UK Cards Data Shows Rise in Delinquencies, First-Party Fraud Risk

In data on UK credit cards, FICO sees a rise in customers missing three payments, and signs of growing first-party fraud

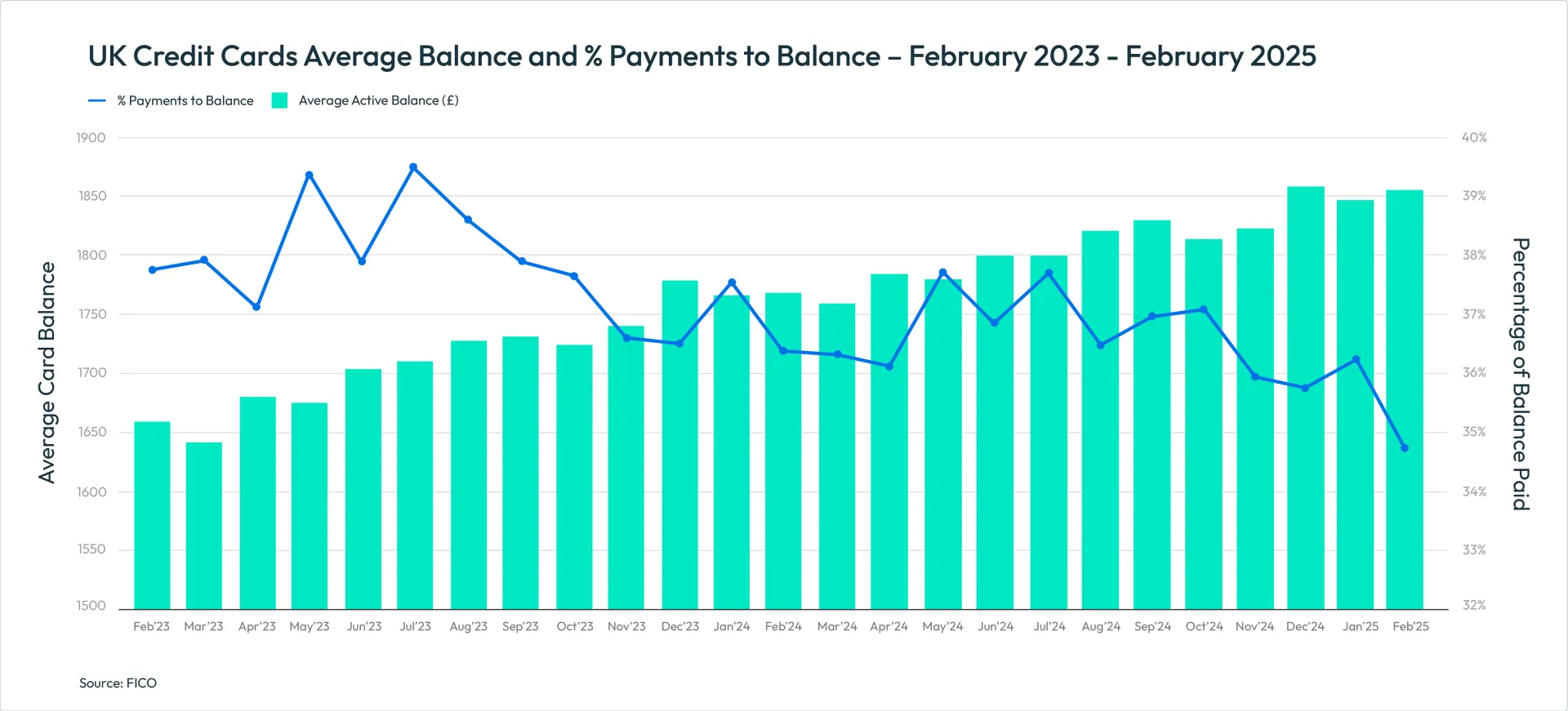

While the trends for UK credit cards in January and February followed the usual trends, with spending falling in January and rising in February, we also observed increases in missed payments across one, two and three months. In particular, there is a persistent rise in customers missing three payments.

Key Trend Indicators UK Cards – January 2024

| Metric | Amount | Month-Month Change | Year-Year Change |

| Average UK Credit Card Spend | £765 | -10.9% | -1.0% |

| Average Card Balance | £1,850 | -0.6% | +4.6% |

| Percentage of Payments to Balance | 36.33% | +1.3% | -3.4% |

| Accounts with One Missed Payment | 1.53% | +4.6% | -9.0% |

| Accounts with Two Missed Payments | 0.35% | +13.3% | -2.9% |

| Accounts with Three Missed Payments | 0.21% | +1.8% | -0.8% |

| Average Credit Limit | £5,800 | +0.1% | +2.9% |

| Average Overlimit Spend | £90 | -2.2% | +4.7% |

| Cash Sales as a % of Total Sales | 0.82% | +14.9% | -4.5% |

Source: FICO

Key Trend Indicators UK Cards – February 2024

| Metric | Amount | Month-Month Change | Year-Year Change |

| Average UK Credit Card Spend | £790 | +3.1% | +0.5% |

| Average Card Balance | £1,860 | +0.5% | +5.0% |

| Percentage of Payments to Balance | 34.87% | -4.0% | -4.4% |

| Accounts with One Missed Payment | 1.35% | -12.0% | -10.2% |

| Accounts with Two Missed Payments | 0.33% | -7.6% | +0.1% |

| Accounts with Three Missed Payments | 0.21% | +1.4% | -1.2% |

| Average Credit Limit | £5,805 | +0.1% | +2.8% |

| Average Overlimit Spend | £90 | +1.1% | +5.8% |

| Cash Sales as a % of Total Sales | 0.82% | +0.3% | -3.9% |

Source: FICO

Highlights of UK Card Data Patterns

- Average credit card spending fell by 11% month-on-month in January (£765) but rose by 3% in February to £790

- January average balances fell by 0.6% month-on-month but rose by 0.5% in February, with the higher cost of living evident in a year-on-year increase of 5%

- By February the percentage of overall balance paid had dropped by more than 4% year-on-year to 35%

- The average balance of one missed payment increased in January and February, to £2,345 which equates to a 4% increase year on year

- The average balance that was two or three payments overdue also increased in February by 3% and 1.3%, to an average balance of £2,805 and £3,195, respectively

- The percentage of customers using credit cards to take out cash continued to decrease, down 3.8% in January and 3.5% in February, to 8.6% on the previous year, to 3%.

Potential for First-Party Fraud

Through our work with the leading UK banks, we have also spotted what appears to be a growing trend in first-party fraud. This is where a cardholder intentionally makes a large purchase up to their credit limit, knowing that the payment they make will bounce. During the period that is required for the payment to clear, available credit may reopen on the card. This allows fraudsters to make additional purchases and increase the balance even further. By the time the payment is returned, and an insufficient funds error is received, the damage has been done.

FICO is working with a number of card issuers to develop strategies where payments identified as high risk are held for a number of days until the payment clears. This helps to reduce these delinquent balances that end up going to charge-off.

Increase in Missed Payments

While the spending and balances patterns seen at the start of the year are typical, there was an unexpected increase in the number of customers missing payments in January. Risk managers should review and potentially refresh collections treatment and communication channels to ensure that customers facing affordability issues during the continuing uncertain economic climate are properly supported.

Percentage of Balance Paid Continues Downward Trend

Further evidence of the continued pressure on personal finances is the percentage of overall balance paid, which has been trending down in recent years, especially among customers who have had their cards less than one year. For this segment, collections treatment and communication channels may need to be reviewed to ensure customers struggling with affordability receive the appropriate pre-delinquent support and are on the right credit product to meet their needs.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends 2023-2024: More Spend and Delinquencies

- Read more posts on UK cards

Popular Posts

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic

The FICO Score is a broad-based, independent standard measure of credit risk

Read more

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.