How Pooled Models Help You Say “Yes” To More Good Credit Applicants

Build Stronger, More Profitable Portfolios with Pooled Models that Drive Smarter Originations Decisions

In my last blog, we explored why lenders should use analytics beyond single credit scores when making originations decisions. To recap, pooled models are a great option for organizations that lack the data and resources to develop custom models, and they can help creditors make more precise, value-based decisions at the critical originations stage.

Pooled models are empirically derived (as are custom-built models), but the data comes from multiple lenders, rather than a single institution. While you could create and deploy your own models – a process involving testing, validation, implementation, and maintenance – pooled models enable you to bypass the time and expense of custom models. This is a tremendous benefit if you are resource-constrained, lack modeling expertise, or need to improve your decisioning processes in a hurry.

But, are pooled models really necessary…and better?

- Can pooled models help you approve applicants you may have declined in the past by just using the bureau score?

- Can they help you identify applicants whose bureau scores don’t reveal their true overall risk?

- Is there any data to validate their usefulness and predictive value?

- And, how difficult and expensive are they to test, deploy, and maintain?

To answer these questions, let’s explore two banking journeys that illustrate the before-and-after value of using pooled models for originations decisions.

ABC Bank: BEFORE

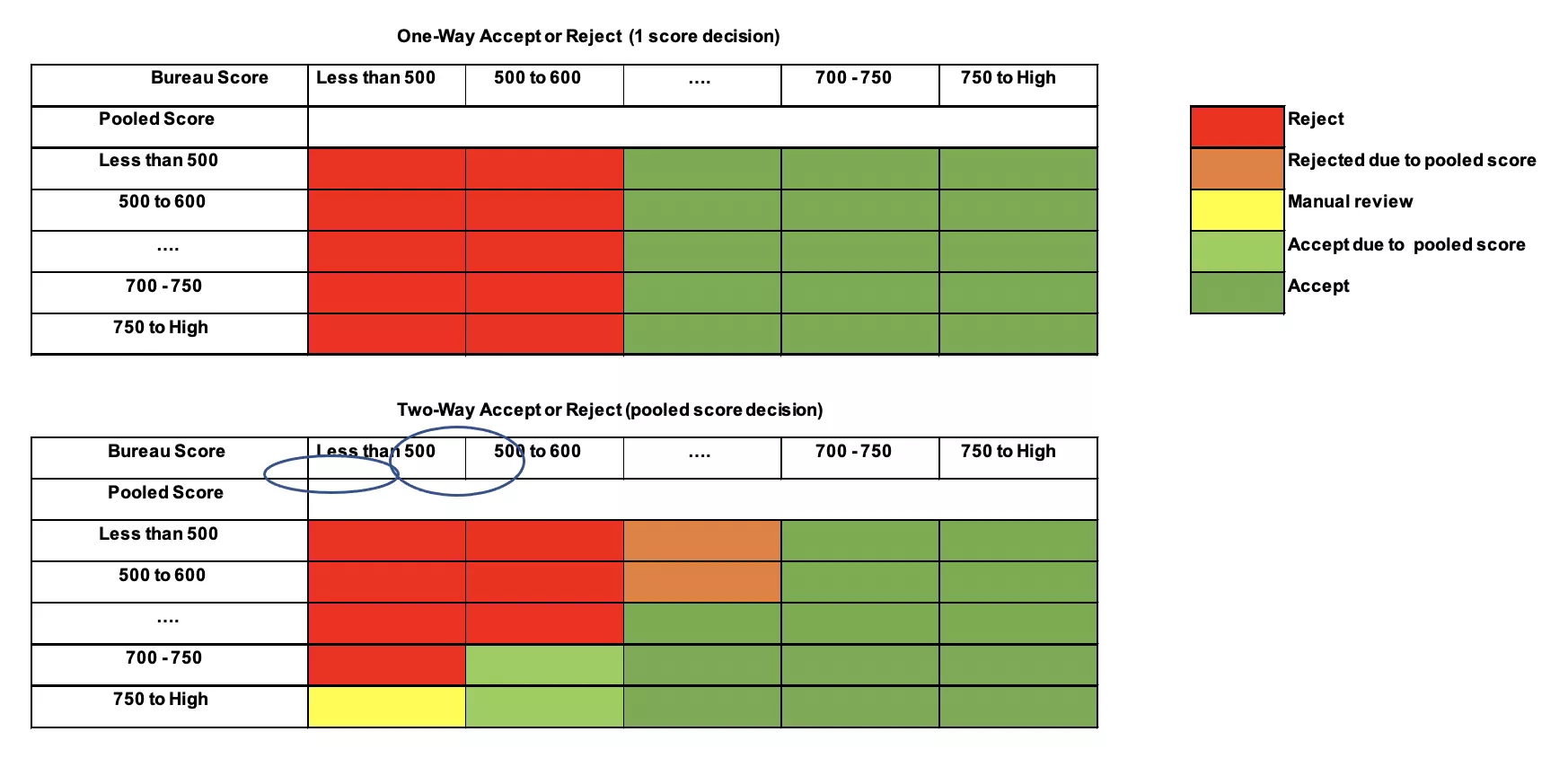

Prior to incorporating pooled models in their decisioning, ABC Bank rejected any new applicant with a bureau score of 600 or less. This hard-and-fast rule was straightforward and compliant, but it was using a chainsaw instead of a scalpel to make intelligent, data-driven credit decisions.

The simple math went like this:

- The “bads” (under 600) were a definitive no.

- The “goods” (over 600) were a definitive yes.

- But what about the “maybes”…the yellows who were on the cusp of that threshold and could hold a wealth of profitable, credit-worthy customers?

To make more sophisticated, analytically-driven decisions, ABC Bank needs to incorporate powerful, focused risk prediction at the originations stage. Why?

- We know that 80% of measurable risk is decided at the originations stage.

- We also know that individual bureau scores and pooled models are complementary and provide substantial benefit together.

- We also know that many scores are based on credit and non-credit seekers, meaning that repayment behavior is weighted for non-credit seekers. However, pooled models can be solely developed for credit applicants, making them much more sensitive to repayment risks of a new obligation.

ABC Bank: AFTER

When ABC Bank introduced a pooled model score in addition to the bureau score, auto-approvals increased. With this more sophisticated analytic approach, ABC Bank now approves those applicants that scored between 500-600 (who would have been rejected in the past) with a pooled model score of 700 or higher. ABC Bank also manually reviews the highest risk clients that scored less than 500 but had a pooled model score of 750 or higher.

Here’s how the new approach looks in terms of reds, yellows, and greens. It’s easy to see the nuanced segmentation of when to say yes, when to say no, and when to manually review.

Now, let’s explore another example to see how pooled models can improve bad capture rates across home equity, installment, and revolving credit lines.

Bad Capture Credit Union: BEFORE

This credit union wanted to increase their approval rates but not at the expense of increasing their overall risk. Prior to their additional of pooled models, it had an approval rate of 67% with a bad rate of 0.31%. (Note that a “bad rate” is the percentage of accounts that perform in an unsatisfactory manner as defined by the good or bad definition that was used in the scorecard development.)

This performance is good—two-thirds of applications were being approved and of those, only 0.31% were going bad and defaulting. But, is there room for improvement? What if the credit union could safely and confidently say “yes” to more applicants without introducing more unnecessary risk into the portfolio? Is there room for refinement and improvement with pooled models? The research says yes.

Bad Capture Credit Union: AFTER

Shortly after including the pooled model score to supplement the bureau score, the credit union began to see incremental performance improvements on two fronts:

- A 10% increase in their approval rates from 67.0% to 73.3% while maintaining the same risk level.

- A 44% decrease of their bad rate to 0.18% while maintaining the same acceptance level.

That means the credit union is originating 6.3% MORE loans while decreasing their bad rate by 44%--all the way down to an impressive 0.18%.

The Bottom Line: Banks can become more profitable through increased auto decisioning, good loans, and fewer losses through defaults.

The Validation Proof with Bad Capture Rates

So, how can pooled models deliver such strong results? Much like custom models, the volume and quality of data is critical to the success of pooled models, as is the comprehensive and ongoing testing and validation.

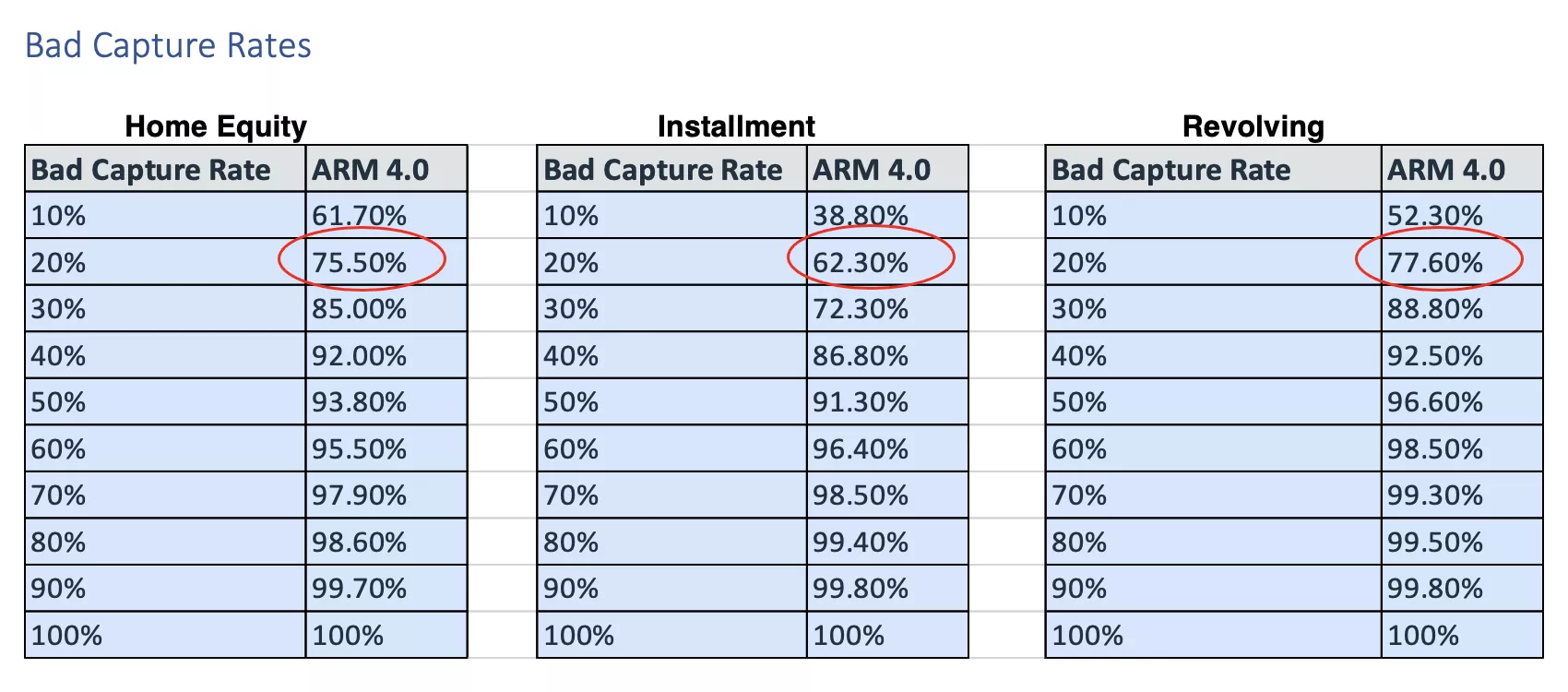

With pooled models, organizations can gain access to more than 5 million records to improve originations decisions for home equity, installment and revolving loans. In one of FICO’s recent pooled model validation studies, we saw impressive results for bad capture rates and predictability across credit products.

- Home Equity – You can expect to identify 75.5% of the potential “bads” from the worst performing 20% of the population.

- Installment – You can expect to identify 62.3% of the potential “bads” from the worst performing 20% of the population.

- Revolving – You can expect to identify 77.6% of the potential “bads” from the worst performing 20% of the population.

This illustrates that the pooled model (for example, FICO® ARM 4.0) can help you segment your applicants and “see” the yellows more clearly. For home equity, you can say “no” to the worst, most risky 20% of the segmented applicant pool and weed out (or capture) 75.5% of the loans with the highest risk.

Off-the-Shelf, To-Go Models: Flexible, Agile, & Streamlined

We often hear from lenders that they do not have the time, money, or resources to deploy and support complex models. It’s all too complicated, expensive, and hard to manage. And for custom models, that is often very true.

However, many pooled model suites offer “models to go” that are off-the-shelf and cost-effective to deploy and maintain. The leading pooled models are flexible, agile, streamlined, and can assess risk quickly without complex data gathering or costly development and deployment.

Armed with industry-leading pooled models, lenders can apply application scoring to new or niche portfolios (like geographic expansion) that lack the extensive history required for building a custom model. This helps lenders grow portfolios responsibly.

In many situations, pooled models are the most practical, cost-effective, and appropriate way to generate predictive scores for new applicants.

- The cost of implementation is lower than for custom or expert models, and scoring can be deployed more quickly.

- Pooled models use performance data gathered from millions of customer records at large and small financial institutions.

- Different pools and specialized scores let your enterprise match closely to your overall customer portfolio and to specific business segments – such as secured loans, non-prime, student, HELOC, and many others.

In my final blog in this series, we’ll explore the three most common myths about pooled models and share best practices with a must-have checklist for how to select winning pooled models.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.