Why This Is a Good Time to Grant Credit Limit Increases

Card issuers should consider a credit limit increase program for existing credit card customers to engage customers and meet demand

Over the past few years, the credit card landscape has seen its fair share of challenges. Pressures from the pandemic coupled with record-breaking inflation have materially impacted both the credit card lending landscape and consumer credit reports. It is during this period that demand for credit cards increased dramatically due to the growth and wider adoption of digital payments, as well as consumers’ desire to maintain their credit card purchasing power for the same basket of goods.

With credit card issuers exercising restraint with conservative new originations (lower approvals and starting limits) and restrictive limit management on existing credit card customers (increased credit limit decrease and suppressed credit limit increase activities) in the same timeframe, this added more fuel to the demand fire.

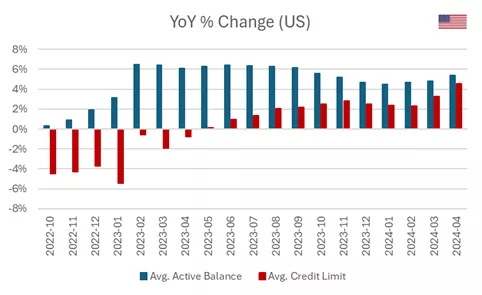

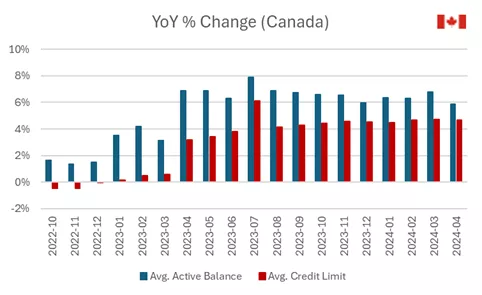

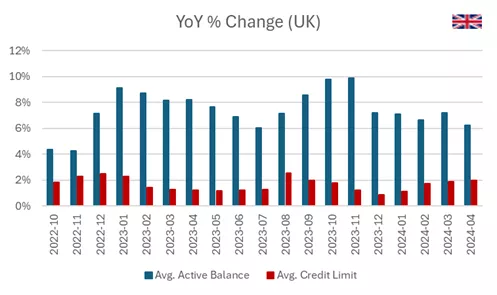

The change in credit limits has not kept pace with the growth in balances

Source: FICO® Advisors Risk Benchmarking

The economy and consumer sentiments are getting better and will continue to improve, therefore it is wise for credit card issuers to have actionable plans in place today that are ready to engage the right customers and fulfill this demand in the short term. A good place to start for issuers would be a credit limit increase (CLI) program for existing credit card customers.

A well-executed credit limit increase program can bring forth benefits such as:

- Improving customer satisfaction and consequently lowering customer attrition

- Empowering customers with the ability to align with inflationary trends (USD$1.00 in 2020 is worth close to USD$1.20 in 2023).

- Infrequent credit limit increase reviews can potentially lead to an increase in customers having transactions declined when they try to spend with an insufficient credit limit, potentially leading to customer dissatisfaction.

- Continued readiness to respond to customer demand throughout the calendar year (e.g., spring/summer travel, back-to-school and year-end holidays)

- The advantage of generating balance growth, capturing more of a customer’s spend and potentially gaining more wallet share. For example, two FICO-supported credit limit increase engagements saw:

Managing a credit limit increase program requires a thoughtful and prudent approach that includes:

- A collaborative effort between the Risk, Marketing, Operations and Finance teams.

- Strategies that are guided by risk-reward principles; extending offers that commensurate with risk tolerance and profitability.

- Consideration for proactive (automated cycle-based or offline batch-based) and reactive (customer-initiated) use cases.

- Meeting all applicable regulatory requirement(s).

Region | US | Canada | UK |

CLI Requirement | Customer’s affordability is accounted for in offer eligibility | Customer must provide opt-in consent to accept offer | Customer must be offered an affordable CLI, and be provided an opt-out option to decline offer |

To further expand on affordability, considering a customer’s ability to repay debt in a CLI strategy is regarded as an industry best practice, and the lack of access to actual income data or a complete 360° affordability view should not be a hindrance in standing up a CLI program. It is commonplace to infer income and other related affordability measures such as debt-to-service ratio using a combination of information sourced from:

- The customer directly (e.g., from most recent application, captured income when a customer requests for a CLI, or a proactive outreach campaign to update a profile on file including income information).

- Existing on-us accounts if the customer has an established credit relationship (e.g., savings/investment accounts, personal loans).

- Off-us records via third parties/affiliates (e.g., debt and payment data from a credit bureau or credit report).

To learn more, review this FICO blog: “Revolving Credit Product Limit Change Management Best Practices” for further tips on how to drive a successful CLI campaign. If you are interested in hearing more from FICO on this or similar topics, reach out to your designated FICO Advisor or Account Manager today and subscribe to our Customer Credit Lifecycle Blog to be notified when new posts are published.

How FICO Can Make Your Credit Line Increase Strategy a Success

- Read the post Revolving Credit Product Limit Change Management Best Practices

- See how HSBC gained from credit line increases

- Read how Akbank improved the way it makes credit limit increase offers with optimization technology

- Read How Credit Limit Increase Optimization Drives Portfolio Profit (fico.com)

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.