How Banks Can Manage Credit Strategies in Turkey’s Economy

At a time of rapid change, Turkish banks could use mathematical optimisation of credit strategies to navigate pricing challenges and spur growth

Financial instability and uncertainty are facts of life nowadays that we all have to navigate as best we can. It is the same for lenders. Turkey is one of the countries with the most challenging economies in the world due to its geopolitical situation and current inflation.

There is no real blueprint for how banks should manage through times like this. But in reviewing the challenges in the market today, we can suggest some avenues for improved growth and profitability.

Turkish Challenges: Inflation, Bad Debt and Regulations

First, as in any economy with high inflation levels, the banks are seeing slowing loan growth and rising bad debts across the country, which are impacting profits and capital. With inflation rates at greater than 60%, Turkish banks and consumers are facing a tougher time with levels expected to reduce over the next two years but still expected to be 14% (source: The Central Bank of the Republic of Türkiye). With the current interest base rate of 40%, the banks are having to constantly revise their savings rates for both Turkish lira and foreign currency deposits, to respond to competitive pressures; they are also revising their retail lending strategy and actions with regards to current limitations set by the Central Bank.

The second challenge is the constantly changing regulatory environment. In the last year there have been more changes than in the previous 5 years. Banks are really struggling to implement and measure the impact of such regulations on their portfolio in limited time.

Responses: The Judgmental Approach

Given these circumstances and challenges, what are banks to do?

For lending decisions, you can manage your policy rules and adjust scorecard cut-offs. You could bring in some new policies that help to address the concerns for the duration of the period of uncertainty. The policy rules would likely be judgemental rules based on the circumstances, as opposed to empirically derived. Similarly, any changes to the score cut-offs could be based on previous experience only rather than recent data.

Given the rapid market changes, it could make sense to rebuild your credit models, but having to wait for sufficient data might not be acceptable.

For deposits pricing, you could follow the competition, which is a common practice in a number of markets, if rates are transparent.

Responses: Simulation and Optimisation

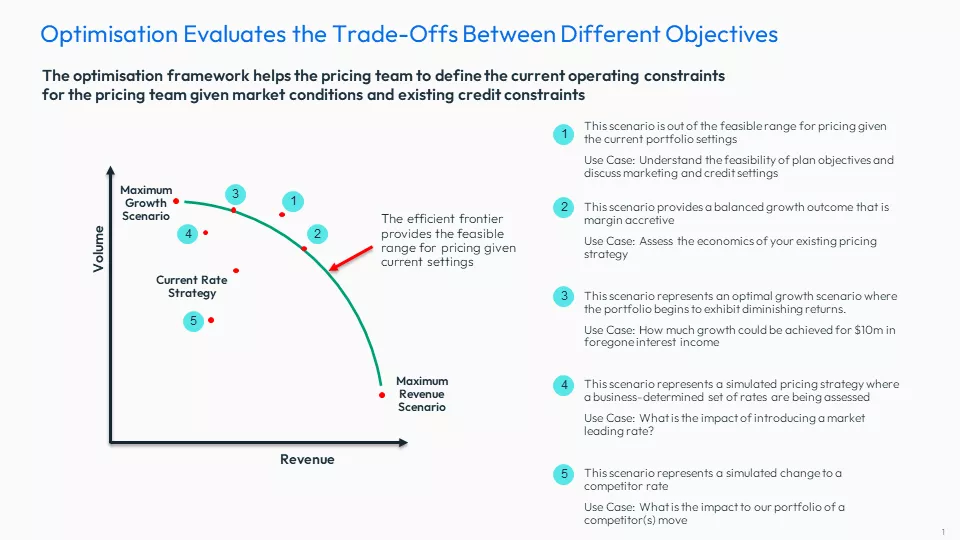

To address the situation with a more robust and effective solution, banks could use optimisation, which allows business users the ability to explore all of the many and various possible strategies within the decision space. The user can see forecasts based on business as usual to see what is expected to happen, and then create scenarios that look at various “what if” scenarios. These “what ifs” leverage the underlying decision impact model that brings together a series of models that reflect the key elements of the decision.

Let’s say, I am the Head of Retail Lending and I want to know how I should change my decision strategies to reduce losses while retaining as much volume as possible. I can use simulation to see what my current decision strategy will achieve. I can then run a series of simulations to explore various options. Additionally, I can run optimisations where I set a specific set of goals and constraints — such as a volume goal with constraints on losses and profit — to create various options for the business to consider. I can also stress-test the scenarios, enabling me to see how the scenario might fair under a variety of circumstances, such as increasing loss rates.

We often hear that constraints, such as limitations on interest rates, are reason enough not to use optimisation and AI to devise new strategies. On the contrary, these constraints make optimisation even more important. In a heavily regulated and highly competitive market, it is crucial to have the best tools possible to set rates and decision strategies to ensure that you can compete effectively and not lag your competition.

The Advantages of Optimisation and Simulation

FICO’s optimisation and simulation capabilities allow banks to not only understand the art of the possible but to stress-test the decision scenarios under a variety of circumstances prior to deployment. Furthermore, these capabilities provide insights into the cost of constraints, which enables banks to determine when policies should be changed. In an environment with constantly changing regulation, banks need a tool to fully understand the business impact of these changes and the options open to them.

In the graphic below you can see how the solution provides the ability to review alternative strategies compared to business as usual.

Optimisation gives you the ability to be more agile in terms of discovering better decision strategies. Another key component is the ability to deliver these strategies to your operational environment, as no models or decision strategies are useful if they cannot be deployed in a timely manner. Fast and agile deployment is critical in a fast-changing market. The flexibility of the optimisation solution ensures that the effort involved in deployment is minimized, irrespective of the strategy format required.

One of the key reasons that optimisation is successful is that each area of the Bank can clearly understand the likely impact of the new decision strategy. Finance, Marketing, Risk, Product and senior management can all come together to understand the impacts on each of their areas and agree upon a common set of metrics, as well as understand the trade-offs between various FPIs.

Optimisation technology does not cause uncertainty to disappear, but it does provide users with a set of highly effective tools and techniques for managing it. Scenario planning capabilities and the ability to stress-test macroeconomic and competitive assumptions are critical in allowing business users to plan for the unknown. Effective optimisation tools also allow for timely refreshes of price sensitivity models, critical in enabling test and learn in a changing macroeconomic environment.

One recent success story in Turkey is Akbank, which has deployed its first optimisation project for managing credit card limits in the current economic climate while complying with rigorous national laws around credit offers. The use of FICO prescriptive analytics for credit card portfolio optimization allowed the bank to grow approvals by 45 percent and limits by 60 percent. You can read more about this, here: https://www.fico.com/blogs/credit-card-portfolio-optimization.

Through periods of economic instability, simulation and optimization have proven to be indispensable techniques to banks, providing the insight and agility necessary to steer an effective course of action through uncharted territory.

Learn More About Optimisation’s Possibilities

- Read the Akbank case study

- Explore FICO solutions for optimisation

- Discover how credit limit optimization drives portfolio profit

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.