Four Key Takeaways Shaping Telco Strategies for 2024

A group of telecom industry leaders put sector’s critical challenges under the spotlight at inaugural FICO Telco MasterMind event

FICO held a two-day Telco MasterMind in San Diego last week, with topics ranging from upcoming economic forecasts to emerging industry trends, the impact of widespread super-fast 5G adoption and how the Internet-of-Things (IoT) is now shaping up. Debate at this inaugural event centred on four critical areas that are set to shape the industry for years to come.

1. Economic Fears and Consumer Spending Concerns Inform Telco Plans

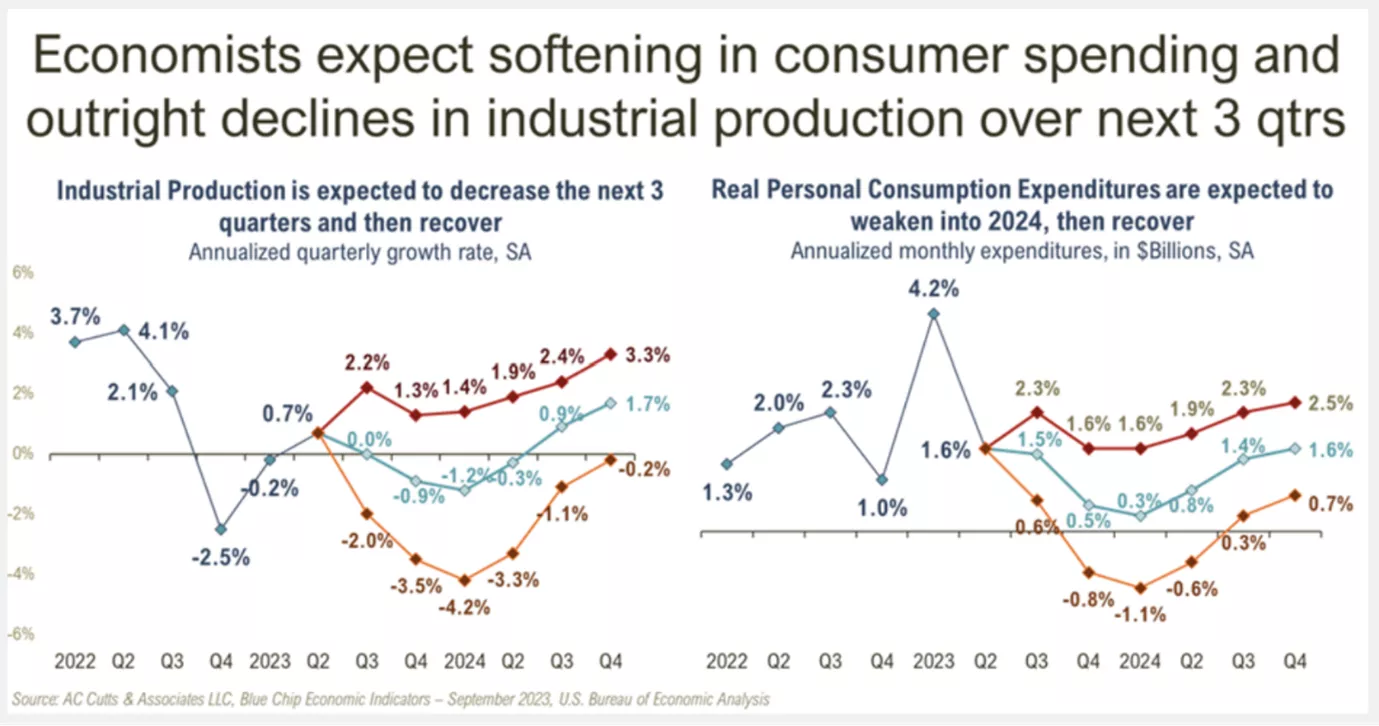

A consensus of economic views pointed to fears that industrial production and personal discretionary spending may soften within the next 12 months or so.

While there's confidence that consumer spending — the US economy’s main driver — won’t deteriorate too much, there are clear indications of a continued squeeze on household income underlined by rising credit card balances and delinquencies. The impact is in turn expected to flow through to reduced consumer spending, although there are strong hopes a significant recession can be avoided. Some participants expressed concerns that the US labor market may also soften.

Despite telco bills being a household necessity for many customers, the knock-on impact of reduced spending is likely to hit everything from bundled subscription renewals to delays on buying decisions around new handsets.

2. Customer Retention Initiatives Feed an Appetite for Telco Apps

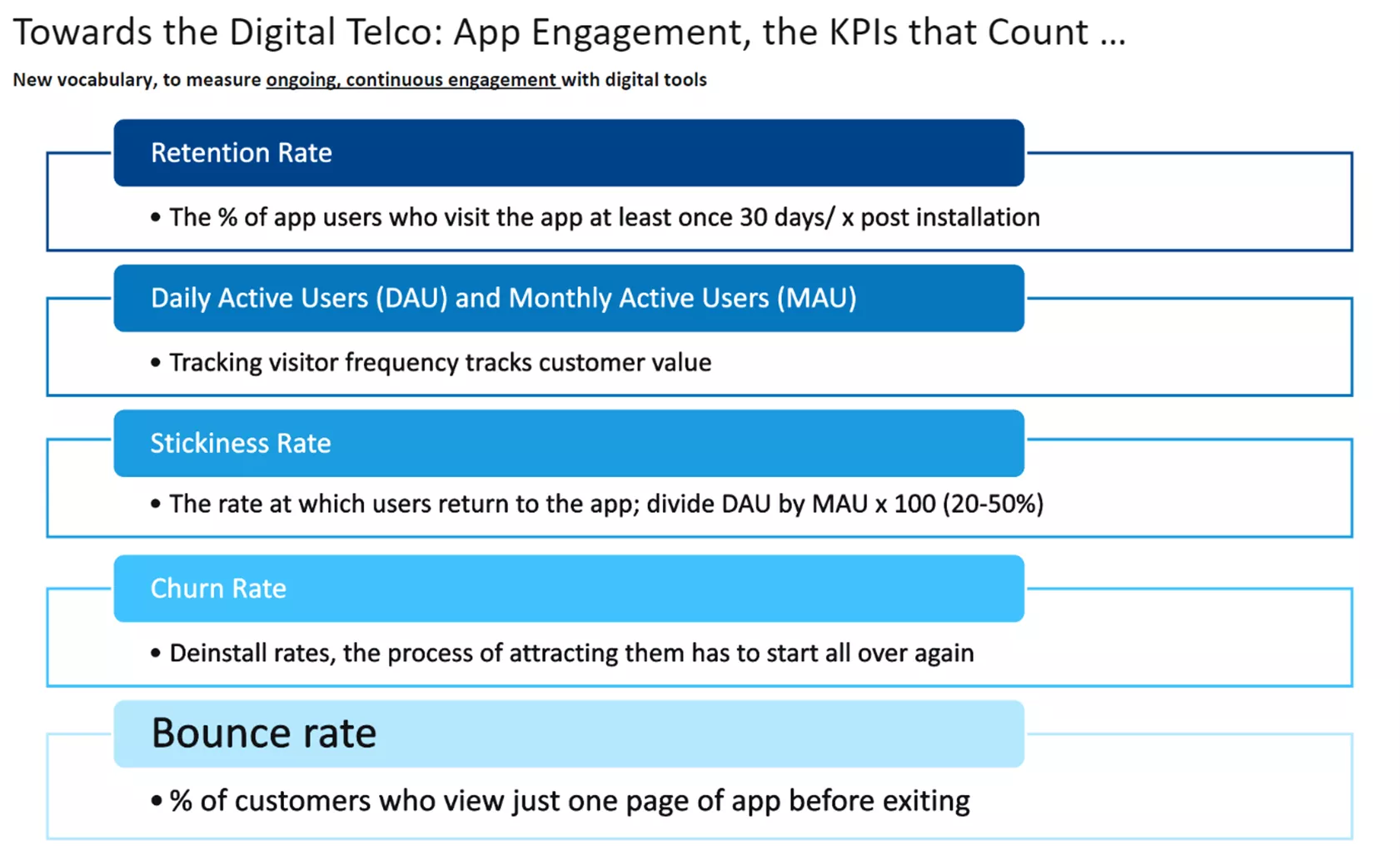

It’s widely accepted that many US carriers are behind their international counterparts when it comes to directly incorporating digital engagement analysis into metrics needed to identify telcos’ “best customers”.

Now, many leading telco brands are launching digital apps to help drive better engagement strategy with consumers — and track all subsequent touchpoints and transactions. Within telcos’ back-offices there’s now a clear appetite to incorporate detailed analysis and more granular measures to assess everything from digital engagement, retention, loyalty, stickiness and churn to so-called "bounce" – activity typified by acutely price-sensitive customers leaving straight after looking at a single web page.

At the same time, greater app adoption is also expected to help provide a springboard for telcos’ creation of virtual marketplaces, with loyal customers continually offered competitive tariff deals, upgrades on consumer tech — tablets and smart watches to complement their phones — as well as related financial services.

In Europe, it was noted that providers were now offering everything via their apps for Disney+ and related streaming services, to Amazon Prime, McAfee security bundles, magazine subscriptions, to selected partners’ white-label financial services.

Every offer tabled has the potential to win or retain more customers while also safeguarding market share.

3. AI and Other Innovations Present New Opportunities

A lot of effort is already being invested in enterprise-wide best practices around AI adoption, collections and two-way digital communications, fraud and device financing. In the discussions among telco leaders at our event, these were the main points around innovation:

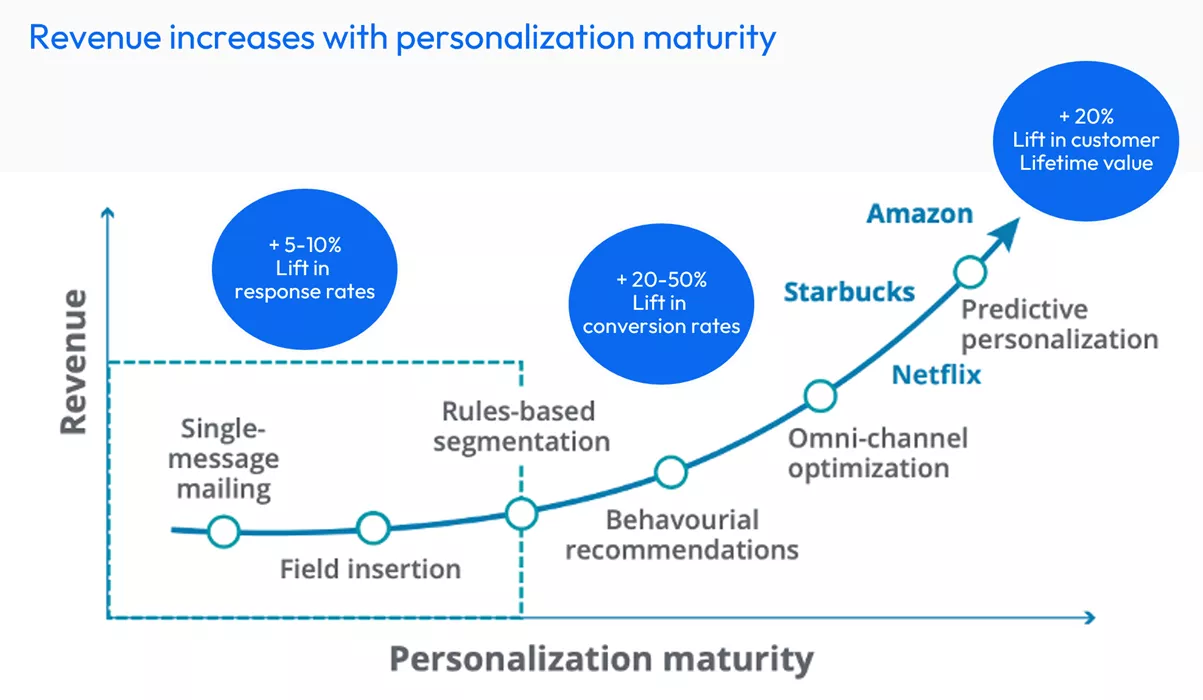

- The responsible use of AI and machine learning is now deemed mandatory to help providers better understand customer behavior and ensure more predictive outcomes to up-sell, cross-sell and marketing activity.

- Continual use of A/B testing is also vital to help refine omni-channel messages and drive two-way digital dialogue with customers when it comes to tackling risk, late payments, and greater product penetration. Cox Communications is a flagship pioneer in its use of omni-channel communications to efficiently drive collections and revenue. It has already seen mobile-first engagements — email, text, and IVR — deliver a US$2 million reduction in costs, a 40% increase in customer self-service payments, and a 50% reduction in call centre transactions.

- Fraud is a massive challenge in telcos’ digital channels. But it’s a very sensitive area, given the relatively low tolerance customers have for high-friction approval and onboarding processes. Among the key initiatives highlighted were using link analysis to detect organised crime and fraud rings, greater co-operation and sharing of so-called “hot lists” to flag known fraudsters and definitive routes to “no pass” authentication — when suspicious applicants and potential scammers are told to show up at their nearest provider’s outlet in person if they wish to proceed with the transaction.

- Given the relentless rise in the costs of mobile handsets, it’s clear reinventing device financing is a priority for many for telcos. In an ultra-competitive marketplace, providers’ ability to harness the power of mathematical optimization and simulation will now be a key differentiator. It will likely be applied to pricing, alternative deal structures and competitive customer offers — most notably when they’re underpinned by appropriate interest fees applied to future sales of costlier smartphones.

4. Improving Margins Comes from Monetizing Telco Data and IoT Services

Telco leaders at the summit said the mass of rapidly looming opportunities offered by the expanding IoT, along with the predicted Zettabytes of data it creates, will deliver a host of new income streams.

The challenge for carriers is improving their monetization of the information and insights on offer.

Crucially, siloed thinking, siloed working, legacy technology and regulatory challenges across an enterprise pose the highest barriers to successfully growing margins at speed and scale. Improved digital engagement, new business models and the emerging income streams that ride on top of IoT services, along with new industry partnerships, are already helping innovative telcos better monetize their own data and infrastructure.

But it’s the accurate targeting of the “segment of one” across the customer lifecycle that is vital. Telcos simply don’t always know who they’re dealing with or have a clear picture of their customers at a household level. For instance, Dad may have bought a bundled family deal so he can watch live sport on the go. Mom may prefer movies and re-runs of Downton Abbey, while the family’s two teenagers favour music streaming and making TikTok clips.

Success in monetizing this type of household opportunity hinges on using a suitably designed technology platform to deliver granular insights and informed strategies for customers, processes, and pricing offers. It’s an area FICO has championed for thousands of clients across the globe.

How FICO Is Helping Telcos

To learn more about how we’re helping telcos across the globe, click on the links below.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.