Is Hyper-Personalization a Game Changer for Fraud Management?

Done right, hyper-personalization is the key to some major challenges faced by fraud departments, transforming customer experience and fraud controls

Over the past decade, personalisation has been the holy grail at key touch points in the customer lifecycle. Now seven out of 10 people expect a personalised experience. However, existing personalization practices are maturing and major gaps are appearing in the personalization capabilities currently in place.

Sectors that leverage digital marketing strategies for acquiring and properly serving customers are moving towards hyper-personalization — a ‘supercharged’ version of personalization using real-time customer data, artificial intelligence, automation and predictive analytics. The results are differentiating for those companies that have embraced it, serving real-time personalized customer experiences.

The vast majority of banks and financial services (88%) are also planning to step-up their hyper-personalization programs through analytics and machine learning. The areas of focus are originations and customer management.

But fraud must be a consideration here too. Done right, a hyper-personalized experience is the key to some major challenges faced by fraud departments today. It has the potential to positively transform the customer’s experience of fraud controls. It will also enable the implementation of strong fraud controls across the whole customer journey.

This is vital because fraudsters are permeating every key moment of that journey. There are thousands of ‘moments’ along the customer journey when a decision will be necessary to determine whether a fraud, a scam or a legitimate event is taking place. If a decision is wrong or the fraud or scam has not been detected, the individuals involved will be impacted negatively and unnecessarily, leaving them financially stranded, frustrated, embarrassed, or confused. This has a detrimental impact on customer loyalty according to FICO research — at least two in five people would consider changing their provider after one to three declines based on false negatives. As fraud controls are tightened, the disconnect with the experiences of customers is also growing.

These are the moments when we must deliver experiences with a better balance between fraud control and customer service. An end-to-end hyper-personalized experience means organizations will be able to ensure a balance that customers are happy with, enable communication that is clear, responsive and demonstrates empathy, and instil customer confidence in the processes.

Right Data to Right Decision at the Right Time

When faced with a ‘moment’ that could be a fraud event, multiple decisions must be made in sequence until a clearer view on whether the event is a fraud or a scam or a legitimate transaction is achieved. Is it a new device? Is an OTP needed? Is there a risk of SIM swap because of the OTP? Is a biometric check needed? Is the customer moving money through an unexpected channel?

Underlying these decisions are multiple datasets about the customer, their accounts, their email, their mobile, their device and the biometrics involved. For a hyper-personalized experience, it is vital that the right data and insight is delivered to the right decision, at the right moment in time to optimize the customer experience.

Current fraud controls tend to focus primarily on the negative indicators from these datasets or ‘bad customer context’ and these will point towards a potential fraud or scam event. The positive indicators are often overlooked. However, they can provide vital additional context which counters the negative indicators and which could change the course of a treatment path. To truly understand what treatment path is the most appropriate, both need to be considered.

Removing Functional Silos

To achieve true hyper-personalization, this context needs to be available centrally and to any decision in the customer journey. Fraud solutions within banks and financial services are all too often deployed in isolation from other key touch points in the customer journey, such as originations and customer management. Instead of bringing it all together as a complete end-to-end journey, with complex fraud controls taking place across that journey, they take place separately.

This can be confusing and frustrating for the customer, who will not, for example, understand why a credit card transaction gets declined but a debit card transaction of the same amount doesn’t. Or why the movement of a certain amount of money through Faster Payment is approved, but declined if moved through a wire.

The decisions that are made and the treatments paths that are taken need to be inter-linked and consistent across the multiple levels of the customer’s relationship within an organization.

For example, banks and financial services commonly segment their customers into types such as high net worth, new to bank, regular traveller and connected accounts, to name a few. By incorporating the fraud segmentation at each stage to understand existing fraud exposure (such as prior victim of fraud or scam, prior victim of fraud or scam that was missed, previously declined or challenged, etc.) providers will gain a more enhanced segmented view. This will better inform the next best decision, whether it is about declining or holding payment, as well as how they communicate with the customer and how often.

Make Your Customer a Part of Your Fraud Department

Customers play a key role in the fraud prevention process. Clear, consistent communication is a crucial element for this to work. However, over the last decade the explosion of communication channels and applications has made communication far more complicated. Customers are inundated with messages and response rates have suffered.

Add to this the rise of scams. Now, more than two in three people have received some form of communication that they believe was a scam.

Traditional strategies, like post-transaction verification checks where a standard ‘is this you?’ message is delivered through SMS, are unlikely to be effective. In the case of a scam the person initiating the transaction is the legitimate customer and a simple ‘is this you?’ message can only be met with an affirmative – even if the customer is under the control of a fraudster who may well be coaching them to ignore such messages.

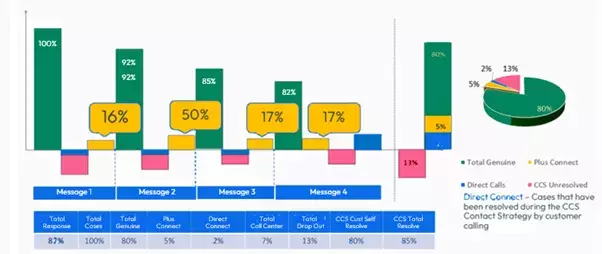

The ‘moments’ of intervention, when there is the opportunity to change a customer’s course of action, are critical to banks and financial services. The channel, clear messaging, the timing and the frequency have to be right. Our work shows that customers are more responsive to a series of timely conversational messages that are clear and relevant, and received through the right channel, rather than a single message that requires a yes or no response. In work with our customers, we see that the right communications strategy for scams prevention sees up to 80% of cases self-resolve as the messages cut through and break the spell cast by the scammer.

By delivering the right message, through the right channel and at the right time, hyper-personalization will enable organizations to cut through the noise and provide customers with exactly what they need. Customers also better understand what is needed of them. This customer experience makes them feel understood and involved in the process.

Conclusion - a Competitive Differentiator

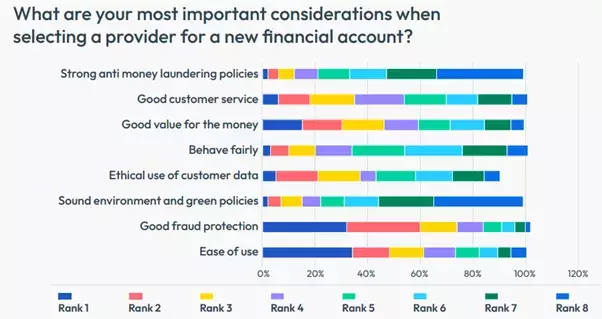

74% of people see good fraud protection as a top consideration above things like ease of use, value for money and good customer service. Providers that introduce hyper-personalized fraud management into the mix will be able to automate more interactions and differentiate themselves from their competitors.

But it means a move away from the reactive and siloed function that fraud management is today, and a continuous assessment of fraud along key points in the customer journey. For this to work well, fraud decisions must be personal to the customer and the situation, and fraud management must be considered simultaneously with authentication and customer experience.

That means getting the right data to the right decisions, asking the right questions and communicating in the right way – to finally achieve that perfect balance between staying safe and delighting customers.

How FICO Helps You Improve Fraud Management

- Read our FICO Annual Fraud Report 2023

- See the results from our FICO 2023 Scams Impact Survey

- Explore our fraud solutions

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.