Application Fraud – Real-Time and Integrated Solutions Are the Priority

Fraud prevention leaders outline their concerns and priorities for tackling application fraud at FICO virtual roundtable

Last month, I had the privilege of co-hosting a virtual roundtable with Julie Conroy, Chief Insights Officer of Datos Insights. This gathering brought together over 40 influential leaders in the field of fraud prevention, all dedicated to addressing the challenges of application fraud. The event proved to be enlightening and engaging, especially as we employed interactive polls to gain deeper insights into our customers' expectations and requirements.

Here are some of the takeaways:

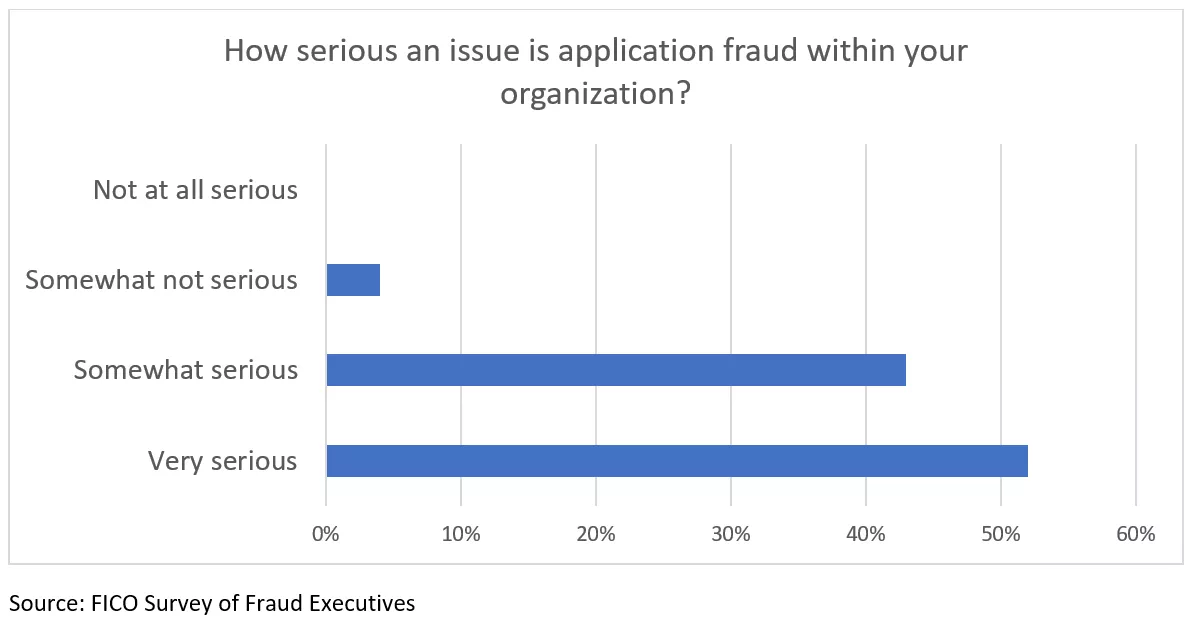

Most acknowledge application fraud is a serious issue and there’s more to do to tackle it.

A resounding 95% of the delegates identified application fraud as a significant concern within their organization. While this response aligns with the event's primary focus, it's notable that more than half emphasized that this issue is not just somewhat serious but indeed a very serious problem for them.

Fortunately, around a quarter of participants felt that their organization is very effective in identifying and preventing application fraud. However, the majority indicated varying degrees of effectiveness, with some feeling their organization is only somewhat effective (65%) and 9% indicating that their organization is somewhat ineffective. These results underscore that there is still substantial room for improvement when it comes to stopping fraudsters in the originations process.

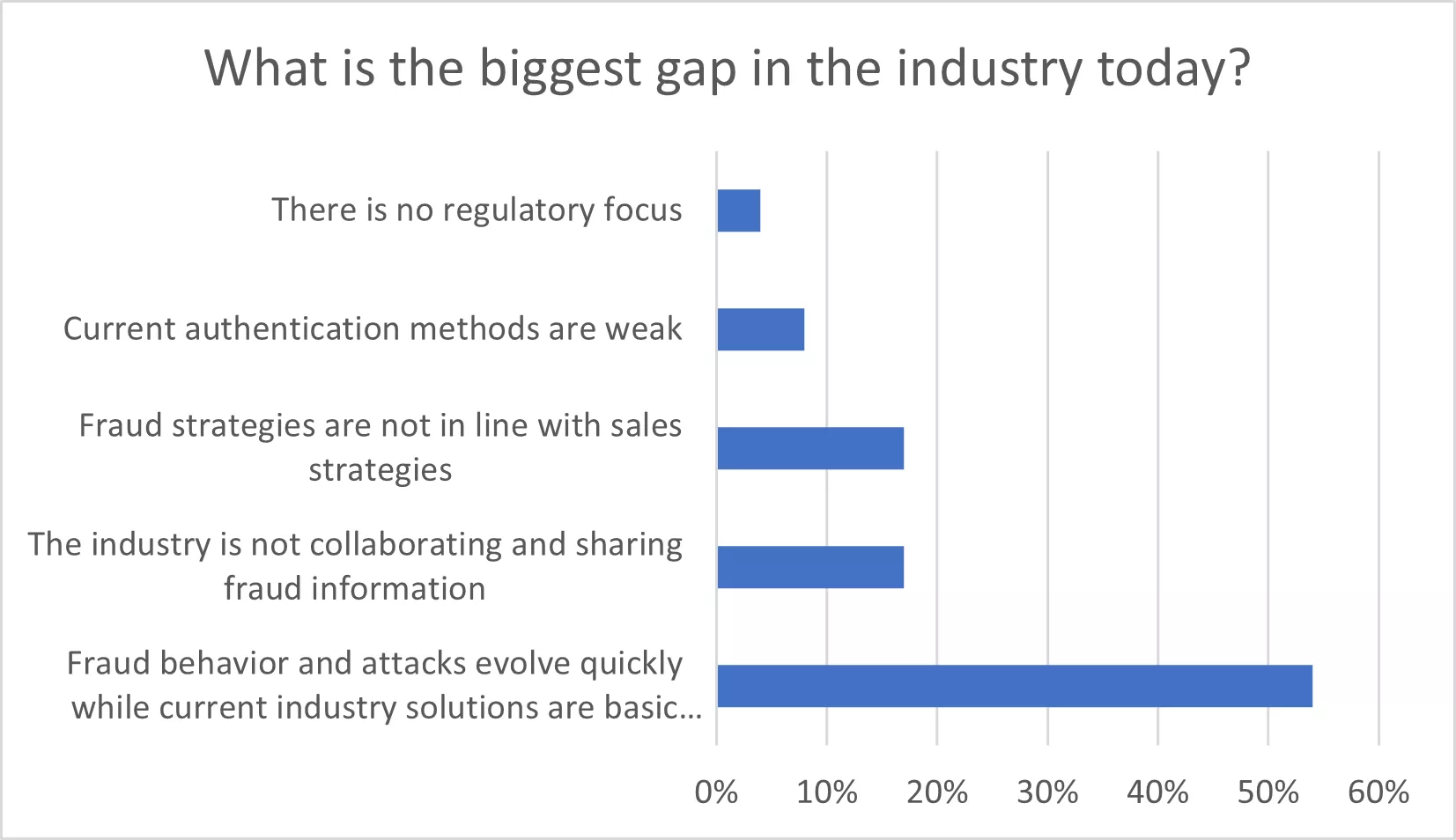

Tackling the speed at which fraud attacks evolve is the biggest challenge

Fraudsters enjoy a distinct advantage in terms of agility when compared to the dedicated fraud fighters at financial institutions. Unlike the latter, fraudsters are unconstrained by regulatory compliance and customer satisfaction concerns. The AI tools they employ are not bound by ethical considerations, and they don't grapple with the complexities of legacy systems that often hinder swift adaptations. It's noteworthy that over half of our delegates pinpointed the rapid evolution of fraudulent tactics and fraudster attacks as the most glaring gap in the industry today.

Designed with analytical excellence in mind, FICO Platform helps organizations get models into production fast. This agility allows organizations to swiftly address emerging fraud trends and thwart criminal activity. Moreover, rules and decision trees can be effortlessly adjusted as need arises, without the need for IT team intervention, which helps organizations stay agile and keep up with fraudsters.

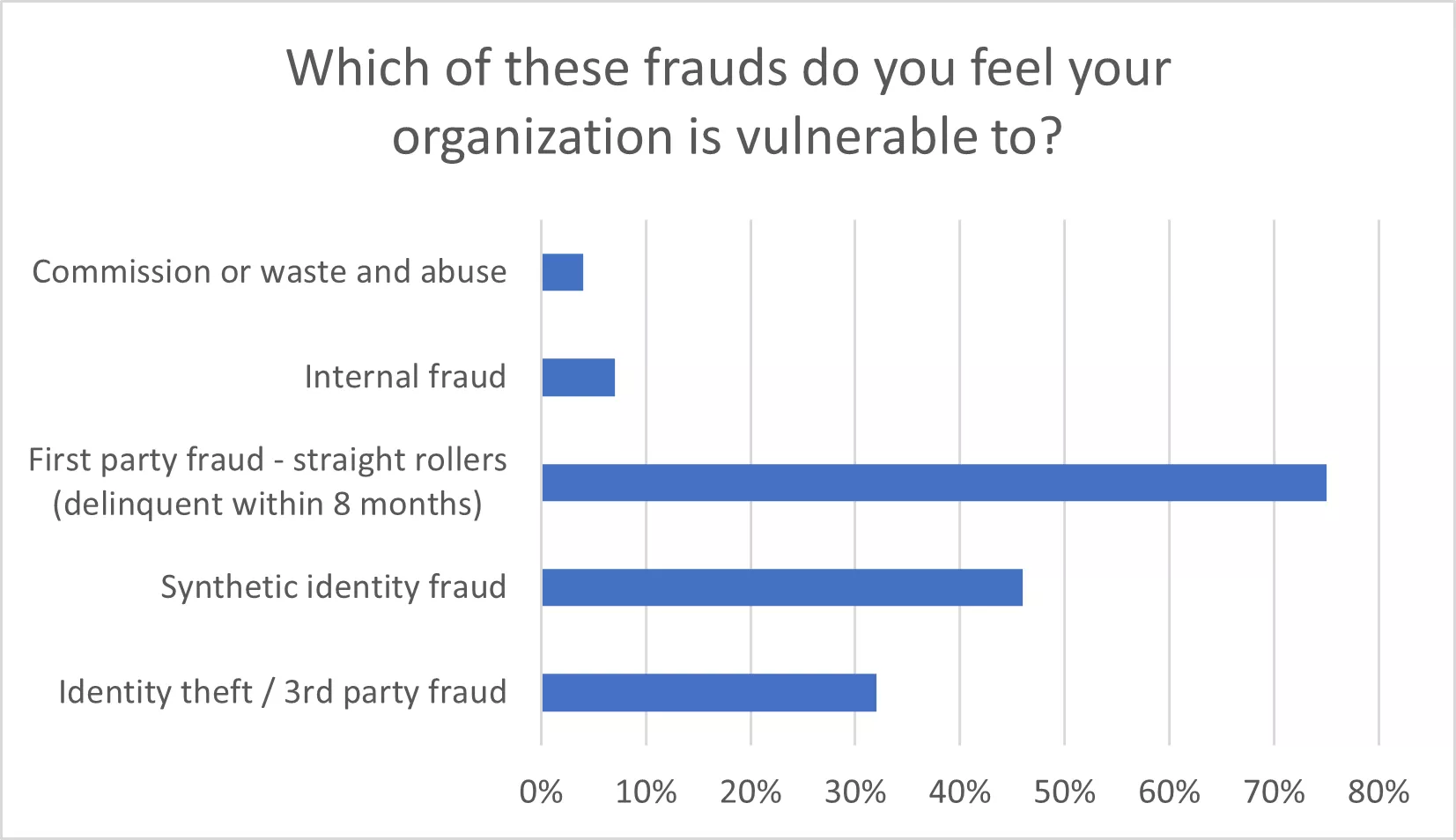

Organizations are vulnerable to multiple application fraud types

First-party fraud, often referred to as “bust out” fraud or “straight rollers”, is marked by accounts becoming delinquent frequently within less than 8 months after the account is opened. This has proven to be the most significant vulnerability for our delegates, reported by 75%. However, nearly half expressed concerns about synthetic identity fraud, while almost a third are worried about third-party fraud resulting from identity theft.

In the prevailing economic climate, this concern is justified. According to a recent FICO survey of 1,000 Americans, up to a third of people say that exaggerating income in applications for financial products is justifiable in some circumstances. Rising concerns about the cost of living and access to credit may be driving factors that make dishonesty amongst applicants seem acceptable to a significant number of people.

FICO Platform equips financial organizations with the necessary tools to detect and combat a variety of application fraud types effectively. Here's how:

- Identity proofing can be orchestrated to ensure that each application is handled appropriately. Leveraging the highest-quality identity verification data enables robust prevention of third-party fraud while enhancing the overall customer experience for legitimate applicants.

- Advanced linking and matching technology uncovers instances where synthetic identities are active in both new applications and existing accounts. By identifying shared data elements across seemingly unrelated accounts and applications, even across multiple layers of separation, we can detect and expose criminal networks.

- Pre-book, FICO Platform can help you proactively spot anomalies that indicate the risk of first-party fraud. Post-book account monitoring utilizes analytics to help you detect changes in account behavior that signifies an impending bust-out.

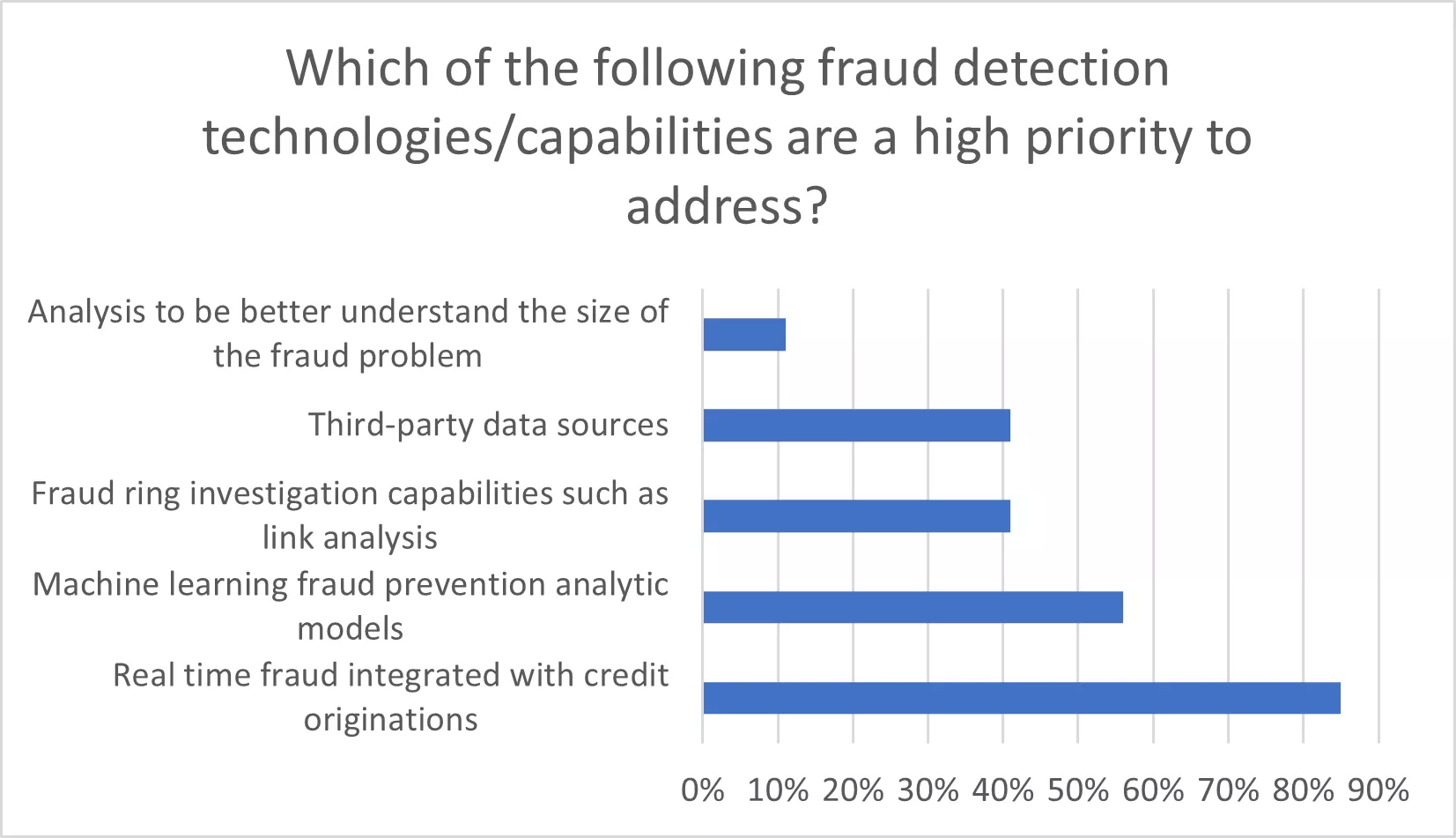

Fraud technology needs to integrate with originations

The move towards a digital-first approach has exposed the siloes that exist within financial institutions when customers seek seamless online experiences. The days of enduring multi-day application processes are no longer tolerable, and relying on overnight batch processing for application fraud detection falls short of meeting the new demands of applicants. 85% of our delegates said that technology that supports real-time fraud detection integrated with credit originations is a high priority.

While real-time integration is seen as their most critical technology investment, other capabilities were high on their wish list. Machine learning fraud prevention models rated high at 56%, showcasing the importance of advanced predictive models. 41% of delegates are keen on incorporating link analysis to investigate fraud rings, and 41% emphasized the need to leverage third-party data sources.

This need for integration does not surprise me. FICO customers see the ability to leverage FICO Platform for multiple use cases as a key differentiator. The ability to apply the same capabilities across multiple use cases, dismantle data siloes and implement a single system to manage processes stands out. Coupled with our renowned machine learning models for fraud prevention and the advanced linking and matching capabilities, FICO Platform addresses the pressing need to onboard more customers, more quickly without compromising on fraud or credit risk.

Learn More About Application Fraud and FICO Solutions

- Discover our application fraud solutions

- Read the white paper The changing face of application fraud

- See the results of our latest fraud, identity and digital banking consumer survey

- Explore the range of FICO fraud solutions

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.