Collection Strategies: Best Practices for the Digital Age

Omni-channel communications, analytics and optimization are bringing greater targeting to debt collection strategies, improving results and customer relationships

In today's value-based approach to transforming business using digital platforms, just putting in place new and flashy digital technologies is simply not enough. Real transformation needs to take place. It starts with realigning organizational structure, culture, engagement models and competencies across the organization.

Why is this critical now? Given the environment of rising interest rates, high levels of unemployment, escalating food and energy prices, many people are under pressure and late payments are rising. They're facing extraordinary financial headwinds and struggling to service their debt on home loans, vehicle loans, credit cards and overdrafts. At the same time, there are significant decreases in disposable income.

Understanding Modern Collection Strategy Fundamentals

A successful collection strategy in today's environment requires a comprehensive understanding of multiple factors that influence debtor behavior and collection outcomes. Modern collection strategy design must consider event severity, value, duration, recency, customer intent, and both ability and willingness to remediate debt situations. Also, in many markets regulators have recently put a strong focus on fair outcomes that take into account debtor’s financial capacities.

Financial institutions need to move beyond traditional approaches and develop collection strategies that are both data-driven and customer-centric. This means leveraging advanced analytics to segment portfolios effectively and implementing targeted approaches based on specific debtor profiles and circumstances.

Why Collection Strategy Design Requires Continuous Evolution

The landscape of debt collection is constantly evolving, making it essential for organizations to regularly revisit and redevelop their collection strategies. Several key factors drive this need for continuous strategy evolution.

Debtor Evolution and Behavioral Shifts

Understanding current spending and repayment trends for each client and product portfolio is crucial for effective debt allocation. Consumer behavior has shifted significantly, particularly with the rise of digital-first interactions and changing economic pressures. Collection strategies must adapt to these evolving debtor profiles and preferences.

Modern debtors exhibit different communication preferences, payment behaviors, and financial management approaches compared to previous generations. They expect personalized interactions, multiple payment options, and respect for their circumstances. Collection strategies must evolve to meet these expectations while maintaining effectiveness.

Economic and Regulatory Adaptation

Changes in regulation require immediate adjustment to contact approaches and collection methodologies. Economic fluctuations influence debt dynamics and directly impact debtors' ability to repay. A robust collection strategy must be flexible enough to adapt to these external changes while maintaining compliance and effectiveness.

Recent regulatory changes have emphasized fair treatment of customers in financial difficulty, requiring collection strategies to incorporate more sophisticated assessment mechanisms for hardship and vulnerability. Organizations must ensure their strategies remain compliant while achieving collection objectives.

Technology Integration and Automation

The rapid advancement of collection technology creates both opportunities and challenges for strategy development. Organizations must continuously evaluate new technologies and integrate them into their collection strategies where appropriate, while ensuring that human elements remain where they add the most value.

Automation capabilities have expanded significantly, enabling organizations to handle routine collection activities more efficiently while freeing up human resources for complex cases requiring personalized attention. Collection strategies must balance automation with human interaction to optimize outcomes across different debtor segments.

The Strategic Framework for Collection Strategy Design

When developing a collection strategy, organizations must begin with the decision outcome in mind. This fundamental principle ensures that every element of the strategy aligns with specific business objectives, whether the goal is to increase returns, build customer trust, reduce risk of account deterioration, or achieve multiple outcomes simultaneously.

Understanding the priority of objectives is equally crucial. For instance, collectors working with high-value accounts may prioritize relationship preservation over immediate payment collection, while those handling smaller accounts might focus on efficiency and automation. This strategic clarity forms the foundation for effective collection strategy implementation across different portfolio segments.

Data-Driven Collection Strategy Development

Making decisions that can impact the success of your business comes down to good use of information. More information allows for more informed and better decisions. Accurate, relevant, current and detailed data is essential for designing effective collection strategies.

When reviewing data requirements for collection strategy development, organizations must consider several critical elements:

Timeframes and Performance Windows

Identifying the period of time used as a gauge for decision-making is fundamental. Most collection strategy projects pull data from a previous observation date and review performance at a later performance date. Having multiple observation and performance snapshots available in your dataset allows for building more stable strategies that can be appropriately segmented.

Data Quality and Completeness

The effectiveness of any collection strategy depends heavily on the quality and completeness of underlying data. Organizations must invest in data cleansing, validation, and enrichment processes to ensure their strategies are built on reliable information foundations.

Real-Time Data Integration

Modern collection strategies require real-time data feeds that enable dynamic decision-making. This includes payment behavior updates, communication behavior and preferences, financial status changes, and external economic indicators that might affect debtor circumstances.

Advanced Analytics in Collection Strategy Design

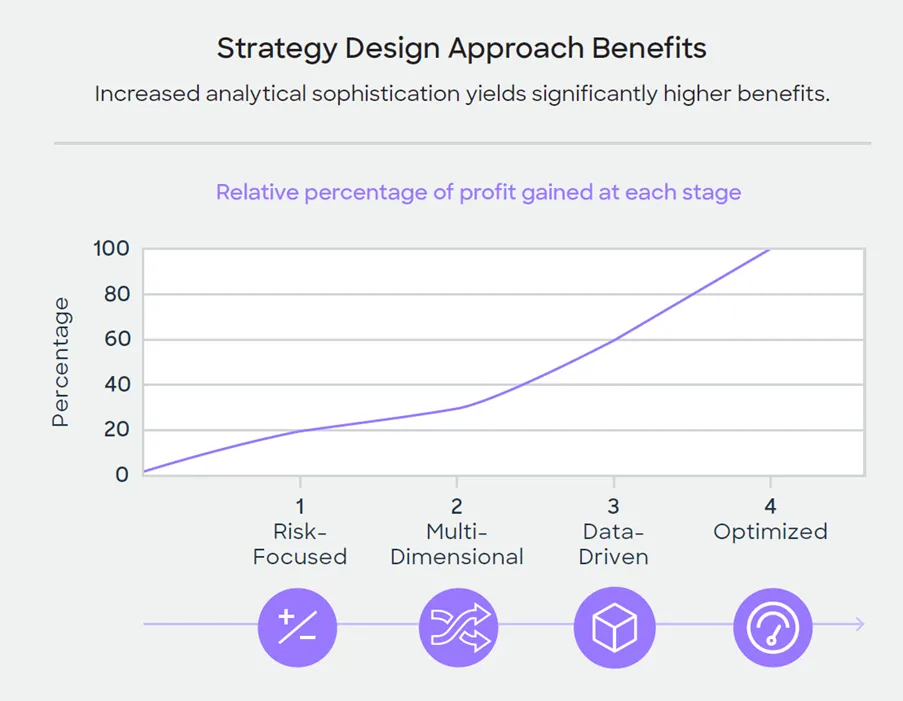

The evolution toward data-driven collection strategies has created significant opportunities for organizations willing to invest in advanced analytics capabilities. Increased analytical sophistication yields significantly higher benefits, with optimization representing the pinnacle of strategic effectiveness.

- Multi-Dimensional Analysis: Moving beyond simple risk-focused approaches, effective collection strategies incorporate multi-dimensional analysis that considers customer value, relationship history, payment patterns, communication preferences, and external economic factors. This comprehensive view enables more nuanced and effective collection approaches.

- Predictive Modeling Capabilities: Advanced collection strategies leverage predictive modeling to forecast payment behavior, optimal contact timing, and most effective collection actions. These models continuously learn from outcomes and adapt to changing portfolio characteristics and economic conditions.

- Machine Learning and Optimization: The integration of machine learning algorithms allows collection strategies to identify patterns and relationships that might not be apparent through traditional analysis methods.

- Decision Optimization: Sophisticated approaches model debtors’ reactions to applied collection treatments and allow a detailed quantitative understanding of trade-offs between competing targets such as cure rate, roll rate and operational costs. This allows you to scientifically derive a strategy that leads to optimal results in terms of a certain KPI, while honoring limits for alternative metrics.

Realigning Yesterday's Collections Structure to Meet Today's Needs

Significantly higher volumes of accounts are entering collections, which inevitably puts pressure on operations, forcing many clients to rethink their operating models. Organizations are dealing with questions around insource versus outsource, digital versus dialer, restructure versus legal approaches.

Performance Variables in Collection Strategy Design

When developing effective collection strategies, organizations must focus on comprehensive performance variables that go beyond simple risk assessment. These variables should evaluate multiple outcomes including proportion of debt repaid, cost of collection operations, revenue generation, profit optimization, customer retention rates, and compliance scores.

Understanding that outcomes such as recovered percentage may have an inverse relationship with the amount of debt is crucial. Simply assigning the most expensive collection actions to the highest debts may not yield the highest recovery rates. Successful collection strategy design requires a holistic view that customizes features around specific portfolio characteristics.

Customer Experience as a Strategic Priority

Customer experience is becoming a key focal point in collection strategy development. Historically, customer experience has been a key driver during the onboarding process, but organizations are realizing that applying the same approach to collections is also proving a successful route to maximizing the lifetime value of customers.

Many organizations are opting for a far more customer-centric approach, with more focus being placed on preferences and understanding a customer's specific needs, while providing solutions that are suitable for both the customer and the lender's risk appetite.

This shift toward customer-centricity in collection strategies involves:

- Personalized Communication Strategies: Tailoring communication approaches based on individual customer preferences, communication history, and demonstrated responsiveness to different message types and channels.

- Hardship identification: Target evaluation of the customer situation identifying eventual vulnerabilities and hardship and assessing the financial capacity of the debtor.

- Flexible Payment Solutions: Offering various payment options that accommodate different financial situations, including extended payment plans, reduced settlement options, and alternative payment methods that align with debtor capabilities.

- Proactive Engagement: Implementing strategies that reach out to customers before they fall into significant delinquency, offering assistance and alternative arrangements that prevent account deterioration.

Digital Transformation in Collection Strategies

The digital transformation of collection strategies encompasses multiple dimensions that organizations must address comprehensively:

Omnichannel Integration: Modern collection strategies must seamlessly integrate across multiple communication channels, providing consistent experiences whether customers interact via phone, email, text message, mobile app, or web portal. Each channel should provide accurate, up-to-date account information and enable customers to take action toward resolution.

Self-Service Capabilities: Implementing robust self-service options allows customers to manage their accounts, make payments, set up payment arrangements, and communicate with collection teams on their own terms. This approach reduces operational costs while improving customer satisfaction and engagement.

Real-Time Decision Making: Collection strategies must incorporate real-time decision-making capabilities that can adjust approaches based on current customer circumstances, recent payment behavior, and external factors that might influence collection outcomes.

Two-Way Digital Dialogue Will Always Speak Volumes to Customers

The shift from traditional one-way communication to interactive digital dialogue represents a fundamental change in collection strategy approach. Modern debtors expect personalized, respectful communication that is available 24/7, acknowledges their individual circumstances and provides flexible resolution options.

In the past, customer communications were there to take stock of accounts in collections and target them with more or less specific campaigns. While there may have been some one-directional digital channels like text or email, the bulk of activity was underpinned by a big dialer, which is still prevalent in many markets.

Despite its commercial popularity, it has subsequently proved not to be the best channel to speak to customers – highlighted by consumer activity at the height of the pandemic. But now, the industry is moving on at pace with technological step-changes in stronger analytics, faster, smarter omnichannel engagement, data streaming and real-time triggers, contacting customers at the best time to engage rather when there is capacity in the call center. All of these help inform the most appropriate strategy execution by leveraging data and analytics with optimization to deliver the right solutions in place.

Auto-Resolution and Customer Self-Service

Auto resolution quickly becomes attainable at scale by enabling customers to self-serve at any time thanks to orchestrated, bi-directional omnichannel solutions. This capability transforms the traditional collection model from one that relies heavily on agent intervention to one that empowers customers to resolve their situations independently while maintaining access to human support when needed.

Modern collection strategies must consider the customer's preferred communication channel and timing, providing options that fit within their daily routines and preferences. This might include evening text message reminders for customers who work during traditional business hours, or email communications for those who prefer written documentation of their payment arrangements.

Testing and Optimization in Collection Strategy

Challenger Strategy Implementation

Developing good practices around treatments and testing new approaches through challenger strategies are crucial steps in determining the best actions to take. Significant insights can be gained during strategy design through systematic testing of different approaches across comparable portfolio segments.

For example, a U.S. retailer once rejected new authorizations on delinquent accounts. By creating a challenger strategy that identified low-risk but late-paying customers, the company allowed new authorizations on selected accounts. The result? Millions of dollars in incremental sales in just one month, sales that would have been lost under the old approach.

The ability to combine policies with data-driven splits is crucial to solid strategy design, as is the ability to view multiple performances side by side to compare segments. Both help users adjust splits more effectively and then assign appropriate treatments based on objectives.

A/B Testing Framework

Implementing robust A/B testing frameworks allows organizations to compare different collection approaches scientifically, measuring not only immediate collection outcomes but also customer satisfaction, complaint rates, and long-term relationship impacts.

Control Groups and Statistical Validation

Maintaining appropriate control groups and ensuring statistical significance in testing results prevents organizations from implementing changes based on random variation rather than genuine improvement in collection strategy effectiveness.

Continuous Improvement Methodologies

Collection strategies must incorporate continuous improvement methodologies that systematically evaluate performance and identify optimization opportunities. This includes regular strategy reviews, performance benchmarking, and integration of lessons learned from both successful and unsuccessful collection attempts.

Organizations should establish feedback loops that capture insights from front-line collection staff, customer feedback, and operational metrics to continuously refine their strategies. This iterative approach ensures that collection strategies remain effective as portfolio characteristics and economic conditions evolve.

Future-Focused Collection Strategy Development

Predictive Analytics: Advanced predictive models can forecast payment behavior, optimal contact timing, and most effective collection messages based on historical performance data and external economic indicators.

Mathematical Optimization: This technology applies advanced analytics to determine the best decision strategy, based on goals and constraints. For example, loan restructure optimization uses mathematical optimization to identify which customers should receive a restructure offer, and which offer should be made. It balances the need to increase loan Net Present Value with take-up probability and re-default rates. Because it can balance multiple objectives and constraints, it’s better than simplistic restructure campaigns based on a couple of polices, and avoids high re-default rates caused by judgmental selection of the right restructure solution.

Artificial Intelligence and Machine Learning Integration: The future of collection strategy lies in the sophisticated application of artificial intelligence and machine learning technologies that can process vast amounts of data to identify the best collection approaches for individual accounts. These technologies enable dynamic treatment adjustment based on real-time data and changing customer circumstances.

Natural Language Processing: Integration of natural language processing capabilities enables more sophisticated analysis of customer communications, identifying sentiment, intent, and circumstances that inform optimal collection approaches.

Regulatory Technology Integration: As regulatory requirements become more complex and stringent, collection strategies must incorporate regulatory technology (RegTech) solutions that ensure compliance while maintaining collection effectiveness. This includes automated compliance monitoring, documentation of customer interactions, and real-time assessment of regulatory requirements across different jurisdictions.

Building Resilient Collection Strategies

Economic Adaptability

Collection strategies must be designed with economic adaptability in mind. This includes stress-testing strategies against various economic scenarios and building flexibility into treatment allocation and escalation processes.

Scenario Planning: Developing collection strategies that can function effectively across different economic conditions ensures organizational resilience and maintains collection performance during challenging periods.

Dynamic Portfolio Management: Implementing dynamic portfolio management capabilities allows organizations to reallocate resources and adjust strategies based on changing portfolio performance and external economic factors.

Long-Term Relationship Focus

Modern collection strategies must also balance immediate collection objectives with long-term customer relationship value. This involves considering the lifetime value of customers when designing collection approaches and ensuring that collection activities support rather than undermine ongoing customer relationships.

Customer Retention Metrics: Incorporating customer retention and satisfaction metrics into collection strategy evaluation ensures that short-term collection gains don't come at the expense of long-term customer value.

Rehabilitation Programs: Developing comprehensive rehabilitation programs that help customers restore their financial standing while maintaining positive relationships with the organization creates win-win outcomes that support both collection objectives and customer loyalty.

Taking Collection Strategies from Standard to Best Practice

Let's look at where most collections strategies are now and what the future should look like.

Standard Collections Strategies

- Basic analytics –bureau scores, behavior score, predicted roll to default, originations score for new customers.

- Product-level view – with minimal to no view of other product holdings or history of collections activity on those products.

- Campaign structure – this is the focus, still driven by month-end decisioning and working in 30-day blocks. The dialer has become the decision engine!

- Multichannel – multiple independent channels with no integrated dialogue between the differing messages, resulting in hectoring of customers.

- Policy rules OK – the lack of analytic insights and data-driven rules means policies are used as a safety net.

- Limited forbearance tools – predominantly term extension, no ability to use the differing instruments of restructure – interest, arrears, principal, term, step ups, balloons, settlement.

Advanced Collection Strategies

- Cycle-specific predictive analytics – used from cycle to cycle or better to avoid IFRS9 stages. We recommend more analytics focused on predicting in-cycle customer behavior to drive strategies for digital, dialer and placement.

- Customer centric:

- View – all products and relationship data, allowing for a fully rounded view,

- Events – synergy of treatment and relevance if holding more than one product.

- Engagement – communication pulse across all activity, not just collections.

- Forbearance treatments based on reason for delinquency, duration of impact and disposable income – true understanding of the customer’s circumstances.

Best Practice Collection Strategies

- Real-time prescriptive decisioning – driving best next action and extending across the in-house and outsourced collection treatments.

- Optimization – the most optimal decision targeted at an objective goal with quantification of constraints, across contract strategies, forbearance treatments and restructure, as well as work/place/sell decisions in recoveries.

- Bi-directional auto resolution – let those that will self-serve do so, efficiently, conveniently, with confidence and trust. Aim for full self-serve forbearance.

- Dynamic forbearance – how dynamic can you be to retain future good customers? From payment breaks and arrears capitalization to house swap to repo avoidance optimization.

Conclusion: The Strategic Imperative for Modern Collections

The collections industry stands at a critical juncture where traditional approaches are becoming obsolete, and new, digitally enabled strategies are essential for success. Organizations that embrace data-driven collection strategy design, prioritize customer experience, and maintain flexibility to adapt to changing conditions will emerge as leaders in this evolving landscape.

As economic pressures continue to challenge both lenders and borrowers, the organizations that thrive will be those that can implement sophisticated, data-driven collection strategies that demonstrate empathy for customer circumstances while maintaining the discipline necessary to protect organizational financial health.

How FICO Platform Can Advance Your Digital Debt Collection Strategies

- See our solutions for debt collection and recovery

- Explore the power of FICO® Platform

- Learn how to Boost your Debt Collections Performance with FICO Platform

- Read 4 Best Practices in Collections Strategies

- Download the white paper Best Practices for Strategy Design in Collections

- Read our brief: Compassionate collection is good, bottom line.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.