Why Microservices Are Driving the Future of Automotive

Microservices are a fast route to directly improving customer experience – and they offer far greater agility to auto lenders and dealers

We've already passed peak automotive. All indications suggest consumer mindsets are shifting in favour of buying fewer cars and making less frequent vehicle purchases in the future.

But it’s predicted that customers will fully expect to make better use of every vehicle they opt to buy – and with a similar level of support and personalised experience.

A vehicle is a big, discretionary, carefully considered long-term purchase.

But with an ongoing squeeze on high-volume mass-market sales, automotive giants will be obliged to rely on data and timely, well-informed insights to deliver the very best financing and offers that keep their customers happy and keep them returning.

The fastest route will be through efficient use of connected car data to help increase the number of touchpoints with a customer, increase brand loyalty and revenue through personalised offers, in-car upgrades and the most appropriate renewal deals.

Microservices Offer Far Greater Agility for Automotive Companies

Agility is everything right now. Changing customer circumstances, changes in risk appetites, habit, pricing or renewal points, along with a continually evolving financial picture mean auto firms need to adapt at speed, at scale, as their market dictates — or even quicker.

But many are already constrained by legacy back-office infrastructures, siloed thinking, insights and data. Instead, it’s time to embrace new ways of working and doing business, to flex and adapt with changing global markets and customer expectations.

Take Volvo Cars, which opted for the cloud-hosted FICO Platform to digitize and accelerate customer acquisition and onboarding for its new vehicle subscription service, Care by Volvo. Thanks to automation, Volvo cut the credit check process on applications from three days down to a matter of seconds.

Microservices Point the Way in a World of Monoliths

Microservices, which are a decentralized platform approach to delivering technology value, are precisely segmented processes adopted to replace large legacy applications, typically developed to meet the demands of a rapidly evolving mass market. The reason for microservices’ growing adoption is the need for development of leaner, more flexible, independently deployable systems.

Consumer data and insights are easier to manage, assess and maintain when they are broken down into smaller, composable pieces that can all be worked seamlessly together – for a comprehensive customer view. While each element is continuously developed and separately maintained, the overall picture then becomes the greater sum of all these constituent and interactive parts. It flies in the face of more traditional, monolithic back-office systems which are developed, deployed and maintained as one giant operating model.

By their nature microservices are dynamic, agile, scalable, portable, reusable — and more. They can help well-established industry players that are weighed down by legacy tech and a reputation for being static or sluggish when it comes to responding to customer demand. Lenders today know they need more flexibility, are hungry to adapt and win and retain a greater market share. In some instances, automotive finance portfolios are being enhanced and improved with optimization, which is informing the best routes to tailored alternative financing deal structures.

Make Decisions Faster

Microservices architecture is made up of a set of independent components which run each back-office process as a service. They all perform a single function. Because they are independently run, each service can be updated, deployed, and scaled to meet demand for specific functions.

All lenders want to know how their teams can be empowered to make better decisions faster, smarter, at scale and in a highly fluid marketplace. Specifically, it’s the day-to-day needle-moving decisions that impact all areas of the business, including everything from product development and pricing strategies, application origination and onboarding, next-best financing offers, fraud mitigation, compliance - and more.

Balancing Rapidly Evolving Market Forces with Emerging Technology

Microservices underpin the back-office systems that also drive multi-channel offers, add-ons, distribution and integration with showroom agents and dealerships, will always be a win-win. They will, typically offer faster times to market, real-time insights, streamed data, analytics, and faster response times for better customer experience.

Right now, market agility is vital given our quickly changing economic picture, emerging vehicle buying habits and the need for increasingly agility. In fact, many auto firms are now obliged to play catch-up to meet the needs and expectations of today’s customers. It means chasing ever-faster times-to-market, resulting in missed opportunities and lost business to more agile peers.

Innovations that help disrupt the typical car buying value chain — with new business models, new products, or routes to improved vehicle sales — are also likely to drive growth, while keeping customers happy, loyal and returning. In fact, our strategic clients are increasingly seeing the benefits and advantages of putting more control in the hands of their key business users. Many noted that out-the-box solutions simply failed to offer the flexibility needed to meet their auto industry requirements.

Having more control over back-office business models, without the level of restrictions imposed by legacy IT, was also a huge area of appeal. Clearly, with fewer technical restrictions, staff are empowered to directly tackle business-specific issues and deliver change in agile manner — at speed and at scale. At the same time, a cloud-based technology platform that could grow with them while delivering critical benefits across all business lines and channels offers a significant competitive advantage.

Fixing Choppy Customer Experiences to Retain Loyal Car Buyers

Microservices are a fast route to directly improving customer experience – including everything from responsive offers, alternative deal financing structures, or defining new business and product models. But it’s also worth looking at the way modern banking and financial services’ architectures and real-time data have become key lynchpins to success. Top lenders are able to scrutinise the value of every customer, enabling analytics teams to increase revenue by incorporating disparate smart insights and data sources via digital decisioning. It all helps create a far more comprehensive picture of the potential each customer offers – and the deals, add-ons and extras that will help ensure they return time and time again.

Cloud-Based Platforms Empower Automotive Business

FICO Platform is underpinned by microservices. It’s already helping lenders across the globe augment their legacy systems, consume new data sources and rapidly deploy new and emerging use cases to meet rapidly changing market requirements.

It's fair to say digital decisioning has already revolutionized customer experiences for millions across the world, all thanks to a platform approach that lends itself to innovation, agility and interchangeable microservices. FICO Platform empowers development of data streaming pipelines alongside new analytically powered applications, which in turn rapidly and cost-effectively deliver the right customer outcomes and a clear return on investment.

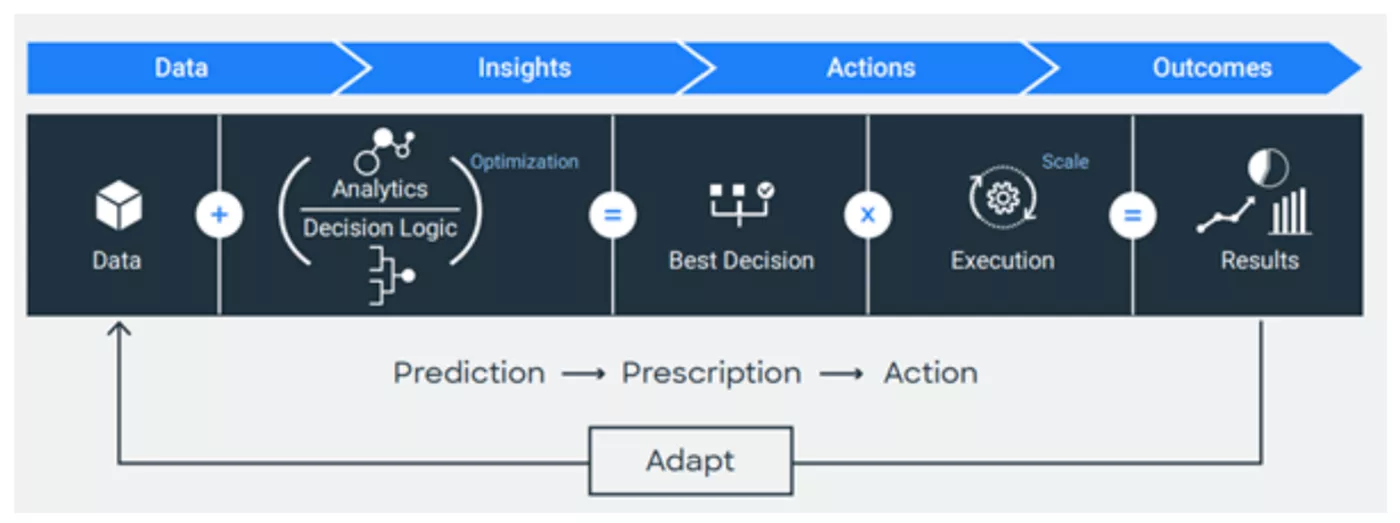

At the heart of FICO Platform are our enterprise capabilities. They're organized into sets of related functionalities that span Data to Insights to Actions to Outcomes — together they enable you to quickly deliver applied intelligence solutions at speed and scale, across the customer lifecycle - regardless of your use case.

Why FICO?

At FICO, integrity is critical with the key challenge posed by enabling lenders to confidently maintain consistently accurate analysis of real-time data. It’s an area we have enormous experience in. The combination of suitably anonymised telematics, robust algorithms and insights, will help to continually empower and inform consumers, motorists and dealerships alike. We’re already helping hundreds of strategic clients across the globe transform the way they use advanced analytics and optimization to make and apply informed, data-driven decisions, on a daily basis.

Find Out More

- See how FICO Platform Supports Care by Volvo.

- Read why UK Auto Buyers Are Switching to Online Auto Financing.

- Explore using Analytics to Prevent Auto Finance Fraud.

- Learn more about FICO Platform

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.