Student loan borrowers at risk of delinquency when payments resume

Student loan borrowers already exhibiting higher delinquency rates than they did pre-pandemic on some credit products

In response to the pandemic, Congress passed the CARES Act to provide financial assistance for those impacted by COVID-19. Federal student loan repayments were suspended with zero percent interest, and collections were stopped on student loan defaults. As a result, approximately 40 million consumers have not been required to make student loan payments since March 2020.

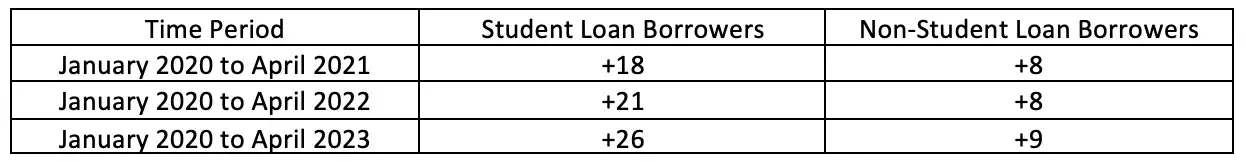

Student loan forbearance, the interest-free federal payment pause, has likely played an important role in the improvement of FICO® Scores for student loan borrowers. Since the start of the pandemic, student loan borrowers’ credit score improvement outpaced the improvement in score observed for the rest of the population. Student loan borrowers represent approximately 20% of the total FICO scorable population, and have increased their average credit score by 26 points since January 2020, while non-student loan borrowers increased their average credit score by 9 points, as seen in Figure 1.

Figure 1: Change in Average FICO® Score 8 Since January 2020

It is worth noting that as of January 2020, the average credit score for student loan borrowers was 663, while the average credit score for non-student loan borrowers was 716, so student loan borrowers had more potential for score improvement. Lower scoring student loan borrowers experienced a particularly notable improvement in credit scores, as seen in Figure 2: over 17% of student loan borrowers had a credit score less than 550 as of January 2020, but by April 2021 that percentage had dropped to 10% and sits at just 7% as of April 2023.

Figure 2: FICO Score 8 distribution for student loan borrowers

This uptick in student loan borrowers’ scores on the lower end of the credit score spectrum is at least partly due to the student loan payment pause being especially helpful to consumers who were delinquent or about to go delinquent on their student loan repayment near the start of the pandemic. With student loan forbearance, borrowers no longer had to make monthly student loan repayments, and there were no new delinquencies reported on their federal student loans. This is noteworthy since payment history is the most important FICO Score category, making up 35% of the credit score calculation.

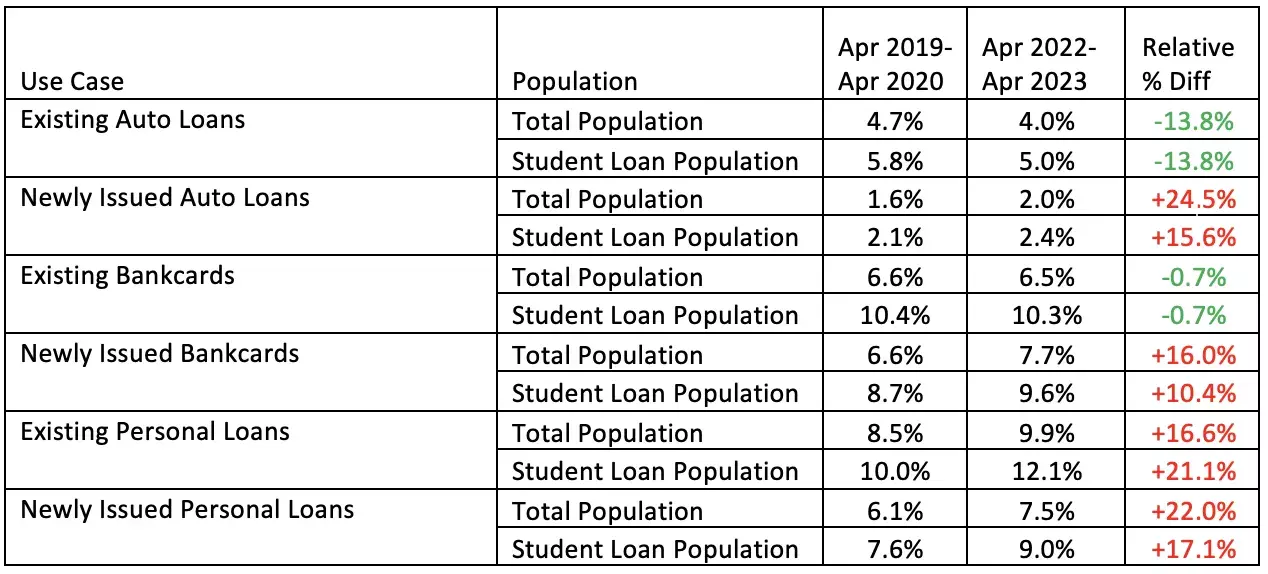

On the other hand, most forbearance and repayment accommodations programs associated with other credit products have ended. Default rates on non-student loan credit obligations are generally higher now than they were during a benchmark pre-pandemic performance period, as shown in Figure 3.

Figure 3: Report-level 90+ day delinquency rates over time1

Severe delinquency rates on newly issued accounts are up across other credit products (bankcards, auto loans, and personal loans) in comparison to the pre-pandemic benchmark. The data in Figure 3 also shows that student loan borrowers have higher delinquency rates across credit products than non-student loan borrowers, and that uptick in default rates relative to the pre-pandemic benchmark is similarly observed for both the student loan population and the total population.

As student loan forbearance comes to an end, the Department of Education has proposed a 12-month “on-ramp” for student loan borrowers. If the on-ramp is implemented, missed payments on federal student loans would not appear on credit reports until December 2024. If student loan borrowers need to make a choice between making a payment for their home, car, credit card, personal loan, or federal student loan, they may opt to miss their federal student loan repayment. This could be motivated both by borrower perception that they need the other credit account (or the asset secured by continued payment of that account) more, as well as the fact that any missed student loan repayments won’t impact credit reports and credit scores until the end of 2024 at the earliest. So at least in the near term, it is possible that we won’t observe a spike in reported delinquencies for student loan borrowers simply because the student loan payment pause has ended.

Stay tuned for a follow-up blog on this topic, where we will dive deeper into how student loan borrowers have managed their debt during the student loan payment pause. This is critical to borrower credit scores, as ‘amounts owed’ is the 2nd most important category of the FICO Score, at nearly 30% of the overall FICO Score calculation. We’ll analyze how student loan borrowers’ debt has changed since the start of the pandemic and how credit scores have been and could be impacted.

1 Existing accounts were opened as of the start of the performance period. For the April 2022-2023 performance period, this reflects accounts opened in April 2022 or earlier. Newly issued accounts were opened in the first three months of the performance period. For the April 2022-2023 performance period, this reflects the May 2022 – July 2022 vintage.

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.