Survey: Banks Face Regulatory Changes, Increased Liability for Scam Fraud

Banks face increasing scam liabilities worldwide as regulators change reimbursement requirements, while consumers signal willingness to complain to regulators and banks

In my last couple of posts, I’ve explored both consumer expectations for scam protection and the global impact of scams for consumers and their families. Both are changing as fraudsters use more and more tactics to try and scam people out of their money, and consumers are increasingly vocal to both banks and regulators about their plight. Given the shifts in the regulatory environment globally, it appears that those voices are being heard – and being heeded.

In October 2024, the UK’s Payment Systems Regulator (PSR) set a critical precedent by introducing new regulation that splits liability for victims of real-time payments (RTP) scams 50/50 between the sending and receiving banks. Worldwide, banks are taking note because scams are on the rise and many consumers believe banks should be held liable and also expect reimbursement if they lose money to a scam.

New Rules: UK, Singapore, Australia Lead Regulatory Changes

Under the UK’s new rules, the sending and receiving banks split the reimbursement evenly. Customers can be reimbursed up to £85,000 in losses and are to be refunded within 5 days of reporting. But the UK isn’t the only geography where the regulatory authorities are making changes based on the prevalence and increase in scams.

In Singapore, a new collaborative approach known as the Shared Responsibility Framework (SRF) clearly outlines the responsibilities “for losses arising from a defined scope of phishing scams under the SRF, and the operational workflow for consumers to report such scams.” According to this recent Deloitte article, the guidelines and the framework:

[O]utline shared responsibility for phishing scam losses among FIs, Telcos, and consumers. It applies to those holding customer funds and providing communication infrastructure. The framework specifically targets phishing scams that manipulate consumers into revealing sensitive information through impersonation of legitimate entities. While it aims to enhance consumer protection against these digital scams, it does not cover malware-enabled or non-digital scams, focusing instead on digital fraud and acknowledging the variety of fraudulent activities.

This new framework also has a waterfall approach to liability, starting with the financial institutions, followed by telecommunications providers, with final responsibility and liability falling to the individual consumer “if both the FI and the Telco have performed their respective tasks and complied with their obligations.” Singapore also recently passed a new law giving police the power to order banks to restrict transactions if they reasonably believe that the account holder will make a transfer as a part of a scam.

In Australia, there is a new Scam Prevention Framework Bill under consideration that would codify the principles and obligations for financial institutions and other regulated entities, as well as define the levels of penalty that non-compliant organizations would face. The proposed regulation is different from the UK in that liability would extend beyond financial institutions to include social media companies and telecommunications providers.

Most Consumers Expect Reimbursement

Specifics aside, it’s abundantly clear that around the globe regulators are taking note of the impact that scams are having on financial institutions and consumers alike. Consumers are changing their expectations as well and seem to agree that banks should hold more liability for scam losses.

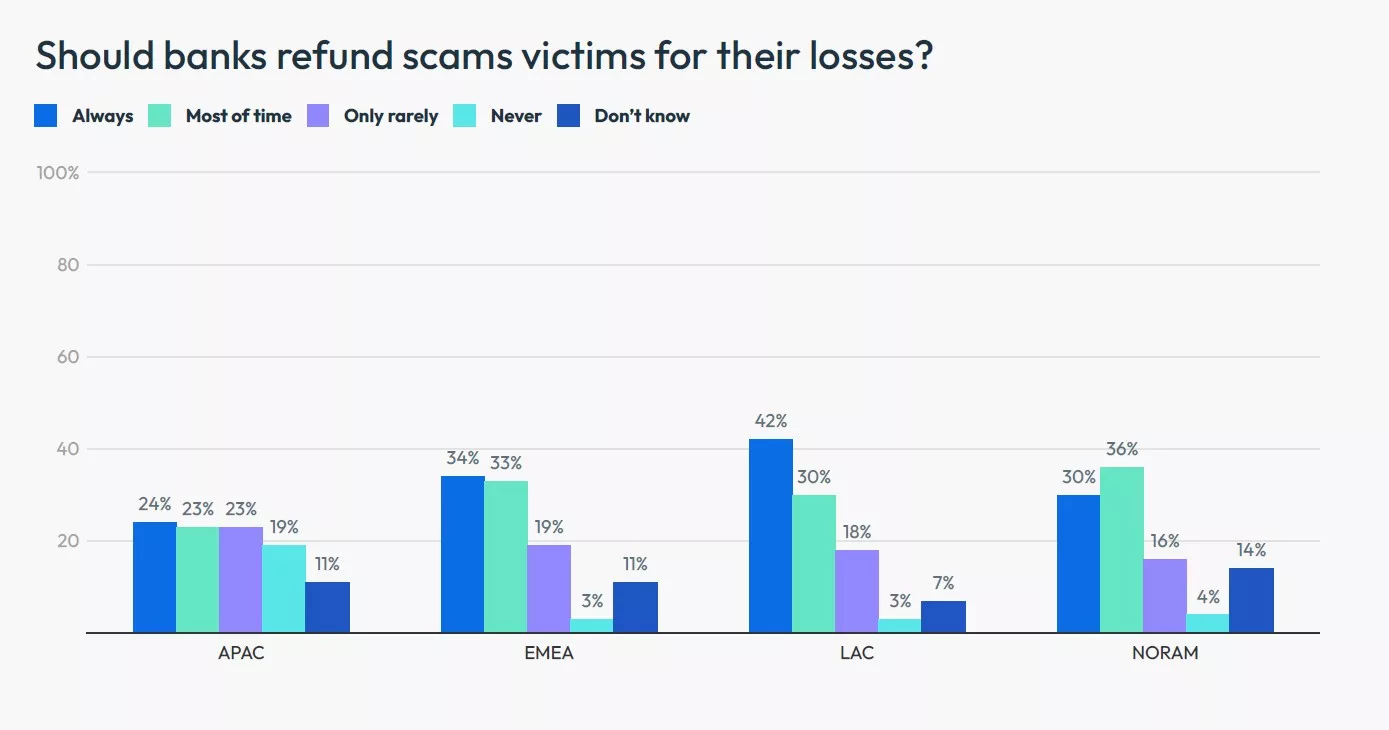

We know from FICO’s 2024 Global Scams Impact Survey that on a global basis, 65% of consumers globally say banks should be responsible for refunding scams victims always (34%) or most of the time (31%). This varies by region, but only in APAC, with 47%, do fewer than two-thirds of consumers say banks should reimburse scams victims always or most of the time.

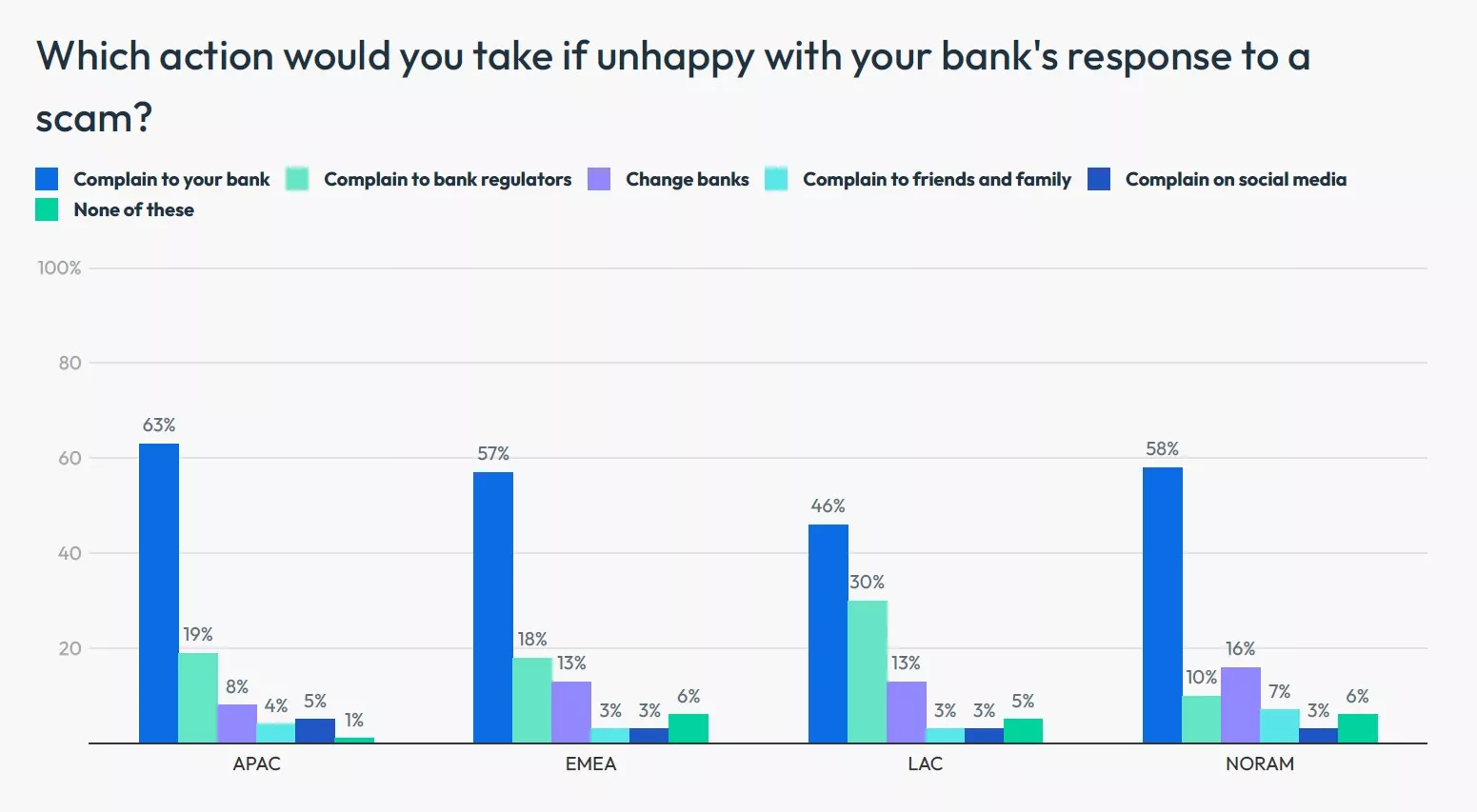

Our survey also shows that a substantial number of consumers are willing to complain to regulators if they are unhappy with how their banks manage RTP scams. Globally, 21% of consumers say they would complain directly to regulators if they were unhappy with their bank’s approach to managing scams. In NORAM 10% of consumers would engage the regulatory authorities, while 30% of consumers in LAC would do the same. These numbers held steady in every region since 2023.

Regulators have begun to listen, as the new fraud laws and proposals clearly show. There is now a precedent and a working model from the UK where both the sending and receiving banks are responsible for compensating scam victims, while more industries are being added to the accountability chain in other regions. But what can banks do to prevent scams in the first place, without waiting for regulatory impetus?

Banks Can Lead the Fight Against Scams

Banks have an opportunity right now to take the leadership role in the fight against scams. With the right strategy and technology, they can not only reduce the occurrence of scams and losses but also differentiate themselves with a superior customer experience when it comes to detecting, preventing, and reconciling RTP scams.

One key approach is to leverage patented, real-time, machine learning powered detection models that differentiate potential scam transactions from unauthorized transactions that may be the result of third-party or account takeover (ATO) fraud. Another strategy is to engage customers in their preferred channel when sending alerts or confirming transactions, and document all information in the customer’s profile for future reference.

Scam tactics and techniques continue to evolve. Banks must use constant vigilance and adaptation to stay one step ahead of the scammers in order to prevent reputational damage, regulatory concerns, and customer losses. The right strategy, combined with the best technology, can help protect both banks and consumers well into the future.

How FICO Helps Fight Fraud from Scams

- Review the FICO 2024 Global Scams Impact Survey

- Learn more about FICO’s award-winning scam detection model

- Engage in real time with FICO’s Customer Communications Services for Fraud

- Read the reports on our scam survey by country:

Follow me on LinkedIn for more insights about FICO’s innovative fraud fighting efforts.

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10 T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10 T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.