The Impact of Regulation on Collections and Customer Care

This FICO World presentation highlights the vital importance of balancing customer care with collections success in a highly regulated environment

At FICO World, Tathiana Paredes and I underscored the critical importance of balancing customer care with collections success in an increasingly regulated environment. Our session explored how, in today’s uncertain economic climate, collections departments face mounting challenges — from rising customer arrears to the increasing struggle individuals face in managing the cost of living.

The Regulatory Challenge Collections Operations Face

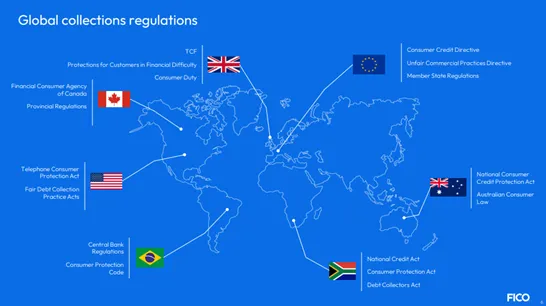

To remain effective, collections operations must adapt to growing volumes while ensuring fair and ethical treatment of customers. This balance is often shaped by regulatory pressures, which increasingly influence collections practices worldwide.

Our presentation highlighted the importance of understanding the regulatory landscape and its implications for collections teams. It emphasized the need for preparedness — not only to manage higher workloads, but also to support customers with compassion and flexibility. Regulatory frameworks frequently mandate such treatment, requiring that customers be viewed as individuals with unique financial circumstances.

A key regulatory focus is the protection of vulnerable customers. Laws like the Fair Debt Collection Practices Act (FDCPA) in the U.S. the Debt Collectors Act in South Africa and the Protection for Customers in Financial Difficultly Consumer Duty in the UK, establish standards that limit excessive contact, prohibit harassment, and emphasize respectful communication. These requirements compel collectors to take a more supportive and ethical approach, transforming collections into financial assistance for those in hardship.

I illustrated this with a case study from a debt charity. Alan, a fictional example, experienced financial strain after losing work and relying on credit cards to cover basic needs. His situation improved when his mortgage provider took time to understand his challenges and referred him to a debt counsellor. This holistic, compliant approach—motivated by regulation—enabled Alan to keep up with priority debts and repay other creditors sustainably.

Global regulations share common themes: Avoidance of unfair treatment, flexibility in approach, and support to help customers return to financial stability. Whenever possible, the goal should be to help customers move out of arrears and onto manageable, long-term repayment paths.

Poor collections practices carry a risk of material regulatory fines and customer redress, which are on a different scale to the cost of implementing the necessary changes. However, the benefits extend beyond regulatory compliance, as more supportive, personalised collections approaches are also proven to provide transformative collections performance impacts.

How FICO Platform Powers Effective and Compliant Collections

FICO Platform is a powerful enabler of effective, customer-centric collections strategies that meet both performance goals and regulatory requirements. It enhances communication, supports compliance, and drives improved outcomes through a combination of advanced analytics, omni-channel engagement, and AI-driven automation.

Omni-Channel Engagement for Customer-Centric Outreach

FICO Platform’s Omni-Channel Engagement capability, allows collections teams to connect with customers across their preferred communication channels—whether via email, SMS, phone calls, or digital apps. This flexibility fosters more meaningful interactions, builds trust, and increases the likelihood of positive repayment outcomes by reaching customers in the ways they’re most comfortable with.

Data-Driven Communications for Better Timing and Tone

FICO Platform uses advanced analytics to inform the timing, frequency, and content of customer communications. By delivering the right message at the right time, collections teams can improve engagement and response rates. The platform also supports compliance by ensuring that outreach remains within regulatory limits and aligns with individual customer preferences—helping organizations avoid over-contact and maintain a respectful tone.

Conversational AI for Scalable, Personalized Service

FICO Platform’s conversational AI capabilities enable dynamic, interactive self-service experiences. This is particularly valuable for digital-native consumers who prefer to manage financial matters through automated, on-demand solutions. Conversational AI improves customer satisfaction while also increasing operational efficiency—boosting self-service adoption and lowering the cost of collections.

Tathiana provided a real-world example from a financial institution in Latin America that emphasized the importance of modernizing collections systems, without jeopardizing customer trust. This compassionate approach increased amounts collected by 37% while reducing cost per promise by up to 75%. Adaptation to modern tools and data-driven strategies also led to 80% of the delinquent portfolio being served in digital channels. In turn, this increase in self-service adoption, delivered faster account collection with a 50% decrease in days to collect and halved the cost to collect.

Conclusion

The regulatory environment surrounding collections is increasingly complex, requiring organizations to strike a careful balance between performance and customer care. FICO Platform plays a critical role in achieving this balance by equipping collections teams with the tools they need to stay compliant, engage customers effectively, and improve outcomes. As regulations evolve, leveraging technology like FICO Platform will be essential for adapting quickly and maintaining ethical, compliant collections practices.

Learn How FICO Can Help You Improve Collections and Meet Regulatory Requirements

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.