UK Cards Data Reveals Fall in Spending but Rise in Balances

Lenders should keep a close eye on credit card delinquencies, which saw a 10.4% increase in the percentage of customers missing one payment in May

Our latest UK credit card data provides stark evidence that consumer financial confidence remains low.

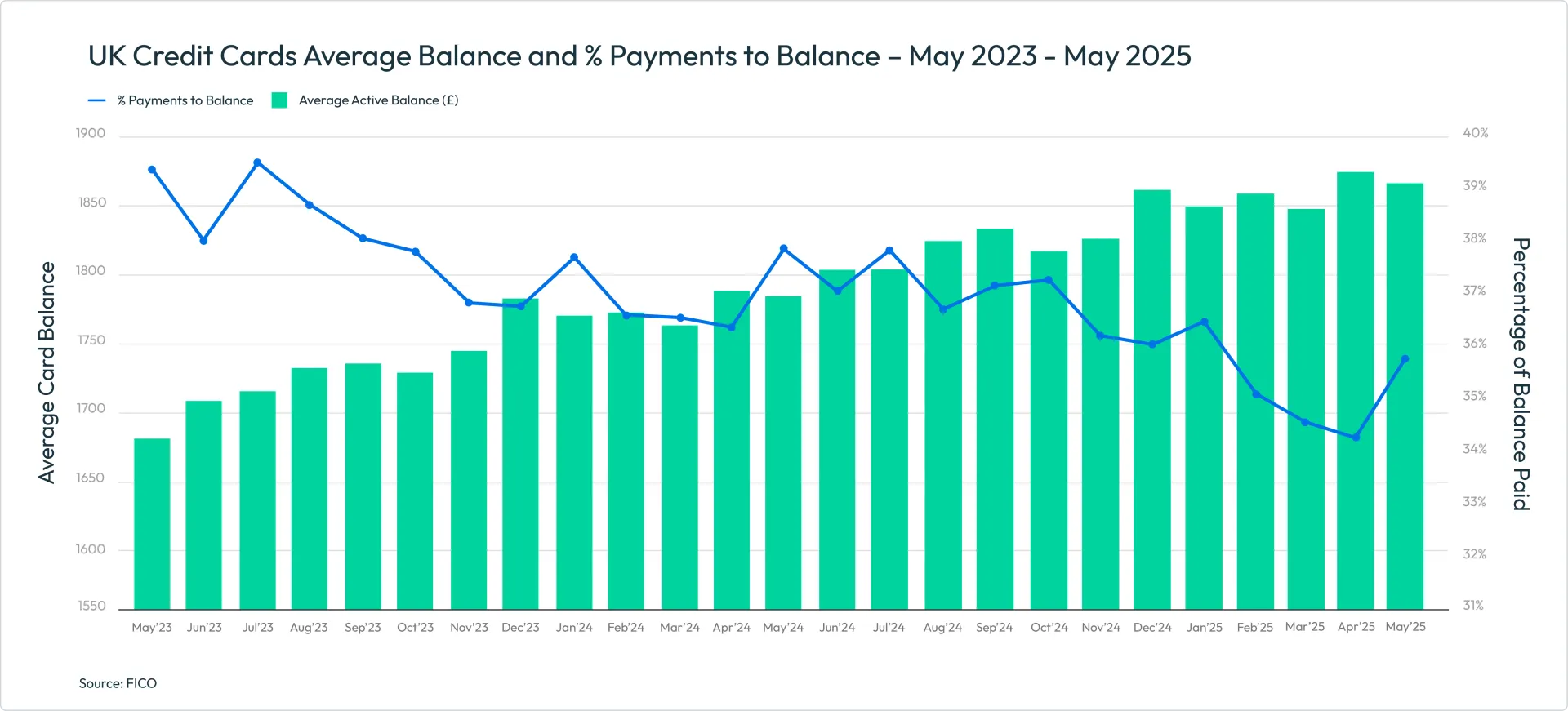

Sales tend to decrease after the Easter holidays, and indeed spending fell by 4.1% month-on-month and 1.7% year-on-year, to an average of £790. However, with the percentage of overall balance paid dropping by 5.8% year-on-year, balances have risen by 4.7% compared to May 2024, which will be a concern for lenders, as it suggests consumers are not able to clear as much of their credit card debt. The percentage of balance paid is also trending downwards year-on-year by 5.8%. Another critical sign of financial difficulty is the percentage of customers using credit cards to take out cash, which has increased month-on-month by 2.5%.

Highlights of UK Credit Card Performance

- Spending fell by 4.1% month-on-month and 1.7% year-on-year

- Balances fell slightly compared to April, to £1,865 but remain 4.7% higher year-on-year

- Percentage of overall balance paid has increased by 4.7% month-on-month to 35.6%, but is 5.8% lower year-on-year

- Year-on=year, missed payments have fallen across all delinquency periods

- The average balance on one missed payment accounts has increased 2.4% compared to April, and 7.2% year-on-year

- Customers using credit cards to take out cash increased for the second month in a row, by 2.5%

Key Trend Indicators UK Cards – May 2025

| Metric | Amount | Month-Month Change | Year-Year Change |

| Average UK Credit Card Spend | £790 | -4.1% | -1.7% |

| Average Card Balance | £1,865 | -0.4% | +4.7% |

| Percentage of Payments to Balance | 35.59% | +4.7% | -5.8% |

| Accounts with One Missed Payment | 1.43% | +10.4% | -12.4% |

| Accounts with Two Missed Payments | 0.29% | -9.6% | -8.1% |

| Accounts with Three Missed Payments | 0.21% | +3.9% | -6.0% |

| Average Credit Limit | £5,855 | +0.2% | +2.9% |

| Average Overlimit Spend | £95 | +3.3% | +5.6% |

| Cash Sales as a % of Total Sales | 0.85% | +2.3% | -3.7% |

Source: FICO

Lenders will also want to keep a close eye on delinquencies, as May saw the erratic patterns of 2025 continuing:

- After the significant 22.1% drop in April 2025, May saw a 10.4% increase in the percentage of customers missing one payment. Year-on-year, there has been a 12.4% decrease.

- For customers missing two payments, there has been a 9.6% decrease month-on-month and 8.1% year-on-year.

- However, the percentage of customers missing three payments increased month-on-month by 3.9%.

When comparing the ratio of the average delinquent balance to the overall balance, this ratio is slightly trending upwards, indicating that missed payment balances are increasing at a faster rate. Lenders may wish to review balance segmentation in risk strategies, as goods and services that cost £2,000 in 2020 would cost £2,350 today. They may also want to consider adopting or reviewing pre-delinquency strategies in order to identify and proactively act on customers before they get into financial trouble.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends 2023-2024: More Spend and Delinquencies

- Read more posts on UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Average U.S. FICO® Score stays at 717 even as consumers are faced with economic uncertainty

Inflation fatigue puts more borrowers under financial pressure

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.