Canadian Bankcards: Delinquencies on Monoline Cards Are Rising

FICO's Canadian Bankcards Industry Benchmarking Trends for Q2 2024 show monolines delinquencies have reached pre-COVID levels

As we cross the halfway mark of 2024, the Canadian credit card industry finds itself at a pivotal point, marked by shifts in consumer behavior and the ongoing impact of economic pressures. A recent six-year review of Canadian credit card delinquency rates, particularly focusing on monolines (financial institutions offering only credit cards), highlights concerning trends that credit card issuers must address proactively.

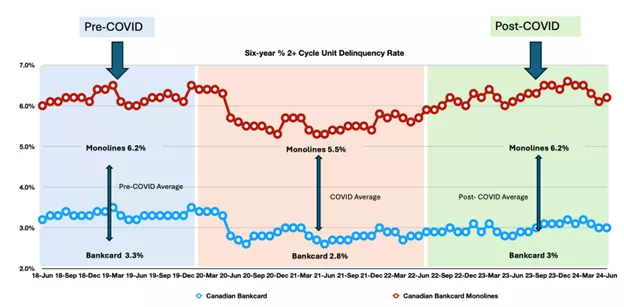

Rising Delinquency Rates: A Tale of Two Stories

The data reveals that delinquency rates for Canadian monolines have not only surpassed pre-COVID levels but have remained elevated, signaling potential financial distress among these consumers. Before the pandemic, Monoline delinquency rates were already higher, averaging around 6.2%. However, post-COVID, these rates have surged beyond this benchmark, reflecting the sustained financial pressures that certain consumer segments are facing.

In contrast, delinquency rates for Canadian bankcards — those offered by institutions providing a wider range of financial products — have shown remarkable stability. Even though there has been a 7% increase compared to last year, these rates still remain below pre-pandemic levels. This divergence suggests that consumers with a broader financial portfolio are better equipped to navigate economic challenges, whereas those relying solely on credit cards are more vulnerable to financial shocks.

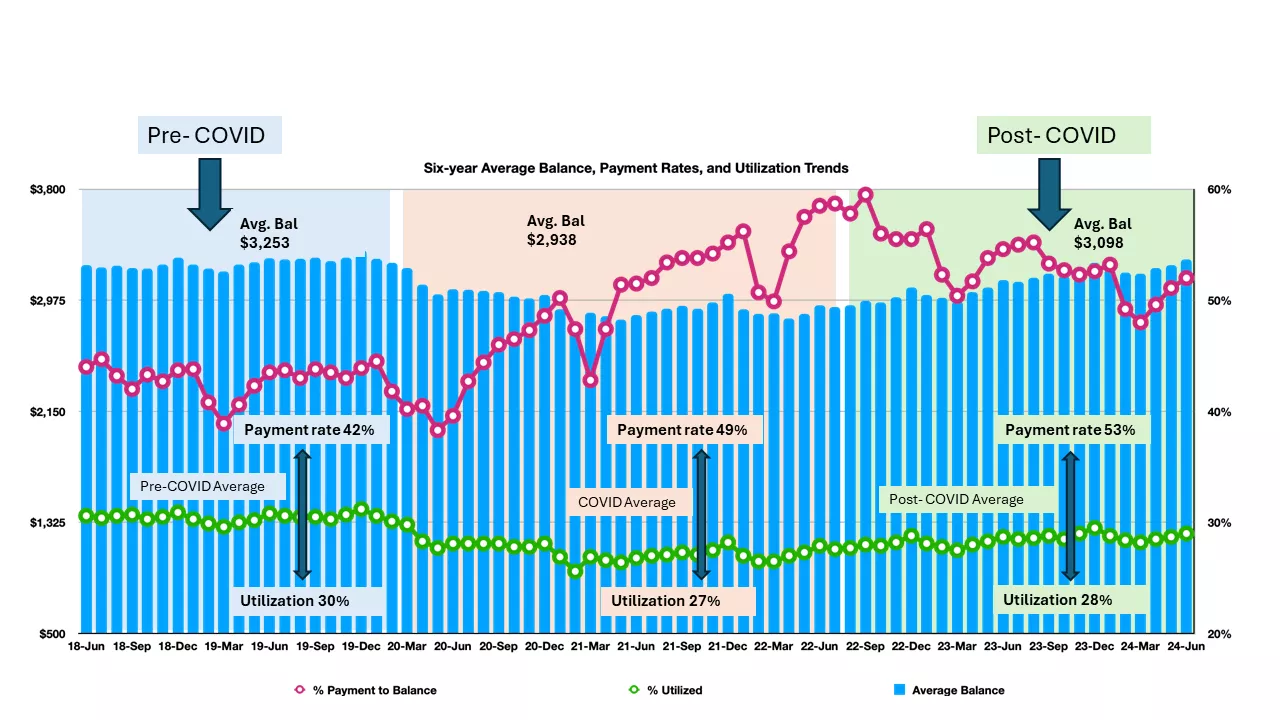

Consumer Behavior: Credit Card Usage and Payment Patterns

Another critical finding from the mid-year review is the shift in credit card usage and payment behavior among Canadian consumers. As of June 2024, the payment rate had dropped to 53%, a notable 4.8% decrease from the previous year. This decline indicates that consumers are paying less towards their credit card balances, likely due to increased financial strain. Concurrently, the average balance on Canadian credit cards has risen by 5%, continuing a trend that began in September 2022.

The trend of consumers paying a smaller percentage of their balances, coupled with fewer individuals paying their balances in full, underscores the growing financial pressure. As consumers struggle with higher living costs and rising interest rates, their ability to manage credit card debt is increasingly challenged.

FICO's Recommendations: Strategic Interventions for Financial Institutions

Given the current landscape, FICO advises that financial institutions take immediate and targeted actions to mitigate the risks associated with rising delinquency rates. Specifically, institutions should consider segmenting cardholders using advanced data analytics to develop tailored communication strategies. These strategies could include offering personalized payment relief plans to stressed customers or credit line increases to consumers who demonstrate a consistent ability to make monthly payments.

Additionally, the importance of enhancing digital interactions and self-cure tactics cannot be overstated. By understanding customer behavior in detail, financial institutions can stay connected with cardholders and provide the necessary support to navigate these challenging times.

Looking Ahead: Preparing for a Busy Season in Collections

The economic indicators from mid-2024 suggest that the remainder of the year will be demanding for collections professionals. The Bank of Canada's proactive approach to managing inflation, including potential interest rate cuts, points to an ongoing period of economic adjustment. However, these measures alone may not be enough to alleviate the financial stress that many consumers are experiencing.

For financial institutions, this means sharpening strategies and proactively preparing for increased activity in collections. By focusing on both preventative measures and responsive support, institutions can better manage the challenges ahead and assist their customers in maintaining financial stability.

Learn How FICO Can Help You Manage Credit Card Risk

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.