Four Ways Intelligent Decisioning Speeds Auto Financing Approvals

New ways of managing auto finance decisions lead to faster loan approvals, better customer matching, fraud prevention, and cost reduction

Decision intelligence solutions, now often infused with AI, deliver many benefits for financial institutions. Here are four ways auto financing providers can leverage decision intelligence to better match prospects with auto loan offers and accelerate approvals to cut costs, increase revenue, and prevent fraud.

In auto finance, speed and accuracy are critical. Auto lenders now need to improve continuously in how well they match prospects with pre-qualified loan offers, leverage automation to ease application processes, find ways to accelerate auto loan approvals, but also stop fraud. Decision intelligence platforms offer a way to address them all.

What Is Intelligent Decisioning?

More businesses are now using intelligent decisioning to improve, accelerate, and automate key aspects of their business. According to Gartner’s Market Guide for Decision Intelligence Platforms, intelligent decisioning, typically provided through an AI-infused software platform, is used to “improve decisions through explicitly modeling and reimagining how they are made and how each can benefit from more effective support, augmentation, or automation…”

Decision intelligence solutions and practices have gained traction with enterprises around the world quickly. Gartner’s research finds that 75% of Global 500 companies will utilize decision intelligence by 2026, with 50% of them evaluating a single decision intelligence platform to take on analytics, business intelligence, data science, and machine learning by that time.

Why Should Auto Lenders Care About Intelligent Decisioning?

Auto loans are tricky because they are not what’s considered “low-hanging fruit” for digital transformation initiatives. Initial digital transformation phases were able to focus on creating self-serve capabilities for many banking products, like checking and savings accounts, and credit cards. But auto finance processes and customers have been more resistant.

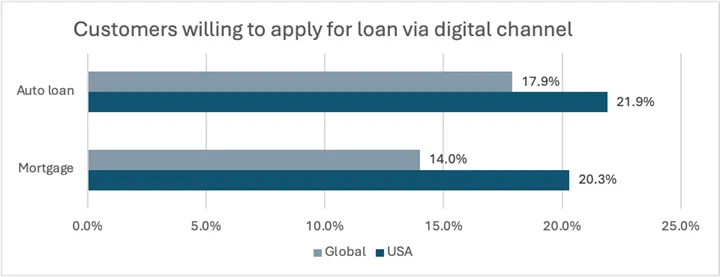

Consumers have not been so quick to adopt digital self-serve customer experiences when applying for either home or auto loans. For example, FICO’s research finds that just 22% of Americans would apply for an auto loan digitally and just 20% for a mortgage (see chart). Globally, just 18% of consumers would apply digitally for an auto loan, and only 14% for a mortgage. As a result, to reap digital transformation benefits in auto lending, efficiencies, improvements, and speed must be derived in other ways.

This is where decision intelligence solutions can now deliver major digital transformation benefits and play a crucial role for auto lenders in accelerating and optimizing auto loan approvals.

Four Ways Intelligent Decisioning Improves Auto Financing

Auto lenders now must continuously find ways to speed up their auto loan approval processes while improving how well they target prospects with pre-qualified loan offers and communicate with them to achieve loan approvals. These lenders’ priorities often include:

- Making approval processes faster and less costly.

- Becoming more efficient at matching customers with pre-approved loan offers.

- Communicating with customers through their preferred channels in real-time.

- Optimizing profitability for each loan offer they make.

- Detecting and preventing auto lending fraud.

Intelligent decisioning can help address each of these priorities, though not alone. When coupled with real-time communications and a range of fraud detection capabilities, decision intelligence solutions can be brought to bear to drive improvements in auto lending.

Here are four major examples of how:

1. Real-time communications add speed, clarity, and security

Real-time communications via the customer’s preferred channel are the best way to communicate important information securely and rapidly. With real-time communications in place, any loan that cannot be approved automatically can be escalated to a loan officer immediately to resolve any queries needed to gain approvals, such as in sub-prime scenarios where such additional authorization may be needed.

Customers may prefer to receive updates, answer questions, and provide information needed to apply via text, email, voice calls, a lender’s own app, or a third-party messenger app. The key for auto lenders is to meet each auto financing customer securely in their favorite channel. Documents and other important information exchanges should occur in a secure thread.

Communicating in real-time adds pace to the process, such as by clearing stipulations faster because live chat is used to exchange account information and photo IDs. Customers can authorize lenders more easily to act on their behalf when working remotely, and required documents and links can be shared more easily in real-time threads.

2. Intelligent decisioning streamlines and optimizes pricing

Current and legacy loan systems have often made price changes slow, difficult, or even accessible only to third-party vendors hired to rewrite software code. As changes in the auto lending market have accelerated, many lenders find they must update their pricing models and streamline how they make pricing updates.

Some lenders manage pricing tables directly in an intelligent decisioning platform like FICOs, for example, and gain full control over the timing, cost, and frequency of their price changes. Using this type of streamlined approach lets lenders change prices, policies, strategies, and their level of process friction rapidly and as needed.

3. Intelligent decisioning accelerates loan approvals

Intelligent decisioning also enables auto lenders to improve how well they match prospects and customers with pre-qualified offers. Using this approach minimizes or eliminates the range of cases where auto financing opportunities are lost because customers are offered loans but find they cannot qualify for them.

Decision intelligence solutions enable auto lenders to use an alternative deal structure approach rather than lose the prospect. The alternative deal structure approach uses automation to move customers who have been denied loans immediately to alternative, pre-approved offers from which to choose. At the same time, customers can be presented with better data to overcome any confusion and help them make a more informed lending choice.

With intelligent decisioning, dealers can match pre-approved customers with vehicles at pre-approved rates, for example. Every vehicle in a dealer’s inventory can be priced and matched with a pre-approved loan while giving the dealer a view of which offers are most profitable.

Having the ability to approve an offer for a customer who has been denied multiple offers keeps the lender in the game and improves the odds of finding a match that leads to a new loan approval and vehicle sale.

4. Intelligent decisioning helps detect and prevent auto lending fraud

Intelligent decisioning also helps lenders detect and prevent fraud. Auto lending fraud and scams present substantial risks to auto lenders who are targeted by organized fraud rings that acquire automobiles with loans they never intend to pay. Fraud rings are known to attack many different auto lenders and loan originators, like auto dealerships, at once. They may use stolen or synthetic identities to secure loans and automobiles.

Auto lenders can combat auto lending fraud with decision intelligence equipped to perform link analyses. Link analysis identifies connections across loan applications and auto lenders, such as reused names and license numbers. Decision intelligence solutions can also identify anomalous behavior and data to spot attack patterns. Coupling link analyses with third-party fraud scores from multiple sources is also considered best practice. It is often used to improve loan application scoring and detect fraud without preventing good customers from gaining approvals quickly.

Improve Auto Lending With Intelligent Decisioning Now

Embracing these and other important uses for intelligent decisioning will prove crucial for auto lenders as they navigate an increasingly competitive and fraudulent marketplace. Lenders who can capitalize on advances in decision intelligence solutions now, particularly with the advent of AI, can gain a lead in the marketplace by adapting quickly, communicating clearly, targeting offers accurately, and gaining more auto loan approvals faster.

How FICO Can Help You Improve Auto Lending

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.