How to Protect the Underbanked from Fraud and Scams

Traditional fraud protection methods may not be effective in protecting the unbanked and underbanked population - a more careful approach is needed

The global push for financial inclusion has led to the development of innovative financial products designed specifically for the unbanked and underbanked population. These individuals, who have traditionally been excluded from the formal financial system, are now gaining access to a range of services, including bank accounts, e-wallets, pre-paid cards, loans, and digital payment platforms. While this progress is undoubtedly positive, it also exposes these vulnerable groups to new and unique fraud risks.

Fraudsters are quick to exploit any vulnerabilities in the system, and the unbanked and underbanked population is particularly susceptible due to a combination of factors, including low financial literacy, lack of financial education, and limited experience with formal financial services. As we work towards expanding financial inclusion, it is crucial that we also prioritize protecting these individuals from fraud and financial exploitation not only through existing strategies, but also new, innovative and custom solutions.

Balancing Growth and Fraud Protection

The rapid expansion of real-time payments, digital banks and payment service providers (PSPs) has brought new opportunities for financial inclusion, but it has also raised concerns about the prioritization of growth over fraud protection. As these institutions focus on acquiring new customers and increasing market share, there is a risk that they may overlook the importance of robust fraud prevention measures.

Traditional fraud protection methods may not be effective in protecting the unbanked and underbanked population, who have unique vulnerabilities and limited experience with formal financial services. It is crucial for banks and PSPs to develop fraud models and rules that are tailored to the specific needs and circumstances of this demographic.

Fraud prevention measures should consider the potential impact of even small losses on low-income individuals and households. What may seem like a nominal amount to a financial institution can be devastating for someone living in poverty. As such, fraud thresholds and response protocols must be adjusted to minimize the harm caused by fraudulent activities.

Financial institutions must strike a delicate balance between enabling access to financial services and protecting users from fraud. TJ Horan, FICO’s vice president of product management, points to “sensible friction” – ensuring that we balance the ease and speed of money movement with the right controls and customer communication along the way, to identify and tackle potential red flags.

This requires a proactive approach to fraud prevention that leverages advanced technologies, such as machine learning and artificial intelligence, as well as effective and bespoke customer communication and engagement to detect and prevent fraudulent activities in real-time.

Some of the considerations that are worth keeping in mind are focused on the treatment and communication:

- If you want to attract more of the underbanked population, how will you adapt your messaging & treatment?

- Do you have the flexibility to segment your customer base, and allow various customer groups for:

- different limits

- tailored fraud strategies

- bespoke fraud messaging flows

- At what point of your customer journey do you graduate a customer from an underbanked way of treatment?

- What does the customer journey in financial literacy and banking experience look like?

- How do you mature your treatment and communications alongside that?

The Importance of Financial Literacy

One of the most significant challenges in protecting the unbanked and underbanked from fraud is the widespread lack of financial literacy. An international study led by the OECD found that just 17% of surveyed adults (both banked and unbanked) considered their financial knowledge to be high. And while the vast majority were aware of the financial products available to them, 20% still turned to family and friends for borrowing or saving. This lack of awareness or understanding makes it difficult for individuals to navigate the financial system and make informed decisions about their money.

The Findex report found that about two-thirds of unbanked adults would need help using an account if they opened one at a financial institution. This highlights the need for accessible and comprehensive financial education programs that can help individuals understand and utilize financial services effectively.

Lack of trust in financial institutions is a significant barrier to financial inclusion, particularly among the unbanked population. In the Philippines, for example, 15% of unbanked individuals cite a lack of trust as their primary reason for not opening an account. A recent FICO study highlights that 69% of respondents view strong fraud protection as one of the top three most important considerations when opening a bank account. Trust is essential for converting the unbanked to the banked, and poor fraud controls can quickly erode this trust, turning people away from using formal financial services.

Governments and policymakers have a crucial role to play in addressing this issue. They must invest in regulations and governance that ensure the availability of safe, affordable, and convenient financial products for all as well as focus on targeted financial literacy initiatives that cater to the specific needs of the unbanked and underbanked population. These programs should be a collaborative effort between regulators and financial institutions, designed to help individuals build the skills and confidence they need to engage with the formal financial system and protect themselves from fraud and exploitation.

The Role of Digital Identity in Financial Inclusion

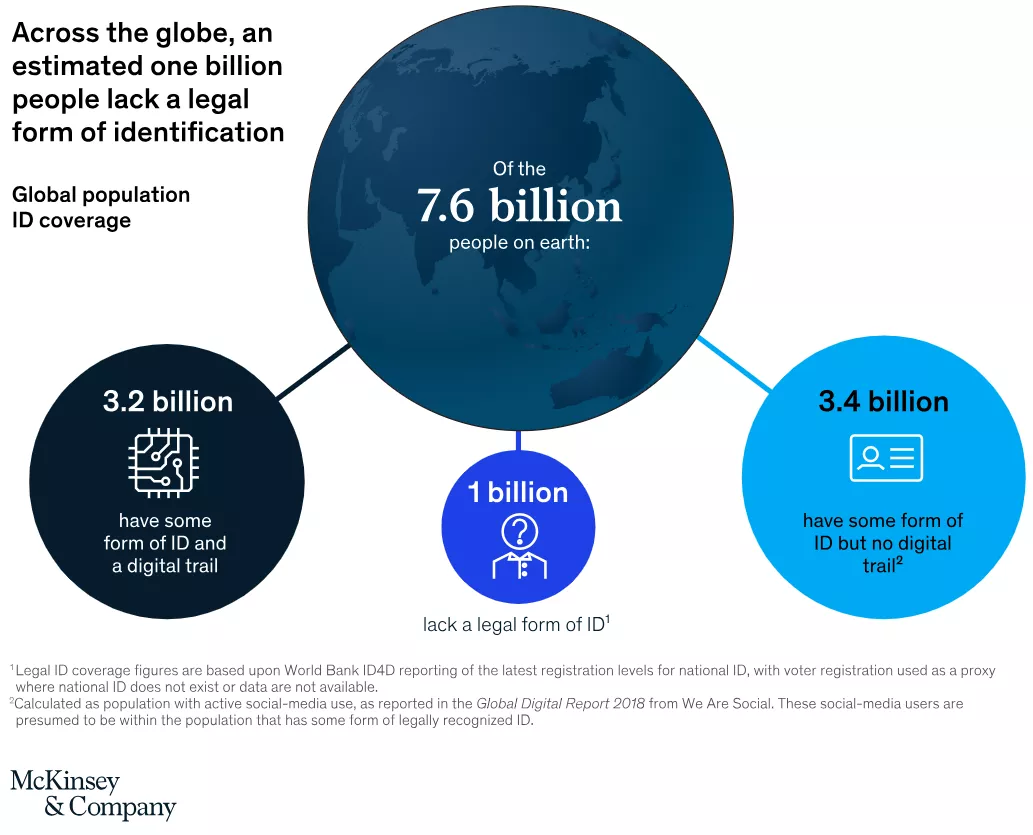

Another significant barrier to financial inclusion is the lack of formal identification. Approximately 1 billion people worldwide lack proof of identity, making it difficult for them to access formal financial services. Identity verification requirements vary across countries and institutions, resulting in fragmented and often challenging processes.

This lack of standardization can reinforce existing disparities, excluding those who lack access to resources and opportunities from the benefits of financial inclusion. The adoption of digital identity can help address this issue, fostering greater inclusion and enabling better delivery of financial services. Digital identity creates a secure, digital representation of an individual's identity using personal information and biometric data and can be used to authenticate and authorize individuals when accessing services or performing transactions.

During the COVID-19 pandemic, countries that had already invested in digitizing financial infrastructure and digital identification systems were the most successful in distributing aid efficiently, with speed, accuracy, and scale. This highlights the potential for digital identity to enhance resilience during times of crisis and uncertainty.

However, attitudes towards digital ID technology vary significantly across the globe. While 70% of consumers in China and 57% in Brazil support digital ID, roughly 71% of respondents in the US and Germany prefer carrying a physical ID. These varying attitudes underscore the need for global leaders to raise awareness about the benefits of digital ID systems and work towards their widespread adoption.

To drive the adoption of digital ID, governments and private sector stakeholders must collaborate to develop and promote digital ID standards, fund initiatives to drive innovation, and take legislative and regulatory action to streamline efforts and avoid fragmentation. By doing so, they can unlock the full potential of digital identity in promoting financial inclusion and protecting the unbanked and underbanked from fraud.

How does a digital ID benefit my fraud strategy? It has several advantages over traditional IDs because it is:

- A more secure and tamper-proof way of identity verification, making it harder for fraudsters to create fake identities or steal someone's identity.

- Enabled for real-time identity verification, allowing you to detect and prevent fraudulent activities more quickly.

- Meaningful information for ingestion, aggregation, and enrichment of your other data to better protect your customers.

How You Can Help Protect the Underbanked From Fraud

Protecting the unbanked and underbanked from fraud is a complex and multifaceted challenge that requires the collaboration of governments, financial institutions, and technology providers. Some of these challenges can only be overcome by collaboration between different institutions, however there are things you as an organization can be doing today to prepare yourselves not only for the future influx of the unbanked, but also to better serve your new to banking customers today.

1. Tailored Fraud Prevention Measures

To effectively protect the unbanked and underbanked from fraud, you must invest in advanced fraud prevention technologies and processes.

This includes implementing real-time monitoring systems with capability to:

- develop flexible rules

- deploy custom treatment strategies

- build models that can adapt to the unique behaviors of different demographics

- simulate new strategies for different peer groups

- deliver bespoke customer communication

2. Digital Identity Infrastructure

Digital identities will play a critical role in promoting financial inclusion and preventing fraud. To maximize their benefits, you should focus on enhancing your digital identity infrastructure. This involves investing in data ingestion and orchestration capabilities to ensure that relevant identity data is collected, verified, and integrated into fraud prevention processes seamlessly and at the right time. By doing so, you can create a more comprehensive and accurate view of your customers' identities, enabling faster and more effective service as well as better fraud detection and prevention.

3. Financial Literacy Programs

Empowering the unbanked & underbanked with the knowledge and skills they need to protect themselves from fraud is essential. You should prioritize financial literacy initiatives, such as targeted customer communication campaigns and educational programs that help individuals understand the risks of fraud and how to avoid it. In the UK, regulatory requirements begin to mandate that financial institutions provide tailored messaging and education to customers at risk of falling victim to scams. By adopting similar approaches for the underbanked, you can help create a more fraud-resilient customer base and promote greater trust in formal financial services.

As the world continues to digitize and more people gain access to formal financial services, institutions that prioritize these areas will be well-positioned to drive greater growth through financial inclusion, while protecting their customers and their bottom line from the evolving threat of fraud.

How FICO Helps Protect You and Your Customers from Fraud

- Explore FICO’s innovative fraud protection technology

- Learn how real-time customer communications can help you prevent more fraud and provide a better customer experience

- Download the FICO 2023 Scams Impact Survey

- Understand the advantages of integrating originations management with application fraud controls

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.