EV and the Future of Hyper-Personalized Automotive Experiences

Steve Greenfield, CEO and Founder of Automotive Ventures, discusses how electric vehicles will drive hyper-personalization in this Q&A from FICO Mastermind

The FICO Mastermind event is an event for executives, influencers and decision-makers in the vehicle finance industry. At this year’s FICO Mastermind, Andrew Chow of FICO sat down with Steve Greenfield, CEO and Founder of Automotive Ventures, an early-stage automotive technology and mobility VC fund, to discuss the future of hyper-personalized automotive experiences, made possible in part by electric vehicles. Steve is an industry thought leader who had previously served as TrueCar’s Senior Vice President of Strategy and Business Development, and AutoTrader.com’s Vice President of Product Management and Business Development, overseeing the acquisitions of vAuto, Kelley Blue Book, HomeNet Automotive, VinSolutions and DealerScience.

Andrew Chow: You started Automotive Ventures almost ten years ago to contribute to the automotive ecosystem by identifying and investing in entrepreneurs and businesses that bring new value with technology developments. Can you tell me about your path leading up to the founding of Automotive Ventures?

Steve Greenfield: I never really planned to be a venture capitalist at this point in my career. I’ve now spent almost 24 years in automotive, mostly in B2B and B2C marketplaces. During that time, I’ve overseen more than $1 billion in acquisitions. It’s given me a unique perspective on the entire automotive ecosystem. Three years ago, I left the corporate world, and now we’re investing in two early-stage mobility and automotive funds. We try to identify seed companies as early as possible and make investments to energize their growth. We’ve made 20 investments in total over the past three years.

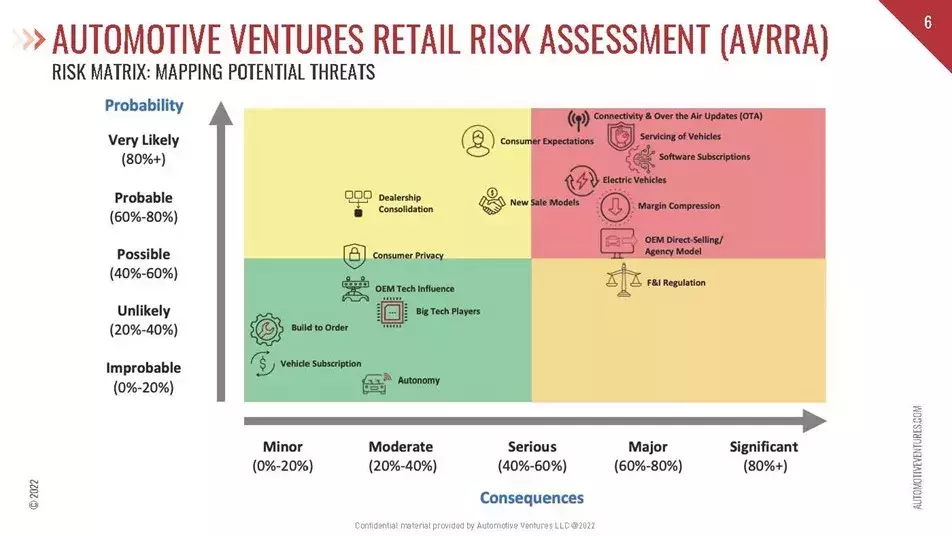

Andrew: That’s fabulous. Steve, can you tell us about your Automotive Ventures Retail Risk Assessment analysis and how you created the risk matrix?

Steve: My central thesis is that there’s going to be more change in the next 10 years in this industry than there has been over the last 100 years. Last summer I published a book titled The Future of Automotive Retail. While recording the audiobook version, I felt like the reader might get to the end of the book and feel slightly dissatisfied about what exactly they should do next, given the amount of change that’s coming to the industry. The Retail Risk Assessment is really a complement to the book. It helps the reader map out the probability and consequence of each of these big automotive industry themes, which makes an actionable roadmap much more achievable. It helps you better focus your energy on the risks and trends that will impact your business.

Andrew: Let’s focus in on the Highest Probability and Most Consequential opportunities and threats. For example, Over the Air updates (top right of your analysis): what are the significant opportunities and threats you are seeing for auto financing? What OTA updates will be free versus financed?

Steve: As an industry, we are all aligned with providing a better relationship with the consumer over the life of the vehicle. The development of Over-the-Air updates means pushing software updates that enable toggling on features of the car (and some require financing). For example, consumers could activate heated seats during the winter months, and only pay for that benefit when they need it. This will allow for more regular communications with consumers that can empower brand retention and personalization. It also builds financing and servicing “stickiness,” and improves the consumer experience by allowing them to activate the features they want, and not use what they don’t want.

Some updates may be costly and require re-writing of contracts, which has near-prime versus subprime consequences. It also requires investments in auto finance to enable real-time decisioning and a more smooth and personalized approach to managing updates. You might talk about the financial benefits of a better credit score to be eligible to unlock new features, and real-time communications related to improvements in credit score that alert the consumer they are now eligible for better offers. Clearly, there are more questions than answers at this point; you have to be in learning mode and be prepared to respond to changes quickly.

Andrew: How do you think consumers will be thinking about OTAs in terms of financing? Are there other business areas that will involve or require financing?

Steve: A dealership’s fixed operations, or their parts and service, are sure to be impacted. For example, consumers won’t need to take their car in as often for recalls and warranty work, if these fixes can be conducted via software updates. Real-time connectivity of vehicles will allow us to recognize travel patterns and enable suggestions on servicing times to deliver a more convenient user experience. Understanding the ability to pay for a consumer, or a Buy-Now-Pay-Later (BNPL) scenario, will make it more convenient to have standard repairs done.

Andrew: Lenders can now extend multiple offers to consumers and more of the consumer application process is now digitized and fulfilled before the customer even visits the dealer F&I office. How do you see the market moving towards a completely digitized lending process?

Steve: The full potential of digital retailing has yet to be realized. Even if I’m a dealer and want to do 100% financing upfront and online, there is effectively no way to transparently provide every facet of the financing experience. On the flip side, I question what percentage of the consumer population is truly ready to do full digital with driveway delivery. There is still quite a bit of work to be done to address the complexity of the car deal, which will require a lot of innovation. Whereas a dealer is in one location, lenders deal with multiple regulatory destinations. Beyond personal choices around new cars (color, options), with a used car it’s more about payment amount for subprime consumers. You want to give consumers more control and transparency over the buying process, but there is still a lot of human interaction involved.

Andrew: With the digital retailing transformation of the automotive business along with the growth of EVs, autonomous vehicles and connected vehicles, do we need to up our game with fraud, privacy protection and cybersecurity?

Steve: 100%. There are more sensors collecting more data from vehicles, and more third parties wanting to consume the information coming off these cars. The surface area of the car is growing and needs to be protected from bad actors that want to hack into a vehicle. Some want to create mayhem, while others are looking for financial gain. Some might seek an extraction of payment; others might want to cause physical harm. As a result, there is growing need for fraud protection for transactions around financing, ownership changes and around OTA updates. Incentive schemes to defraud consumers during loyalty/retention transactions will require staying ahead of the fraudsters. As cars become more complex, and throw off more data, there will be more vulnerabilities for fraud.

Andrew: Do you see subscriptions playing a larger role in automotive sales and financing in the U.S.? If so, what kind of new subscription and financing options are you anticipating in the market? Or are you aware of any other financing models out there where lenders can bring greater value to the OEMs, dealers and consumers?

Steve: I put subscriptions into 2 buckets – vehicle subscriptions versus bundling (or unbundling) of vehicle features. For vehicle subscriptions, the cost of ownership involves predictable monthly payments that include financing, insurance, roadside assistance, protection products and such, along with the ability to get out of that vehicle more easily. As an example, we have recently seen Hyundai take some of their more popular EV models and allow consumers to try out the car for a few months, hoping to see if these consumers convert to owners.

On the other hand, vehicle feature subscriptions are bound to become more popular as consumers understand they only have to pay for the features they need during the months that they use them. Unbundled features can include performance and horsepower to help with acceleration, software improvements to expand EV range, or cold weather packages that unlock heated seats. Imagine Sirius XM magnified. Battery upgrades will provide new options. Self-driving packages are another. And you only pay for what you want when you use it. The notion of an automaker installing features and then charging a monthly fee to unlock them evokes a visceral reaction from some consumers. Some say, “how dare you offer features that aren’t available to me”, but I believe that over time consumers will appreciate features they can unlock and only pay for when they actually need them.

If the automakers are successful in generating billions of dollars of new, high-margin subscription revenue, one of the big questions is if and how that revenue will be shared back to the dealers. We’re on the cusp of a very exciting future.

Andrew: Electric vehicle issues are constantly in the news. What are the key opportunities and threats that auto lenders should be thinking about over the next few years considering incentives, voluntary protection products, batteries, servicing, etc.?

Steve: EVs hold a lot of promise, but also a lot of uncertainties. What we do know is that first generation of EVs have a lot more recalls. So, the cars will be in the shop more as the legacy automakers work out the kinks. But after this first-generation transition phase, the average EV is going to have much longer service intervals than their internal combustion counterparts. There will be far fewer moving parts to fail, and no oil changes or spark plugs that need regular service.

Residual values are going to be really tough to forecast for the initial waves of new EVs that hit the market. Automotive News reported that we’re going to see about 150 new EV models over the next two years. I feel sorry for the poor residual value analysts. This is also likely to create volatility in used EV prices, depending on how much demand we have as these EVs come back into the market.

We’re already hearing horror stories about these big, expensive batteries, that can be 40% to 50% of the entire price of the car, getting a small scratch or a bit of damage to one single cell, leading to the entire vehicle being written off as a “total loss.” As battery technology advances, allowing for swapping out of individual cells, this will improve. The good thing is that F&I providers are initially seeing strong attach-rates for protection products on EVs. This isn’t too surprising given the sheer amount of technology that’s being baked into these new cars. Think about when you bought your last iPhone. These devices have gotten so expensive, you’d be silly not to opt in for the monthly insurance plan. I think the average consumer is going to be fearful of the cost of fixing these sophisticated “iPhones on wheels” if something does inevitably break.

Andrew: With more and more data available about a particular consumer, what should auto lenders be thinking about in leveraging consumer information during the sales and financing process?

Steve: Great question. We don’t want to scare the consumer. We will know a lot more about consumers as more telematics data is collected from vehicles via sensors. Privacy laws will need to be interpreted and evolve. But this increased volume of consumer and vehicle data will allow us to custom tailor individual packages of custom services for the customer. Personalization will become more powerful as the car learns more about the consumer over time. Lenders will be able to build a real-time risk profile about the consumer based on data and behavior.

Having said that, as we’ve seen with social media, I think that consumers may be willing to surrender some of their privacy concerns if value is being delivered. As a consumer, I can deal with a bit of the “creepy factor” if the quid-pro-quo is enhanced benefits to me. You can also imagine a future where a consumer’s creditworthiness, coupled with vehicle depreciation and equity, will allow for more opportunities around personalization of payments.

Andrew: After the car is sold and financed, what digital communications strategies work best with customers to build trust and loyalty?

Steve: Historically, the industry has really been weak, in terms of keeping in touch with and nurturing a relationship with the consumer after purchase. There hasn’t been a lot of loyalty back to the dealer for service, especially after the end of the warranty period.

Vehicle connectivity uniquely provides the opportunity to “flip the script” on this equation. The car should recognize when it needs service and then recommend when and where to get that service done. Much of the communication with the customer should be through the main screen (“head unit”) in the vehicle. And both automakers and dealers will have a tremendous amount of consumer and vehicle data to leverage into dramatically better and more personalized experiences throughout the ownership experience. Consumers should no longer need roadside assistance since these cars will know ahead of time when they need service.

Andrew: Margin compression is a threat you have ranked as highly probable and consequential. This would apply to OEMs, suppliers, dealers and lenders. What can auto lenders be thinking about in terms of protecting their margins by managing consumer and dealer risk?

Steve: Great question. Part of the answer will be based on building better risk models, given the sheer amount of vehicle and consumer data that we’ll be able to collect in real time. There won’t be any shortage of data to feed into these models. The bottleneck may be with our ability to ingest and draw insights from the massive amounts of data. If the automakers and lenders can leverage the data for better insights, the whole industry benefits. Lenders that can help do that will have a huge competitive advantage.

Second, we really are seeing a remarkable acceleration around the hope (and potential threat, depending on your perspective) of AI augmenting or even replacing repetitive human tasks. This may mean that lenders can dramatically reduce human capital costs in the future, which may mean even stronger profit margins in the future. We are just scratching the surface with AI to replace repetitive tasks. AI can be much more efficient at taking massive amounts of data and insights that drive revenue and profitability for lenders.

Andrew: How can lenders better forecast consumer affordability? Could changes in the overall long-term cost of ownership change the financing of a vehicle?

Steve: I believe that the technology in cars is going to continue to get more complex and more costly. And consumers seem to have an insatiable appetite for well-equipped vehicles. But, at the same time, vehicles are becoming far more reliable. So, it’s not a bad thing that we’re pushing out the terms on financing to make these more expensive vehicles affordable. The challenge is going to be if we witness a lot of volatility in EV residual values, if some of these used EVs come back into the market and they’re just not very attractive versus new models. A lot of this will depend on breakthroughs in battery technology that give newer EVs an advantage around vehicle range, charging speed, or other technology advances.

But remember, the longer-term cost of ownership for an EV should be a lot lower. They don’t need much maintenance. And as long as electricity prices remain reasonable versus gas prices, consumers should benefit from lower lifetime cost of ownership.

Andrew: How do you see a vendor like FICO, who is the global leader in decision management, assist the various players in the automotive ecosystem?

Steve: To me, FICO is uniquely positioned to help the various industry players, whether it’s an automaker, a financial company, a dealership or the consumer, navigate through all of these issues that we’ve discussed today. These are data issues. The path to a more successful future is going to be harnessing all of the massive amount of data available to us, and distilling this data down to actionable insights around which business decisions can be made. And that seems to be FICO’s core competency. I believe that FICO will prove to be a valued partner to many industry players to help them chart a course through much of this industry uncertainty and come out healthier on the other side.

How FICO Helps Auto Dealers and Manufacturers

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.