Rising Delinquencies in Canada Point to Need for Stress Testing

Canadian cards data for the second quarter of 2023 shows the need for lenders to project unexpected rapid shock to portfolios, staffing, and expenses

In a rapidly changing economic scenario, stress testing becomes more important than ever. In this post I will review the latest economic trends in Canada, FICO’s card performance data and some recommendations for stress testing.

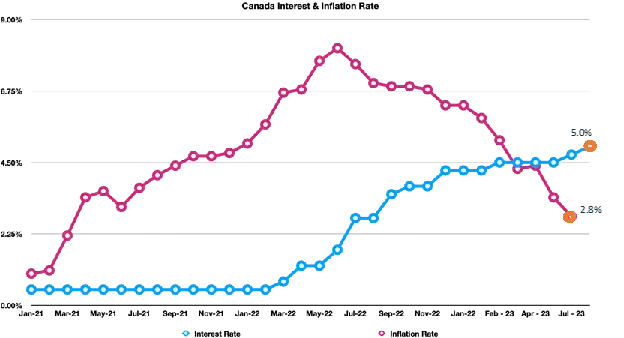

Inflation and Rates in Canada

Good news for Canadian households as the annual inflation rate in Canada fell to 2.8% in June of 2023, from 3.4% in May. This is the lowest inflation rate observed since March 2021. This deceleration trend is in line with Bank of Canada’s projections and the expected inflation rate is 3% by the third quarter of 2023. However, the food inflation rate is still elevated at 8.3%.

Bank of Canada raised the overnight rate by 25 basis points to 5% in July. This is the highest level since 2001. Bank of Canada is expected to continue with quantitative tightening.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/230718/dq230718a-eng.htm

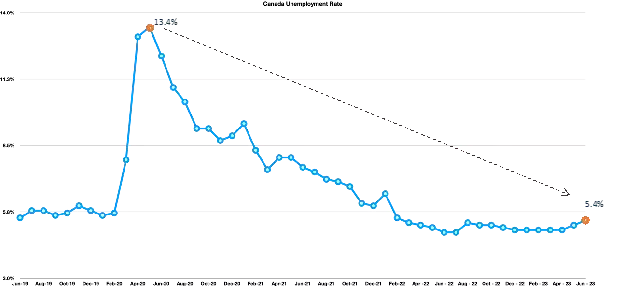

The Canadian labor market continues to remain resilient, but the unemployment rate in Canada increased to 5.4% in June from 5.2% in May. 60,000 new jobs were added in the Canadian economy, which is above market expectations. Immigration, which is the main supply of labor fueling industry in the Canadian market, plummeted during the pandemic and the country lost a major supply of labor. These levels are now recovering. Moreover, job vacancies remain elevated, especially in the lower-paying jobs. Given the tight labor conditions, the unemployment rate in Canada is not expected to fall substantially if there is an economic downturn.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/230707/dq230707a-eng.htm?HPA=1&indid=3587-2&indgeo=0

A review of the Q1 2023 Canadian credit card industry data provides a clear picture of the impact of inflation and rising interest rates on consumer transactions. Credit card delinquency rates are increasing, indicating that consumers who are feeling the financial pressure from rising cost of living and higher borrowing costs are starting to show signs of vulnerability.

Canada Average Balance, Payment Rates, and Utilization Trends

Source: FICO risk benchmarking

The average balance on Canadian credit cards rose by 6.1 % YoY. This trend in increased average balance indicates that consumers who might be vulnerable to financial stress are leaning more heavily on card transactions and beginning to revolve on their credit cards.

For a more comprehensive industry view, we can look at payment rates and credit card utilization in concert with average balance. Not surprisingly, payment rates on credit cards are stabilizing (below pandemic levels when households savings rate was high), indicating that consumers who were paying off their credit card previously during the pandemic are making lower transaction payments in total. This is pushing credit card utilization to increase modestly, which is 2.9% higher YoY. As the payment rate decreases further, card utilization rates and average balances on credit cards might continue to increase further in 2023.

Canada % 2 + Cycles Delinquency Rate

Source: FICO risk benchmarking

Canada’s 2+ cycle unit delinquency rate, which captures consumers in Canada who are missing two or more payments, is increasing. Overall, the delinquency rate is equal to the pre-pandemic levels of June 2020. Meanwhile, the delinquency rate of new accounts (< 1YR) is 15.4% higher when compared to June 2020. This trend may indicate that consumers who are new to credit or young adults are more vulnerable to a payment shock from rising interest rates and increased cost of living.

The Need for Stress Testing

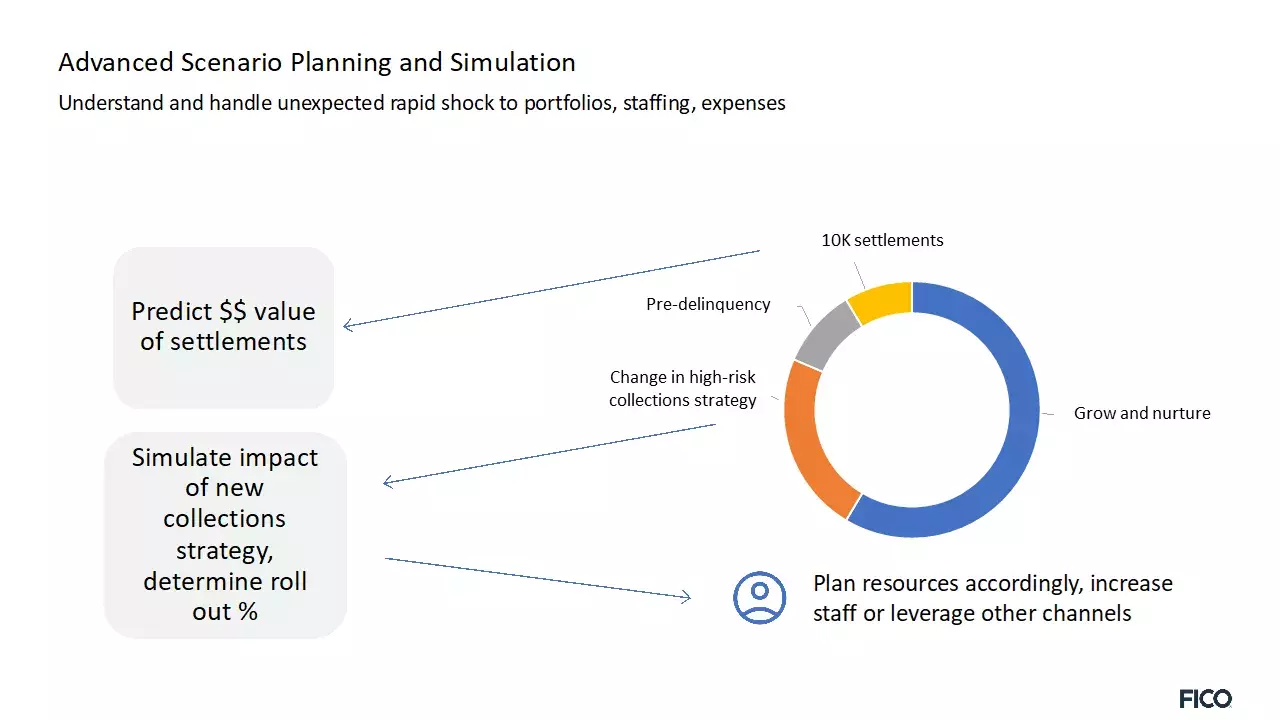

In these challenging times, banking institutions and card issuers can be more resilient by understanding unexpected rapid shocks to portfolios, staffing, and expenses.

For example, if a risk manager is expecting credit card delinquencies to increase substantially, does the organization have the staffing capacity to handle additional call volumes? You can understand the resource planning by simulating the impact of a collections strategy you are planning to roll out in anticipation of rising delinquency rates. This will help you to understand staffing capacity, predict the $$ value of settlements, and leverage digital channels for the self-curing population.

It starts with using tools such FICO Business Outcome Simulation and creating different economic scenarios to understand the impact. FICO Platform technology enables you to build simulation scenarios by changing one or more underlying parameters, then run “what-if” analysis comparing outcomes to expected performance results. This provides a powerful, risk-free learning environment where you can understand the impact that your actions will have in the real world.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my previous posts on Canada card performance

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.