment, for example, is good practice. FICO’s survey data shows 65% of consumers worldwide want more warnings about emerging scams when they are making real-time payments.

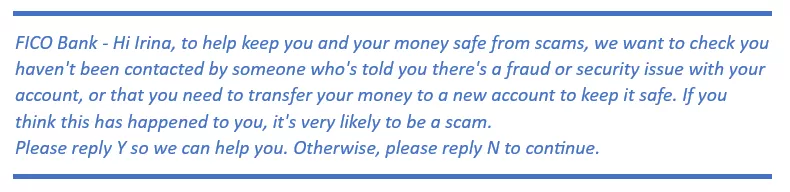

A communication that both warns and educated about real-time payment scams might look like this:

This approach educates customers, enables them to make decisions, and gives them a path to communicate in real-time for more assistance. As a result, customers are neither compelled to act nor isolated without knowing how to respond to a potential incident. They can “choose their own adventure”, with a clear view of how to proceed with their self-interest intact.

Balance Ease of Use with Sensible Friction

When asked what they look for most when opening a financial account, 61% of consumers globally rate “ease of use” among their top 3 considerations, along with good fraud protection and good value. Balancing ease of use and good fraud protection is always a central challenge for fraud management teams. Clear communications delivered at the right time and in the right channel are absolutely necessary to get and keep this mix between simplicity and sensible friction just right.

How FICO Helps Engage Customers in the Right Channel at the Right Time

- Learn about FICO’s comprehensive fraud prevention, detection and compliance solutions

- Explore using hyper-personalization to balance fraud prevention and customer experience

- Read about orchestration to balance real-time decisions and interventions

- Discover effective customer communications for fraud management

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.