Omnichannel Communications Help Banks Serve the Neurodivergent

For neurodivergent people struggling with debt, such as those with ADHD or autism, an omnichannel approach helps them meet payment deadlines and keep debt under control

In a new survey by the UK debt charity StepChange released this month, 97% of neurodivergent respondents — people with autism, ADHS, dyslexia and other conditions that mean their brains function differently than what is “typical” — felt being neurodivergent presented challenges when it came to managing their debt. However, two in three did not seek help from their creditors, mainly because they were overwhelmed or anxious. And the creditors don’t generally know when they are dealing with a neurodivergent borrower, as only about a third of those seeking debt advice reported it.

Neurodivergent people interviewed by StepChange said they faced challenges around making impulsive purchases, tracking incomings and outgoings, missing payment deadlines and reading and responding to communications from creditors. “A lack of channel choice or awareness of the channel options available made it difficult for those with specific preferences or communication requirements,” the report states.

‘There is no ‘one size fits all’ solution when it comes to meeting communication needs,’ the report notes. That’s why the first item on the report’s list of 10 key principles to support inclusive debt management is “Offer a user-centred, omnichannel service to meet communication needs.”

Why Omnichannel Communications Work Better for Neurodivergent People (and Everyone Else)

So how can lenders do a better job helping borrowers manage their debt, and get out of trouble when they fall behind on payments?

FICO clients in retail banking use our omnichannel communications services to reach customers through their preferred channel, reducing the stress on people who are struggling with debt. These services enable lenders to interact conversationally and seamlessly with customers via multiple channels. Customers can also choose to engage on whatever channels work best for them, whenever and wherever they want.

As a result, lenders are able to build customized communication strategies that factor in real-time data, client preferences, regulatory requirements, market conditions, and consumer behavior with the integration of rules-based logic, multi-step workflows, and predictive models and machine learning.

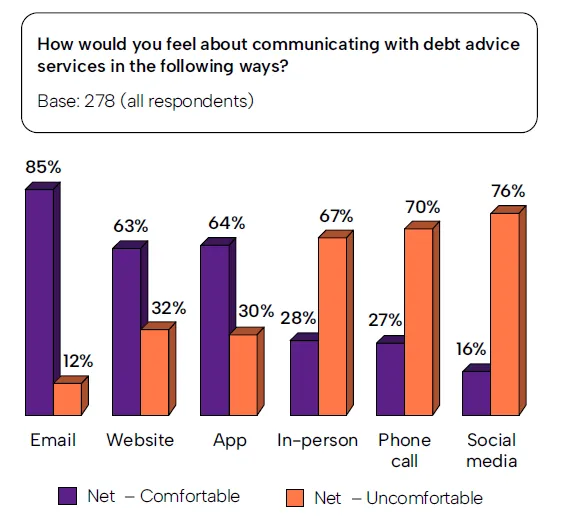

As shown in the chart below, communication preferences vary widely, which is why an individualized approach is critical.

StepChange’s research shows the need has never been greater for omnichannel communications technology. And it’s not just true for neurodivergent people — our clients have demonstrated the great results that come from communicating in the right channel at the right time to each customer. This particularly important in debt collection, as many people find phone calls embarrassing or difficult, but will respond to two-way automated communications that allow them to make promises to pay and set up payment schedules.

How FICO Helps Lenders Use Omnichannel Communications to Improve Results

- Read our white paper Everywhere at Once: The Power and Promise of Omnichannel Communications

- Explore How to Build a Winning Customer Communication Strategy

- Read Collection Strategies: Best Practices for the Digital Age

- Discover our solutions for debt collection and recovery

- Read our brief: Compassionate collection is good, bottom line

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.