The Future of AI and Hyper-Personalization in Auto Loan Finance

Lenders meeting at FICO’s Auto MasterMind event discussed the technologies that can make auto loan finance smarter

FICO recently hosted an Auto MasterMind event at the Ritz Carlton in downtown Dallas, Texas. The day was a huge success, with expert speakers and attendees from many of the nation’s top automotive finance companies.

Here are the major topics covered and key takeaways from this auto finance industry event.

2023 Auto Finance Industry Survey Results

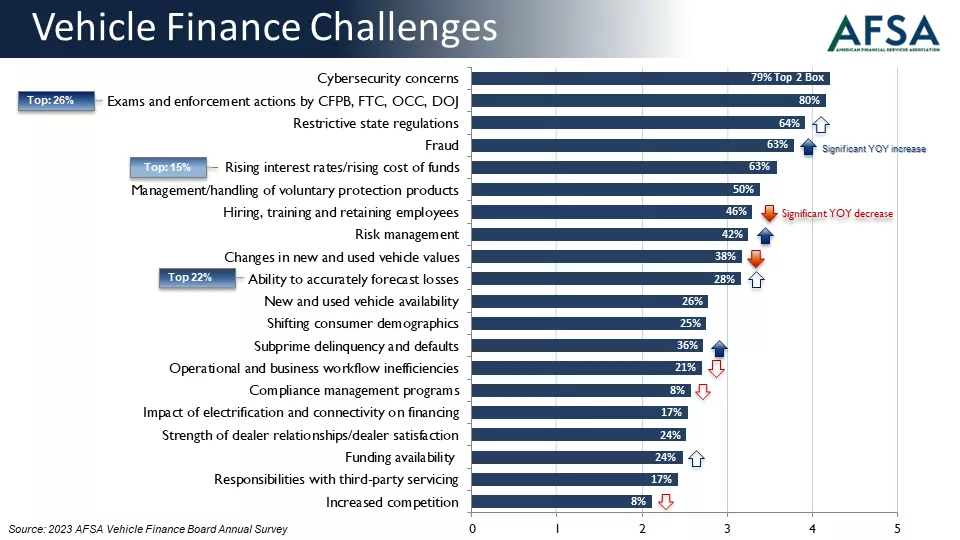

Recent findings from the 2023 AFSA Vehicle Finance Board Annual Survey show that the top challenges for the auto industry and auto finance include: cybersecurity concerns, exams and enforcement actions (by the CFPB, FTC, OCC, and DOJ), restrictive state regulations, fraud, and rising interest rates.

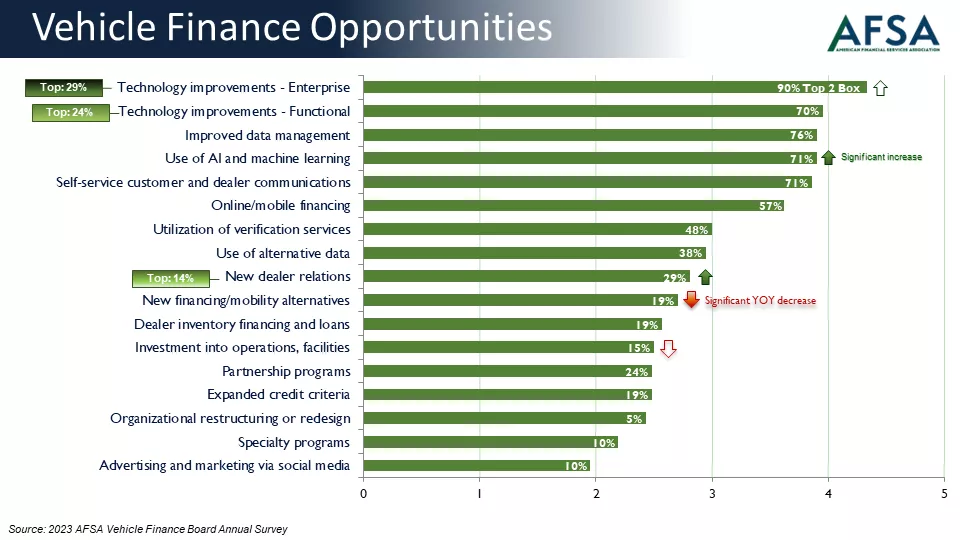

Despite the volatile economy and political uncertainty, there are a number of opportunities within the auto loan financing industry, including: technology improvements (enterprise and functional), better data management, the use of AI and machine learning, and self-service customer and dealer communications.

How Will AI Evolve for the Automotive Finance Industry?

There’s been a lot of hype around AI lately and lenders across industries have been making big investments in this type of technology. But how will the development of AI affect the auto loan financing industry specifically?

The biggest areas where AI will likely impact auto lenders are in policy, automation, and fraud. However, there are a variety of ways that we will see AI evolving within the lending space – including operational efficiency, customer communications, and digital collections strategies.

Implemented properly, AI will be able to help auto loan companies make smarter lending decisions regarding risk and compliance, as well as identify customers before they default. Forward-thinking auto lenders are integrating AI with their legacy systems and incorporating AI into decisioning models to optimize their customer management, care, and development.

The competitive auto finance landscape is growing fiercer as everyone is now competing for the same AI resources (e.g., AI-trained suppliers, IT staff). With the increasingly popularity of AI, it’s vitally important to make sure that it’s being implemented safely. That means addressing and eliminating bias, and ensuring AI governance across the board.

The Future of AI in Auto Finance

While AI is helping us solve problems in ways we never thought possible, it’s also growing without boundaries in some areas, which is dangerous. All companies, including those in auto finance, must be wary of the ethical issues that surround AI, which is why the concept of Responsible AI is so crucial. We must make sure that AI is being implemented safely with interpretability, accountability, and ethics.

Moreover, use of interpretable machine learning algorithms is driving responsible use of AI in areas involving credit risk and decisioning. These interpretable machine learning models enable human-in-the-loop machine learning development where learned relationships that drive more prediction are exposed for palatability, bias, and stability purposes enabling responsible and safe use of AI/ML to drive incremental performance and moreover prepare auto finance for the use of alternate data combined in ways that enhance detection without creating ethical issues.

AI in Omni-Channel Communications

Thanks to advancing technology, personalization is being used as a strategy for consumer communications. Leading auto finance companies are going even further by implementing hyper-personalization strategies. Hyper-personalization uses customer data and understanding to frame, guide, extend, and enhance interactions based on that person’s history, preferences, context, and intent.

Consumers’ needs are constantly changing, so to make personalization relevant, organizations must analyze customer level data in real time to understand their journey and predict future needs. This has the power to impact the auto loan financing industry on many levels – including collections communications, deteriorating contact lending rates, customer pressures (e.g., affordability), inconsistent communications strategies that raise flags with regulators, and more.

The bottom line is: If you’re not leveraging digital channels and providing hyper-personalized experiences, you’re not meeting customers where they want to be met.

Techniques That Power Hyper-Personalization for the Automotive Finance Industry

There are a number of techniques that help lenders power hyper-personalization for auto financing consumers, including:

- Natural Language Processing (NLP)

- Personalization algorithms

- Real-time content

Hyper-personalization involves mapping each customer’s journey and data sources, and being able to move customers to different channels (e.g., phone to text or email) at their request. It means leveraging two-way communications/capability to help drive self-service and allow the consumer to decide what kind of experience they want.

Today’s auto loan consumers want more humanized, contextual lending experiences that display empathy – and technology is making this possible. Consider this example:

Before: Auto loan customer types “I hate this experience” and company chatbot responds “Thank you for being a customer…”

Now: Company chat responds with “Sorry you’re upset. What can I do to help?”

AI is moving toward problem-solving mode, which means we can balance machine intelligence with human expertise. This gives us the opportunity to intervene when necessary and let humans win back the customer.

More Information on Auto Lending and Hyper-Personalization

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.