Canada Bankcard Industry Benchmarking Trends: Q1 2025

Credit card data reveals many Canadians are struggling to pay off their monthly balances

Payment rates are declining, delinquencies are rising, and financial pressure is most pronounced among borrowers with thinner financial profiles or limited banking relationships. Notably, monoline credit card customers — those served by non-bank issuers focused exclusively on credit products — who missed two or more payments in January 2025 hit the highest level recorded in the past five years. This marks a growing risk segment, particularly among younger or underserved consumers.

Key Takeaways:

- Payment rates are down to 47%, reversing previous gains and signaling repayment pressure.

- Average spending is down 4.2% YoY, while balances are creeping upward.

- Early-stage delinquencies are rising (+8% YoY), and severe delinquencies in the monoline space have hit a five-year high.

- Young and thin-file borrowers remain the most vulnerable, especially those with limited access to full-service banking products.

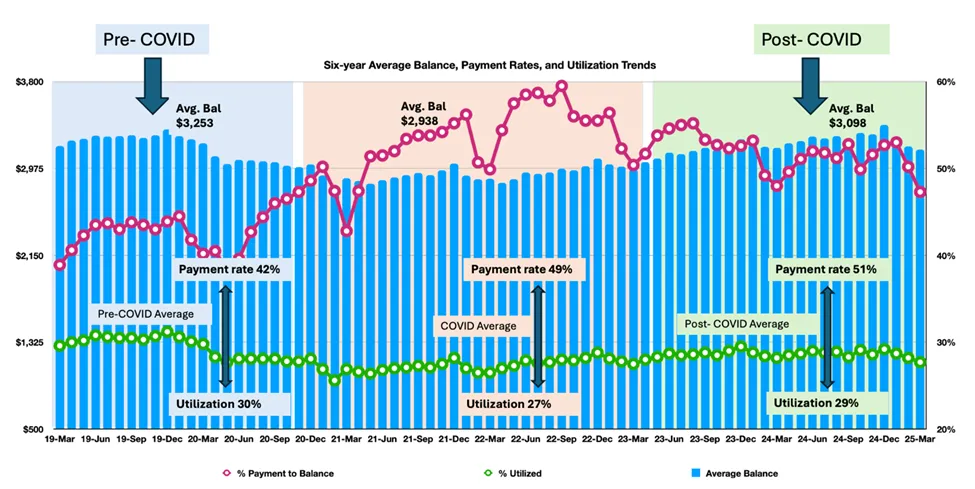

Payment Rates Softening, While Balances Remain Elevated

After a strong post-COVID rebound in repayment behavior, credit card payment rates have now declined to 47%, down from a peak of 60% in September 2022. This drop suggests that more Canadians are struggling to pay off their monthly balances, despite previous improvements in repayment discipline.

Average balances remain elevated and have started to climb again:

- Pre-COVID: $3,253

- During COVID: $2,938

- Post-COVID: $3,098

Although still below pre-pandemic highs, the recent upward trajectory signals renewed pressure on household finances, potentially from rising living costs or shifting spending habits.

Compounding this, average credit card spending fell by 4.2% year-over-year, to $1,549. This decline reflects more cautious consumer behavior or financial constraint as households rebalance their budgets.

Credit Card Utilization Remains Low but Trending Up

Credit utilization — the percentage of available credit being used — continues to trend upward, though it remains below pre-pandemic levels:

- Pre-COVID: 30%

- During COVID: 27%

- Post-COVID: 29%

The rising trend suggests that consumers may be leaning more heavily on available credit, particularly as disposable income growth slows. While still within manageable ranges, higher utilization can be an early indicator of mounting financial reliance on credit products.

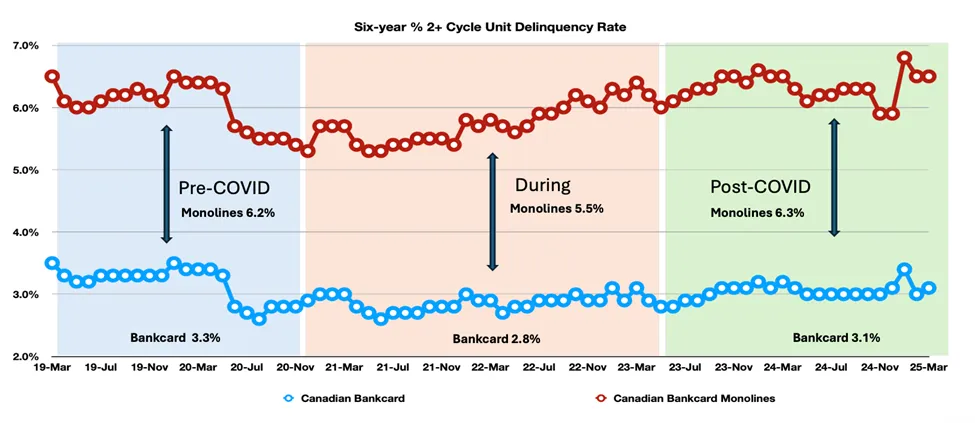

Delinquency Rates Reveal Stress Among Vulnerable Segments: While overall delinquency rates remain broadly stable, a closer look at borrower segments paints a more concerning picture.

Customers Missing One Payment: The share of customers missing a single credit card payment rose 8% year-over-year — often a leading signal of repayment trouble. This increase points to the beginning of strain among a growing portion of the population.

Customers Missing Two or More Payments: Severe delinquency (60+ days past due) is elevated and holding steady year-over-year, but January 2025 marked a key turning point.

- Monoline cardholders who missed two or more payments reached their highest level in five years. This spike highlights sustained pressure on higher-risk segments — particularly those with limited financial history, fewer products with a financial institution, or recent entry into the credit market.

- Breakdown by issuer type:

- Monoline issuers:

- Pre-COVID: 6.2%

- During COVID: 5.5%

- Post-COVID: 6.3% (peaking in Jan 2025)

- Bank-issued cards:

- Pre-COVID: 3.3%

- During COVID: 2.8%

- Post-COVID: 3.1%

- Monoline issuers:

This divergence reflects the heightened vulnerability of non-prime borrowers, who are often younger, lower-income, or less entrenched in the traditional banking system.

Conclusion: Risk Is Concentrated, but Rising

Q1 2025 marks a shift in the trajectory of Canadian credit health. While aggregate numbers may still appear manageable, segment-level trends tell a more urgent story. Consumers with fewer banking relationships — particularly younger individuals or those relying solely on credit products — are under increasing pressure. The surge in serious delinquencies among monoline borrowers is a flashing signal: financial fragility is deepening where there is the least cushion.

As the year progresses, lenders and policymakers should focus on early intervention strategies, improved financial education, and risk monitoring in underbanked segments to prevent broader credit deterioration.

How FICO Can Help You Manage Credit Card Risk and Performance:

- Explore our solutions for customer management.

- See my previous posts on CA card performance.

- Make more informed and profitable decisions with FICO’s Scoring Solutions.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.