Application Fraud: How to Prevent Losses by Busting Through Siloes

Barriers between functions create credit risk and fraud exposure and lead to poor customer experiences and reduced business growth

HubSpot calculates it costs more than $644 for financial services organizations to acquire a new customer. It is vital that this investment isn’t wasted, and applicants are not lost to a poor onboarding experience. With each new customer there are potential risks; applicants may be a poor credit risk, a fraudster, or even be a stolen or fabricated identity. You need to protect against these risks, but most applicants are valuable new customers, and you don’t want to put unnecessary barriers in their way.

As you onboard new customers, the checks involved can be extensive and different checks are managed by different parts of the business. Typically, each has their own systems and processes. As one part of the business solves their issues, the unintended consequence is that they create problems for their colleagues, resulting in various application fraud and credit risk challenges for the organization. These include:

False positives – fraud risk prevents good customer experience. Suspicion of fraud does not always equate to real fraudulent activity, but each case must be investigated. This is costly in terms of resources, and for customers who are unnecessarily investigated it can be a poor experience as their application is halted or delayed.

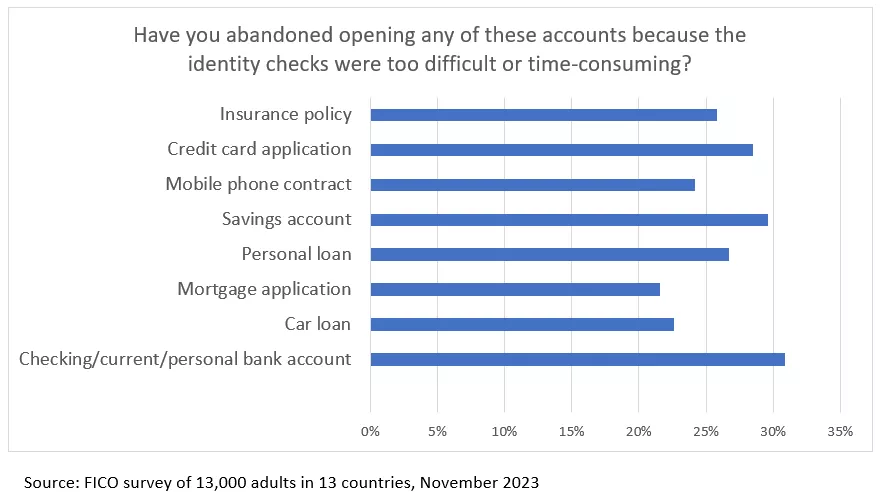

Customer verification – identity fraud checks increase application abandonment. Fraud prevention and protection against money laundering require appropriate know your customer (KYC) processes. While customers understand the need for checks, their patience is limited. FICO research found that up to 31% of people have abandoned opening a new financial account because identity checks conducted by financial institutions were either too difficult or too time-consuming.

Sales drive — undetected fraud creates future losses. As financial organizations look to meet aggressive sales targets and originate as many new customers as possible, anti-fraud measures can be identified as business prevention — this can lead to businesses lowering their defenses. With application fraud, the fraudulent intent is frequently not immediately obvious and notoriously challenging to detect. Fraud can stay dormant with accounts managed by fake or synthetic identities that appear to be profitable customers, until they have amassed enough credit to bust out causing maximum losses.

Mis-identified fraud — first-party fraud creates collections burden. First-party fraud accounts for around 10% of the volume of credit losses but more than 20% of the value. These direct fraud losses are amplified when it is mis-identified and treated as bad debt. Collections teams waste significant time and resource chasing “bad debt” that is really fraud and which they cannot recover.

3 Ways to Break Through the Siloes

Breaking down these siloes and fostering a more collaborative and communicative culture typically requires a concerted effort from leadership, changes in organizational structure, and a commitment to promoting cross-functional teamwork and a shared organizational mission. A recent FICO poll of senior executives tasked with preventing application fraud found that 85% of them put a high priority on technology that supports real-time fraud detection integrated with credit originations.

Here are three ways you can break through the siloes:

1. Develop a common language

Diverse interpretations and definitions of crucial terms often foster isolated thinking, leading to communication breakdowns, inefficiency, and conflicts. To illustrate, numerous organizations lack universally accepted definitions for various fraud typologies, resulting in the misclassification of fraud as bad debt. The boundaries between fraud, especially first-party fraud, and bad debt are blurred. While the precise definitions may differ among organizations, it is essential to maintain consistency within your financial institution.

By clearly articulating the definitions of first-party, third-party, and synthetic identity fraud, you significantly enhance the likelihood of appropriate handling, thereby reducing fraud losses and optimizing operational efficiencies.

A refined definition can also play a pivotal role in formulating an effective strategy for fraud management. Presently, organizations often segregate the oversight of first-party and third-party fraud, delegating the former to the credit risk team and the latter to the fraud team. However, this approach leads to complications, particularly when dealing with synthetic identities that exhibit characteristics of both first-party and third-party fraud. The resulting lack of synergy often results in a higher incidence of synthetic identity fraud cases being routed to the collections team. By reducing the influx of fraud cases directed toward the collections process, we empower the collections team to focus their energies on pursuing recoverable debts, ultimately bolstering their overall efficiency.

To start your journey to robust and agreed fraud classifications check out these resources from The Federal Reserve and the Euro Banking Association

2. Establish Common Reporting Lines

Numerous financial institutions have already entrusted the Chief Risk Officer with paramount responsibility for managing both application fraud risk and credit risk. Nevertheless, the real value emerges when these objectives are comprehended and collaboratively embraced throughout the reporting hierarchy. The convergence of reporting lines yields significant dividends, including the establishment of effective communication channels, the formation of cross-functional teams, better allocation of resources, and enhanced information sharing.

3. Nurture the Necessary Differences

Removing siloes doesn’t necessarily make the total convergence of different functions desirable. Originations, fraud, financial crime compliance and collections all intersect with recently established customer relationships, but they remain inherently distinct. Each function has its own objectives and requires specialized skillsets to achieve them. Breaking down siloes requires finesse and should not lose sight of the fundamental goals each function must achieve. By focusing on a common vision, promoting cross-functional teams, and fostering effective communication, we can eliminate these barriers without jeopardizing core competencies.

Removing siloes: People, Process and Technology

In my next two posts I consider the role innovations in processes and technology deliver in reducing or eliminating the barriers that prevent collaborative and effective originations and fraud management.

- Read the white paper: Breaking Down Siloes – Originations and Application Fraud

- Read the white paper The changing face of application fraud

- See the results of our latest fraud, identity and digital banking consumer survey

- Explore the range of FICO fraud solutions

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.