UK Credit Cards Hit New Highs for Spending and Balances

FICO data suggests the ongoing impact of inflation could affect consumer affordability through 2025

Are UK consumers experiencing growing payment issues? While we expect to see a rise in spending and balances on credit cards as Christmas approaches — and we did in 2024 — we also saw both spending and balances reach the highest averages that FICO has seen since we started recording the data in 2006.

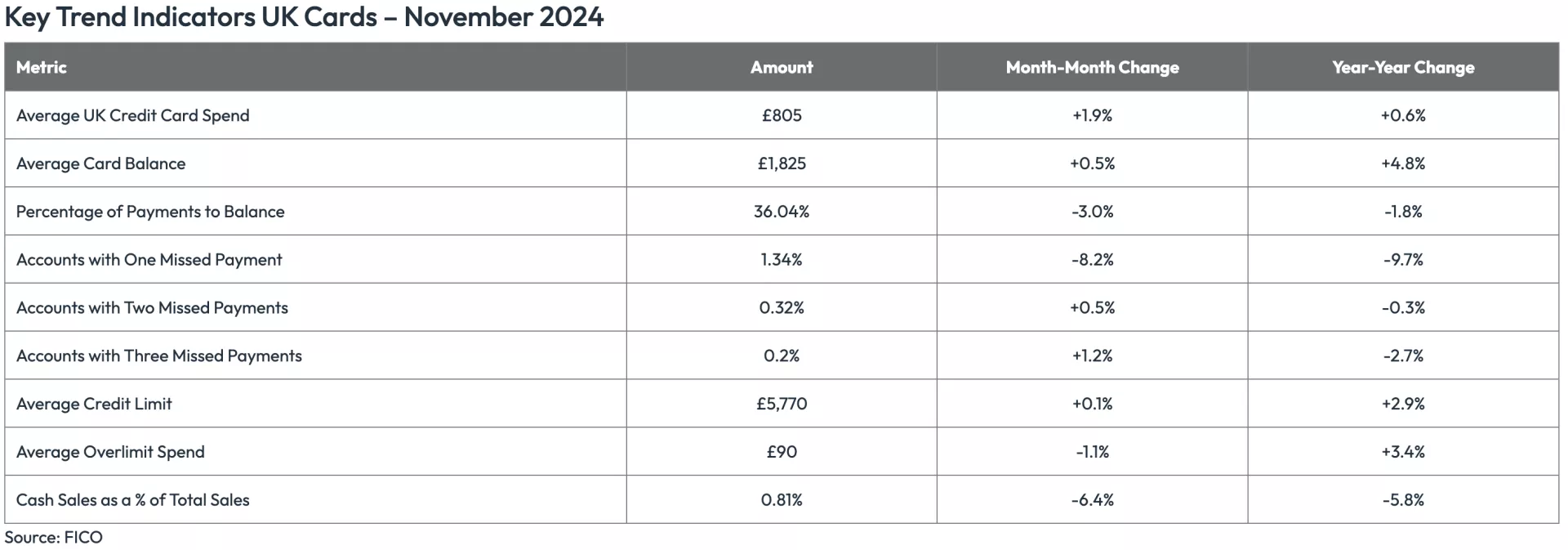

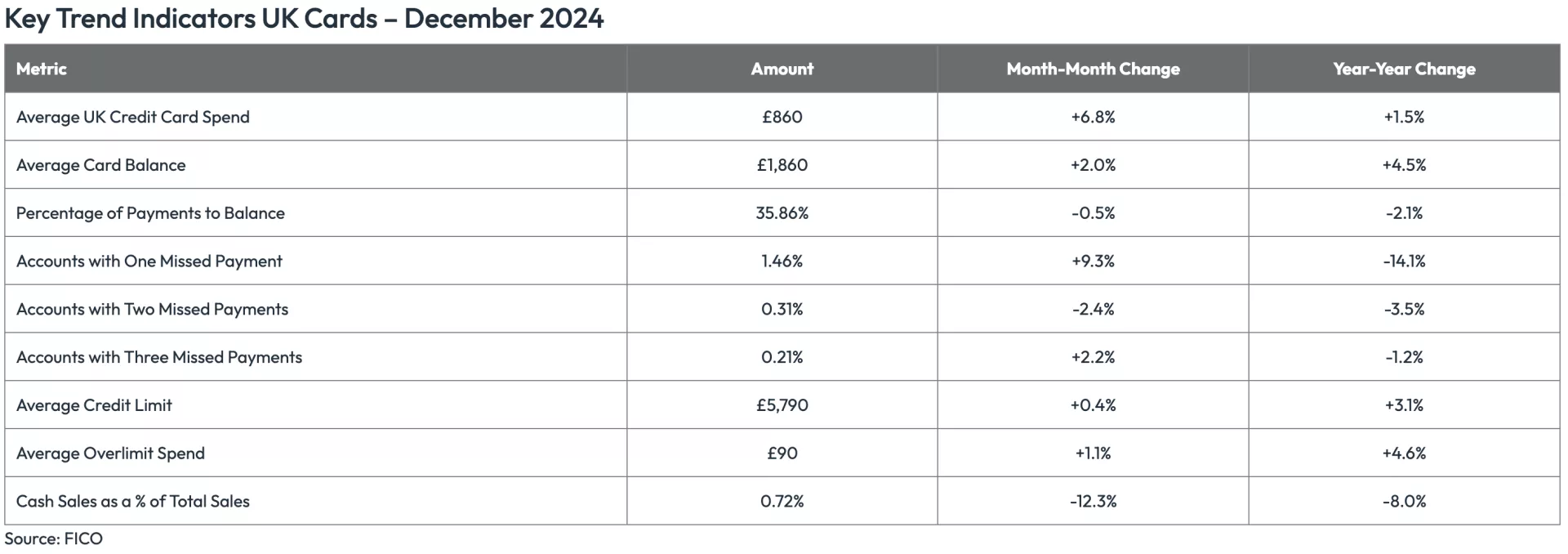

Here are the highlights from our FICO Credit Market Report on UK cards for November and December 2024:

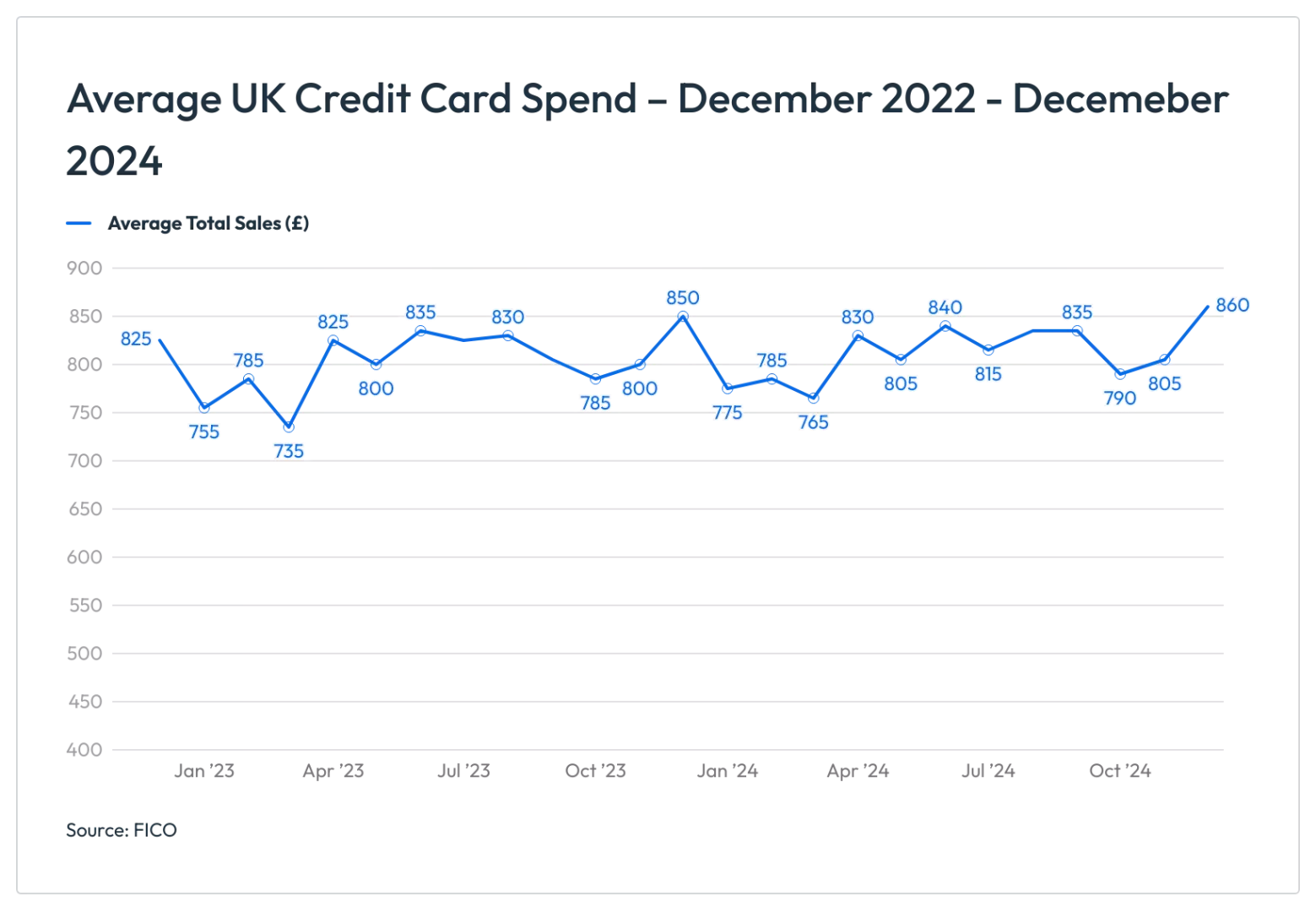

- Average credit card spend rose in the lead-up to Christmas 2024, reaching £860 in December; a 6.8% increase on November and a 1.5% increase on December 2023

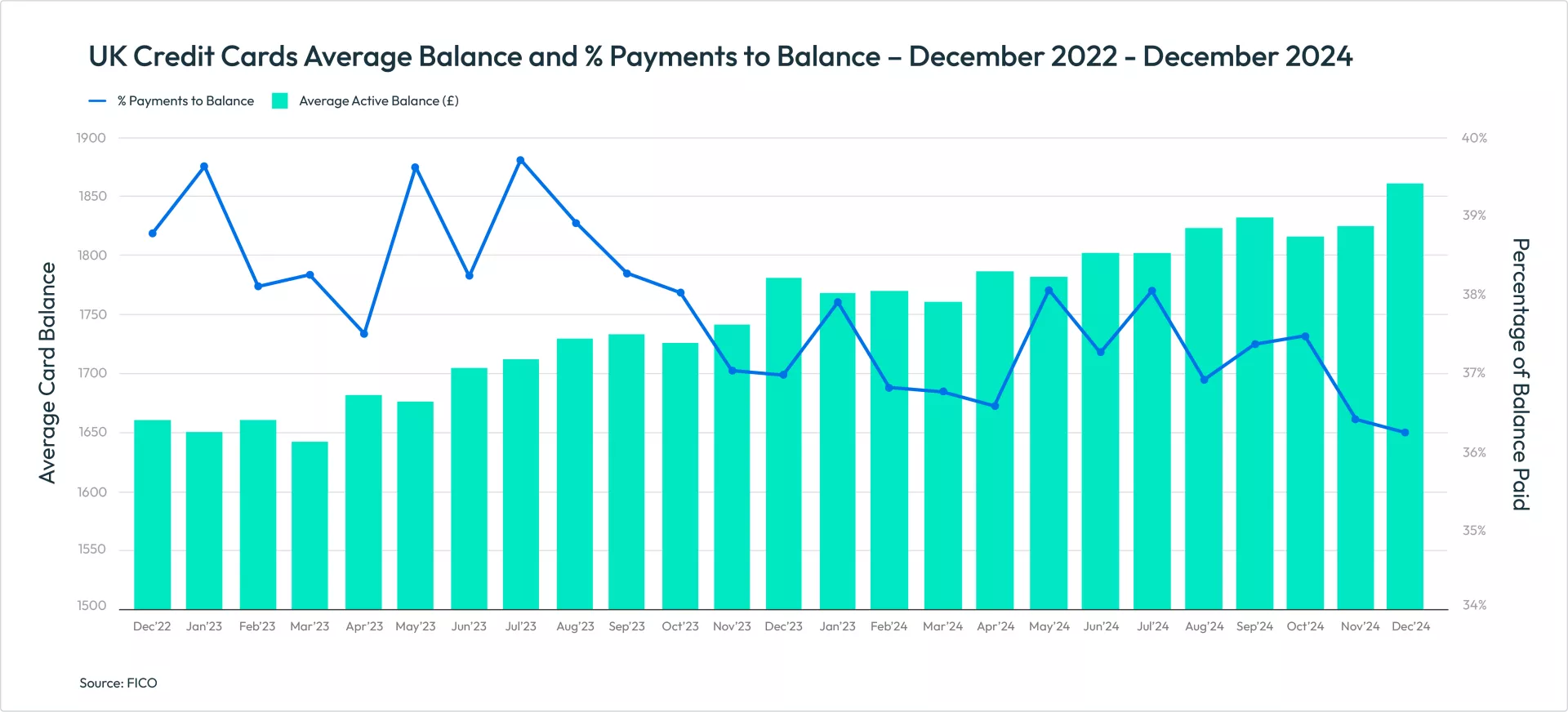

- The percentage of overall balance paid fell by 3% in November compared to October and by a further 0.5% in December, with 35.86% of the balance being paid off in December 2024

- Fewer customers missed payments in November and December 2024 than across the same two months in 2023

Average Credit Card Spending

Average spending saw typical seasonal increases in the run-up to Christmas. However, with average spend reaching £860 in December – a 6.8% increase on November and the highest since FICO records began in 2006 – the ongoing impact of continued inflation could dent consumer affordability through 2025.

Average Credit Card Balances

Similarly, average credit card balances reached an all-time high in December at £1,860, with typical seasonal pressures seeing a 3% month-on-month decrease in the percentage of balance paid in November and a further 0.5% drop in December. If seasonal patterns continue, the balance paid is expected to rise in January as consumers focus on paying off Christmas spend.

Missed Payments

For customers missing one, two or three payments, the average balance increased year-on-year in November and December – another indicator of the financial pressures faced throughout 2024. Average balances for one missed payment are now £2,255, for two payments £2,780 and for three payments £3,190.

The usual seasonal trend sees a reduction in customers missing one payment in the run-up to Christmas, as people want to keep lines of credit open. However, in December 2024 there was a 9.3% increase compared to November. And after four consecutive decreases in the percentage of customers missing three payments, there was a 1.2% increase in November month-on-month and a further 2.2% increase in December. As indebted customers struggle with payments in the new year, this trend is expected to continue in early 2025.

Action Items – Review Limit Management and Contact Strategies

Given the continued financial pressures affecting households, FICO recommends that risk managers review both limit management and collections contact strategies in order to help customers avoid getting into long-term debt.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80% of UK card issuers.

How FICO Can Help You Manage Credit Card Risk and Performance

- Explore our solutions for customer management

- See my post on UK Credit Card Trends 2023-2024: More Spend and Delinquencies

- Read more posts on UK cards

Popular Posts

Business and IT Alignment is Critical to Your AI Success

These are the five pillars that can unite business and IT goals and convert artificial intelligence into measurable value — fast

Read more

Average U.S. FICO Score at 717 as More Consumers Face Financial Headwinds

Outlier or Start of a New Credit Score Trend?

Read more

FICO® Score 10 T Decisively Beats VantageScore 4.0 on Predictability

An analysis by FICO data scientists has found that FICO Score 10 T significantly outperforms VantageScore 4.0 in mortgage origination predictive power.

Read moreTake the next step

Connect with FICO for answers to all your product and solution questions. Interested in becoming a business partner? Contact us to learn more. We look forward to hearing from you.