How to Improve Application Fraud and Originations Processes

Siloes between your application fraud management and originations teams can create customer experience problems and increase losses - here are some ways to break through the siloes

In a siloed organization each department or function has their own processes. However, when faced with a common objective such as onboarding a new customer, simply layering in these processes has a downside. Customers are repeatedly requested to provide the same information, leading to redundancy, unnecessary expenses as superfluous checks are conducted, and a lack of information sharing that could threaten fraud prevention. These issues collectively contribute to poor customer experience and elevated risks and costs.

Shared Workflows

Historically, each lender operates distinct workflows to manage credit risk and detect fraud. Each process is run end-to-end with little oversight into the entire onboarding experience. However, the integration of these workflows can result in significant benefits, such as reduced time to completion and decreased costs associated with verification checks.

Consider, for instance, a new applicant who requires both a credit check and an identity verification. If the acceptable threshold for one is not met, there is no point in making a costly call to third-party data sources for the other. Where workflows remain separate both checks still happen. In a shared workflow a considered decision is made regarding the order of checks; if the threshold for the first check is not met, the application can be promptly halted without incurring additional cost or internal resources. This streamlined approach enhances efficiency and ensures a more cost-effective and customer-centric onboarding process.

Leverage the Application Source to Enhance Customer Experience and Reduce Risk

In many cases, the initial stages of the application process start with limited information available. While you have access to application data, crucial details explaining the motivation and source of the application are often not available to those assessing credit or fraud risk. Processes can be streamlined and more effective when the source of an application becomes a parameter that determines the checks required.

For instance, when an application originates from a long-standing customer, the levels of identity and anti-fraud checks are lower than for an application from an applicant new to the organization. Customers who responded to a targeted ad campaign by the financial institution can be considered a lower risk from both a fraud and credit risk perspective compared to applicants with no prior interactions who are more likely to be fraudsters.

By breaking down this silo and sharing this pertinent information you can realize tangible benefits. This approach allows you to identify lower-risk applicants to automate and expedite their application processing, significantly enhancing their customer experience. Conversely, it enables you to detect specific applications carrying higher risk of fraud that require more rigorous scrutiny, thereby concentrating your efforts on mitigating potential risks.

Gain Insights into the Customer Onboarding Process

The journey from initial application to successfully onboarded customer is a critical one, but not all applicants make it to the finish line. Application processes can falter at various stages for a multitude of reasons. To enhance this process, it's imperative to prioritize conversion rates as a key performance indicator for all involved. This helps you to detect and rectify bottlenecks in the onboarding process.

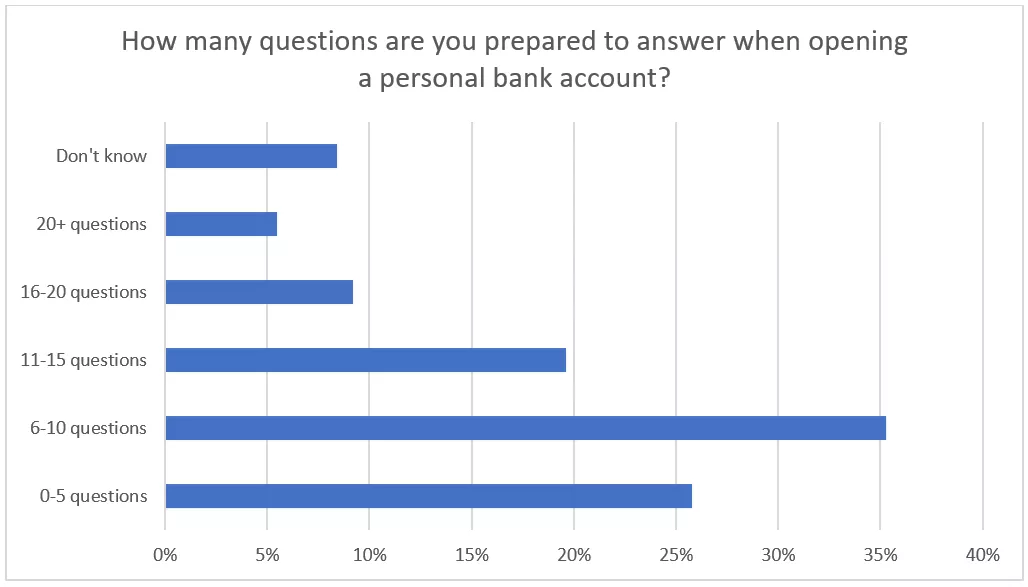

Terminating applications for legitimate reasons because of compliance concerns or unacceptable credit or fraud risk is essential, but it’s vital to reach this decision without incurring unnecessary costs. However, a significant portion of applications are abandoned due to customer dissatisfaction. According to FICO research, a staggering 57% of individuals embarking on opening a bank account are only willing to answer less than 10 questions. Furthermore, 30% will abandon a bank account application if the identity fraud checks are too onerous or time-consuming.

Clearly, a more profound understanding of when and why customers decide to abandon their applications can yield substantial benefits and ensure that the desired applicants become valued customers. To achieve this, identifying points where customers routinely abandon the origination process is crucial. In these instances, we can evaluate and adapt by considering the following:

- Timing and Presentation: Can the question be asked at a different stage or in a different manner? For instance, is it information that could be gathered post-book, to streamline the application process?

- Avoiding Redundancy: Are you asking questions that duplicate information gathering? For example, if you’ve already obtained the applicant's date of birth, there is no need to request their age as well.

- Are you attracting the right customer for your product or service? When the customer profile doesn't align with your offering, they are more inclined to terminate their engagement once they realize it's not a fit. While you might view this as a positive outcome, it's important to recognize that you've already invested marketing budget and resources in getting them to this point and you’ve left them with a poor experience of your organization.

By proactively addressing these issues, you can optimize the customer onboarding process, reduce drop-offs, and ensure that more applicants successfully transition into satisfied customers.

Removing Siloes: People, Process and Technology

This post is the second in my series; in the first I discussed some of the problems siloes create, and the people practices that can reduce siloes. In my final post I will explore the role technology including AI and machine learning plays in fostering collaboration and effective working for financial institutions involved in both credit risk and application fraud management.

- Read the white paper: Breaking Down Siloes – Originations and Application Fraud

- Read the white paper The changing face of application fraud

- See the results of our latest fraud, identity and digital banking consumer survey

- Explore the range of FICO fraud solutions

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.