Card Skimming and Other Fraud Types Continue to Grow - US Data

Debit card skimming continues to grow in the U.S. - albeit slower than last year - while other fraud like scams and first party fraud impact consumers and banks alike

Fraudsters continue to siphon away consumer finances here in the U.S., and those of us who have spent decades fighting them are working overtime to keep up. One of the most pernicious kinds of fraud that I monitor is card skimming, which is when criminals put small card-reading devices into payments terminals to steal card information. It remains a growing threat to consumers around the country.

Here is updated data about what we’re seeing with respect to card skimming in America. While the latest numbers are not as dramatic as my updates from the first half of 2022 and the 2022 full year review, there is still a disturbing increase in skimming nationally.

Card Skimming Fraud Keeps Climbing

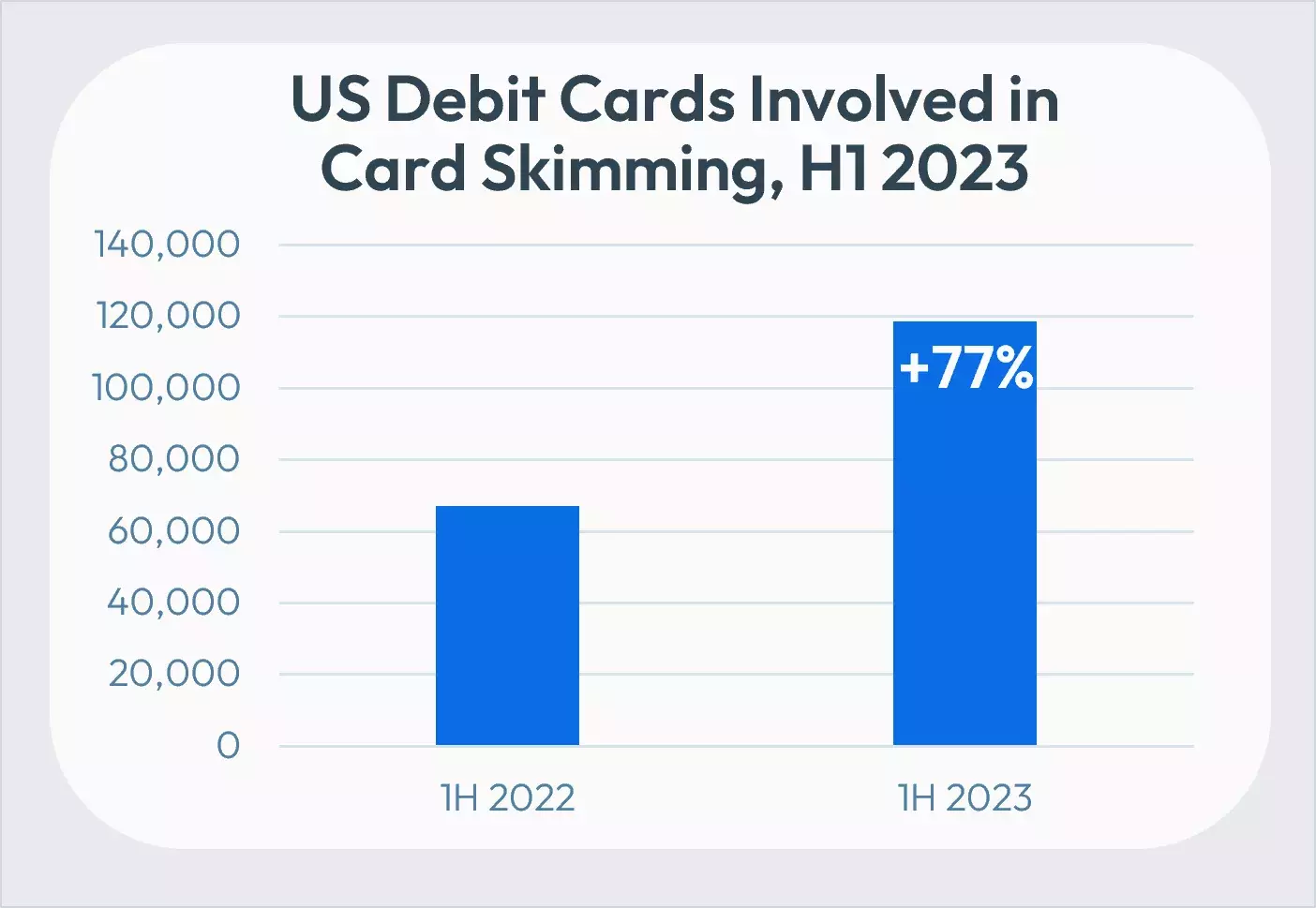

For the first half of 2023, we’ve seen a year-over-year increase in compromise events of 20%, jumping from 525 card compromise reports (CCRs) in 2022 to 625 CCRs in 2023. However, the more concerning increase is related to the total number of cards impacted, which jumped 77% year-over-year from roughly 70,000 cards in 2022 to nearly 120,000 cards in just the first six months of 2023.

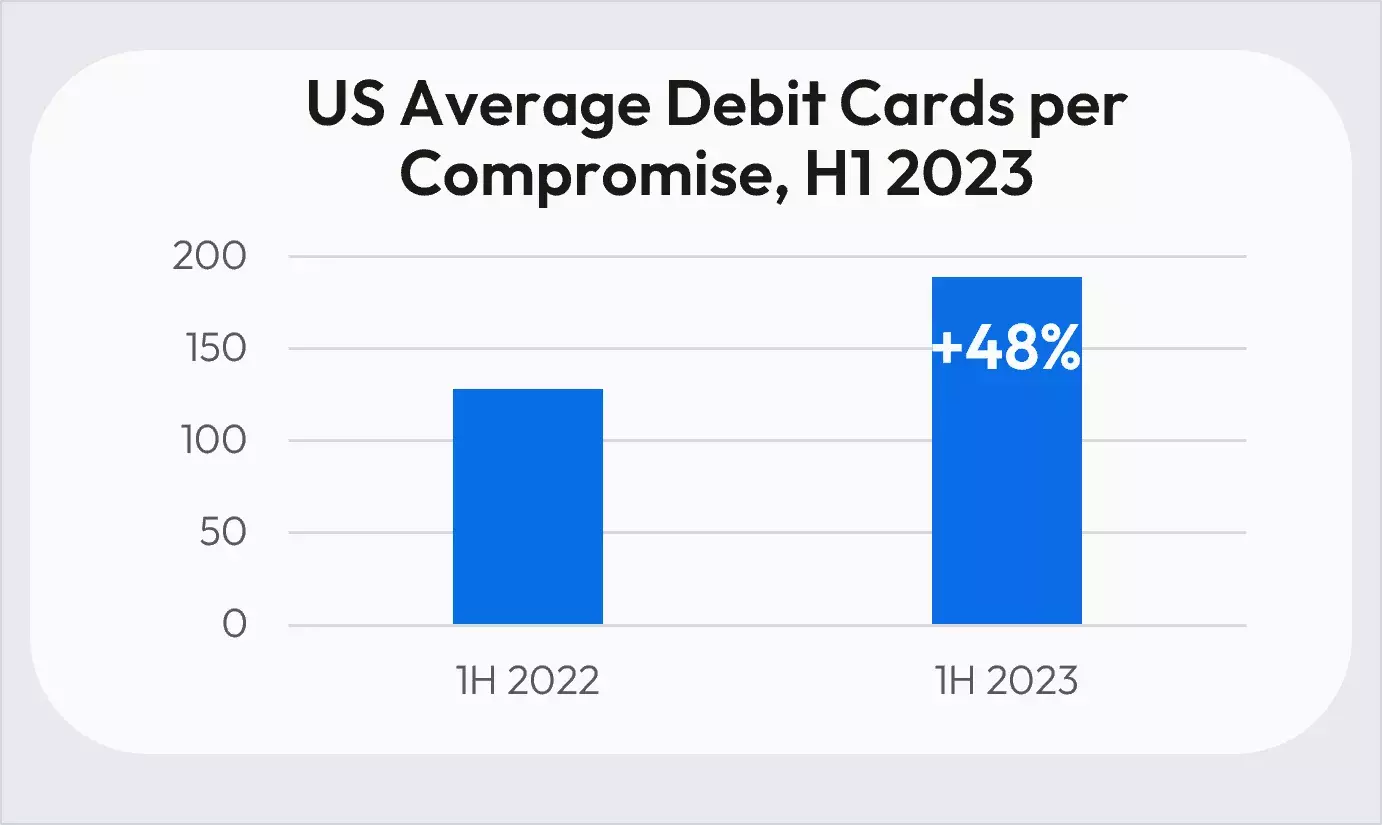

This growth in total cards compromised, despite a smaller increase in compromise events, indicates that criminals are stealing more card details per compromise event. FICO’s data supports this trend, which shows a 48% increase in the average number of cards impacted per compromise in the first half of 2023.

Unfortunately, the trend means more consumers are becoming victims, even though the compromise growth is slowing a bit, as we’ve already seen 75% of the total number of compromised cards in 2022 in just the first half of this year.

Bank ATMs See Increased Compromise

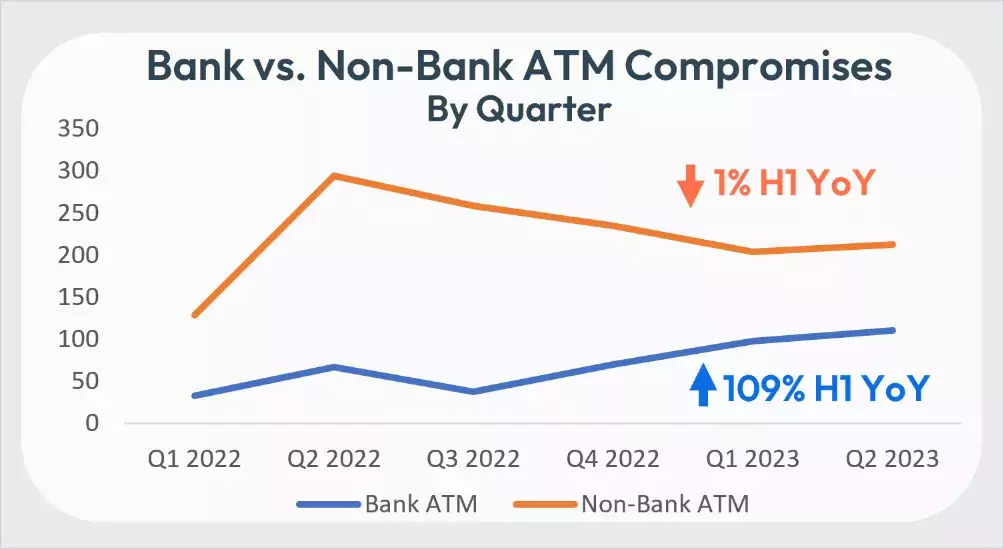

One of the new insights in this latest round is an increase in skimming at bank ATMs, up 109% year-over-year. This represents a significant shift in the terminal types and locations of card compromises.

In the past, we saw a roughly 80%/20% split of compromise locations, with banks only representing 20% of the locations and the majority at non-bank ATMs, such as convenience stores and gas stations. This year, we are seeing a change in that breakdown, with bank ATMs now representing approximately 33% of the compromise locations.

Geographically, we are also seeing some changes in skimming patterns. Virginia, Texas, New Jersey, Florida, and Colorado have all had an increase of 50% or more in compromises year-over-year, with Virginia and Texas moving into the top five states for compromises.

California, Washington, and Maryland have all seen decreases in compromises of 50% or more, although California remains the top state for skimming activity, with three times the number of total compromises than the next highest state.

More than Just Skimming

While this is a sobering look at first-half 2023 skimming trends, it’s just one thread in the dark tapestry woven by fraudsters. Other kinds of fraud are on the rise as well, keeping all of us on our toes.

One of the major shifts in the last few years has been fraudsters targeting consumers directly, resulting in authorized user fraud, or scams. This is also known as authorized push payment fraud, or APP fraud, in the UK and elsewhere. Scams account for billions of dollars of direct losses to consumers, with the FTC reporting that US consumers lost $8.8 billion to scams in 2022, a 30% increase over 2021.

FICO’s proprietary research shows that consumers plan to increase their usage of the real-time payments schemes that fraudsters use to perpetrate their scams. This can potentially lead to even more losses, especially as new schemes like the recently released FedNow real-time payments system come online.

We are also anecdotally seeing an increase in first-party fraud, as consumers feel the pinch from persistent inflation, rising interest rates and tightening credit standards. Much of that fraud manifests as consumers exaggerating or falsifying information – like annual income on a mortgage or credit card application.

With banks and consumers under attack from fraudsters on all sides, what can they do to fight back?

Stemming the Tide of Fraud

Let’s take a quick look at ways to tackle these three types of fraud. For skimming, both banks and consumers can take concrete, proactive steps to mitigate the potential for compromising cards.

Banks can use monitoring and notification technology to identify at-risk cards, and connect with customers in real time to help intervene should a card be compromised. Consumers can avoid becoming victims by paying attention to card reader PIN pads, payment terminals and ATMs, and look for anything that seems “off”. Instead of relying on swiping a credit or debit card and exposing the magnetic strip, consumers can use chip-and-PIN, as well as contactless technology, to more securely conduct transactions. Check out some other recommendations in my last post on skimming.

To mitigate scams, banks should deploy AI and machine learning technology to help identify and differentiate unauthorized transactions from authorized payments associated with a potential scam. By identifying these transactions in real time, banks can tailor their intervention strategies to help consumers stop and think before sending a potentially life-changing sum of money to a fraudster. Using automated, two-way communications in the channel of customer choice is another great tool for banks to put some sensible friction into the payments process.

For first-party fraud, banks will need to use customer data from both inside and outside the organization, in a strategic and orchestrated manner. Compiling all the relevant data and using it in decisioning when and where it’s needed can help mitigate risk associated with things like fraudulent income exaggeration. Through connected, integrated, enterprise-grade technology, banks can ensure they are making the right decision, informed with the best available data.

At the end of the day, from credit and debit card fraud to scams to skimming, there’s never going to be a single solution for all the inventive scenarios that thieves will create. But a strategic, layered approach can help protect both customers and banks, while improving operational efficiency.

How FICO Fights Fraud, Including Card Skimming

- Discover FICO’s comprehensive suite of fraud-fighting solutions

- Explore Customer Communications Services for Fraud and learn how to alert customers about compromised card details in real-time

- Learn more about FICO’s Card Alert Service

- Get acquainted with FICO’s award-winning retail banking and scam detection model

Follow me on LinkedIn for more insights about FICO’s innovative fraud-fighting efforts.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.